Ftmo Passing Robot

- エキスパート

- Tshivhidzo Moss Mbedzi

- バージョン: 1.33

- アップデート済み: 23 5月 2025

- アクティベーション: 10

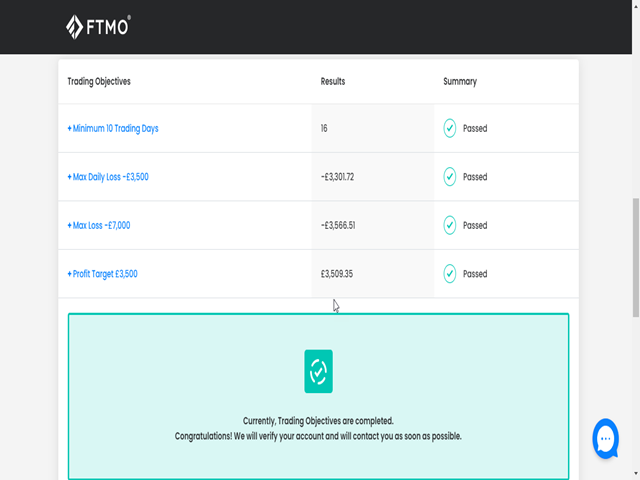

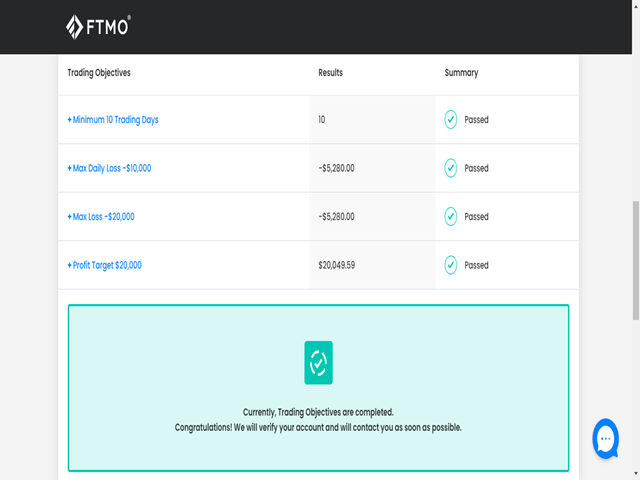

The Ftmo Passing Robot is a professional MetaTrader 4 Expert Advisor (EA) designed to help traders pass and manage proprietary firm challenges such as FTMO, Funded Next, and My Forex Funds (MFF).

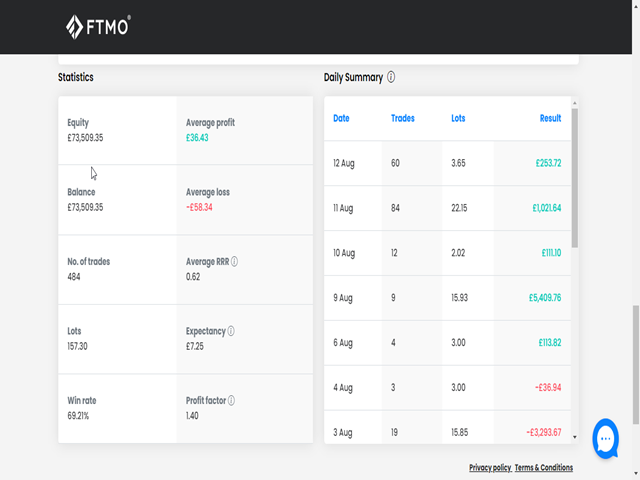

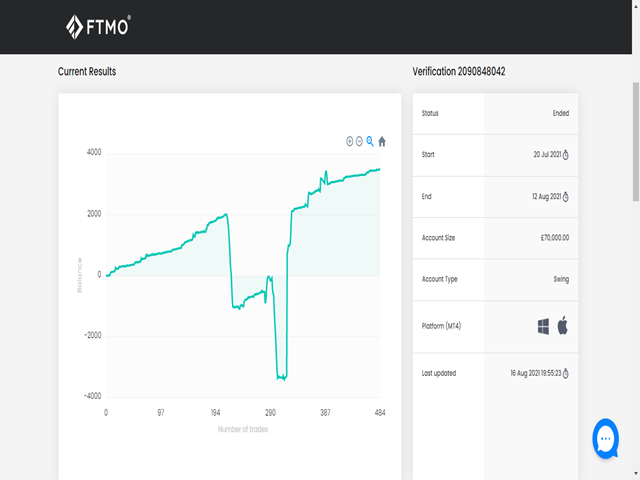

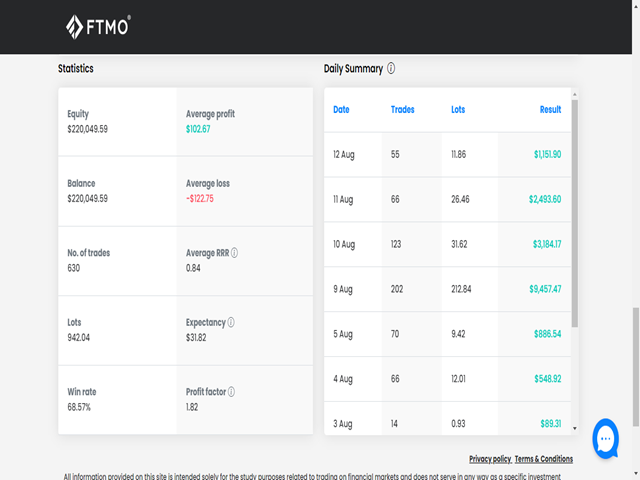

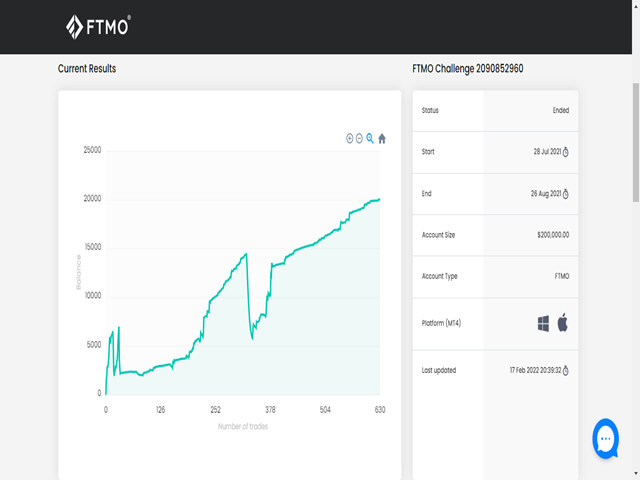

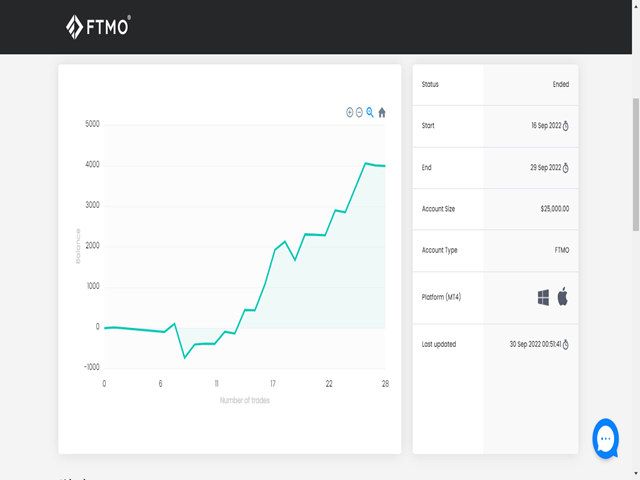

This affordable and fully automated trading system is built to deliver steady performance, controlled drawdown, and consistent risk management—all essential for success in prop firm environments.

Trading Logic and Strategy

The Ftmo Passing Robot uses a trend-confirmation strategy on the EURUSD M15 timeframe. It relies on a proprietary blend of price-action and momentum indicators to identify strong directional moves before trade entry.

Each trade setup is confirmed using multiple filters to ensure precision and compliance with prop firm rules, enabling traders to meet profit targets while maintaining low risk.

This EA focuses on reliable daily performance, low drawdown, and strict rule adherence, making it ideal for prop firm evaluations.

Core Features

-

Prop Firm Focused: Default settings are optimized for FTMO, Funded Next, and other major prop firm challenges.

-

Smart Risk Management: Adaptive Stop Loss and trade management adjust automatically to market volatility.

-

Optimized Pair: Delivers best performance on EURUSD M15.

-

Fully Automated: Runs independently with minimal user input required.

-

Challenge-Ready Logic: Designed to meet profit and drawdown objectives safely.

-

Recommended Setup: Use with a low-spread ECN broker and a reliable VPS for stable performance.

Why Choose Ftmo Passing Robot

-

Specifically tailored for FTMO and similar challenge rules

-

Conservative trading parameters and consistent results

-

Simple plug-and-play configuration with detailed setup instructions

-

Stable, low-risk approach ideal for evaluation accounts

-

Proven reliability through long-term backtesting and optimization

How It Works

-

Install the EA on your EURUSD M15 chart.

-

Load the optimized preset file included with your purchase.

-

Allow the EA to trade automatically during its configured session.

-

Monitor progress toward challenge targets while staying within prop firm limits.

Get Started

Download the free demo version and experience how the Ftmo Passing Robot can simplify your prop firm challenge journey.

This automated solution helps traders achieve consistent daily results and maintain rule-compliant trading discipline.

Explore More Expert Advisors

-

FTMO Smart Trader EA (Flagship MT4 EA for Stable Success)

https://www.mql5.com/en/market/product/89653 -

NSA Prop Firm Robot (FTMO Passer Gold/EURUSD)

https://www.mql5.com/en/market/product/97463 -

Auzar – AI-Powered MT5 Scalper

https://www.mql5.com/en/market/product/114230

Join Our Community

Access real-time updates, setup files, and user support:

Official MQL5 Channel: https://www.mql5.com/en/channels/ghostea

Keywords (for MQL5 Search Optimization)

FTMO EA, FTMO Passing Robot, Prop Firm EA, Prop Firm Robot, MT4 Expert Advisor, Prop Firm Challenge EA, EURUSD Scalper, Funded Account EA, Automated Forex Robot, Low Drawdown EA, Challenge Passer EA, Funded Next EA, MFF EA, FTMO Trading System