Mogalef Bands MT5

- Indicatori

- Victor Tengo Quiles

- Versione: 2.0

- Attivazioni: 7

Mogalef Bands — Dynamic Range Structure & Target Zones (MT5)

Mogalef Bands is a visual market-structure indicator that models price as a dynamic range that shifts in stages. Instead of relying on isolated “signals”, it provides contextual levels to:

-

identify where price is currently “working” (operating zone),

-

locate potential extension areas (targets),

-

and filter market noise through a non-impulsive, stable update logic (with inertia).

It is designed for discretionary traders who want clear levels for repeatable decisions: context-based entries, structure-based management, and exits around probable zones.

What you see on the chart

The indicator plots bands that frame price behavior in each phase:

-

Central zone (operational balance): where the market typically “works” and consolidates.

-

Outer bands (extremes): areas where moves are often more “stretched”, and reactions, pauses, or final extensions appear more frequently.

-

Middle bands (±1x): intermediate levels for continuation, pullbacks, and trade management.

Important: the bands are not meant to react to every wick. The logic prioritizes stability so the indicator doesn’t “chase” price in noisy environments.

Practical interpretation (how to use it)

Range market (back-and-forth trading)

When price respects the structure and oscillates within the bands, the typical approach is:

-

treat the central zone as a balance reference,

-

and use outer bands as working/reaction areas where price often slows down, absorbs, or partially reverts.

Key idea: it’s not “buy/sell on touch”. The bands help you know where it makes sense to look for confirmations (candles, volume, structure, context).

Directional market (trend by stages)

In directional phases, the range doesn’t disappear — it shifts. Mogalef Bands helps you:

-

stay aligned with the move without relying on micro-signals,

-

spot when price is in a “normal” zone versus a stretched extreme zone,

-

plan management: protect profits when price repeatedly hits extremes or when continuity starts to fade.

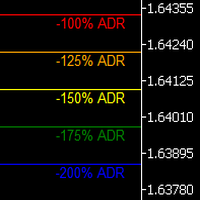

Targets and extensions

During expansion phases, extremes often act as:

-

natural target zones (especially after larger swings),

-

areas where price can reach, slightly overshoot, then stabilize or correct.

This lets you prioritize structure-based exits instead of relying only on “noise stops”.

Confluence (the most powerful use-case)

The indicator’s value increases with confluence:

-

when an extreme or middle level aligns across timeframes (or with your support/resistance), it becomes more relevant as a decision zone.

To support this, the indicator can be calculated on a higher timeframe (HTF) and displayed on your working chart.

Usage recommendations

-

Works especially well as a structure tool: clear levels + context.

-

For live trading, combine it with your usual confirmation method (price action, structure, volatility, sessions, etc.).

-

For intraday trading, it can be useful to visualize confluence between your execution TF and a higher-context HTF (when your approach benefits from it).

Disclaimer

This indicator is not an automatic buy/sell signal or a performance promise. It is a structure-reading tool to support decisions with proper risk management.

Inputs

-

Deviation (stdP) = 7 → makes bands wider or tighter.

-

Regression (linP) = 3 → smooths band movement.

-

Extreme multiplier = 2.0 → adjusts how far the outer bands are.

-

Show middle bands (±1x) = true → enables/disables intermediate bands.

-

Calculate on HTF = false → when enabled, uses a higher timeframe for calculation.

-

HTF timeframe = current → selects which HTF to use when enabled.