Rejoignez notre page de fans

- Vues:

- 191

- Note:

- Publié:

-

Besoin d'un robot ou d'un indicateur basé sur ce code ? Commandez-le sur Freelance Aller sur Freelance

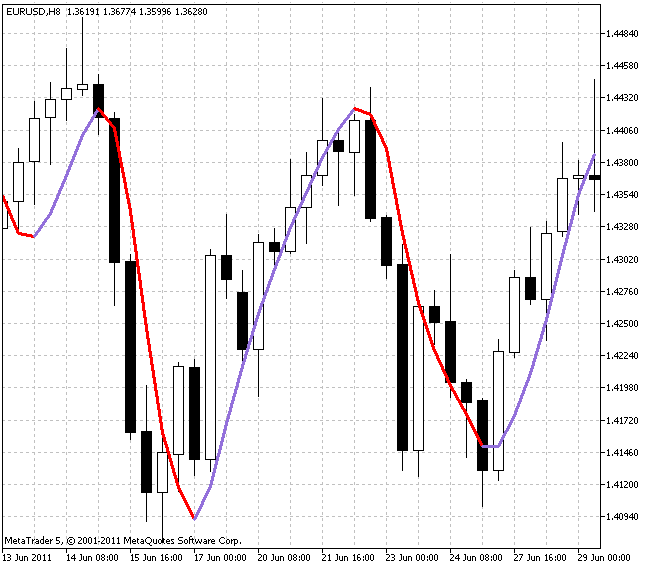

La moyenne mobile de Hull (HMA), qui change de couleur. La HMA est utilisée pour identifier les entrées et les sorties du marché.

Le fonctionnement de l'indicateur est très simple : lorsque le cours monte, la ligne de l'indicateur est colorée en violet, et s'il baisse, elle passe au rouge.

La couleur de l'indicateur peut varier en fonction de la barre actuelle. La fonction principale de l'indicateur n'est donc pas sa couleur, mais la position du prix. Si le prix est inférieur à la ligne de l'indicateur, cela signifie que le prix a tendance à baisser, et si le prix est supérieur à la ligne de l'indicateur, cela signifie que le prix a tendance à augmenter.

L'indicateur utilise les classes de la bibliothèque SmoothAlgorithms.mqh (vous devez les copier dans le répertoire terminal_data_directory\MQL5\Include), une description détaillée de leur utilisation a été publiée dans l'article "Averaging price series without additional buffers for intermediate calculations".

Moyenne mobile de Hull (Hull Moving Average)

Traduit du russe par MetaQuotes Ltd.

Code original : https://www.mql5.com/ru/code/549

Oscillateur CG

Oscillateur CG

L'intersection de la ligne principale et de la ligne de signal de l'oscillateur CG indique des signaux d'achat et de vente.

CyberCycle

CyberCycle

Filtre passe-haut Cyber Cycle.

Value Area Retracement Volume Indicator

Value Area Retracement Volume Indicator

L'indicateur Value Area Retracement est un outil puissant basé sur le profil de volume et conçu pour identifier les niveaux de trading clés - point de contrôle (POC), zone de valeur haute (VAH), zone de valeur basse (VAL) et profil haut/bas - sur différents horizons de temps. Il aide les traders à repérer les opportunités potentielles de retracement vers le POC, les zones de rupture et les zones de valeur, ce qui le rend utile pour le trading intrajournalier, le swing et le trading de position.

AutoFibo indicator of two last swings based on ZigZag

AutoFibo indicator of two last swings based on ZigZag

L'indicateur AutoFibo est un outil avancé de retracement de Fibonacci qui dessine automatiquement des niveaux de Fibonacci basés sur le motif ZigZag. Cet indicateur est conçu pour aider les traders à identifier rapidement les niveaux de support et de résistance potentiels dans les marchés en tendance.