Muhammad Syamil Bin Abdullah / Feed de Noticias

- Información

|

10+ años

experiencia

|

0

productos

|

0

versiones demo

|

|

0

trabajos

|

0

señales

|

0

suscriptores

|

I am using RoboForex as main broker for all my trade.

La alerta de bandas ATR es un indicador de canal donde el ancho del canal se calcula como un multiplicador constante ("Multiplicador") y el valor del indicador "Rango verdadero promedio". A diferencia de las Bandas de Bollinger, el ancho de banda no cambia con tanta frecuencia: en el indicador de alerta de bandas ATR, las bandas suelen tener líneas rectas largas. La interpretación de la Alerta de Bandas ATR se basa en el hecho de que el precio se encuentra dentro de las bandas la mayor parte

| Calidad de la tarea técnica | 4.0 | |

| Calidad de la verificación de resultados | 5.0 | |

| Disponibilidad y habilidades de comunicación | 5.0 |

El asesor experto de Fox utiliza el indicador RSI de una manera muy inteligente y efectiva al crear un sistema comercial que mejorará sus resultados comerciales. El EA comprará en el RSI inferior de 30 y venderá en el RSI superior de 70, pero el EA esperará hasta una pérdida virtual que está marcada con una cruz roja en el gráfico. Después de la pérdida virtual, el EA esperará la siguiente señal para realizar la operación real. El EA controlará todas las órdenes abiertas en una estrategia de

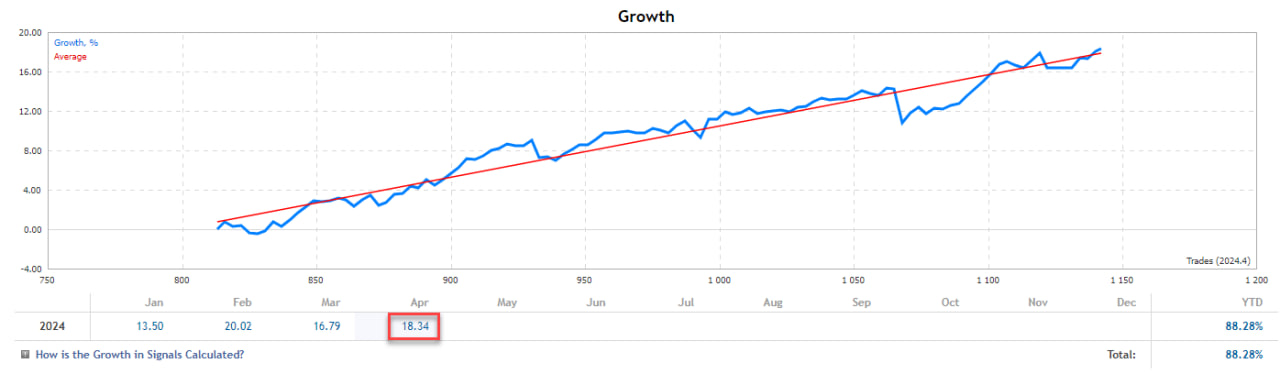

As you can see from the curve, GG secure close trades into losses when needed: it do not pretend to win always and being always right.

In the same time, The Forex Exchanger EA continues to work as it shown us for years. It will remain at the actual discounted price until the end of April.

GG Secure: https://www.mql5.com/en/signals/2177489

The Forex Exchanger: https://www.mql5.com/en/market/product/76773

⚙️ On 29 April 2024, we will include FT Gold Robot in our offers. The new system will be available to all customers for $399. More details will be provided soon...

1) When you look in the market (or somewhere else, on some channel, etc.) at the description of any product (indicator or robot), you give priority (buy) to the product, the seller of which presented the most possible a long series of positive transactions based on the use of this product. And you think you made the right choice. But don't be so naive. The seller can choose from one hundred series of transactions, 99 series of which are losing, one winning series of transactions and present it in the description of his product. And this is what almost all salespeople do because they need to sell their product. I don't do that because my products are designed for the thinking consumer.

2) Optimization of the robot, which gives an exponential growth of the deposit, when billions are obtained from a hundred dollars, this is, in essence, just an adjustment to the previous history. When new data comes in that goes beyond the history of optimization (i.e. you start to actually trade), then such a robot with a 100% guarantee will bring losses. They buy such robots, in general, suckers. Friends, do not be suckers, i.e. do not lose your money neither on the purchase of such robots, nor when playing on the stock exchange with their help. Many sellers, in general, simply write bright clips, where the stories of allegedly positive transactions of their product and the frantic growth of the deposit are clearly unfolding in the drawn terminal. Some sellers do the same programmatically. If someone had such robots, then no one would sell them. This must be understood, and not wishful thinking.

3) I (a professional scientist, not some schoolboy) sell products with algorithms, which are my own original developments based on a scientific approach ( https://www.mql5.com/en/articles/10955 ,

https://www.mql5.com/en/articles/11158

https://www.mql5.com/en/articles/12891 ) to the study of the foreign exchange market and stock market, which, by the way, no one has done yet. All existing models of the foreign exchange market are not scientific, but simply "shamanic dances with tambourines." Trust me as a scientist. But people tend to buy products (at least robots, at least indicators) with popular algorithms “tested” by time, i.e. well-known strategies and calculation formulas. At the same time, they hope that the popularity of algorithms will provide them with a profit. This is also a naive fallacy. After all, if there were well-known formulas and algorithms that would bring profit in all market conditions, then everyone would become millionaires, which is not observed. On the contrary, in the reality hidden from suckers, all traders (using "time-tested" algorithms) either mark time in one place or lose money. Therefore, among the popular mathematical algorithms (even the most sophisticated ones, such as some kind of neural networks, etc.), there are no algorithms that consistently provide profit, and with a change in the state of the market, they begin to incur losses. Profitable algorithms should be looked for, just the opposite, among the original little-known developments, which are my products. https://www.mql5.com/en/blogs/post/741637

Alligator Analysis FREE https://www.mql5.com/en/market/product/35227

The “Alligator Analysis” (AA) indicator allows you to build various (by averaging types and by scales) “Alligators” and their combinations, i.e. allows you to analyze the state of the market based on the correlation of this state with a whole range of different "Alligators". The classic "Alligator" by Bill Williams is based on moving averages and Fibonacci numbers, which makes it one of the best indicators now. The classic "Alligator" is based on Fibonacci numbers and is a combination of three smoothed moving averages (SМMA) with periods 5, 8 and 13, which are part of the Fibonacci sequence. In this case, the moving averages are shifted forwards by 3, 5, and 8 bars, respectively, which are numbers from the same sequence (preceding the corresponding period values).

Alligators from the AA indicator is based, on the same principle as the classic “Alligator”, but on different parts of a number of Fibonacci numbers, as well as on different moving average averaging algorithms.

The indicator AA uses 6 types of averaging, where the classical averaging SMA, EMA, SMMA, LMA are supplemented by averaging the moving average by the median and averaging weighted by volume.

Line shifts can be removed. The colors of the AA indicator lines are set according to the type of color spectrum: from violet for a small smoothing period to red - for the largest period.

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Estimation moving average without lag https://www.mql5.com/en/market/product/36945

A simple moving average (SMA) with an averaging period (2n + 1) of bars is always obtained lagging by n bars. If SMA or other types of moving averages are the basis for making trading decisions, then their strong delay does not allow to open positions in time and close positions, which leads to losses.

The Estimation moving average without lag indicator calculates an estimate of a non-lagging moving average and displays the corresponding confidence interval.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382