Ivan Pochta / Perfil

- Información

|

9+ años

experiencia

|

13

productos

|

1916

versiones demo

|

|

1

trabajos

|

3

señales

|

0

suscriptores

|

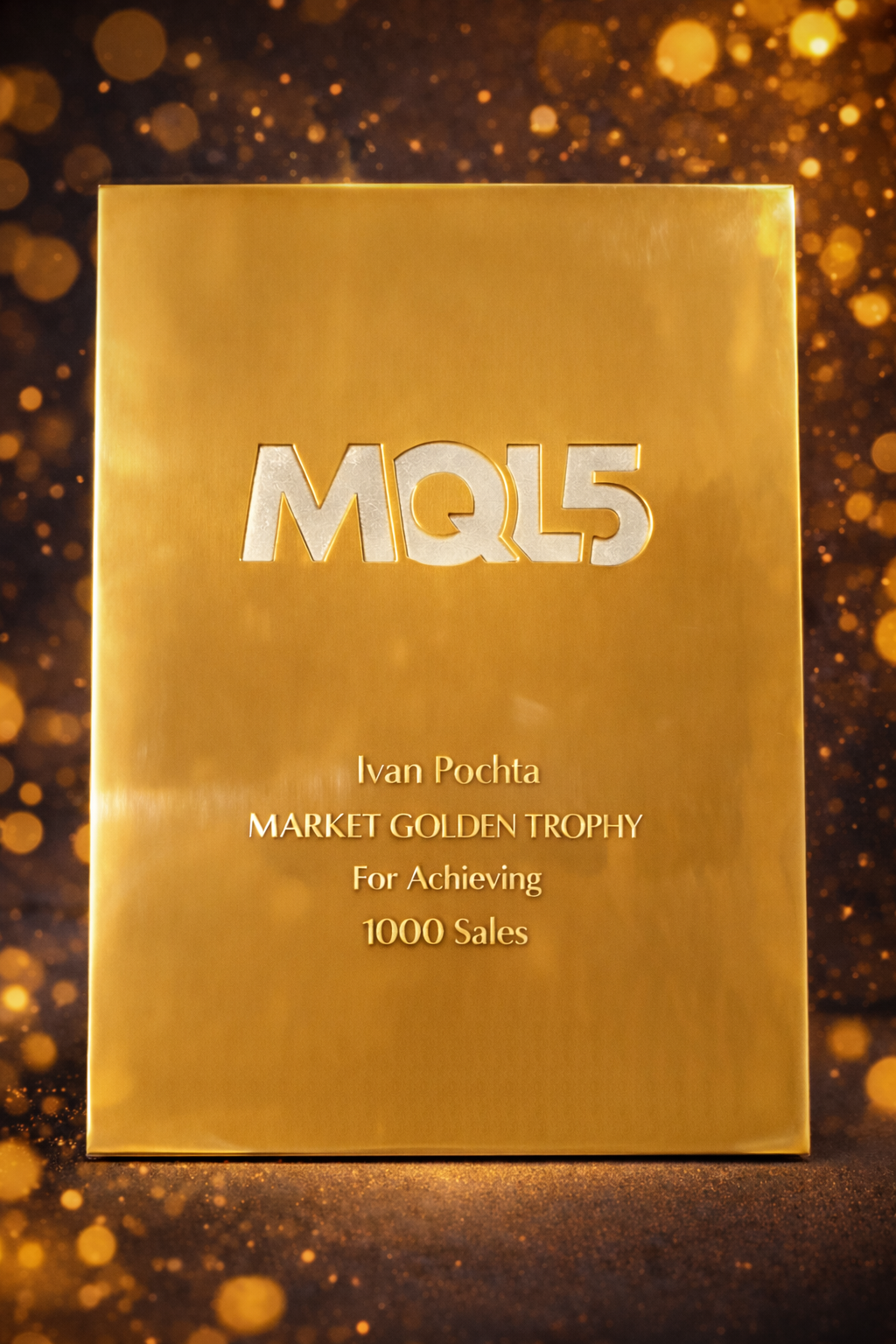

⭐️ Market Gold Award for Achievement in EA Creation!

⭐️ 9+ years experience at MQL5.Market

⭐️ 1000+ satisfied customers

=======================================================================================

Do you have questions about products or you need a support?

✅ Contact with me via Telegram: https://t.me/ivan_pochta

✅ Telegram Info Channel: https://t.me/ipfsystems

🎯 PROMO: Only 1 copy left at $79. After that, the price will be increased to $99.

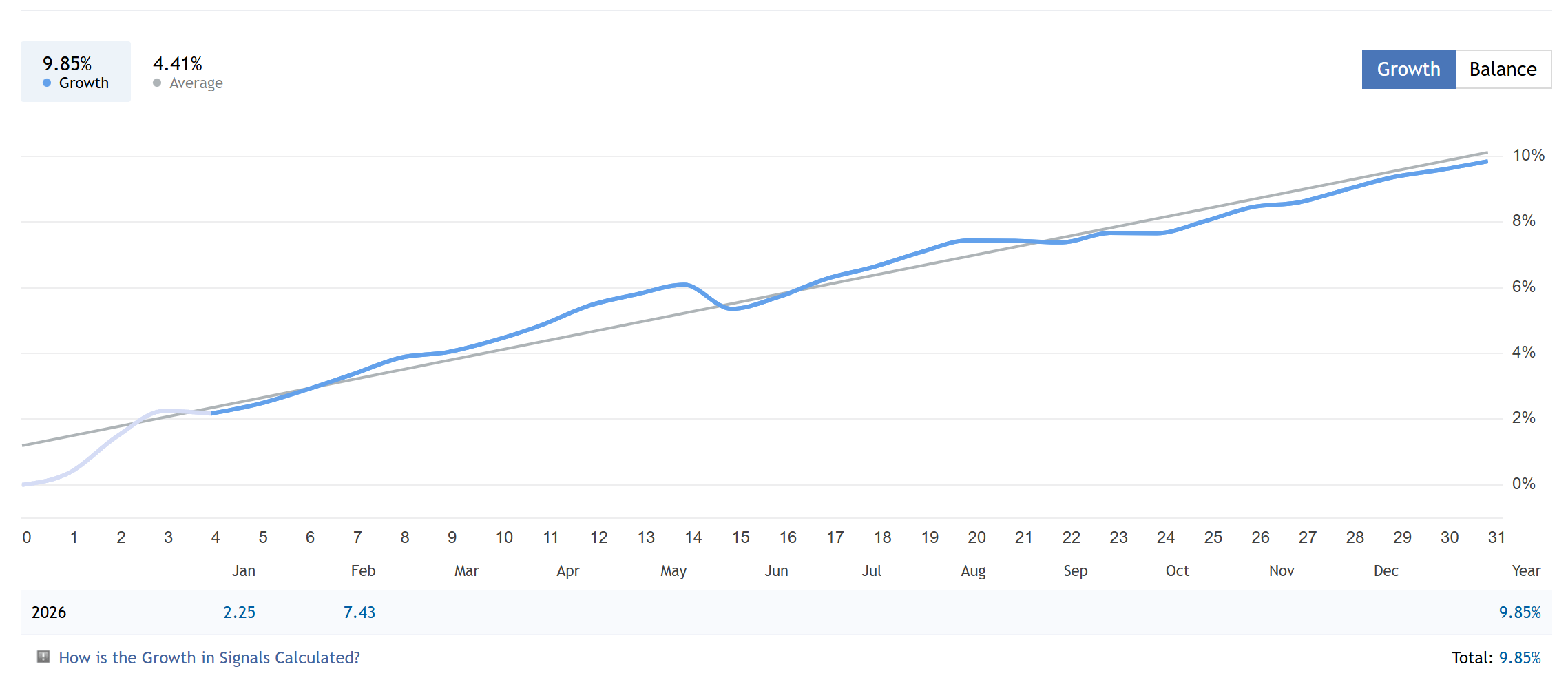

📈 Current growth: +9.85%

The system continues to accumulate profit steadily, trade by trade, maintaining a smooth equity structure.

On Monday, I temporarily disabled the EA due to geopolitical risks related to potential US–Iran escalation. As a result, a good trading opportunity was missed — but risk control always comes first.

Yesterday, trading was resumed.

🔗 Product page: https://www.mql5.com/en/market/product/160849

The price has been increased to $199 as announced.

🔹 10 copies available at $199 (until the end of the week)

🔹 Next price level: $299

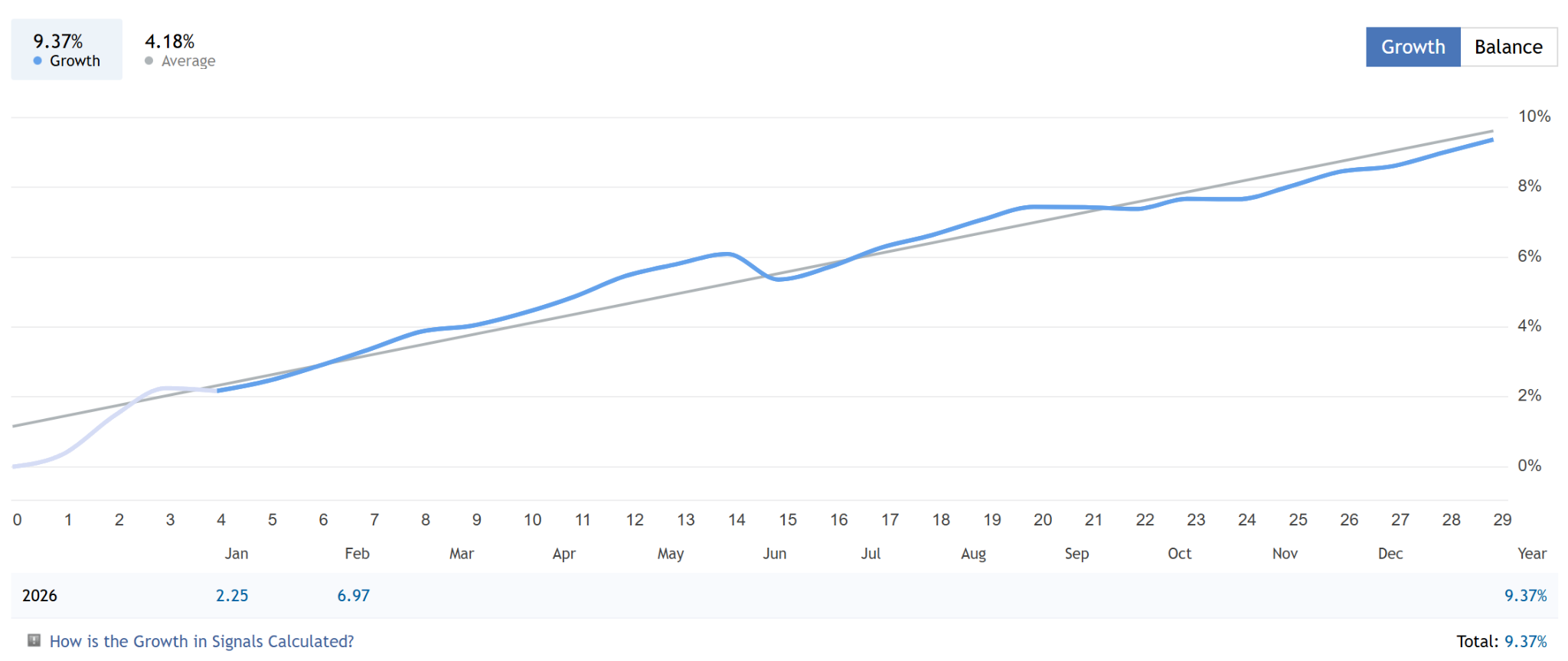

💡 Inside the Aurum Alpha V 8 integrated strategies combining trend-following, Smart Money reversals, divergences, scalping and momentum breakout logic — all in one multi-strategy Gold EA.

If you’ve been watching it — this is the current window.

🔗 Product page: https://www.mql5.com/en/market/product/164599

Hello everyone 👋

The updated version of Aurum Alpha V is now available.

🔹 Strategy #8 has been officially added to the system.

This new component combines EMA Ribbon structure, Momentum confirmation, and ADX breakout logic, designed to trade strong directional expansions after compression phases.

With this addition, Aurum Alpha V now integrates 8 strategies in one unified engine, further strengthening its adaptability across different market conditions.

🔧 Improvements to Strategy #7

In addition to the new strategy, I have implemented several refinements to Strategy #7 (Divergence-based Reversal) aimed at improving its stability and signal filtering. The adjustments focus on cleaner confirmations and better balance during corrective phases.

🔗 Product page: https://www.mql5.com/en/market/product/164599

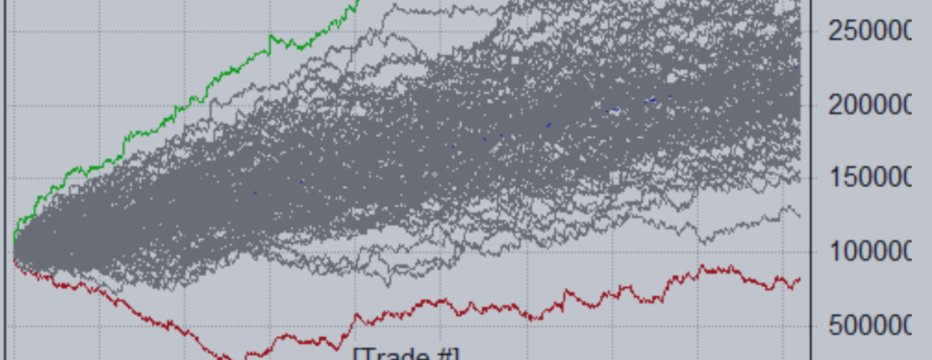

Night Walker EA continues to build performance carefully, step by step, accumulating profit trade by trade.

📈 Current growth: +9.37%

Today I will temporarily disable the EA due to increased geopolitical risk and the potential escalation of US–Iran tensions. Risk control comes first.

👉 Product page: https://www.mql5.com/en/market/product/160849

Night Walker EA is a night trading advisor designed to operate during the transition from the US trading session close to the Asian session open — a market phase typically characterized by reduced volatility, a low probability of strong trend movements, and predominantly range-bound price behavior.

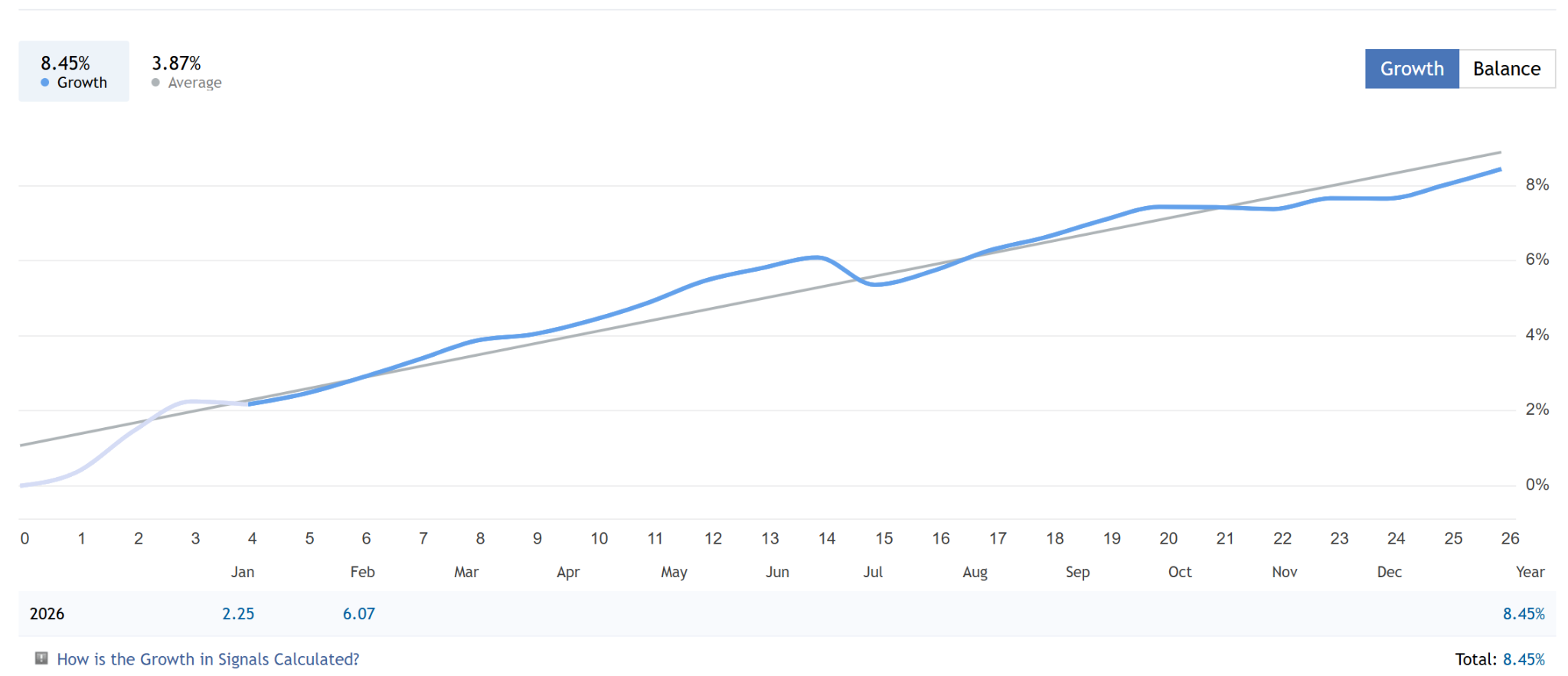

📈 Updated results: +8.45% growth

📊 Smooth and consistent equity progression

🕰 Trading during night hours and rollover periods

⚙️ No martingale, no grid, no aggressive money management

Trade by trade, Night Walker EA continues to steadily accumulate profit.

The equity curve reflects a systematic and disciplined approach, where performance is built gradually rather than through isolated high-risk trades.

These results further confirm the stable behavior of the strategy in real market conditions.

Night Walker EA is not designed for aggressive trading.

It was developed as a portfolio component, intended to complement trend-following and medium-term systems by adding a controlled night scalping logic.

🔹 Portfolio-oriented approach

🔹 Designed for diversification

🔹 Focused on stability and long-term consistency

👉 Product page: https://www.mql5.com/en/market/product/160849

¡ PROMOCIÓN DE LANZAMIENTO! ¡Sólo 10 ejemplares disponibles a 249 $ ! ¡ Cada 10 copias vendidas, el precio aumentará! Señal en Vivo #1 (Stock Trader Pro, Admiral Markets, Riesgo 2%) >> Canal de Anuncios << Stock Trader Core es una versión simplificada y lista para usar de Stock Trader Pro ( Página del producto >>) . Está construida sobre la misma lógica de trading, algoritmos y presets utilizados en el sistema Pro, pero entregada como una solución de trading de cartera Plug

🚀 New update released!

Strategy #6 has been added to the system.

🔁 Smart Money Reversal Strategy

A reversal-based strategy built on Smart Money concepts and liquidity sweep logic.

It is designed to trade false breakouts and order block reactions, complementing the trend and momentum strategies already present in the system.

🧠 6 strategies in one EA — trend, momentum, breakouts & reversals

⚖️ Better balance between trending and range-bound market conditions

📈 More stable overall system behavior after the update

💡 Plug & Play — attach to H1 and trade

🥇 Gold only (XAUUSD)

🛡 Controlled risk, no aggressive techniques

🚫 No martingale

🚫 No grid

🚫 No AI hype

✅ Classical technical analysis

Aurum Alpha V — multiple proven strategies working as one engine.

The Golden Edge. ✨

🔗 Product page: https://www.mql5.com/en/market/product/164599

Night Walker EA is a night trading advisor designed to operate during the transition from the US trading session close to the Asian session open — a market phase typically characterized by reduced volatility, a low probability of strong trend movements, and predominantly range-bound price behavior.

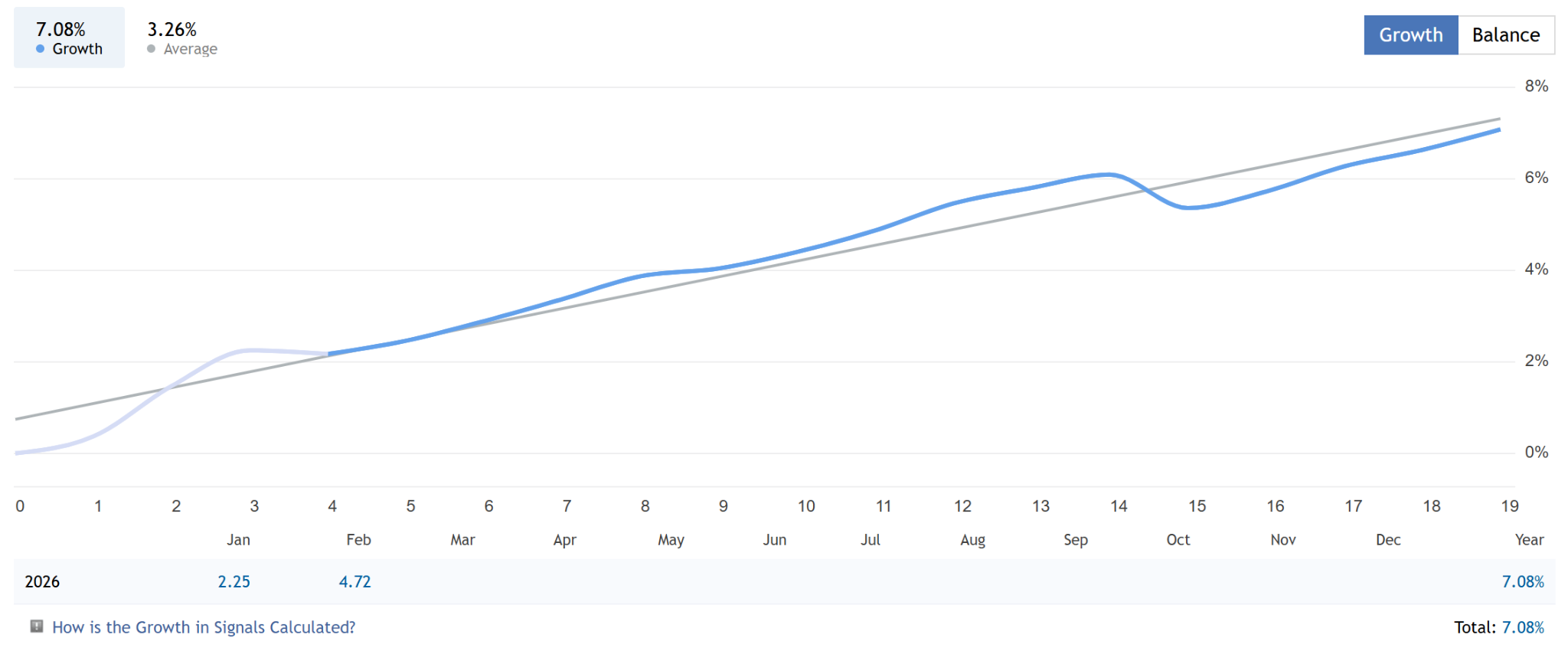

📈 Updated results: +7.08% growth

📊 Smooth and steadily rising equity curve

🕰 Trading during night hours and rollover periods

⚙️ No martingale, no grid, no aggressive money management

These results confirm the stable and consistent behavior of the strategy in real market conditions.

Night Walker EA continues to perform as intended — calmly and systematically.

The system is not designed for aggressive trading.

It was developed as a portfolio component, complementing trend-following and medium-term strategies with a controlled night scalping approach.

🔹 Portfolio-oriented solution

🔹 Designed for diversification

🔹 Focused on stability and risk control

🎯 PROMO: Only 3 copies left at $79.

After that, the price will be increased to $99.

👉 Product page: https://www.mql5.com/en/market/product/160849

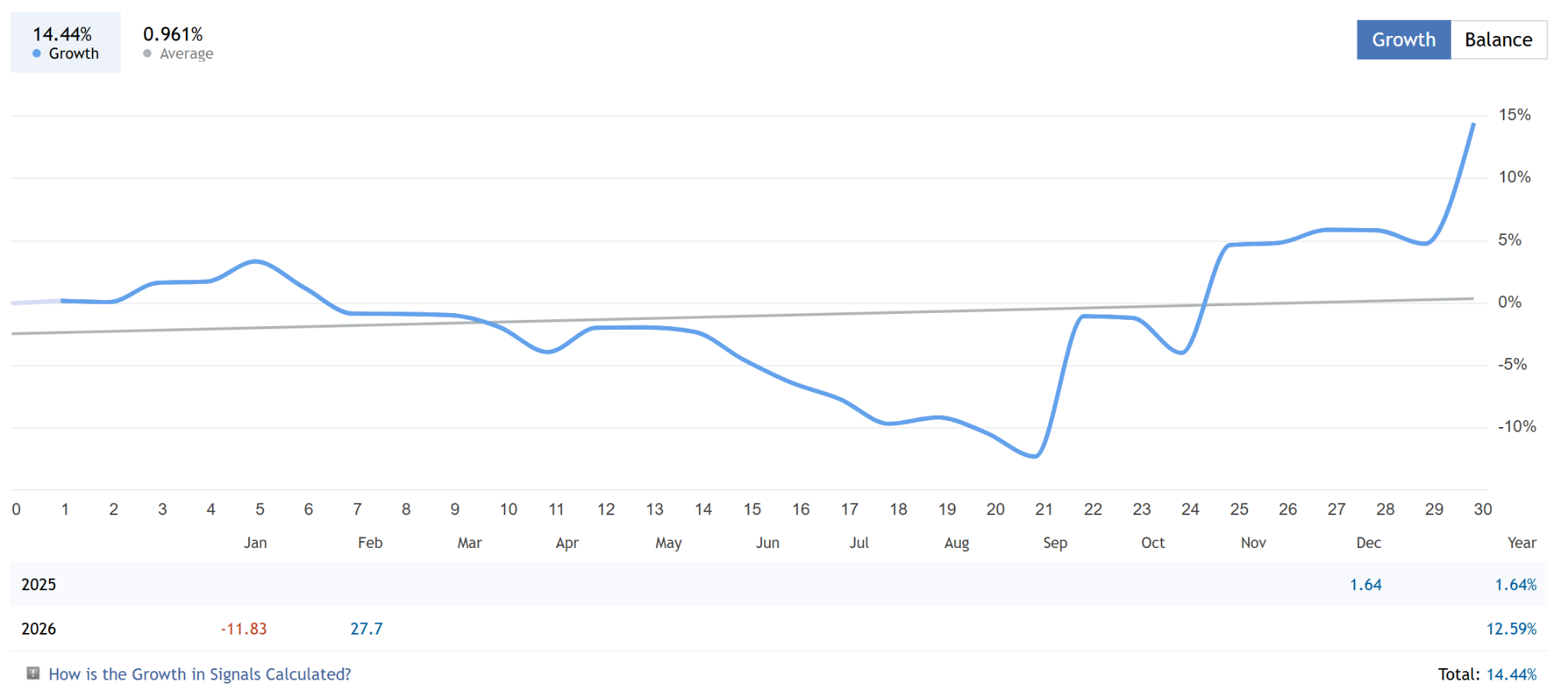

Stock Trader Pro follows a classic Buy the Dip approach. The stock market moves in cycles, and every correction is treated as an opportunity to buy quality stocks at a discount, with a focus on long-term recovery.

The January drawdown was driven by market instability, AI-bubble concerns, and a correction in tech stocks.

Thanks to portfolio diversification, the system has returned to positive performance: while tech was under pressure, capital flowed into defensive sectors. Strong gains were generated from KO, PG, and MCD, even as the S&P 500 declined.

The system continues to accumulate positions in selected tech and financial stocks, positioning for future recovery.

📈 Diversification and discipline make Stock Trader Pro a solid long-term investment solution.

👉 Product page: https://www.mql5.com/en/market/product/36161

Night Walker EA is a night trading advisor designed to operate during the transition from the US trading session close to the Asian session open — a market phase typically characterized by reduced volatility, a low probability of strong trend movements, and predominantly range-bound price behavior.

🎯 PROMO: 5 copies available at $79. After that, the price will be increased to $99.

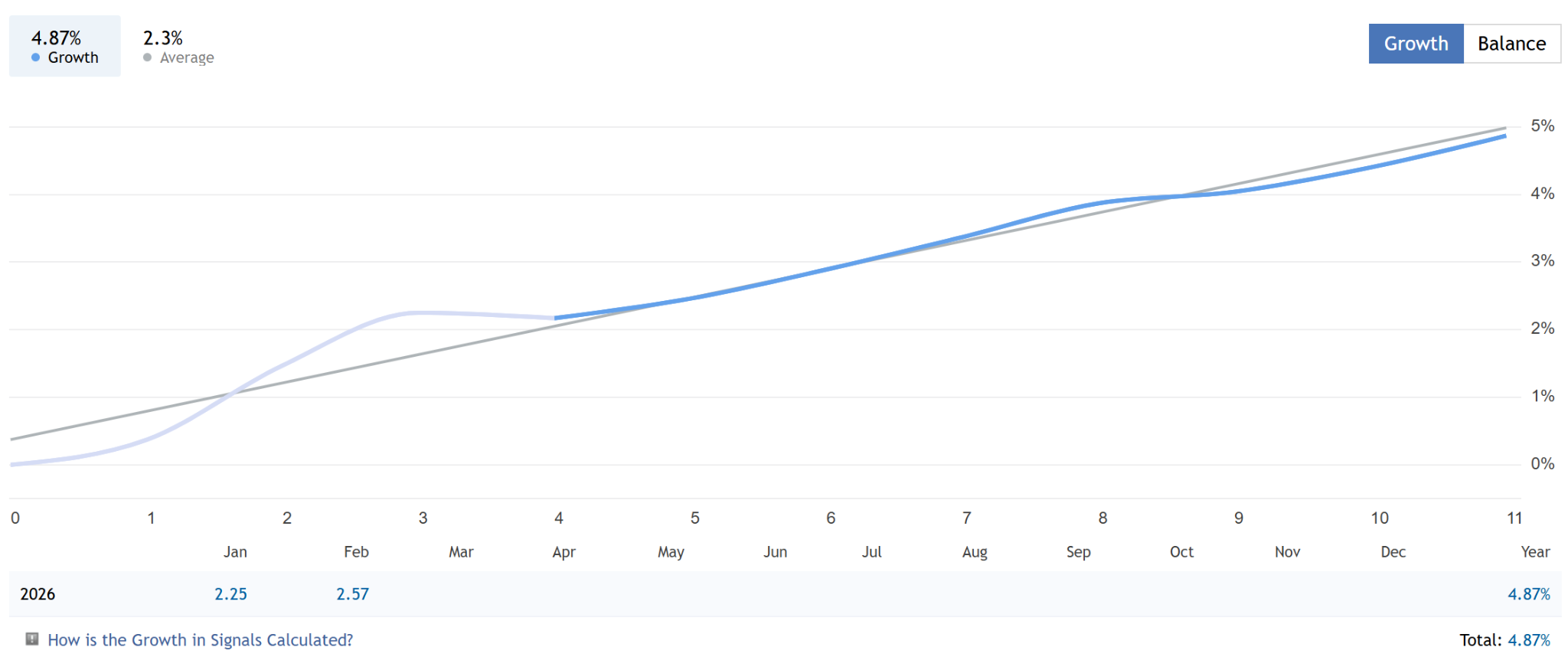

📈 First results: +4.87% growth over the period

📊 Smooth equity curve without aggressive drawdowns

🕰 Trading during night hours and rollover periods

⚙️ No martingale, no grid, no high-risk money management techniques

These are the initial live results of the system, demonstrating stable and correct strategy behavior in real market conditions.

Night Walker EA is not intended for aggressive trading. It was developed as a portfolio-level solution, designed to complement trend-following and medium-term strategies by adding a controlled night scalping component.

🔹 Suitable for portfolio diversification

🔹 Can be used alongside trend and swing systems

🔹 Focused on stability, discipline, and risk control

👉 Product page: https://www.mql5.com/en/market/product/160849

One market. One EA. Multiple proven strategies.

💡 Plug & Play — attach to H1 and start trading

🧠 5 strategies in one system — trend, momentum, breakouts & Price Action

⚖️ High Risk–Reward — focus on quality setups

🛡 Stable performance — controlled risk, low drawdown

🏆 Prop Firm friendly logic — disciplined execution, no risky techniques

🥇 Gold only (XAUUSD) — fully optimized for a single market

🚫 No martingale

🚫 No grid

🚫 No AI hype

✅ Classical technical analysis

Aurum Alpha V combines the best Gold strategies into one professional trading engine.

🔗 Product page: https://www.mql5.com/en/market/product/164599

💡 Plug & Play — just attach it to H1 and the system starts trading

🧠 5 strategies in one EA — trend, momentum, breakouts & Price Action

⚖️ High Risk–Reward — focus on trade quality, not quantity

🛡 Stable performance — controlled risk and low drawdown

🥇 Gold only (XAUUSD) — logic optimized for a single market

🚫 No martingale

🚫 No grid

🚫 No AI hype

✅ Classical technical analysis only

Aurum Alpha V — when multiple proven strategies work as a single engine.

The Golden Edge. ✨

🔗 Product page: https://www.mql5.com/en/market/product/164599

PROMO ¡Sólo 10 ejemplares disponibles a 199 $! Próximo precio $299. Señal en vivo #1 >> Canal de Anuncios << Aurum Alpha V es un 8-en-1 profesional multi-estrategia Asesor Experto diseñado exclusivamente para el Oro (XAUUSD) . El sistema está construido como una solución plug & play - simplemente conéctelo al marco de tiempo H1 , y comenzará a operar automáticamente utilizando su lógica de ejecución integrada. En lugar de basarse en un único concepto de negociación, Aurum Alpha

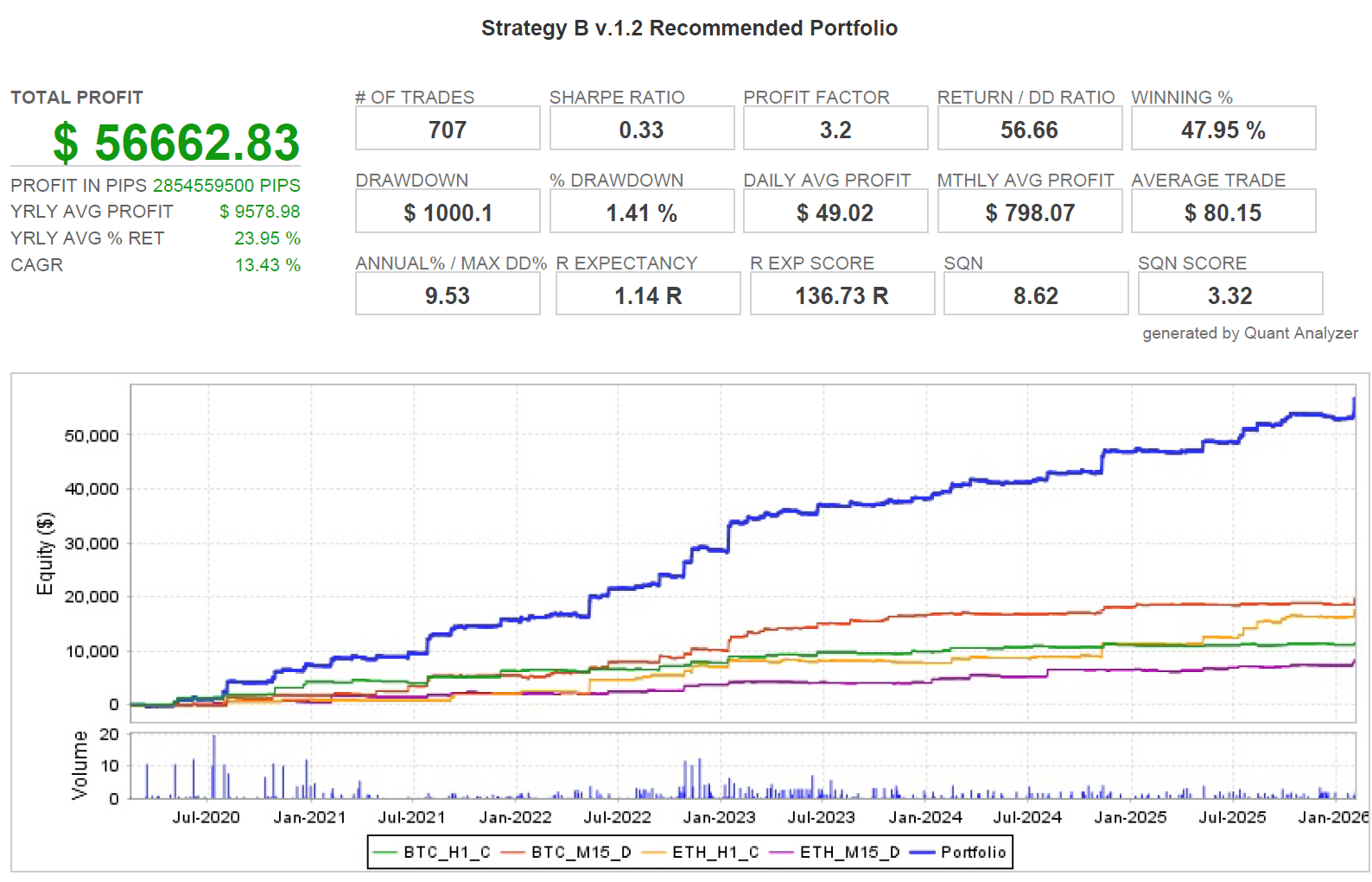

Strategy B — How Momentum and Price Action Systems Work in Real Markets

At that moment, it felt like my journey as a developer had come to an end.

I was psychologically exhausted.

For me, an EA is a form of art, and at that time I experienced a real creative burnout.

But the markets are something I cannot imagine my life without.

Then came a difficult period, a pause…

Yet even during that time, I was still 24/7 in the markets — analyzing, observing, learning.

Eventually, I returned with new knowledge and fresh ideas.

What I love the most is creating.

When an idea is born 💡

Then come the first lines of code,

The first results in the Strategy Tester,

And at some point, you realize that it’s no longer just code — it’s a living EA.

First, it performs in the tester.

Then it starts working on real user accounts.

And when the first positive feedback arrives — that feeling is what truly drives me to keep creating.

Of course, mistakes happen.

Often, things don’t work out on the first attempt.

But these very emotions and this journey are what push me forward —

to refine ideas, improve systems, and bring each EA closer to perfection.

It's my way.

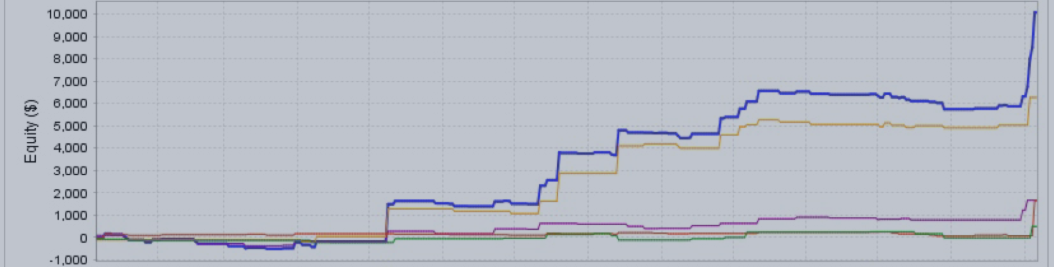

I’ve updated the recommended preset set for Strategy B to better match current crypto market conditions.

🆕 New presets included:

• BTC_M15_D

• BTC_H1_C

• ETH_M15_D

• ETH_H1_C

📊 After the ETF launch and the arrival of institutional players, the market shifted toward lower volatility, higher noise, and longer range phases.

This update focuses on more conservative and stable performance, while preserving profitability in the new environment.

🔗 Product page: https://www.mql5.com/en/market/product/156340

The Golden Mean is a long-term trend Expert Advisor designed for traders and investors who prioritize stability, robust logic, and risk efficiency over fast and aggressive profits.

This system is fully universal, supporting trading across multiple markets and asset classes using a single, consistent trend-following logic.

🔹 Strategy type — long-term trend following

🔹 Trading philosophy — capture rare but strong trends

🔹 Target audience — professional investors focused on capital growth and stability

⚖️ High Risk-to-Reward ratio

The Golden Mean operates with a Risk Reward of 1:4 and higher, which makes it especially attractive for investors who understand that long-term profitability is built on asymmetric risk, not high trade frequency.

🚫 No chasing fast profits

🚫 No aggressive scalping

✅ Disciplined entries

✅ Letting profits run

📊 Supported instruments:

✅ Metals: Gold (XAUUSD) — H1, H4

✅ Cryptocurrency: Bitcoin (BTCUSD) — H1, H4

✅ Stock Indices: S&P 500, NASDAQ (US100), NIKKEI (JP225)

✅ US Stock Market: AAPL, ADBE, ADSK, AMD, AMZN, AXP, DELL, EBAY, GOOGL, JNJ, JPM, LMT, META, MSFT, NFLX, NVDA, ORCL, TSLA, V

📌 The Golden Mean is built for those who prefer systematic trend exposure, controlled drawdowns, and long-term consistency — not short-term excitement.

👉 Product page: https://www.mql5.com/en/market/product/163388

Night Walker EA is a night scalper developed to trade during the quiet market phase after the US session close and at the beginning of the Asian session.

🔹 Core concept — frequent but fast trades

🔹 System goal — capture small, technically clean price movements

🔹 Trading style — controlled night scalping without aggressive exposure

📊 Trading instruments:

✅ AUDCAD, EURAUD, EURGBP, GBPUSD, USDCAD, USDCHF, USDJPY

⚙️ During night hours, the market becomes more range-driven, spreads stabilize (especially on RAW accounts), and price action follows technical structures more clearly — exactly the environment Night Walker EA is optimized for.

📈 Since its public release in January, Night Walker EA has demonstrated stable live trading results after the EA launch, confirming the robustness of the strategy in real market conditions.

👉 Product page: https://www.mql5.com/en/market/product/160849