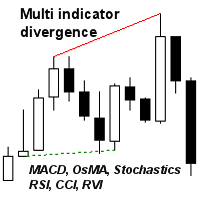

Multi oscillator divergence MT5

- Indicadores

- Jan Flodin

- Versión: 3.6

- Actualizado: 12 julio 2025

- Activaciones: 10

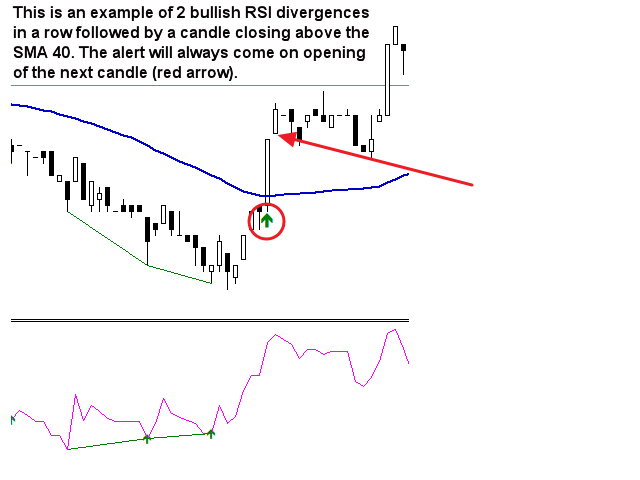

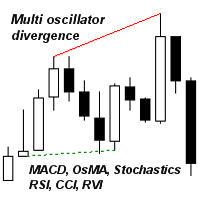

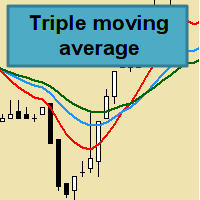

El indicador identifica cuando ocurre una divergencia entre el precio y un oscilador / indicador. Identifica divergencias tanto regulares como ocultas. Tiene una opción de filtro RSI que permite filtrar solo las configuraciones más fuertes. El indicador también ofrece opciones para esperar una ruptura del canal de Donchian o que el precio cruce una media móvil (ver captura de pantalla n. ° 3) para confirmar la divergencia antes de señalar la oportunidad comercial. Combinado con sus propias reglas y técnicas, este indicador le permitirá crear (o mejorar) su propio sistema poderoso.

Características

- Puede detectar divergencias para los siguientes osciladores / indicadores: MACD, OsMA, estocásticos, RSI, CCI, RVI, Awesome, ADX, índice compuesto, ATR, OBV, MFI y Momentum. Solo se puede seleccionar un oscilador / indicador.

- Dibuja líneas continuas para divergencias regulares / clásicas (reversión potencial) y líneas discontinuas para divergencias ocultas (continuación de tendencia). Las líneas se dibujan tanto en el gráfico como en la ventana del indicador.

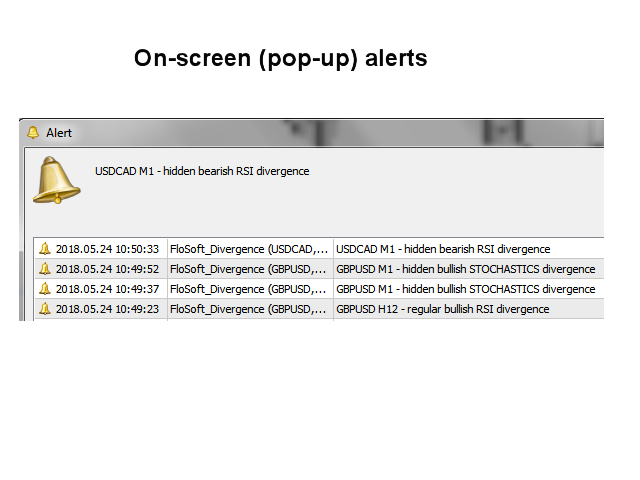

- Envía una alerta cuando una divergencia o una ruptura / cruce ha sido detectado. Se admiten todos los tipos de alertas nativas de Metatrader.

- Contiene 1 búfer que un desarrollador puede usar con la función iCustom () en un Asesor Experto (EA). El índice del búfer es 4 y el desplazamiento es siempre 0. El ejemplo de código y los valores de retorno del búfer se pueden encontrar al final del blog .

Parámetros de entrada

Encuentre la descripción y explicación de los parámetros de entrada aquí .

A very good indicator. Lots of settings for displaying signals, MA, Donchian, etc. This alone filters out many false signals. A few years ago, I used MT4, but I returned to this indicator in MT5. Of course, no indicator always displays 100% correct signals, so it is always necessary to check whether the divergence is correctly plotted, because sometimes the divergence is marked strangely. In any case, despite this, it is the best divergence indicator I have known since 2020.