GS grid

- Asesores Expertos

- Aleksander Gladkov

- Versión: 10.1

- Actualizado: 14 abril 2025

- Activaciones: 10

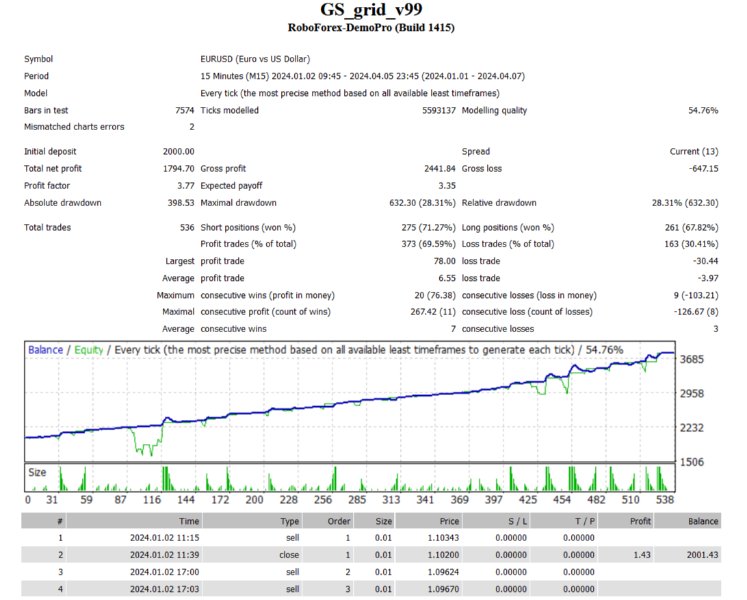

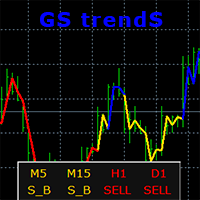

Utiliza un algoritmo de rejilla avanzado sin martingala o con martingala limitada (por defecto) (versión para MT5: GS grid5 ).

- Define y controla la tendencia actual;

- Cambia él mismo sus parámetros de acuerdo con las condiciones actuales del mercado;

- Algoritmo de rejilla flexible personalizable con o sin martingala;

- Algoritmo de reducción del Drawdown (DD Reduction Algoritm);

- Algoritmo de cobertura;

- Botones interactivos de control de operaciones;

- Posibilidad de abrir/cerrar órdenes manualmente;

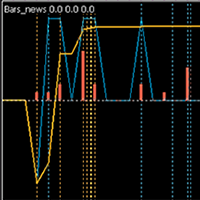

- Filtro de noticias para evitar la negociación durante la publicación de noticias.

Configurado para trabajar en EURUSD timeframe M15, H1.

Funciona en cuentas con un apalancamiento de 1: 500 y un depósito de 1000USD.

Principio de funcionamiento

Utiliza los indicadores Heiken Ashi, RSI. Puede activar la martingala limitada o utilizar un lote permanente.

Filtro incorporado para noticias sobre tipos de interés: El Asesor no abre nuevas operaciones en los días de publicación de las decisiones sobre tipos de la Fed y el BCE.

La operación comienza con la primera orden abierta y finaliza cuando el beneficio total de las órdenes (por separado Vender, por separado Comprar) supera el valor del parámetro Beneficio objetivo y, en función del valor del parámetro Beneficio máximo de la toma establecida:

- NO_use - las órdenes se cierran inmediatamente;

- use_Signal - se cierran cuando se recibe una señal de reversión;

- use_Trailing - se establecen grupos de órdenes Stop Loss y se activa el modo Trailing.

Parámetro El Conjunto de Ajustes contiene una lista de varios parámetros de autoajuste para el asesor. Incluyendo " Nightly" - modo de scalping nocturno.

Los ajustes están ordenados por riesgo y rentabilidad crecientes. Puede considerarlos como ejemplos para dominar la gestión del asesor.

Hay filtros que le permiten configurar el Asesor experto para las mejores condiciones de negociación.

Información adicional en mi blog: https://www.mql5.com/en/blogs/post/724376Parámetros

Ajuste Set = NO - opciones para autoajustar los parámetros del asesor (NO, Safety, Nightly_GMT, Work1, Work2, Work3, Work4, Risky)

Set Take Maximum profit = use_Signal - modo de cerrar la operación con el mayor beneficio posible {NO_use, use_Signal, use_Trailing}

Use orders SELL=true;

Use orders BUY=true;

Open New Series = true;

Use Auto Direction Trade=true;

Target profit (points) = 90 - beneficio objetivo

Magic number = 23777 - debe ser único para cada gráfico

------- Hedge

Use Hedge =true;

Persent Equity for activate Hedge = 50;

Persent Equity for close Hedge = 99;

Hedge order Lot Increment Factor = 1.5;

Orden de cobertura TP = 200;

Orden de cobertura SL = 150;

Orden de cobertura Trailing Step (0 -no usar) = 0;

------- Ajustes del lote -------

Modo del Lote = Lot_Increment;

Factor de Incremento del Lote = 1.3 - tamaño del lote lot = lot * MathPow (Factor de Incremento del Lote, num), donde num es el número de orden en el grupo de VENTA o COMPRA

Factor de Incremento del Tamaño del Paso =1.1 - parámetro para incrementar el intervalo dependiendo del número de órdenes abiertas

Usar Gestión de Dinero = false;

Nivel de Riesgo = Risk_Medium;

Lotes de Inicio = 0.01 - el volumen inicial del lote

Número de pasos para aumentar el lote = 7 - limita el aumento del lote al número de pasos especificado

------- Configuración de órdenes -------

Distancia fija entre órdenes =false;

Distancia entre órdenes(puntos ) =80;

Orden Stop Loss (puntos) = 0 - Stop Loss para la orden actual

Orden Take Profit (puntos) = 0 - TakeProfit para la orden actual

Ordenes máximas = 13 - el número máximo de órdenes abiertas

Max orders for DD Reduction Algorithm (0 -no usar) = 0;

------- Filtros de tiempo -------

Día final = viernes - el día final de la transacción

Hora de inicio = "00:00" - hora de inicio (Hora local)

Hora final = "23:59" - hora final (Hora local)

------- NEWS filters -------

Filter News Forex Factory=false; - filtrar por noticias de Forex Factory

News Alert=true;

IncludeHigh=true;

IncludeMedium=true;

IncludeLow=false;

IncludeSpeaks=true;

STOP minutes before an event News = 30;

STOP minutes after an event News = 60;

Finally a normal robot at an affordable price! Several modes, lots of options and most importantly satbil! Your account will not be reset in the 2nd month! The secret is a lot of backtesting! Thanks!