Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.09.03 10:17

Weekly Outlook: 2016, September 04 - September 11 (based from the article)

Kuroda’s speech, Rate decision in Australia, Canada the EU, Employment data in the US and Canada as well as US Crude Oil Inventories. These are the highlights of this week.

- Haruhiko Kuroda speaks: Monday, 4:30. Bank of Japan Governor Haruhiko Kuroda will speak in Tokyo. Volatility is expected.

- Australian rate decision: Tuesday, 4:30. Economists anticipate more easing measures in the coming months with a 68% chance for another cut is December.

- US ISM Non-Manufacturing PMI: Tuesday, 16:00. The ISM Non-Manufacturing index is expected to reach 55.4 this time.

- Australian GDP: Wednesday, 1:30.

- Canadian rate decision: Wednesday, 14:00. Economists do not expect a change in monetary policy anytime soon.

- EU rate decision: Thursday, 11:45. Analysts expect the ECB will act in the fall or winter to extend its bond-buying stimulus program past its expiry date of March 2017.

- US Unemployment rate: Thursday, 12:30.

- US Crude Oil Inventories: Thursday, 15:00. This unexpected trend cast shadow over the oil industry in the coming months.

- Canadian Employment data: Friday, 12:30.

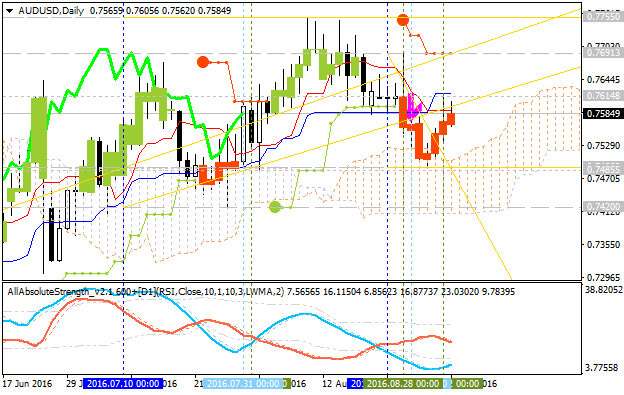

Daily price was on the secondary correction within the primary bullish market condition: the price was bounced from 0.7489 support level to above for the ranging condition to be started. For now, the price is on ranging within the following support/resistance levels:

- 0.7691 resistance level located far above Ichimoku cloud in the bullish area of the chart, and

- 0.7489 support level located inside Ichimoku cloud on the way to the bearish reversal.

Absolute Strength indicator is estimating the ranging bullish market condition to be continuing in the near future.

If D1 price breaks 0.7489

support level on close bar so the secondary correction within the

primary bullish trend will be resumed with the ranging way: the price

will be located inside Ichimoku cloud in this case.

If D1 price breaks 0.7407

support level on close bar so the reversal of the price movement from

the ranging bullish to the primary ebarish market condition will be

started.

If D1 price breaks 0.7691

resistance level on close bar from below to above so the bullish trend

will be resumed with 0.7755 nearest bullish target to re-enter.

If not so the price will be on bullish ranging within the levels.

- Recommendation for long: watch close D1 price to break 0.7691 for possible buy trade

- Recommendation

to go short: watch D1 price to break 0.7489 support level for possible sell trade

- Trading Summary: ranging

| Resistance | Support |

|---|---|

| 0.7691 | 0.7489 |

| 0.7755 | 0.7407 |

SUMMARY : bullish

TREND : rangingNew daily bar was opened and our dynamic support/resistance levels were changed a little:

- the support level at 0.7485 is the level for the secondary correction to be started (instead of 0.7489),

- bearish reversal support level is 0.7420 (instead of 0.7407).

Descending triangle pattern was formed by the price to be crossed to below for the correction to be started (if crossed).

Most likely scenarios for the daily price movement for the week are the following:

- secondary correction on the ranging way to be started by 0.748 support to be crossed by the price to below (the price will be inside Ichimoku cloud on this way), or

- bullish ranging within the levels.

So, it is the ranging anyway (good for martingale and for scalping systems for example).

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.09.06 07:38

AUD/USD Intra-Day Fundamentals: Reserve Bank of Australia Cash Rate and 20 pips range price movement

2016-09-06 04:30 GMT | [AUD - Cash Rate]

- past data is 1.50%

- forecast data is 1.50%

- actual data is 1.50% according to the latest press release

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Cash Rate] = Interest rate charged on overnight loans between financial intermediaries.

==========

From Financial Times article: RBA keeps benchmark rate on hold

"The Reserve Bank of Australia has kept its benchmark rate on hold at 1.5 per cent, as Glenn Stevens presides over his final policy meeting as governor."

From the RBA’s statement:

Low interest rates have been supporting domestic demand and the lower exchange rate since 2013 is helping the traded sector. Financial institutions are in a position to lend for worthwhile purposes. These factors are all assisting the economy to make the necessary economic adjustments, though an appreciating exchange rate could complicate this.

Supervisory measures have strengthened lending standards in the housing market. Separately, a number of lenders are also taking a more cautious attitude to lending in certain segments. The best available information suggests that dwelling prices overall have risen moderately over the past year and growth in lending for housing purposes has slowed. Considerable supply of apartments is scheduled to come on stream over the next couple of years, particularly in the eastern capital cities.

==========

AUD/USD M5: 20 pips range price movement by RBA Cash Rate news event

Forum on trading, automated trading systems and testing trading strategies

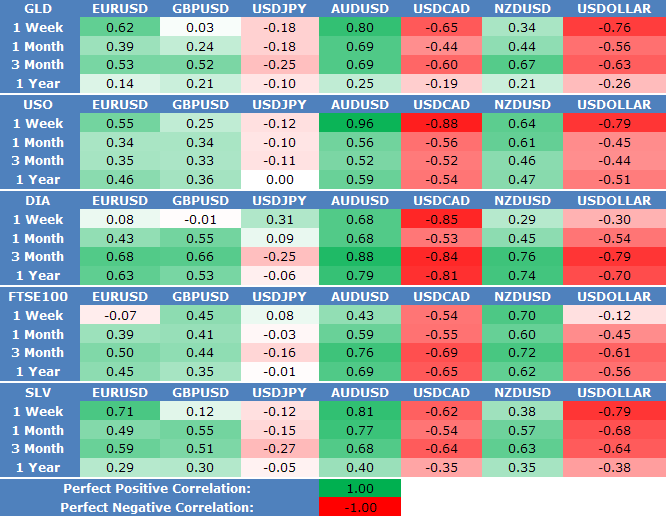

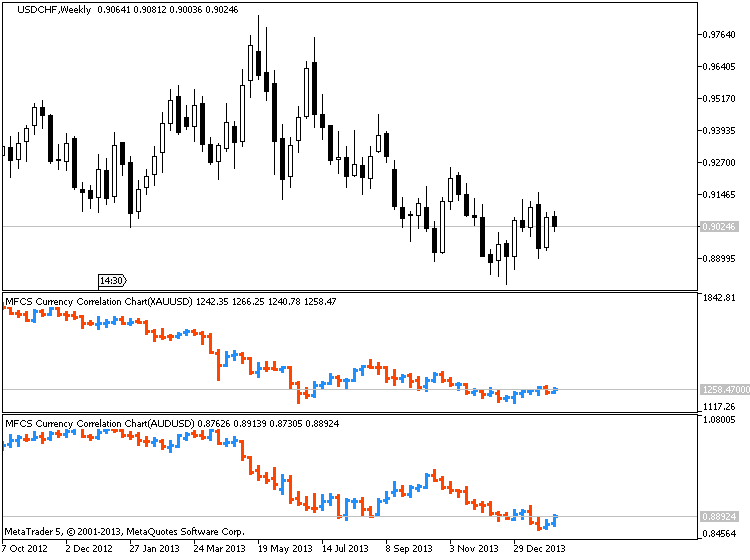

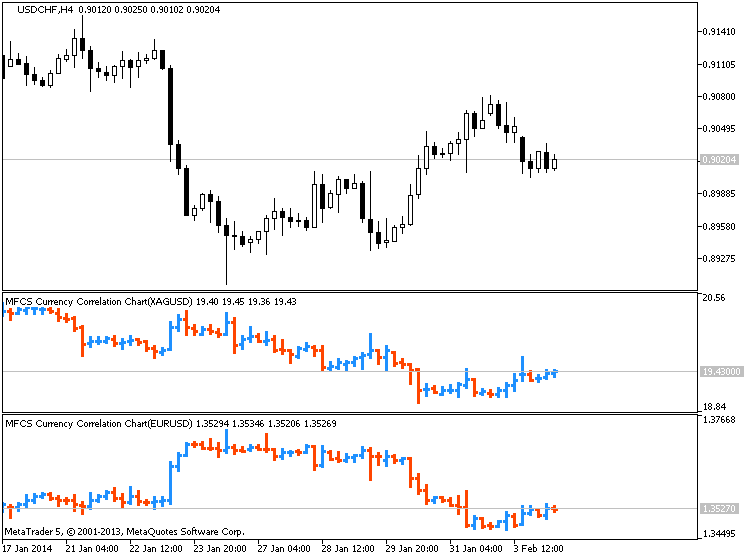

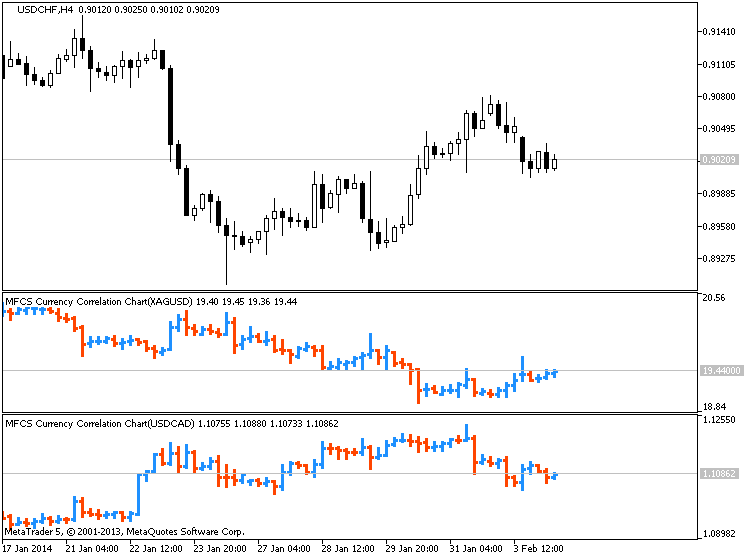

Indicators: MFCS Currency Correlation Chart

Sergey Golubev, 2014.02.04 09:27

Australian Dollar Strongly Correlated to Gold, Silver, Steel Prices (based on this article)

View forex correlations to the SPDR Gold ETF Trust

(GLD), United States Oil Fund ETF (USO), SPDR Dow Jones Industrial

Average ETF Trust (DIA), UK FTSE 100 Index, and IShares Silver Trust ETF

(SLV) prices:

XAUUSD/AUDUSD :

XAGUSD/EURUSD :

XAGUSD/USDCAD :

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.09.07 08:14

AUD/USD Intra-Day Fundamentals: Australian Gross Domestic Product and 28 pips range price movement

2016-09-07 01:30 GMT | [AUD - GDP]

- past data is 1.0%

- forecast data is 0.6%

- actual data is 0.5% according to the latest press release

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - GDP] = Change in the inflation-adjusted value of all goods and services produced by the economy.

==========

- The Australian economy grew by 0.5% in seasonally adjusted chain volume terms in the June quarter.

- Final consumption expenditure increased 0.8%, contributing 0.6 percentage points to growth in GDP.

- Private non-financial corporations Gross operating surplus increased 2.9% while Compensation of employees increased 0.5%.

- The Terms of trade increased by 2.3% in seasonally adjusted terms.

==========

AUD/USD M5: 28 pips range price movement by Australian GDP news event

Forum on trading, automated trading systems and testing trading strategies

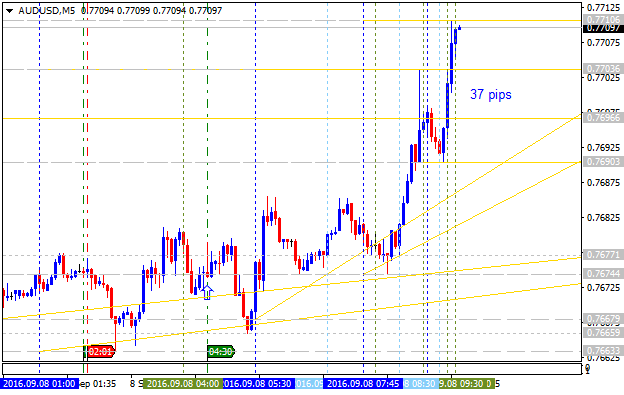

Sergey Golubev, 2016.09.08 08:47

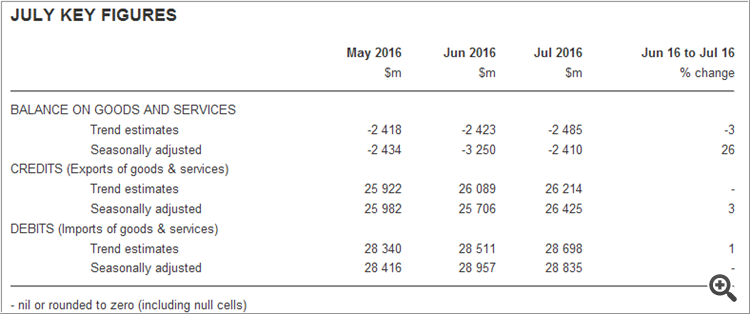

AUD/USD Intra-Day Fundamentals: Australian Trade Balance and 37 pips price movement

2016-09-08 01:30 GMT | [AUD - Trade Balance]

- past data is -3.25B

- forecast data is -2.70B

- actual data is -2.41B according to the latest press release

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Trade Balance] = Difference in value between imported and exported goods and services during the reported month.

==========

==========

AUD/USD M5: 37 pips price movement by Australian Trade Balance news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Daily price was on the secondary correction within the primary bullish market condition: the price was bounced from 0.7489 support level to above for the ranging condition to be started. For now, the price is on ranging within the following support/resistance levels:

Absolute Strength indicator is estimating the ranging bullish market condition to be continuing in the near future.

If D1 price breaks 0.7489 support level on close bar so the secondary correction within the primary bullish trend will be resumed with the ranging way: the price will be located inside Ichimoku cloud in this case.

If D1 price breaks 0.7407 support level on close bar so the reversal of the price movement from the ranging bullish to the primary ebarish market condition will be started.

If D1 price breaks 0.7691 resistance level on close bar from below to above so the bullish trend will be resumed with 0.7755 nearest bullish target to re-enter.

If not so the price will be on bullish ranging within the levels.

SUMMARY : bullish

TREND : ranging