Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.09.13 12:57

AUD/USD Technical Analysis: Aussie Rejected at 0.77 Figure (based on the article)

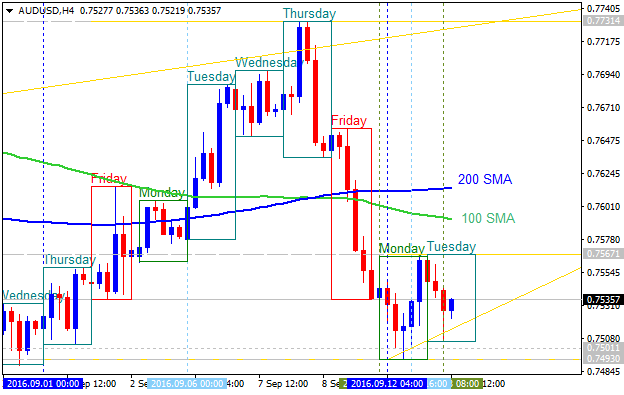

H4

price is on bearish condition located below 100 SMA/200 SMA: price was

bounced from 0.7731 resistance level to below for the breakdown with the

bearish reversal. Fow now, the price is on bearish ranging within

narrow support/resistance levels: 0.7567 resistance and 0.7493 support.

- "The Australian Dollar faltered at familiar resistance near 0.77 against its US counterpart having rebounded as expected after forming a Morning Star candlestick pattern. The bounce saw a retest of broken trend line support-turned-resistance, with subsequent losses potentially marking longer-term down trend resumption."

- "Prices are too close to near-term support to justify entering short from a risk/reward perspective. Opting for the sidelines seems prudent for now, waiting for the pair to offer a better-defined opportunity to sell in line with the emerging bearish bias."

If H4 price breaks 0.7567 resistance level to above on close bar so the local uptrend as the bear market rally will be started.

If H4 price breaks 0.7493 support level to below so the primary bearish trend will be resumed.

If not so the price will be on bearish ranging within the levels.

- Recommendation for long: watch close D1 price to break 0.7567 for possible buy trade

- Recommendation

to go short: watch D1 price to break 0.7493 support level for possible sell trade

- Trading Summary: ranging

| Resistance | Support |

|---|---|

| 0.7567 | 0.7493 |

| 0.7731 | N/A |

SUMMARY : bearish

TREND : rangingForum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.09.14 08:36

AUD/USD Intra-Day Fundamentals: Westpac-Melbourne Institute Consumer Sentiment and 12 pips range price movement

2016-09-14 00:30 GMT | [AUD - Westpac Consumer Sentiment]

- past data is 2.0%

- forecast data is n/a

- actual data is 0.3% according to the latest press release

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Westpac Consumer Sentiment] = Change in the level of a diffusion index based on surveyed consumers.

==========

From thebull.com.au article:

"Wisest place for savings: Banks (chosen by 29.9 per cent of respondents) were regarded as the wisest place for new savings from “Pay Debt” (21.0 per cent) and Real Estate (15.4 per cent)."

"Less certain: Over 5 per cent of respondents don’t know the best place to put new savings."

"These are uncertain times. And

that is shown by the views of Aussie consumers regarding the best place

to put new savings. Before 2015, Aussie consumers had firm views about

where to put new savings. But over the past year, the proportion of

people unsure about the best place to put new savings has lifted to the

highest levels on record. In March this year 7 per cent of people said

that they didn’t know the wisest place for savings. The latest survey

result showed that the proportion of undecided consumers was still high

at 5.3 per cent."

==========

AUD/USD M5: 12 pips range price movement by Westpac-Melbourne Institute Consumer Sentiment news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.09.15 08:10

AUD/USD Intra-Day Fundamentals: Australia Employment Change and 29 pips price movement

2016-09-15 01:30 GMT | [AUD - Employment Change]

- past data is 26.2K

- forecast data is 15.2K

- actual data is -3.9K according to the latest press release

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Employment Change] = Change in the number of employed people during the previous month.

==========

- Employment decreased 3,900 to 11,963,700. Full-time employment increased 11,500 to 8,166,100 and part-time employment decreased 15,400 to 3,797,700.

- Unemployment decreased 10,500 to 713,300. The number of unemployed persons looking for full-time work increased 14,900 to 496,900 and the number of unemployed persons only looking for part-time work decreased 25,400 to 216,400.

- Unemployment rate decreased 0.1 pts to 5.6%.

- Participation rate decreased 0.2 pts to 64.7%.

- Monthly hours worked in all jobs decreased 3.9 million hours to 1,656.0 million hours.

==========

AUD/USD M5: 29 pips price movement by Australia Employment Change news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.09.15 15:01

Intra-Day Fundamentals - EUR/USD, USD/CAD and AUD/USD: U.S. Retail Sales and U.S. Philadelphia Fed Business Outlook Survey

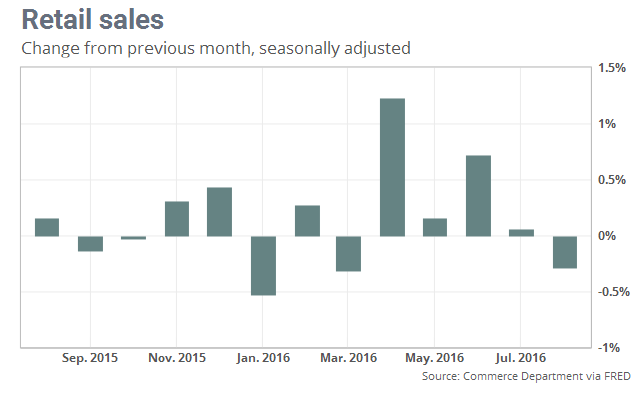

2016-09-15 12:30 GMT | [USD - Retail Sales]

- past data is 0.1%

- forecast data is -0.1%

- actual data is -0.3% according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Retail Sales] = Change in the total value of sales at the retail level.

==========

==========

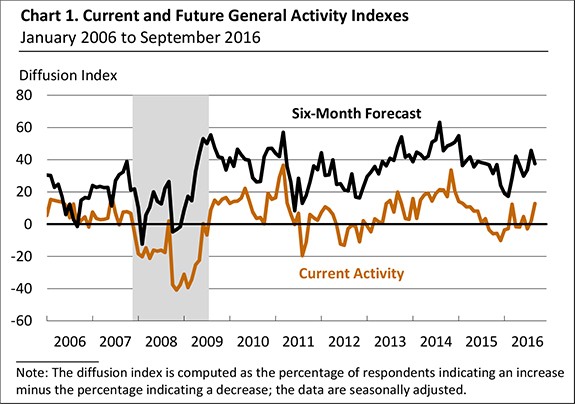

2016-09-15 12:30 GMT | [USD - Philly Fed Manufacturing Index]

- past data is 2.0

- forecast data is 1.1

- actual data is 12.8 according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Philly Fed Manufacturing Index] = Level of a diffusion index based on surveyed manufacturers in Philadelphia.

==========

==========

EUR/USD M5: 20 pips price movement by U.S. Retail Sales and Philly Fed Manufacturing Index news events

==========

USD/CAD M5: 57 pips range price movement by U.S. Retail Sales and Philly Fed Manufacturing Index news events

==========

AUD/USD M5: 42 pips range price movement by U.S. Retail Sales and Philly Fed Manufacturing Index news events

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Daily price is on breakdown which was started on Friday on close daily bar: the price is testing upper border of Ichimoku cloud to below for the bullish breakdown to be continuing with the secondary ranging way and with 0.7485 bearish reversal target. Chinkou Span line of Ichimoku indicator is estimating the breakdown to be continuing, and Absolute Strength indicator is evaluating the trend as a ranging correction within the primary bullish market condition.

If D1 price breaks 0.7485 support level on close bar so the reversal of the price movement from the ranging bullish to the primary bearish market condition will be started.If D1 price breaks 0.7731 resistance level on close bar from below to above so the bullish trend will be resumed with 0.7755 nearest bullish target to re-enter.

If not so the price will be on bullish ranging within the levels.

SUMMARY : bullish

TREND : ranging correction