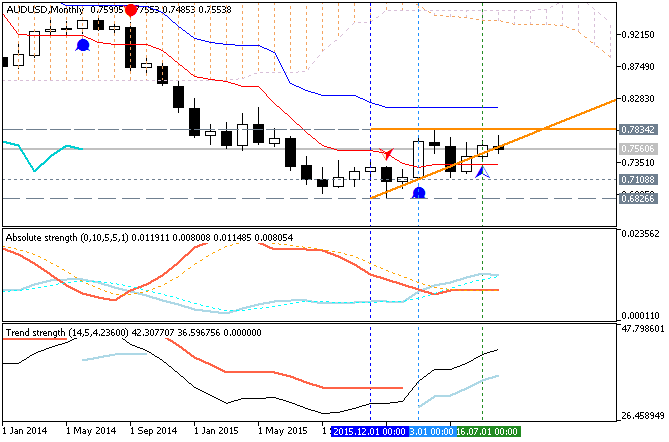

By the way, if we look at the weekly price so the secondary correction may be started on this timeframe as well. And if the weekly price breaks 0.7420 support on close bar to below so the next level will be 0.7324 which is bearish reversal level for the medium term sirtuation for example (up to the end of this year).

As to monthly price so it is already on the bearish, and this bearish tendency is the long-term situation for the many years.

The question is how much bearish (too much bearish or not too much - what is the question):

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.08.28 08:23

Fundamental Weekly Forecasts for Dollar Index, GBP/USD, USD/JPY, AUD/USD, NZD/USD, USD/CNH and GOLD (based on the article)

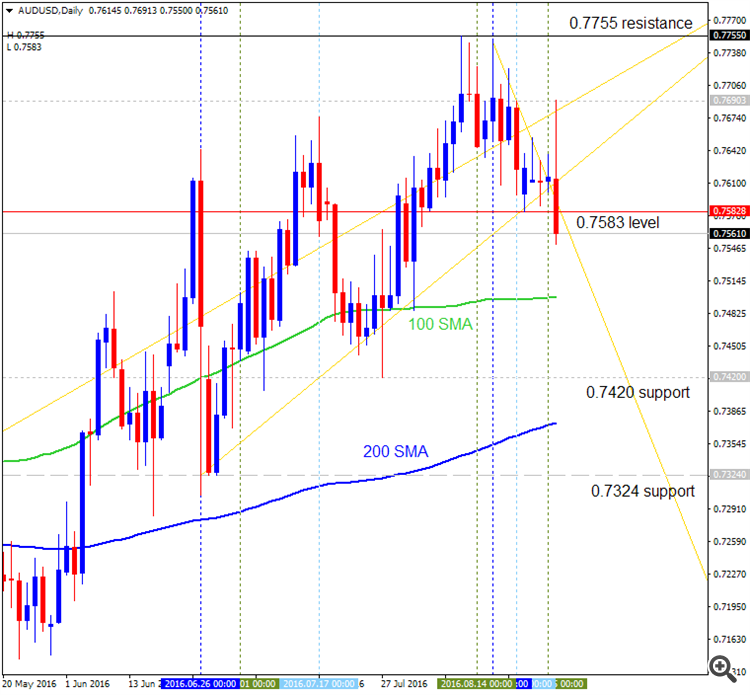

AUD/USD - "On the domestic front, a steady stream of activity data will feed speculation about the RBA’s policy trajectory. Building Permits, Retail Sales and capex numbers are all due to cross the wires. Australian economic news-flow has weakened relative to economists’ expectations over recent weeks and the year-end monetary policy outlook implied in futures prices has steadily eroded despite central bank officials’ downplaying of near-term stimulus expansion prospects. Another soft round of data outcomes may encourage the markets’ dovish disposition, compounding downward-pulling external forces and deepening the selloff."- If the price breaks this 0.7583 level to above on close daily bar so the primary bullish trend will be continuing with 0.7755 resistance as a nearest daily target.

- If the price breaks this 0.7583 level to below on daily close bar so the local downtrend as the secondary correction within the primary bullish trend will be started.

- If the price breaks 0.7420 support to below on daily close bar so the reversal of the price movement from the bullush to the primary ebarish market condition will be started with 0.7324 level to re-enter.

The most likely scenario for this pair for the coming week is the following: bullish ranging within the levels.

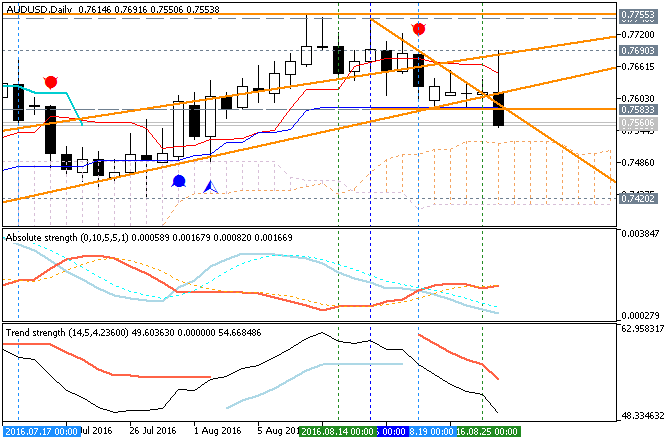

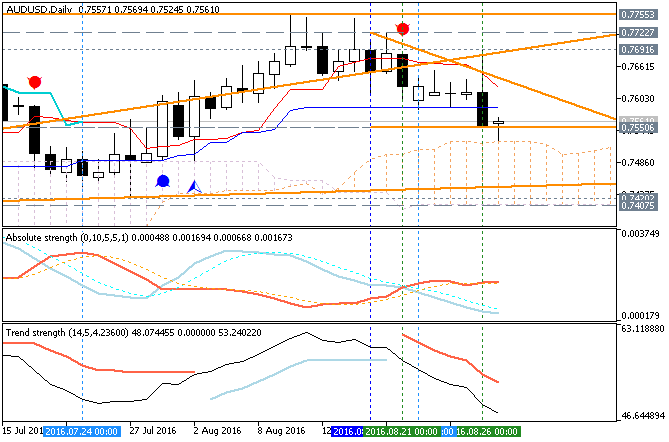

Daily price is breaking 0.7583 support level to below for the daily secondary correction within the primary bullish trend.

- The price is breaking descending triangle pattern to below for the local downtrend as the secondary correction to be continuing.

- Chinkou Span line of Ichimoku indicator is located above Ichimoku cloud indicating the future possible breakdown to be started in the near future.

- Trend Strength indicator and Absolute Strength indicator are estimating the trend as the correctional one.

The bearish reversal level is 0.7420 support, and if the price breaks this level to below so the bearish reversal will be started.

If D1 price breaks 0.7420 support level on close bar so the reversal of the daily price movement from the bullish to the primary bearish market condition will be started.

If D1 price breaks 0.7755 resistance level on close bar from below to above so the bullish trend will be resumed.

If not so the price will be on bullish ranging within the levels.

- Recommendation for long: watch close D1 price to break 0.7755 for possible buy trade

- Recommendation

to go short: watch D1 price to break 0.7420 support level for possible sell trade

- Trading Summary: correction

| Resistance | Support |

|---|---|

| 0.7690 | 0.7583 |

| 0.7755 | 0.7420 |

SUMMARY : bullish

Support level at 0.7583 was broken by the price to below, and new support level together with new descending triangle pattern is going to be tested for now: 0.7550 - this level is necessary to be broken for the secondary correction to be continuing.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.08.30 07:13

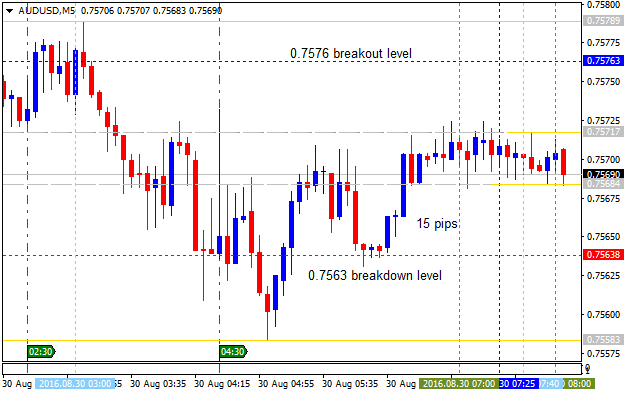

AUD/USD Intra-Day Fundamentals: Australia Building Approvals and 15 pips price movement

2016-08-30 01:30 GMT | [AUD - Building Approvals]

- past data is -4.7%

- forecast data is 0.0%

- actual data is 11.3% according to the latest press release

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Building Approvals] = Change in the number of new building approvals issued.

==========

==========

AUD/USD M5: 15 pips range price movement by Australia Building Approvals news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.08.30 16:22

Intra-Day Fundamentals - EUR/USD, GBP/USD and AUD/USD: The Conference Board Consumer Confidence

2016-08-30 14:00 GMT | [USD - Consumer Confidence]

- past data is 96.7

- forecast data is 97.0

- actual data is 101.1 according to the latest press release

[USD - Consumer Confidence] = Level of a composite index based on surveyed households. Survey of about 5,000 households which asks respondents to rate the relative level of current and future economic conditions including labor availability, business conditions, and overall economic situation.

==========

The Conference Board Consumer Confidence Index®, which had decreased slightly in July, increased in August. The Index now stands at 101.1 (1985=100), compared to 96.7 in July. The Present Situation Index rose from 118.8 to 123.0, while the Expectations Index improved from 82.0 last month to 86.4.

The monthly Consumer Confidence Survey®, based on a probability-design random sample, is conducted for The Conference Board by Nielsen, a leading global provider of information and analytics around what consumers buy and watch. The cutoff date for the preliminary results was August 18.

“Consumer confidence improved in August to its highest level in nearly a year, after a marginal decline in July,” said Lynn Franco, Director of Economic Indicators at The Conference Board. “Consumers’ assessment of both current business and labor market conditions was considerably more favorable than last month. Short-term expectations regarding business and employment conditions, as well as personal income prospects, also improved, suggesting the possibility of a moderate pick-up in growth in the coming months.”

==========

EUR/USD M5: 11 pips price movement by The Conference Board Consumer Confidence news event

==========

GBP/USD M5: 18 pips price movement by The Conference Board Consumer Confidence news event

==========

AUD/USD M5: 16 pips price movement by The Conference Board Consumer Confidence news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.08.31 08:12

AUD/USD Intra-Day Fundamentals: RBA Assist Gov Debelle Speech and 11 pips range price movement

2016-08-31 01:00 GMT | [AUD - RBA Assist Gov Debelle Speaks]

- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

[AUD - RBA Assist Gov Debelle Speaks] = The Speech at the FX Week Asia conference in Singapore.

==========

A well-functioning foreign exchange market is very much in the interest of all market participants. This clearly includes central banks, both in their own role as market participants but also as the exchange rate is an important channel of monetary policy transmission. In a globalised world, the foreign exchange market is one of the most vital parts of the financial plumbing.

==========

AUD/USD M5: 11 pips range price movement by RBA Assist Gov Debelle Speech news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.08.31 14:31

Intra-Day Fundamentals - EUR/USD, GBP/USD and AUD/USD: ADP Non-Farm Employment Change

2016-08-31 12:15 GMT | [USD - ADP Non-Farm Employment Change]

- past data is 194K

- forecast data is 175K

- actual data is 177K according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - ADP Non-Farm Employment Change] = Estimated change in the number of employed people during the previous month, excluding the farming industry and government.

==========

==========

EUR/USD M5: 6 pips range price movement by ADP Non-Farm Employment Change news event

==========

GBP/USD M5: 17 pips range price movement by ADP Non-Farm Employment Change news event

==========

AUD/USD M5: 12 pips range price movement by ADP Non-Farm Employment Change news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.09.01 09:37

AUD/USD Intra-Day Fundamentals: Australian Retail Sales and 23 pips range price movement

2016-09-01 01:30 GMT | [AUD - Retail Sales]

- past data is 0.1%

- forecast data is 0.3%

- actual data is 0.0% according to the latest press release

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Retail Sales] = Change in the total value of sales at the retail level.

==========

- "The trend estimate rose 0.1% in July 2016. This follows a rise of 0.1% in June 2016 and a rise of 0.1% in May 2016."

- "The seasonally adjusted estimate was relatively unchanged (0.0%) in July 2016. This follows a rise of 0.1% in June 2016 and a rise of 0.1% in May 2016."

- "In trend terms, Australian turnover rose 2.7% in July 2016 compared with July 2015."

==========

AUD/USD M5: 23 pips range price movement by Australian Retail Sales news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.09.02 14:48

Intra-Day Fundamentals - EUR/USD, USD/JPY, AUD/USD and NZD/USD: Non-Farm Payrolls

2016-09-02 12:30 GMT | [USD - Non-Farm Employment Change]

- past data is 275K

- forecast data is 180K

- actual data is 151K according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Non-Farm Employment Change] = Change in the number of employed people during the previous month, excluding the farming industry.

==========

"Total nonfarm payroll employment increased by 151,000 in August, and the unemployment rate remained at 4.9 percent, the U.S. Bureau of Labor Statistics reported today. Employment continued to trend up in several service-providing industries."

==========

AUD/USD M5: 58 pips price movement by Non-Farm Payrolls news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Daily price is breaking 0.7583 support level to below for the daily secondary correction within the primary bullish trend.

The bearish reversal level is 0.7420 support, and if the price breaks this level to below so the bearish reversal will be started.

If D1 price breaks 0.7583 support level on close bar together with descending triangle pattern to below so the local downtrend as the secondary correction will be continuing.If D1 price breaks 0.7420 support level on close bar so the reversal of the daily price movement from the bullish to the primary bearish market condition will be started.

If D1 price breaks 0.7755 resistance level on close bar from below to above so the bullish trend will be resumed.

If not so the price will be on bullish ranging within the levels.

SUMMARY : bullish

TREND : correction