U.S. Commercial Crude Oil Inventories

news event: intra-day bearish breakdown; daily ranging for direction

2016-07-13 14:30 GMT | [USD - Crude Oil Inventories]

- past data is -2.2M

- forecast data is -2.3M

- actual data is -2.3M according to the latest press release

[USD - Crude Oil Inventories] = Change in the number of barrels of crude oil held in inventory by commercial firms during the past week.

==========

"U.S.

commercial crude oil inventories (excluding those in the Strategic

Petroleum Reserve) decreased by 2.3 million barrels from the previous

week."

==========

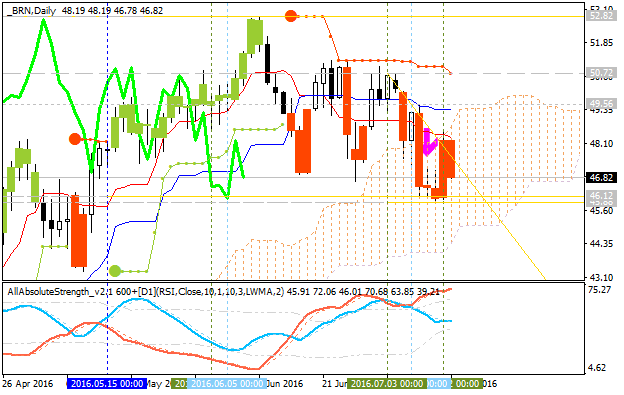

Crude Oil M5: bounced from 200 SMA to below for the bearish breakdown.

The price was bounced from 200 SMA for the bearish breakdown. Price is testing 46.78 support level for the bearish trend to be continuing, otherwise - ranging bearish.

Crude Oil Daily: ranging within Ichimoku cloud for direction. The price is located inside Ichimoku cloud for the ranging condition in the bullish area of the chart to be near and above Senkou Span line which is the virtual border between the primary bearish and the primary bullish trend.

If the price breaks 45.88 support level on close daily bar so the reversal of the price movement from the ranging bullish to the primary bearish market condition will be started.

If not so the price will be on bullish ranging within the levels.

U.S. Commercial Crude Oil Inventories news event: bullish ranging above bearish reversal

2016-07-20 14:30 GMT | [USD - Crude Oil Inventories]

- past data is -2.5M

- forecast data is -1.3M

- actual data is -2.3M according to the latest press release

[USD - Crude Oil Inventories] = Change in the number of barrels of crude oil held in inventory by commercial firms during the past week.

==========

"U.S.

commercial crude oil inventories (excluding those in the Strategic

Petroleum Reserve) decreased by 2.3 million barrels from the previous

week."

==========

Crude Oil M5: breaking 200 SMA for the bullish reversal.

The price is testing 200 SMA to above for the reversal to the primary bullish market condition.

If the price breaks 45.88 support so the intra-day primary bearish trend will be continuing.

If not so the price will be on ranging within the levels.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.07.25 18:14

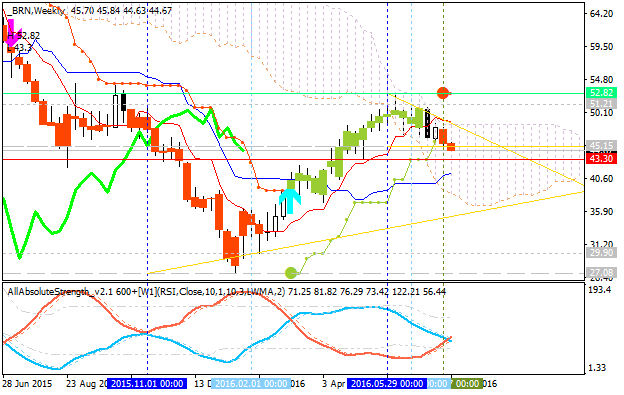

Daily price broke Ichimoku cloud together with 'reversal' Senkou Span line to below for the bearish reversal. The price is testing 45.15 support level on open daily bar for the bearish breakdown to be continuing with 55-day low at 43.30 level as a nearest daily bearish target to re-enter.

If D1 price breaks 48.19 resistance level on close bar from below to above so the reversal of the price movement to the primary bullish market condition will be started.

If D1 price breaks 51.21 resistance level on close bar from below to above so the price will be reversed to the primary bullish market condition with 52.82 nearest bullish target.

If not so the price will be on ranging bearish within the levels.

- Recommendation for long: watch close D1 price to break 51.21 for possible buy trade

- Recommendation

to go short: watch D1 price to break 43.30 support level for possible sell trade

- Trading Summary: bearish

| Resistance | Support |

|---|---|

| 48.19 | 45.15 |

| 51.21 | 43.30 |

SUMMARY : bearish breakdown

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.07.27 16:41

U.S. Commercial Crude Oil Inventories news event: bullish ranging above bearish reversal

2016-07-27 14:30 GMT | [USD - Crude Oil Inventories]

- past data is -2.3M

- forecast data is -2.1M

- actual data is 1.7M according to the latest press release

[USD - Crude Oil Inventories] = Change in the number of barrels of crude oil held in inventory by commercial firms during the past week.

==========

"U.S.

commercial crude oil inventories (excluding those in the Strategic

Petroleum Reserve) increased by 1.7 million barrels from the previous

week."

==========

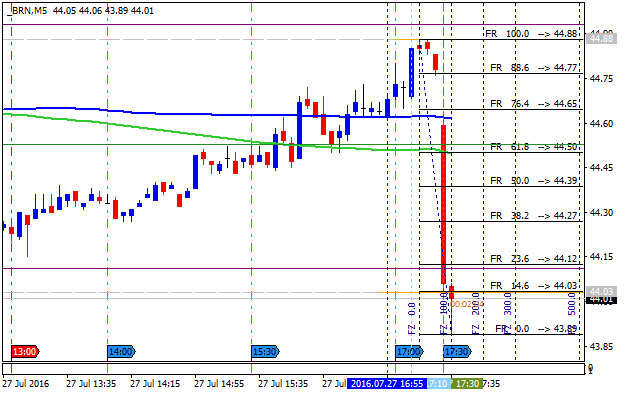

Crude Oil M5: bearish breakdown. The price broke 200 SMA for the breakdown to the bearish area of the chart: price broke 100 SMA/200 SMA for the primary bearish market condition with 43.89 support level as a nearest intra-day bearish target to re-enter.If the price breaks 44.65 resistance level so the reversal of the intra-day price movement from the primary bearish to the primary bullish market condition will be started.

If the price breaks 43.89 support so the intra-day primary bearish trend will be continuing.

If not so the price will be on ranging within the levels.

==========

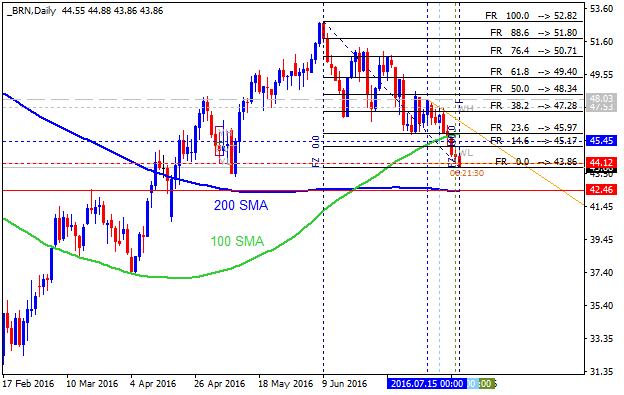

Crude Oil Daily: correction to the bearish reversal.

The price broke 100 period SMA to below for the secondary ranging condition within the primary bearish trend. The price is breakdown for the ready to break 200-day SMA value at 42.46 to below for the reversal of the price movement to the primary bearish market condition.

If the price breaks 50.0% Fibo resistance level at 48.34 to above on close daily bar so the primary bullish trend will be continuing.

if the price breaks 42.46

support level on close daily bar so the reversal of the price movement to the primary bearish market condition will be started.

If not so the price will be on ranging within the levels.

This is very interesting situation for Brent Crude Oil price concerning the weekly chart (the medium term situation up to the beginning fo the next year for example):

- The price is testing 200-day SMA daily chart value at 42.46 to below for the weekly bearish trend to be continuing.

- Symmetric triangle pattern was formed by the price to be crossed for the direction: if ther weekly price breaks this pattern t 35/37 to below on close bar so 29.90/27.08 is the nearest bearish target with this situation.

- Alternative, if the weekly price breaks symmetric triangle pattern to above together with 51.21/52.82 resistance so the local uptrend as the bear market rally will be started.

Most likely scenario by Q1'17: the bearish trend will be continuing with 29.90/27.08 possible target.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.07.29 09:01

Brent Crude Oil Technical Analysis - daily bearish with 42.54 key support (adapted from the article)

Daily price is on bearish market condition located below Ichimoku cloud: price is testing 42.54 support level to below for the bearish trend to be continuing. Alternative, if the price breaks 45.15 resistance level to above so the local uptrend as the bear market rally will be started, otherwise - ranging bearish.

- "Ichimoku Cloud is a trend following indicator that allows you to see the “big-picture trend” on the chart. If price (shown via candles), and the momentum line (bright green on my chart) are below the cloud, we are in a bearish environment. Buying against the momentum and trend is not advised because a downtrend tends to gather steam much like a snowball rolling down a mountain."

- "For now, we can use the bottom of the cloud, which aligns with the

100-DMA at $44.63/bbl as clear resistance. Until price breaks above this

level on a closing basis, higher prices should be viewed as more

favorable levels to enter a short position as opposed to buying low."

- "Significant support aligns at the 61.8% Fibonacci Retracement zone of the February-June zone, which is also the late-March low ~$35.81/bbl. While fighting a trend is not encouraged, that is a level to see if buyers begin to show up due to bargain prices."

Descending triangle pattern was formed by the price to be crossed to below for the bearish trend to be continuing.

- Recommendation for long: watch close D1 price to break 45.15 for possible buy trade

- Recommendation

to go short: watch D1 price to break 42.54 support level for possible sell trade

- Trading Summary: bearish

| Resistance | Support |

|---|---|

| 45.15 | 42.54 |

| 47.53 | N/A |

Weekly price is located below 100 period SMA (100 SMA) and 200 period SMA (200 SMA) in the primary bearish area of the chart. Price is on ranging within the following support/resistance levels:

- 52.82 resistance level located near 100 SMA in the beginning of the bear market rally to be started, and

- 41.49 support level located below 100 SMA/200 SMA in the primary bearish area of the chart.

Symmetric triangle pattern was broken by the price to below for the bearish trend to be continuing.

- If the price breaks 52.82

resistance level so the local uptrend as the secondary rally within the primary bearish market condition will be started.

- If price breaks 41.49 support so the primary bearish trend will be continuing with 35.93 target to re-enter.

- If not so the price will be ranging within the levels.

| Resistance | Support |

|---|---|

| 52.82 | 41.49 |

| N/A | 35.93 |

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.08.10 17:18

U.S. Commercial Crude Oil Inventories

news event: intra-day bearish breakdown; daily ranging for direction

2016-08-10 14:30 GMT | [USD - Crude Oil Inventories]

- past data is 1.4M

- forecast data is -1.3M

- actual data is 1.1M according to the latest press release

[USD - Crude Oil Inventories] = Change in the number of barrels of crude oil held in inventory by commercial firms during the past week.

==========

"U.S.

commercial crude oil inventories (excluding those in the Strategic

Petroleum Reserve) increased by 1.1 million barrels from the previous

week."

==========

Crude Oil M5: intra-day breakdown with the bearish reversal. The price is breaking 100 SMA/200 SMA for the bearish reversal.If the price breaks 45.08 resistance level on close M5 to above so the primary bullish trend will be resumed.

If the price breaks 44.45 support on close M5 bar so the intra-day bearish breakdown will be continuing.

If not so the price will be on ranging within the levels.

==========

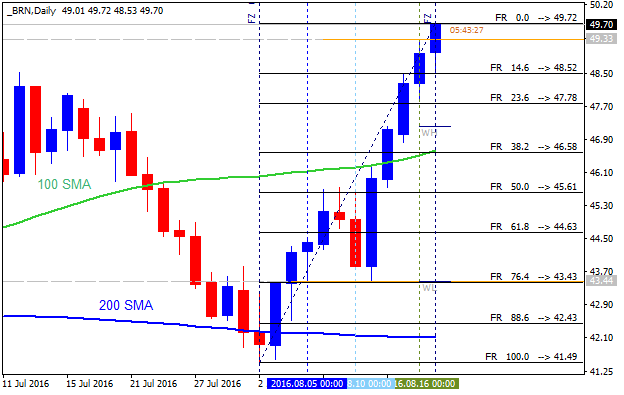

Crude Oil Daily: ranging within 100 SMA/200 SMA reversal area for direction. The price is on bullish ranging condition located to be above 200 SMA and below 100 SMA on the ranging for direction.

If the price breaks 47.16 resistance on close daily bar so the primary bullish trend will be resumed.

If the price breaks 41.49

support level on close daily bar to below so the bearish reversal will be started.

If not so the price will be on ranging within the levels.

U.S. Commercial Crude Oil Inventories

news event: bullish breakout

2016-08-17 14:30 GMT | [USD - Crude Oil Inventories]

- past data is 1.1M

- forecast data is 0.3M

- actual data is -2.5M according to the latest press release

[USD - Crude Oil Inventories] = Change in the number of barrels of crude oil held in inventory by commercial firms during the past week.

==========

"U.S.

commercial crude oil inventories (excluding those in the Strategic

Petroleum Reserve) decreased by 2.5 million barrels from the previous

week."

==========

Crude Oil M5: bullish reversal breakout. The price broke 100 SMA/200 SMA to above to be reversed to the primary bullish market condition. Price is testing 49.72 resistance level to above for the bullish trend to be continuing, otherwise - ranging.If the price breaks 49.72 resistance level so bullish trend will be resumed.

If the price breaks 48.72 support so the reversal of the intra-day price movement to the primary bearish market condition will be started.

If not so the price will be on ranging within the levels.

==========

Crude Oil Daily: bullish breakout. The price is on bullish breakout located to be above 100 SMA/200 SMA reversal area: price is on testing 49.72 resistance level to above for the bullish trend to be continuing.

If the price breaks 49.72 resistance on close daily bar so the primary bullish trend will be continuing.

If not so the price will be on bullish ranging within the levels.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

U.S. Commercial Crude Oil Inventories news event: bullish ranging above bearish reversal

2016-07-07 15:00 GMT | [USD - Crude Oil Inventories]

[USD - Crude Oil Inventories] = Change in the number of barrels of crude oil held in inventory by commercial firms during the past week.

==========

"U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 2.2 million barrels from the previous week."

==========

Crude Oil M5: breakdown with intra-day bearish reversal. The price broke 200 SMA for the breakdown to the bearish area of the chart: price broke some key support levels and it was stopped by 47.04 level for the ranging to be started.If the price breaks 47.98 resistance level so the local uptrend as the bear market rally will be started.

If the price breaks 48.97 resistance level so the reversal of the intra-day price movement from the primary bearish to the primary bullish market condition will be started.

If the price breaks 47.04 support so the intra-day primary bearish trend will be continuing.

If not so the price will be on ranging within the levels.

==========

Crude Oil Daily: bullish ranging within narrow levels. The price is above 100 SMA/200 SMA reversal area in the bullish are of the chart: price is on ranging within 52.82 resistance level and 46.67 support level.If the price breaks 52.82 resistance on close daily bar so the primary bullish trend will be continuing.

if the price breaks 46.67 support level on close daily bar so the local downtrend as a secondary correction within the primary bullish trend will be started.

If not so the price will be on bullish ranging within the levels.