You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.06.22 09:43

Crude Oil Price Trades Higher for 3rd Consecutive Session (adapted from the article)

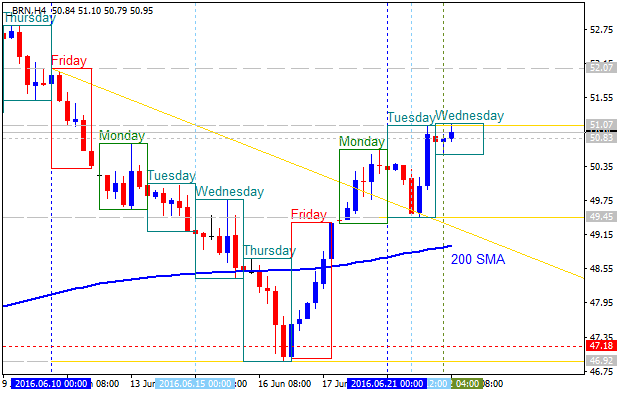

Crude Oil price is on trading higher for the 4th day: intra-day H4 price was started with breakout by 200 SMA crossing to above for the intra-day bullish market condition.

If the price breaks 51.07 resistance level on close H4 bar so the primary bullish trend will be continuing on H4 timeframe.

If the price breaks 49.45 support level to below on close bar so the intra-day bearish trend will be resumed.

If not so the price will be on ranging within the levels.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.06.22 16:38

U.S. Commercial Crude Oil Inventories news event: bullish ranging above bearish reversal

2016-05-25 14:30 GMT | [USD - Crude Oil Inventories]

[USD - Crude Oil Inventories] = Change in the number of barrels of crude oil held in inventory by commercial firms during the past week.

==========

"U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 0.9 million barrels from the previous week."

==========

Crude Oil M5: intra-day bearish breakdown. The price is on ranging to be above 200 period SMA within 49.65 resistance and 49.14 support levels.If the price breaks 51.05 resistance level so the reversal of the M5 price movement from the primary bearish to the primary bullish market condition will be started.

If the price breaks 50.35 support so the intra-day primary bearish trend will be continuing.

If not so the price will be on ranging within the levels.

==========

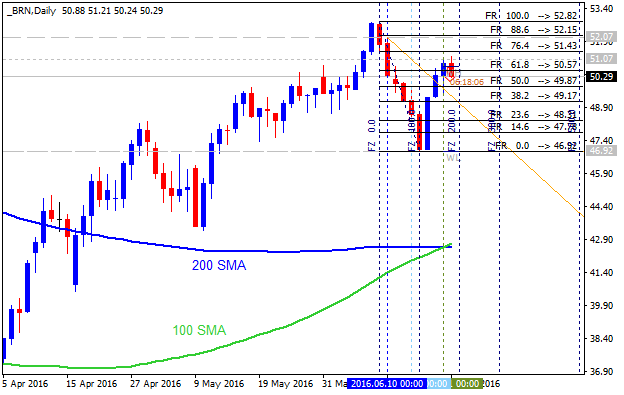

Crude Oil Daily: bullish ranging within key narrow levels. The price is located to be above 100 SMA/200 SMA reversal area in the bullish market condition: price is on ranging within 52.82 resistance level and 46.92 support level.

If the price breaks 52.82 resistance on close daily bar so the primary bullish trend will be continuing.

if the price breaks 46.92 support level on close daily bar so the local downtrend as a secondary correction within the primary bullish trend will be started.

If not so the price will be on bullish ranging within the levels.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.06.27 10:21

After - Crude Oil Aims in Opposite Directions After Brexit (adapted from the article)

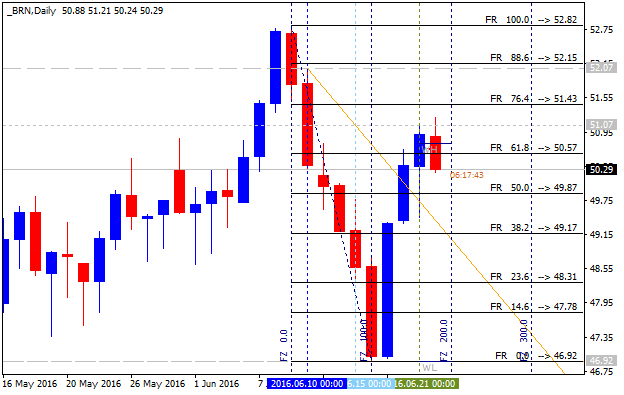

Brent Crude Oil, D1:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.06.27 19:24

Crude Oil Price Forecast: Brexit - daily correction to be started with 43.30 as a daily bearish reversal target (adapted on the article)

D1 price is on ranging market condition within the primary bullish area of the chart: price is located above 100 SMA/200 SMA area for 46.92 support level to be broken to below for the secondary correction to be started with 43.30 bearish reversal target.

If D1 price will break 43.30 support level so the reversal of the price movement from the bullish to the primary bearish market condition will be started.

If D1 price will break 52.82 resistance level so the primary bullish trend will be continuing.

If not so the price will be ranging within the levels.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.06.29 16:51

U.S. Commercial Crude Oil Inventories news event: intra-day bullish breakout; ranging bullish on daily

2016-05-29 14:30 GMT | [USD - Crude Oil Inventories]

[USD - Crude Oil Inventories] = Change in the number of barrels of crude oil held in inventory by commercial firms during the past week.

==========

"U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 4.1 million barrels from the previous week."

==========

Crude Oil M5: intra-day bullish breakout. The price broke 100 SMA to above on Pending Home Sales news event to be reversed from the ranging bullish market condition to the primary bullish. The price is started with the bullish breakout immediate after Crude Oil Inventories news event with 49.73 resistance level to be tested for the bullish trend to be continuing.

If the price breaks 49.73 resistance level so the primary bullish trend will be continuing on this timeframe.If the price breaks 48.88 support so the reversal of the intra-day price movement to the primary bearish market condition will be started.

If not so the price will be on ranging within the levels.

==========

Crude Oil Daily: bullish ranging within 52.82/46.67 levels. The price is located to be above 100 SMA/200 SMA ranging/reversal area in the bullish area of the chart: price is on ranging within 52.82 resistance level and 46.67 support level.If the price breaks 52.82 resistance on close daily bar so the primary bullish trend will be continuing.

if the price breaks 46.67 support level on close daily bar so the local downtrend as a secondary correction within the primary bullish trend will be started.

If not so the price will be on bullish ranging within the levels.