Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.04.06 06:51

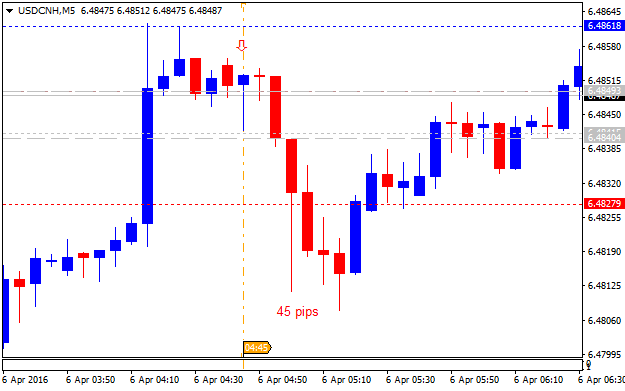

USD/CNH Intra-Day Fundamentals: Caixin Services PMI and 45 pips price movement

2016-04-06 02:45 GMT | [CNH - Caixin Services PMI]

- past data is 51.2

- forecast data is 51.4

- actual data is 52.2 according to the latest press release

if actual > forecast (or previous one) = good for currency (for CNH in our case)

[CNH - Caixin Services PMI] = Level of a diffusion index based on surveyed purchasing managers in the services industry.

==========

"March survey data pointed to a modest rebound in overall Chinese business activity, driven by slightly stronger growth of services activity and a renewed expansion of manufacturing output. The stronger performance of the service sector was highlighted by the Caixin China General Services Business Activity Index posting at 52.2, up from 51.2. That said, the reading continued to point to a modest rate of expansion that was slower than the series average. Meanwhile, manufacturing output returned to growth after an 11-month sequence of stagnant or reducedproduction, though the rate of growth was only marginal."

==========

USDCNH M5: 45 pips price movement by Caixin Services PMI news event :

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.04.07 07:38

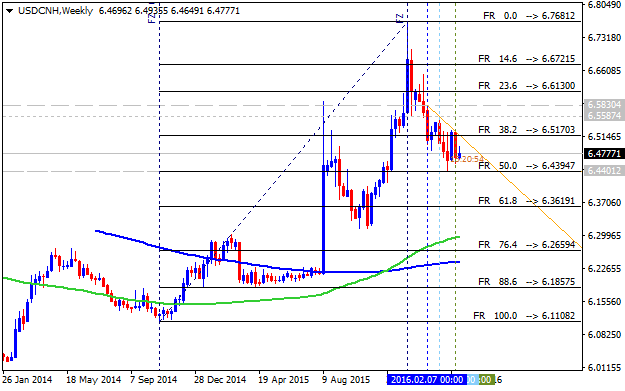

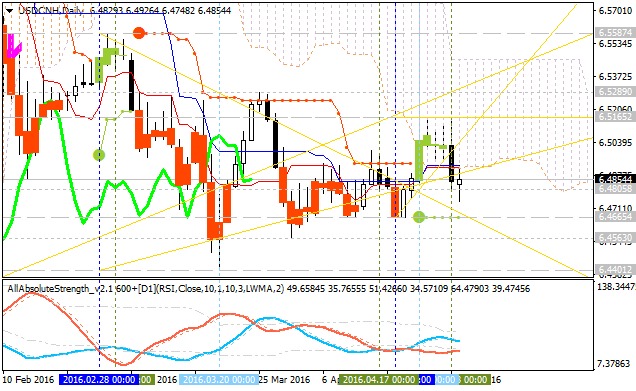

USD/CNH Technical Analysis: Trying to Extend Weekly Uptrend (based on the article)

- "The US Dollar is attempting to build upside momentum against the Chinese Yuan in offshore trade after pushing off support guiding price higher over the past week. Positioning is inconclusive however and gains may yet prove to be corrective in the context of a larger down move from the late-March swing high."

- "A daily close above the 38.2% Fibonacci retracement opens the door for a test of the 50% level. Alternatively, a reversal below 6.4767, a level bolstered by trend line support, paves the way for a challenge of 6.4662."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.04.07 11:18

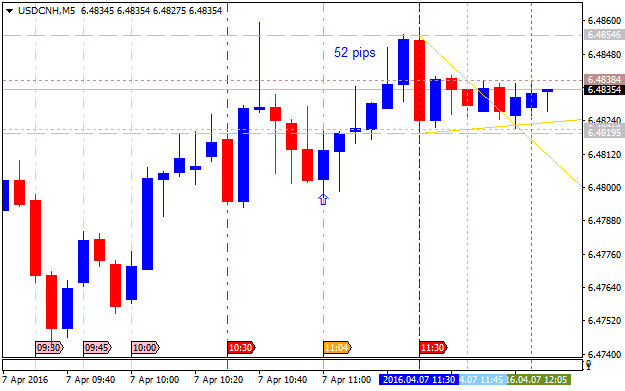

USD/CNH Intra-Day Fundamentals: China Foreign Exchange Reserves and 52 pips price movement

2016-04-07 09:04 GMT | [CNH - Foreign Exchange Reserves (MoM)]

- past data is 3.20T

- forecast data is 3.20T

- actual data is 3.21T according to the latest press release

A high reading is seen as positive (or bullish) for the CNY, while a low reading is seen as negative (or Bearish) for the CNY.

[CNH - Foreign Exchange Reserves] = It presents the total amount of foreign currency held by a government.

==========

USDCNH M5: 52 pips price movement by China Foreign Exchange Reserves news event :

Forum on trading, automated trading systems and testing trading strategies

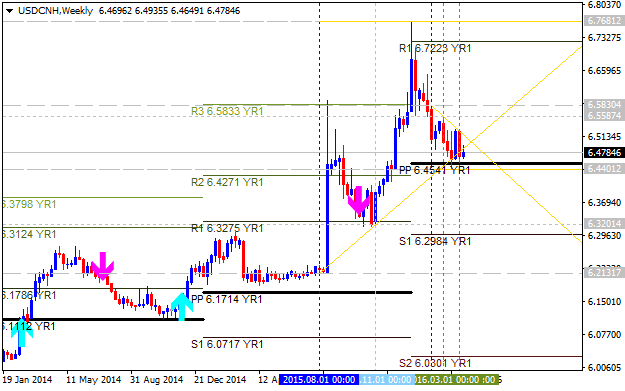

Sergey Golubev, 2016.04.09 09:10

Forex Weekly Outlook April 11 - 15 (based on the article)

The Japanese yen was the king in the past week, frustrating Japanese officials. Inflation data in the UK and the US, Retail sales PPI, and Consumer sentiment in the US, rate decisions in the UK and Canada, Employment data in Australia stand out. These are the main events on forex calendar.

- UK inflation data: Tuesday, 8:30. UK inflation increased 0.3% in February unchanged from the previous month.

- US Retail sales: Wednesday, 12:30. U.S. retail sales fell less than expected in February, down 0.1% following a downwardly-revised minus 0.4% posted in the prior month.

- US PPI: Wednesday, 12:30. U.S. producer prices declined 0.2% in February amid lower energy and food costs.

- Canadian rate decision: Wednesday, 14:00. The Bank of Canada kept its interest rate unchanged at 0.50% in line with market forecast.

- US Crude Oil Inventories: Wednesday, 14:30. Last week, US crude oil inventory plunged 4.9 million barrels to 529.9 million following a 2.3 million gain in the week before. Economists expected a 3.1 million barrels increase. The inventory fell due to growing demand from refineries and a drop in US imports. However, US crude oil inventories are 9.8% higher than in the same period in 2015.

- Australian employment data: Thursday, 1:30. Australian unemployment rate fell unexpectedly to 5.8% in February, from 6.0% in the previous month.

- UK rate decision: Thursday, 11:00. Bank of England maintained its monetary policy and benchmark rate, noting the policymakers will refrain from changing its strategy before the referendum on EU membership, expecting growth would keep the same momentum this quarter as it had at the end of last year.

- US inflation data: Thursday, 12:30. US Consumer Price Index, excluding food and energy, climbed 0.3% in February after a similar rise in January, raising yearly core CPI by 2.3% in the 12 months through February, the largest increase since May 2012. Economists expected a monthly rise of 0.2% and a yearly gain of 2.2%.

- US Unemployment Claims: Thursday, 12:30. The number of Americans filing initial claims for unemployment benefits declined more than expected last week, indicating the labor market continues to strengthen despite lukewarm economic growth. The number of new claims fell 9,000 to a seasonally adjusted 267,000.

- US UoM Consumer Sentiment: Friday, 14:00. The UoM preliminary consumer sentiment index reached 90.0 in March, compared with a final February reading of 91.7. Economists expected the February index would rise to 92.1.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.04.13 08:02

USD/CNH Intra-Day Fundamentals: CNY - USD-Denominated Trade Balance and 55 pips price movement

2016-04-13 02:22 GMT | [CNY - USD-Denominated Trade Balance]

- past data is -32.6B

- forecast data is 30.2B

- actual data is 29.9B according to the latest press release

if actual > forecast (or previous one) = good for currency (for CNY in our case)

[CNY - USD-Denominated Trade Balance] = Trade Balance in US Dollars terms.

==========

USD/CNH M5: 55 pips price movement by CNY - USD-Denominated Trade Balance news event :

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.04.15 07:34

USD/CNH Intra-Day Fundamentals: China GDP and 38 pips range price movement

2016-04-15 02:00 GMT | [CNY - GDP]

- past data is 6.8%

- forecast data is 6.7%

- actual data is 6.7% according to the latest press release

if actual > forecast (or previous one) = good for currency (for CNY in our case)

[CNY - GDP] = Change in the inflation-adjusted value of all goods and services produced by the economy.

==========

- China gross domestic product expanded 6.7 percent on year in the first quarter of 2016.

- Industrial production was 6.8 percent in March compare with forecasts for 6.0 percent and up from 5.9 percent in February.

- Retail sales advanced 10.5 percent on year which was expected for 10.3 percent only.

==========

USD/CNH M5: 38 pips range price movement by China GDP news event :

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.04.23 08:53

Fundamental Weekly Forecasts for Dollar Index, USD/JPY, USD/CNH, NZD/USD, AUD/USD and GOLD (based on the article)

USD/CNH - "The probability of PBOC cutting RRR after the Fed’s next meeting on April 27th is high. The Fed will determine whether to raise US benchmark rates at this meeting, and the probability of the Fed increasing rates in the April meeting is 0% and for June is currently showing at 15.4% based on Fed Funds futures. The Yuan’s appreciation against the US Dollar over the past two weeks has helped to slow down the pace of capital flowing out of China."

This pair was on ranging condition for whole the week with some new reversal levels and setups so let's describe some of the interesting moments for USD/CNH.

------------------

D1 price is on ranging condition: the price is located near and below Senkou Span line which ias the virtual border between the primary ebarish and the primary bullish trend on the chart. The key reversal support/resistance levels for daily price are the following:

- 6.4665 support level located below Ichimoku cloud in the primary bearish area of the chart, and

- 6.5165 resistance level located inside Ichimoku cloud and above Senkou Span line in the ranging bullish area.

If the price breaks 6.4665 support level to below so the primary bearish trend will be continuing.

If the price breaks 6.5165 resistance level to above so the ranging bullish reversal of the price movement may be started with 6.5587 bullish target.

If not so the price will be ranging within the levels.

| Resistance | Support |

|---|---|

| 6.5165 | 6.4665 |

| 6.5587 | 6.4563 |

| N/A | 6.4401 |

SUMMARY : ranging waiting for direction

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.05.03 08:55

Intra-Day Fundamentals - Reserve Bank of Australia Cash Rate: 79 pips for USD/CNH and 141 pips for AUD/USD

2016-05-03 04:30 GMT | [AUD - RBA Cash Rate]

- past data is 2.00%

- forecast data is 2.00%

- actual data is 1.75% according to the latest press release

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - RBA Cash Rate] = Interest rate charged on overnight loans between financial intermediaries.

==========

- "At its meeting today, the Board decided to lower the cash rate by 25 basis points to 1.75 per cent, effective 4 May 2016. This follows information showing inflationary pressures are lower than expected."

- "The global economy is continuing to grow, though at a slightly lower pace than earlier expected, with forecasts having been revised down a little further recently. While several advanced economies have recorded improved conditions over the past year, conditions have become more difficult for a number of emerging market economies. China's growth rate moderated further in the first part of the year, though recent actions by Chinese policymakers are supporting the near-term outlook."

- "Commodity prices have firmed noticeably from recent lows, but this follows very substantial declines over the past couple of years. Australia's terms of trade remain much lower than they had been in recent years."

-

"Sentiment in financial markets has improved, after a

period of heightened volatility early in the year. However,

uncertainty about the global economic outlook and policy

settings among the major jurisdictions continues. Funding

costs for high-quality borrowers remain very low and,

globally, monetary policy remains remarkably accommodative."

- "Taking all these considerations into account, the Board judged that prospects for sustainable growth in the economy, with inflation returning to target over time, would be improved by easing monetary policy at this meeting."

==========

AUD/USD M5: 141 pips price movement by RBA Cash Rate news event

:

USD/CNH M5: 79 pips price movement by RBA Cash Rate news event

:

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.05.07 17:00

China’s forex reserves rise for second month in a row in April to US$3.22 trillion (based on the article)

- "The central bank has started to publish forex reserve data measured by Special Drawing Rights (SDR), a move to cement the presence of the accounting unit of the International Monetary Fund and an effort to reduce the valuation volatility induced by big changes in major currencies."

- "In terms of SDR, the country’s foreign exchange reserves were 2.27 trillion at the end of last month, down from 2.28 trillion at the end of March."

- "The yuan will be officially included as a component currency of the SDR later this year."

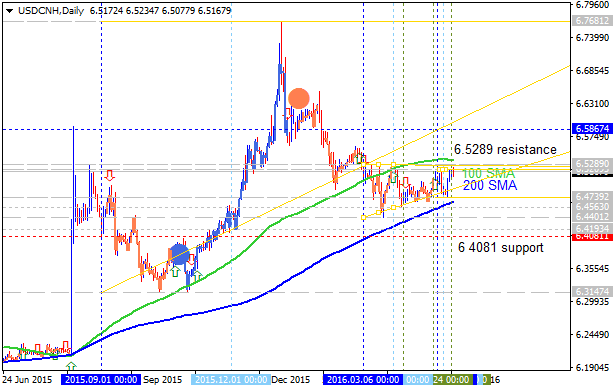

USD to China Offshore Spot - intra-day bullish breakout; daily ranging to the bullish reversal; weekly ranging bullish; 6.5289 is the key level

H4 price is on bullish breakout: the price is teasting 6.5289 resistance level for the bullish trend to be continuing. The key bearish reversal level is 6.4858, and if the price breaks this level to below so the reversal of the price movement from primary bullish to the primary bearish market condition will be started.

Daily price is on ranging condition waiting for direction: if the price breaks 6.5289 resistance to above so we may see the primary bullish trend on this timeframe without secondary ranging with good breakout piossibility.

Weekly price is on ranging bullish condition: if the price breaks 6.5289 to above so the bullish trend will be continuing, otherwise - ranging.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

W1 price is located to be above Ichimoku cloud and above Senkou Span line which is the border of the cloud and virtual border between the primary bearish and the primary bullish trend on the chart.

The price was on the secondary correction since the end of January this year, and the ranging near-and-above Ichimoku cloud is started since the middle of March with the nearest support level at 6.4401. The price is ranging within the following key support/resistance levels:

The price is crossing symmetric triangle pattern for the direction with Absolute Strength indicator estimating the correction to be continuing up to the bearish reversal.

If the price will break 6.3201 support level so the reversal of the price movement from the primary bullish to the primary bearish market condition will be started.

If the price will break 6.6508 resistance level from below to above so the primary bullish trend will be continuing.

If not so the price will be ranging between the levels.

Trend:

W1 - correction