You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.06.10 10:02

EUR/USD Fundamentals: U.K. Goods Trade Balance and 22 pips price movement

==========

2016-06-10 07:00 GMT | [EUR - German Buba President Weidmann Speaks]

[EUR - German Buba President Weidmann Speaks] = The speech about monetary, financial, and fiscal stability at the Bundesbank Spring Conference, in Germany.

==========

==========

EUR/USD M5: 22 pips price movement by German Buba President Weidmann Speaks news event

==========

EUR/USD Intra-Day Technicals: ranging near bearish/bullish reversal for direction

H4 price is located near 200 period SMA waiting for the direction for the bearish or bullish trend to be started. There are 3 main scenario for H4 price movement for today:

- Recommendation

to go short: watch close H4 price to break 1.1289 support level for possible sell trade

- Recommendation

to go long: watch close H4 price to break 1.1414 resistance level for possible buy trade

- Trading Summary: ranging

SUMMARY : ranging for directionForum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.06.13 10:24

EUR/USD Price Action Analysis - bullish ranging near 50.0% Fibo level for the secondary daily correction to the possible bearish reversal

Daily price is above 200 SMA and near-and-above 100 SMA for the bullish market condition with the ranging within Fibo resistance level at 1.1415 and Fibo bearish reversal level at 1.1070.

If the price will break Fibo support level at 1.1070 so the reversal of the price movement from the primary bullish to the primary bearish market condition will be started.

If the price will break Fibo resistance level at 1.1415 from below to above so the primary bullish trend will be continuing with good possible breakout of the price movement up to 1.1615 as a possible bullish target.

If not so the price will be ranging within the levels.

Trend:

D1 - ranging bullish near bearish reversal areaForum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.06.14 14:48

EUR/USD Intra-Day Fundamentals: U.S. Retail Sales and 10 pips price movement

2016-06-14 12:30 GMT | [USD - Retail Sales]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Retail Sales] = Change in the total value of sales at the retail level.

==========

CNBC reported:

==========

EUR/USD M5: 10 pips price movement by U.S. Retail Sales news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.06.15 15:57

Trading News Events: Federal Open Market Committee Interest Rate Decision (adapted from the article)

===

EURUSD D1: secondary correction to the possible ranging bearish reversal. The daily price is located above 200 SMA for the bullish market condition: the price is breaking 100 SMA together with 61.8% Fibo support level at 1.1203 to below to be reversed from the primary bullish to the ranging market condition. The bearish reversal level is 1.1070 located near 200 SMA so if the price breaks this level to below - the bearish reversal will be started. Alternative, if the price breaks 1.1415 resistance to above so the bullish trend will be resumed.

Anyway, the RSI indicator is estimating the secondary correction to be continuing for the price to the ranging zone.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.06.15 20:25

EUR/USD Intra-Day Fundamentals: Federal Funds Rate and 33 pips range price movement

2016-06-15 18:00 GMT | [USD - Federal Funds Rate]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Federal Funds Rate] = Interest rate at which depository institutions lend balances held at the Federal Reserve to other depository institutions overnight.

==========

"Against this backdrop, the Committee decided to maintain the target range for the federal funds rate at 1/4 to 1/2 percent. The stance of monetary policy remains accommodative, thereby supporting further improvement in labor market conditions and a return to 2 percent inflation."

==========

EUR/USD M5: 33 pips range price movement by Federal Funds Rate news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.06.16 08:54

Traders are left to wonder how many times the Fed may hike rates in 2016, if at all (adapted from the article)

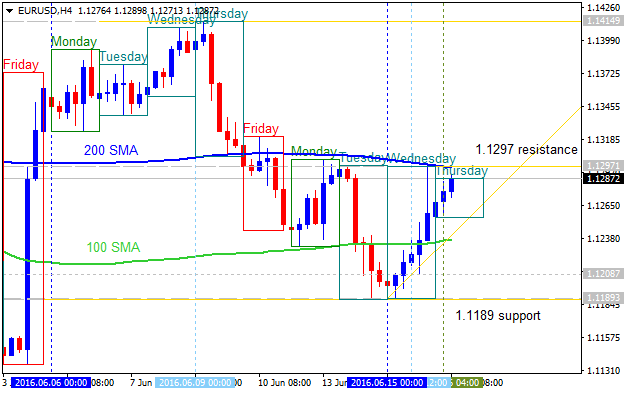

From the technical points of view - the EUR/USD H4 price was bounced from 1.1189 bearish support level by 100 SMA level breaking to above: the price is testing Tuesday's high at 1.1297 to be reversed to the bullish market condition.

If the price breaks 1.1297 resistance on close H4 bar so the reversal of the intra-day price movement from the bearish to the primary bullish market condition will be started.

if the price breaks 1.1189 support to below so the primary bearish trend will be resumed.

If not so the price will be ranging within 100 SMA/200 SMA ranging reversal area for direction.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.06.16 11:00

Trading News Events: U.S. Consumer Price Index (CPI) (adapted from the article)"The U.S. Consumer Price Index (CPI) increased an annualized 1.1% in April following the 0.9% expansion the month prior, while the core rate of inflation narrowed to 2.1% from 2.2% during the same period. A deeper look at the report showed transportation costs climbing another 0.7% on the back of higher energy prices, which was accompanied by a 0.2% rise in food costs, while prices for apparel slipped 0.3% in April. The U.S. dollar struggled to hold its ground following the slowdown in core inflation, with EUR/USD bouncing back from the 1.1300 handle to end the day at 1.1309."

What’s Expected:

EUR/USD H4: bearish ranging near bullish reversal. The H4 price is located inside Ichimoku cloud for the ranging market condition waiting for the direction of the trend to be established. Ascending triangle pattern was formed by the price to be crossed to above for the possible bullish reversal, and Absolute Strength indicator together with Trend Strength indicator are estimating the possible bullish trend to be started in the near future.

If H4 price breaks 1.1298 resistance level to above so the reversal of the price movement from the ranging bearish to the primary bullish market condition will be started: the price will cross uppper Senkou Span line to below.

If H4 price breaks 1.1188 support level to below so the primary bearish trend will be resumed.

If not so the price will be on bearish ranging condition.

===

EUR/USD M5: 14 pips price movement by U.S. Consumer Price Index news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.06.21 10:07

EUR/USD: Targets on Brexit or Bremain (adapted from the article)

Brexit

"EUR to quickly follow GBP lower on Brexit: we believe that a sharp fall in GBP under Brexit could quickly spill-over to a similar-sized sell-off in EUR/USD and which could see parity tested within days of a Brexit referendum outcome."

Bremain

"Dual EUR/USD upside from ‘Remain’ but still a range trade: under our continued, albeit not high-conviction, assumption that the UK elects to say in the EU, global risk sentiment will undoubtedly improve. We would judge that EUR/USD should recoup part of the ground lost since early May when EUR/USD briefly traded above 1.16."

Daily price is located above 200 SMA and near-above 100 SMA in the primary bullish area of the chart: the price is on ranging within the following key s/r levels:

If the price breaks 1.1097 support level to below on daily close bar so the reversal of the price movement from the primary bullish to the primary bearish market condition will be started.

If the price breaks 1.1414 resistance level to above on daily close bar so the primary bullish trend will be continuing up to 1.1615 level as a possible bullish target.

If not so the price will be on bullish rabnging within the levels.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.06.21 17:14

EUR/USD Intra-Day Fundamentals: Fed Chair Yellen Testifies and 34 pips price movement

2016-06-21 14:00 GMT | [USD - Fed Chair Yellen Testifies]

[USD - Fed Chair Yellen Testifies] = Testify on the Semiannual Monetary Policy Report before the Senate Banking Committee, in Washington DC.

==========

The Washington Post:"Yellen is scheduled to testify before the Senate Banking Committee on Tuesday morning. In prepared remarks, she acknowledged that hiring has dropped off sharply in recent months but also pointed to early signs that wages are beginning to rise after years of stagnation. She said she is “optimistic” that the progress in employment will continue."

"The Fed is responsible for charting the course for the nation’s economy, with the dual mission to keep prices stable and strengthen employment. It does that by adjusting the influential federal funds rate. A higher rate helps curb inflation by making borrowing money more expensive, which discourages spending and investment and reins in economic growth. A lower rate means that money is cheap, stimulating purchases by households and businesses. That helps boost employment and speeds up the economy."

"Because rates are already so low, the Fed has limited room to reduce them further if the economy were to weaken, she said. Moving gradually also gives the central bank time to assess whether its forecast of continued economic improvement will come true."

==========

EUR/USD M5: 34 pips price movement by Fed Chair Yellen Testifies news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.06.22 16:21

EUR/USD Intra-Day Fundamentals: Fed Chair Yellen Testifies and 23 pips price movement

2016-06-22 14:00 GMT | [USD - Fed Chair Yellen Testifies]

[USD - Fed Chair Yellen Testifies] = Testify on the Semiannual Monetary Policy Report before the House Financial Services Committee, in Washington DC.

==========

From barchart article review:==========

EUR/USD M5: 23 pips price movement by Fed Chair Yellen Testifies news event