You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Technical Targets for GBP/USD - United Overseas Bank (adapted from the article)

GBP/USD: Bearish: Take profit at 1.3930.

"While we have been bearish GBP since last Wednesday, the pace of the down-move took us by surprise. The major support at 1.4080 was easily breached with a low of 1.4057. The outlook is still clearly bearish and the next support below 1.4055/60 is near 1.3930."

Daily price

UOB is considering the bearish market condition for GBPUSD with the key support level at 1.4080 (1.4079 in case of Metatrader 5). If the price breaks this 1.4080 support so the next bearish target will be 1.3930:

Descending triangle pattern was formed by the price to be broken for the bearish trend to be continuing, and RSI indicator is estimating the ranging bearish condition in the near future.

The most likely scenario for the daily price of this pair is bearish breakdown.

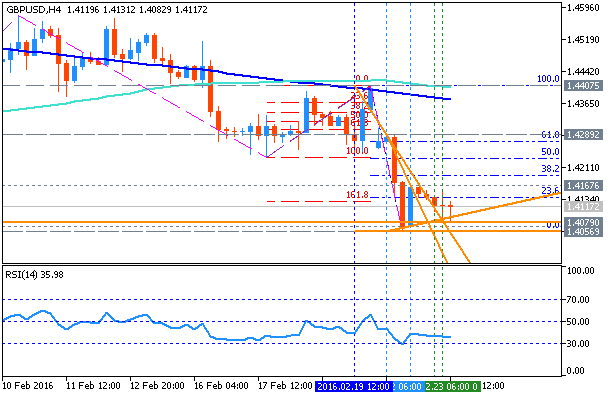

Intra-day price (H4)

This is very similar situation for H4 timerframe: possible bearish breakdown in case the price breaks 1.4080 support level to below with 1.4056 as the next nearest bearish target to re-enter.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.02.24 08:02

Trading News Events: UK Gross Domestic Product (GDP) (based on the article)The U.K.’s Gross Domestic Product (GDP) report may heighten the bearish sentiment surround British Pound and fuel the near-term decline in GBP/USD should the data encourage the Bank of England (BoE) to further delay its normalization cycle.

What’s Expected:

Why Is This Event Important:

Even though BoE officials sees a ‘solid’ recovery in the U.K. and talk down bets for additional monetary support, the downside risk surrounding the economic outlook may prompt the Monetary Policy Committee (MPC) to retain its current policy throughout 2016 as the central bank struggles to achieve the 2% target for inflation.

Nevertheless, increased demand from home and abroad may encourage a stronger-than-expected GDP print, and an unexpected upward revision in the growth rate may spur a near-term rebound in GBP/USD as the fundamental outlook for the U.K. improves.

How To Trade This Event Risk

Bearish GBP Trade: U.K. Expands Annualized 1.9% or Less

- Need red, five-minute candle following the GDP report to consider a short British Pound trade.

- If market reaction favors bearish sterling trade, short GBP/USD with two separate position.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit, set reasonable limit.

Bullish GBP Trade: GDP Report Beats Market Expectations- Need green, five-minute candle to favor a long GBP/USD trade.

- Implement same setup as the bearish British Pound trade, just in reverse.

Potential Price Targets For The ReleaseGBPUSD Daily

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.02.25 11:30

GBPUSD M5: 37 pips range price movement by UK GDP news event :

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.02.26 10:11

Intra-Day Fundamentals: CNY Swift Global Payments CNY and 72 pips price movement for majors

2016-02-26 01:00 GMT | [CNY - Swift Global Payments]

==========

EURUSD M5: 19 pips price movement by Swift Global Payments CNY news event :

USDJPY M5: 33 pips price movement by Swift Global Payments CNY news event :

GBPUSD M5: 11 pips price movement by Swift Global Payments CNY news event :

USDCHF M5: 9 pips price movement by Swift Global Payments CNY news event :

Forum on trading, automated trading systems and testing trading strategies

Market Condition Evaluation based on standard indicators in Metatrader 5

Sergey Golubev, 2016.02.29 17:13

Forecast for Tomorrow - levels for NZD/USD, GBP/USD, AUD/USD

NZD/USD: bearish reversal. This pair just reversed to the bearish condition by today's daily bar opened below 200-day SMA. The price is testing 50.0% Fibo support level at 0.6561 to below for the bearish trend to be continuing.

GBP/USD: bearish breakdown. The price was on bearish breakdown with key support resistance levels together with descending triangle patterns to be broken to below. Price was bounced from Fibo support level at 1.3835 and started to be ranging within bearish s/r levels.

AUD/USD: ranging-to-bearish reversal. Daily price broke 100-day SMA to below to be reversed from the ranging bearish within 200-day SMA/100-day SMA area to the primary bearish area of the chart. RSI indicator is estimating the ranging market condition to be continuing, and the nearest support level for the price on the way to the bearish trend is 38.2% Fibo level at 0.7095. The key reversal bullish level for the price for the bullish reversal to be started is Fibo resistance at 0.7258, and if the price breaks this level from below to above so the bullish reversal will be started with the secondary ranging condition.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.03.01 07:59

Technical Intra-Day Targets for EUR/USD by United Overseas Bank (based on the article)

EUR/USD: Bearish to 1.0800 psy target

Intra-day price was moved to be below 100 SMA/200 SMA area for the primary bearish market condition: the price was bounced from 1.0858 support level for the ranging bearish condition to be started.

RSI indicator is estimating the ranging bearish condition to be continuing.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.03.02 11:40

GBP/USD Intra-Day Fundamentals: UK Construction PMI and 26 pips price movement

2016-03-02 09:30 GMT | [GBP - Construction PMI]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Construction PMI] = Level of a diffusion index based on surveyed purchasing managers in the construction industry.

==========

"The headline seasonally adjusted Markit/CIPS UK Construction Purchasing Managers’ Index® (PMI®) registered 54.2 in February, down from 55.0 in January and the lowest since April 2015. Although still above the 50.0 value that separates expansion from contraction, the latest reading pointed to one of the weakest rises in construction output seen over the past two-and-a-half years."

==========

GBPUSD M5: 26 pips price movement by UK Construction PMI news event :

Intraday inclination in EUR/USD stays on the drawback for 1.0809 bolster first. As noted some time recently, bounce back from 1.0517 is done at 1.1376 as of now. Break of 1.0809 will bring retest of 1.0461/0517 bolster zone. On the upside, break of 1.0961 minor resistance will turn predisposition nonpartisan and bring recuperation.

Be that as it may, hazard will remain focused drawback the length of 1.1376 resistance holds.Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.03.03 10:52

GBP/USD Intra-Day Fundamentals: UK Services PMI and 39 pips range price movement

2016-03-03 09:30 GMT | [GBP - Services PMI]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Services PMI] = Level of a diffusion index based on surveyed purchasing managers in the services industry.

==========

"The headline figure for the survey is the seasonally adjusted Markit/CIPS UK Services Business Activity Index, a single-figure measure designed to track changes in total UK services activity compared with one month previously. Readings above 50.0 signal growth of activity compared with the previous month, and below 50.0 contraction. The seasonally adjusted Business Activity Index fell to 52.7 in February, from 55.6 in January. This signalled the slowest rise in service sector activity since March 2013. Moreover, the Index was below its long-run trend level (since July 1996) of 55.2. Nevertheless, services output has risen continuously for 38 months, the second-longest sequence of expansion in the survey history."==========

GBPUSD M5: 39 pips range price movement by UK Services PMI news event :

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.03.05 19:11

Weekly Fundamentals (adapted from the article)

GBPUSD - "The broader outlook for GBP/USD remains tilted to the downside as the BoE lags behind its U.S. counterpart, and the pair may continue to carve a long-term series of lower highs & lows as the threat of an EU exit dampens the fundamental outlook for the U.K".

USDJPY - "The Bank of Japan will look at market developments with great interest at its March 15 meeting, and much would need to change between now and then to make fresh BoJ policy action likely. It is nonetheless clear that much could change between now and then. Whether or not the Yen resumes its uptrend may very well depend on market reactions to the ECB and other key events in the week ahead."

AUDUSD - "Beijing pre-announced a lower GDP growth target, setting a range of 6.5 to 7 percent as the objective. Premier Li Keqiang likewise offered broad outlines of a broad range of initiatives. The most directly significant items for Australia seem to be efforts to cut over-capacity in coal and steel, both of which are central to the country’s China-oriented mining industry. Details on this and a host of other policy changes will be closely watched for their knock-on effects on Australian growth and, by extension, on RBA policy trends."

NZDUSD - "NZ 10yr Government Yields have declined from 3.617% in mid-December toward 2.901 this week. Given the data, it will be worth watching a move higher in yields that could signal a move of risk-on that may continue to lift up the NZD alongside an increasingly confident and stable RBNZ."

XAUUSD - "The simple removal of a bit of that emergency policy created risk aversion around the world that brought on questions of a globalized-coordinated recession. Sure, stock prices are still elevated, but how confident should one feel being invested in equities right now? Bond yields are pitifully low after six years of ZIRP, and any duration taken on will get absolutely crushed in a rising rate environment. And most Central Banks are actively looking to deflect capital flows. So where is an investor to go."

All the charts were made by using Metatrader 5 with free indicators from CodeBase.