The code that is uploaded is a bit messy. But I don't care now because of the fact that it was difficult to upload this (due to the validator).

If you want to make the total volume (white histogram) on multi-timeframe, then set MTF to true and turn these into inputs:

bool use_multi_timeframe = false; // Enable multitimeframe mode ENUM_TIMEFRAMES timeframe = PERIOD_D1; // Timeframe to examine

and use this for the number of bars to copy:

int barsToUse = (use_multi_timeframe) ? iBars(_Symbol, timeframe) : rates_total - prev_calculated + 1;

or

int barsToUse = (use_multi_timeframe) ? rates_total / (PeriodSeconds(timeframe) / PeriodSeconds()) + 2 : rates_total - prev_calculated + 1;

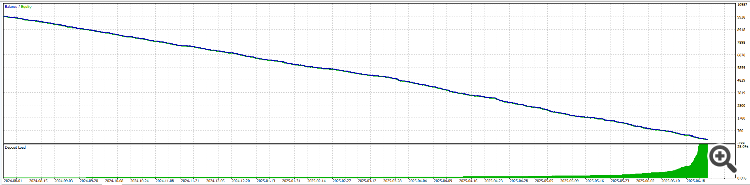

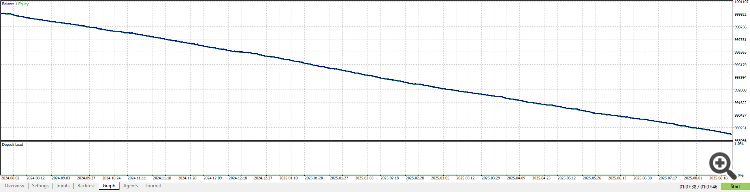

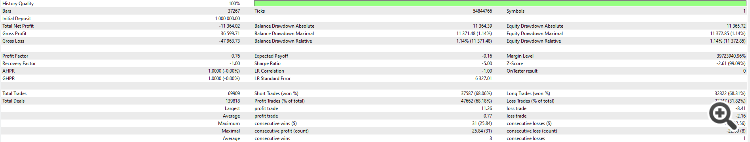

i would like to say thank you to the author or developer of this indicator, i manage to turn it into an Expert Advisor in MT5 and i am doing back testing for it in strategy tester.. even though its going downwards, i am using 1:3 risk ratio with fixed 21 pips of stop loss and 7 pips take profit on GOLD. I am using multiple time frame analysis for entering the market.

i am hoping this 100% back test modelling data will provide profits when i reverse the signal using the same risk ratio which is 1:3 , 7 pips SL and 21 pips TP on real account

Wish me luck...

i would like to say thank you to the author or developer of this indicator, i manage to turn it into an Expert Advisor in MT5 and i am doing back testing for it in strategy tester.. even though its going downwards, i am using 1:3 risk ratio with fixed 21 pips of stop loss and 7 pips take profit on GOLD. I am using multiple time frame analysis for entering the market.

i am hoping this 100% back test modelling data will provide profits when i reverse the signal using the same risk ratio which is 1:3 , 7 pips SL and 21 pips TP on real account

Wish me luck...

Simply reversing the signals does not usually fix the problem. A losing system is not losing just for being "the wrong way around" but because its entries lack a positive edge.

In addition, spread, commissions, and the SL/TP asymmetry make inverted rules almost always unprofitable. The solution is not to flip the logic but to redesign the strategy from the ground up.

Simply reversing the signals does not usually fix the problem. A losing system is not losing just for being "the wrong way around" but because its entries lack a positive edge.

In addition, spread, commissions, and the SL/TP asymmetry make inverted rules almost always unprofitable. The solution is not to flip the logic but to redesign the strategy from the ground up.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Bull Bear Volume:

An indicator that provides a clear visualization of volume pressure on each side of the market

Author: Conor Mcnamara