- Trading Principles - Trade - MetaTrader 5 for iPhone

- Types of Orders - Trading Principles - Trade - MetaTrader 5 for Android

- Types of Orders - Trading Principles - Trade - MetaTrader 5 for iPhone

Newbie question I know..trying to place a leveraged buy order for stock RNG.N. Current ask price is at 32,950. Account balance is 103€ with the same free margin (no other open positions) and a 1:200 leverage. For 50 stocks this should be enough, right? Stop loss is not set. Still getting the "not enough money" message when trying to place it. Thanks!

The account leverage and the individual margin requirements of each symbol can be different, especially for stocks.

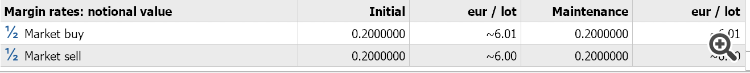

Look at the contract specifications of the symbol and see what the margin requirements are for it. You may have both an Initial Margin and a Maintenance Margin, so consider both if you plan to hold the stock for longer.

Please consider which section is most appropriate — https://www.mql5.com/en/forum/172166/page6#comment_49114893

So for 50 Lots, that would be 50 * 6€ = 300€ for the initial margin. That is more than your 103€ balance. Hence the message "not enough money" !

EDIT: You should never open a position with volume only considering the margin. You should first consider the position size based on the planned stop-loss, then check it against the margin as well.

Usually, if you size it based on the stop-loss, it normally is already within the margin requirements, but not always. So always calculate the volume based on both conditions, and choose the lesser of the two calculated volumes.

Newbie question I know..trying to place a leveraged buy order for stock RNG.N. Current ask price is at 32,950. Account balance is 103€ with the same free margin (no other open positions) and a 1:200 leverage. For 50 stocks this should be enough, right? Stop loss is not set. Still getting the "not enough money" message when trying to place it. Thanks!

Thanks Mcnamara for your new invention.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use