Pair trading and multicurrency arbitrage. The showdown. - page 258

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

By the way (but this is rather a stone in MQ's favour): I wanted to point out for a long time - charts with balance should be real-time only. That is, the X-axis should not be the serial number of the transaction, but date-hours:min:sec

then it is more informative and relates to reality

I understand why it is done by deals. So firstly it is easier to do, secondly it is more convenient for some users to breed others :-)

But why should we deceive ourselves...the chart should be by time.

It is urgent to make it like that.

ps/ when you look at your report chart, you know exactly which segments refer to which time point and what happened to the quotes there.

When you look at someone else's chart, then alas and ah - well curve...well up...and if you overlay it on time, you will find out that there is over-sitting, trading is torn and does not correspond to anything at all, does not fall into daily cycles, "neither in the n nor in the red army"....

This principle is implemented on the fly swatter.

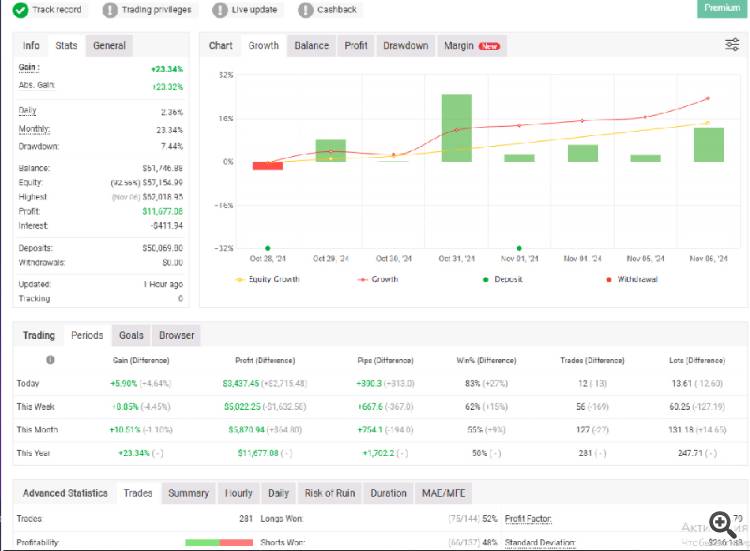

here is the monitoring from there.

Bringing money to the cash desk 1700 pips for 7 days.

There is no hibernation with pribilnyh or kills - the shooting of orders goes the same as pribilnyh and kills trades.

On tikes, about 10% of orders are closed, on stops )bezobitok) about 5% of orders.

Orders are closed on the signal of major (H4), if there is a signal on this pair in the opposite direction.

Basically, orders are closed when changing the differential or when reaching the parameters of the ranges of limit and stop orders.

The screen is not very high quality - the screen is from a remote computer, the screen resolution is different there.

in case anyone is interested, I reread it...

the article though ancient here - but the constructions in general work... you can look at.... and use...

https://www.mql5.com/ru/articles/1479

here's a reread in case anyone's interested.....

the article though ancient here - but the constructions in general work... you can look at.... and use it...

https://www.mql5.com/ru/articles/1479

Again on the result - cross

Again, the bottom line is cross.

Yes, I'm looking at it now - here purely by experience...

like AUDCAD traded under AUDUSD-USDCAD and then I think to connect AUDCHF type :-)

in short, trade AUDCAD - AUDCHF spread.

like cross is insured by cross.....

It's like one man with a channel from YouTube - like two calendar traded.... like one insures the other spread...

also inside the channel trades and everything.....

the outflows collect... at the bottom I bought. From the top - sold....

you also wrote like AUDUSD - NZDUSD - something like that....

write your recommendations of spreads for trading - I will put them - even though on demo... I'll set them up - I'll see....

I thought you also wrote something like AUDUSD - NZDUSD - something like that....

write your recommendations of spreads for trading - I will put them - even though on demo... I'll set them up - I'll see....

I have never written such a thing = it does NOT work.

--

I only wrote pairs so that they don't have the same currency.

I've never written such a thing = it does NOT work

--

I only wrote pairs so they don't have the same currency in them

Yeah. That was a mistake. Yeah, that reminds me. thanks. I'll have a better look this weekend.....

Yeah. That was a little bit of a mistake. Yeah, that reminds me. thanks. I'll have a better look this weekend.....

Right now you can open AUDJPY(buy)/NZDCHF(sell) and hold it for understanding.

Lot coefficient 0.1 => profit $10

I have these pairs "locked" now, all closed, and these have been hanging since Monday, but that's normal.

The maximum loss was on Thursday = -73$

I am now at 0 and will close until the next signal, swap is also making a loss.

--

P.S. Closed at +$2.

Which was as bad as possible:

AUDJPY = -$148

NZDCHF = -98$

But, the moment a loss on one pair was overlapped by a gain on the other, the final maximum loss was -74$

And again, at different moments of time there were different results

Separately, NZDCHF (BUY).

--

Separately AUDJPY(SELL)

--

As you can see from the chart, one was rising/falling, the other was falling/growing = so the loss was small.

The reason for this was that I entered the market early - not on the signal, as you can see on the indicator.

The histogram did not have time to change colour