You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

AUDUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for Australian Dollar: Neutral

After weeks of preoccupation with external forces, the Australian Dollar will see domestic factors re-enter the spotlight. The Reserve Bank of Australia is due to hold its monthly monetary policy meeting, with conflicting cues ahead of the sit-down’s outcome warning of volatility ahead.

A survey of economists polled by Bloomberg forecasts that Glenn Stevens and company will keep the benchmark lending rate unchanged at 2.25 percent. Priced-in expectations put the probability of a 25 basis point reduction at 75 percent however. This means that – whatever the outcome – a meaningful share of the market may be caught wrong-footed and scramble to adjust exposure.

For its part, the RBA may well have warmed up to topping up stimulus. Growth slowed to the weakest in a year in the fourth quarter and the malaise appears to be carrying over into 2015. Overall economic news-flow continues to disappoint relative to consensus forecasts and exports – long a bastion of strength – have fallen for 10 consecutive months compared with a year prior as iron ore prices sank.

The reintroduction of event risk on the homegrown front will dismiss the market-moving potential of macro forces however. The Fed will publish minutes from its March meeting, with traders keen for confirmation of the deepening dovish shift in timing bets on the first post-QE rate hike. Futures markets reveal a lean toward an increase in October after Friday’s dismal payrolls data, a far cry from earlier speculation about June or July. Signs of trepidation on the FOMC may boost risk sentiment as well as the Aussie.

Continued deadlock between Greece and its creditors remains another source of worry. Athens is due to repay €462 million to the IMF next week and service an additional €2.4 billion in maturing treasury bills in the week that follows. The absence of an accord on bailout funding may mean these payments are missed, setting off the spiral toward default and – in the worst case scenario – an exit from the Eurozone. Needless to say, such a turn of events would spell trouble for sentiment and the Australian unit.

GOLD Fundamentals (based on dailyfx article)

Fundamental Forecast for Gold: Bullish

Gold prices are higher for a third consecutive week with the precious metal advancing nearly 0.4% to trade at 1202 into the close. The rally comes on the back of weakness in the USD with a dismal US employment report on Friday fueling a sell-off in the greenback into the close of the week.

The US Non-Farm Payrolls (NFP) release on Friday came amid thin liquidity conditions with global markets (save Japan) closed in observance of Good Friday. A print of 126K jobs added last month missed consensus estimates for a read of 135K with the headline unemployment rate holding steady at 5.5%. Despite an unexpected uptick in wage growth, the ongoing deterioration in labor force participation along with the recent batch of weaker-than-expected U.S. data may fuel further dissent within the committee and drag on interest rate expectations. As such, narrowing bets for a mid-2015 rate hike may undermine the bullish sentiment surrounding the dollar and heighten the appeal of bullion as the slowing recovery raises the Fed’s scope to retain the highly accommodative policy stance for an extended period of time.

Last week we noted that gold was, “vulnerable for a pullback early next week but the bias remains constructive while above the 1167/72 barrier where the 61.8% retracement of the advance converges with a former resistance line off the 2015 high (bullish invalidation).” A pullback early in the week extended as low as 1178 before reversing sharply back through the 1196 inflection barrier we’ve been tracking for the past month (now near-term support).

The technicals get a little murky here after such an extended rally & until full market participation returns on Tuesday, we’ll remain neutral here while noting a general topside bias while within the confines of an ascending median-line formation. Expect price action to spend some time in this range with support & bullish-invalidation now raised to this week’s low. Initial Resistance is eyed at a longer dated median-line, currently around 1215 backed by 1223/25 & key resistance at 1245/48. A break of the lows targets the 1167 support barrier with subsequent objectives seen at 1150/51 & 1141/42. Bottom line: waiting for market conditions to normalize into next week with our outlook weighted to the topside while above 1180.

USD/CAD Weekly Fundamental Analysis, April 6 – April 10, 2015 – Forecast (based on fxempire article)

The USD/CAD finished lower last week led by heavy selling pressure following the release of a weaker-than-expected U.S. Non-Farm Payrolls report. The abysmal report casts doubts on the timing of the Fed interest rate hike, most likely eliminating a June rate hike and putting in jeopardy a September move. We’ll find out early next week what investors are thinking when the major market players return to action after stepping to the sidelines for Good Friday.

According to the Department of Labor, the U.S. economy added 126,000 new jobs in March, badly missing the consensus forecast of 248K. Despite the low figure, the unemployment rate managed to remain unchanged at 5.5%. Hourly average wages, however, improved by 0.3%, beating the 0.2% estimate.

After consolidating since the beginning of the year, the USD/CAD may have finally found the catalyst that could trigger a breakout of the range. The U.S. jobs report should fuel a break, however, losses are likely to be limited because of expectations for weaker crude oil prices.

Late Thursday, it was announced that Iran and the six global powers had reached solutions on key parameters of the country’s nuclear program. If Iran follows the plan then the United States and the European Union would likely ease sanctions on the country. Iran would agree to cut its nuclear capacity while agreeing to monitoring and modernization of its facilities. A final deadline for the talks was set for June 30.

Lifting the sanctions on Iran could bring millions of additional Iranian crude oil barrels onto the global market. This would be bearish for prices. A breakdown in crude prices will be bearish for the Canadian Dollar.

The direction of the market is likely to be determined by whether the investors believe the weak jobs report outweighs the impact of the Iran nuclear deal. Since the jobs data came out after the Iran news and the USD/CAD weakened, traders are likely to open Monday’s session with fresh selling pressure.

Range Trading on the USD/CAD (based on invezz article)

If we take a look, we can see that the support has been around the 1.2400 level and the resistance around the 1.2800 level. The middle of the range is the 1.2600 level and we can tell from the chart that the price has also found that level to be a temporary support or resistance zone.

The general theory when trading within a range is that short or sell positions are taken on the resistance and long or buy positions on the support, but this is easier said than done, because first of all, we cannot be so sure about the range until the price has already tested the upper and lower boundaries a couple of times and the consolidation becomes clear.

The risk of taking short positions at the resistance and long positions at the support is that at any moment the price may break that resistance or that support and we may get stuck with a position on the opposite direction of the breakout. This is what makes range trading more difficult. That is why when trading within a range, we must be aware of the risks involved and we should accommodate our stop loss to a level that does not represent a huge loss to our account. Remember that usually when the price breaks out of these ranges, it tends to accelerate its momentum in the direction of the breakout and it may be not very wise to trade against that momentum or speed.

Weekly Economic & Political Timeline (based on dailyforex article)

This week opens quietly, with most of Europe and the Western world on holiday, with the exception of the U.S.A. and Canada. Following the holiday, it should be a fairly significant week as it opens the month, as usual, with central bank statements and actions for the USD, JPY, GBP and AUD. The major political area of interest that is likely to result in unscheduled, market-moving breaking news remains the European Greek crisis. Additional political focus is beginning to fall on the U.K. as next month’s election approaches and opinion polls continue to forecast a parliamentary balance that would make it almost impossible for any plausible government to be formed.

U.S. DollarThis will be a big week for the U.S. Dollar as following last week’s disappointing Non-Farm Payroll numbers, all eyes will be on the FOMC Minutes that will be released on Wednesday. There will actually be a data release earlier on Monday with the ISM Non-Manufacturing PMI numbers. On Thursday, the day following the FOMC release, there will be additional economic data given with the Unemployment Claims numbers.

Japanese YenThis will be a significant week for the Japanese Yen with the Bank of Japan’s Monetary Policy Statement being given plus a press conference on Wednesday.

British PoundOn Tuesday there will be a release of Services PMI data. Thursday will see the release of the Bank of England’s MPC Rate Statement and Official Bank Rate, followed on Friday by Manufacturing Production data.

Australian DollarTuesday is going to be a big day for the Australian Dollar, with the RBA Rate Statement, Cash Rate, and Retail Sales data all due for release within a three-hour window before the London open.

EuroAlthough most countries in Europe will be enjoying public holidays this Monday, Spain will be at work as usual, and will be releasing Spanish Unemployment Change data this day. This is the only high-impact news scheduled for the Euro this week.

Canadian DollarThere will be a release of Ivey PMI data on Monday followed by further releases at the end of the week. On Thursday there will be Building Permits data followed on Friday by Unemployment Change and Unemployment Rate data.

Forex Forecast: Quant vs Chart Reading (adapted from dailyforex article)

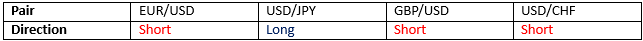

Quantitative Forecast

Technical ForecastDownward Correction on the Way for USD/CAD? (based on primepair article)

USD/CAD remains within the mildly upward slanting rectangular consolidation pattern, shown in dark blue below, although it is hovering just above the sideways pattern’s support line. After peaking at 1.2797 on January 30th, the rate fell to 1.2351 to define the pattern’s initial 446 pip width.

A sustained break of either the 1.2847 resistance or the 1.2421 support should result in a follow on move of roughly 446 pips in the direction of the breakout from that point.

Prior to the formation of the aforementioned rectangle, USD/CAD had been moving strongly higher from the 1.0619 low seen on July 3rd of 2014. This rally accelerated once the pair broke the resistance line of an ascending wedge pattern.

Furthermore, since early November, the rate also seemed supported by an upward slanting trend line, drawn in orange above. Nevertheless, this line has just been breached to the downside, indicating that the rectangular consolidation pattern may soon see the same fate, perhaps leading to a significant correction lower.

Since bottoming at 0.9055 in November of 2007, the pair has been moving through successive Fibonacci retracement levels of its long term decline from the 1.6196 peak of January 2002. The present consolidation phase is trading around the 50% Fibo level situated at 1.2626. The key 61.87 percent Fibo level lies at 1.3468.

The 200 day moving average for USD/CAD is drawn in red above. It currently reads below the rate at 1.1471, with a positive slope supportive of a bullish medium term outlook. Also, the 14-day RSI is plotted in pale blue in the above chart’s indicator box. It showed regular bearish divergence, indicating a loss of upside momentum at the 1.2834 high point of March 18th. The indicator has since normalized to read in central neutral territory at 43.23, which should not significantly impede moves either way.

Overall, the near term outlook for USD/CAD appears neutral within a mildly rising rectangular consolidation pattern with a 446 pip width. Also, while the medium term outlook remains bullish, a recent break below a significant trend line — as well as bearish regular divergence on the RSI — points to a loss of upside momentum that may see the rate soon begin a downside correction phase.

if actual > forecast (or previous data) = good for currency (for CAD in our case)

[CAD - Ivey PMI] = Level of a diffusion index based on surveyed purchasing managers. It's a leading indicator of economic health - businesses react quickly to market conditions, and their purchasing managers hold perhaps the most current and relevant insight into the company's view of the economy.

==========

Canadian Ivey PMI drops to 47.9 in March

"Canada's Ivey purchasing managers’ index contracted at a faster rate than expected in March, fuelling concerns over the country’s economic outlook, industry data showed on Monday.

In a report, the Richard Ivey School of Business said its purchasing managers’ index fell to 47.9 last month from a reading of 49.7 in February. Analysts had expected the index to inch up to 51.1 in March.

A figure above 50.0 indicates industry expansion, below indicates contraction.

USD/CAD was trading at 1.2460 from around 1.2466 ahead of the release of the data."

USD/CAD Retail FX Flips Net-Long at 1.2400 Support (based on dailyfx article)

USD/CAD: Well-Defined Range, 2 Drivers (based on efxnews article)

USD/CAD continues to trade in a well-defined range between 1.24 and 1.28. We remain bearish on CAD and continue to look for USD/CAD to test 1.30 sometime in Q2.

Notably, two drivers should continue to underpin CAD weakness.

First, this week Canada releases the Ivey PMI index for March. Another print below 50 which suggests that the economy contracted in Q1 with an average reading of 47.6 in the first two months of the year. What is more relative to trend is that headline PMI continues to suggest a deepening slowdown in activity, which may force the BoC to cut its 2015 growth forecast.

Second, the external backdrop in Canada continues to worsen. Indeed, in 2015, market consensus expects the current account deficit to widen to -2.8% from -2.2% previously. This reflects the drag from exports and lower oil prices but also the rise in import growth, which averaged 7.8% per annum from January 2014 to January 2015. The deterioration in the external balance suggests that Canada will need to attract fresh capital to support CAD. Against a backdrop of low rates and weak growth we doubt Canada can attract the needed flows. Canada economic growth weak and contracting Canada’s capital