You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Just appreciate the scale of what has already been achieved. Really compare. And realise that these opportunities have already been overtaken. They just aren't needed.

Vitaly, I don't know. Life experience tells me that in the world of people complex things do not work. No further than the two-way, because where you rely on a doer (a companion, just a person), he will let you down. So I don't believe in a global conspiracy. Nobody knows the future. Of course everyone has different opportunities, but everyone is doing the best they can in life, it's hard for everyone. And the Buffetts and everybody else.

Alexei, I don't believe in anything at all. But that doesn't mean you have to deny the obvious. Oh, come on. It doesn't matter.

And with what purpose you do what you do? Out of interest, out of necessity or some other motive? Why this particular field? And what is more important to you, experience and fulfilment, or income?

And what is the purpose of what you do?

I think we're all the same here.

Once you're here, you don't leave! It's interesting, and..... an enticing theoretical opportunity to make money.

I think we are all the same here.

Once you're here, you don't get out! It's interesting, and..... an enticing theoretical opportunity to make money.

Thank you for the information and the conversation. Based on your conclusions, I would venture to guess that you are not familiar with such a definition as big data. If I'm right, you should find out.

... creating a completely profitable EA is not an impossible task if the necessary resources are applied. Imagine an AI that is linked to multiple modules containing databases of billions of patterns, continuous interactive communication with formal event publications, including details of mundane news that could affect quotes. That is, a kind of mini Skynet like in Terminator (or better even Google), in real time determining reactions based on a set of events run through patterns, etc ...

Right, Google and others have created databases with patterns. But what are these patterns? For example the letters of the alphabet of different languages. They are deterministic. Do you know of any patterns in the financial markets that can be combined into a database for profitable trading? Just don't call double top/bottom, head/shoulders etc. The answer is simple - there are no such patterns conventionally. Why conventionally? Because even if they exist, they worked a long time ago and still do, but their statistical advantage is insignificant. There are some that give a significant advantage, but they appear and disappear very quickly. The market is volatile. As soon as you discover a pattern, it stops working. Perhaps that pattern was not there, but was a tweak as in optimising the TS.

Unfortunately, the reality in financial markets is strikingly different from theory.

... You defined the movement limits using your script? This is already a great achievement. Frankly speaking, I am impressed by your analysis.

I wouldn't rush to such conclusions. You can clearly see the limits of the movement on the history. But online, how can you determine when the movement has started? After all, the beginning of the current movement is the end of the previous one. It is not determined until a new high/low is formed. Again we have a lag, which nullifies all the brilliant discoveries.

How did you verify the fact that this pattern was fulfilled?

I remember when I was a kid, we were playing for badges using the knock-out method. And I was as good a player as anyone. One day a friend came to visit me with three badges, while I had a few dozen in the box. And so we played with him and I lost absolutely everything.

The other point is that actually where we are, we don't play against each other. Just because I opened 0.01 lot on a particular pair at a particular moment does not mean that someone necessarily did the same in the opposite direction. And the fact that I closed an order with a profit of USD 1 does not mean that someone will close the same order with the same minus. Objectively, if you look at it objectively, accounts with $10000 will sink just as nicely as accounts with $100. And they are not draining to each other but to somewhere else.

Another point is that if someone has access to certain information, they have an advantage with any amount in the account.

That is, completely different initial conditions and you can't tie it all into one.

The frequency of repetitions and probability, which shows how long a useful wave movement will last. Obtained on the EURUSD history for 20 years, for daily waves (lasting 10-20 hours):

Here the mean value is 6 hours and the median value is 1 hour (more than 10% of all cases). This means that after 6 hours the useful wave movement stops 50% of the time.

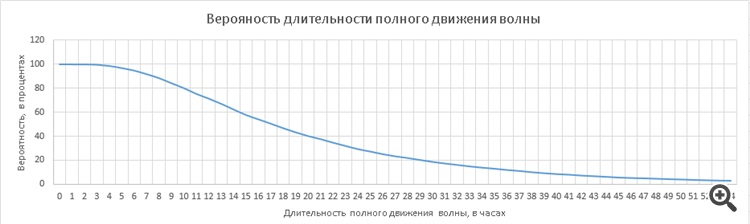

All the same for a complete wave movement, it is the distance from the rollback of the previous wave to a new extremum:

Here, the average is 17 hours, while the median value is smeared between 10 and 13 hours (almost 5% of all cases)But what do these patterns represent? For example, the letters of the alphabet of different languages. They are deterministic. Do you know any patterns in the financial markets that can be combined into a database for profitable trading?

Yeah, I just got a little excited yesterday. It's been a nervous week.

The frequency of repetitions and probability, which shows how long a useful wave movement will last. Obtained on the EURUSD history for 20 years, for daily waves (lasting 10-20 hours):

Here the mean value is 6 hours and the median value is 1 hour (more than 10% of all cases). This means that after 6 hours the useful wave movement stops 50% of the time.

All the same for a complete wave movement, it is the distance from the rollback of the previous wave to a new extremum:

Here, the average is 17 hours and the median value is smeared between 10 and 13 hours (almost 5% of all cases)Oooh, I did a similar thing in 2011) along my lines)

Tell me the details, the details. That's interesting. Because general concepts can be discussed, but not applied. But how, who and what does what, calculations, concrete experience - this can already be developed, maybe some ideas will emerge. Let's discuss them together. I am ready to share my thoughts.

And I urge everyone not to be shy. Nothing is secret, everything is stolen before us