and you are allowed to open 2.81 with a deposit of $100, what are the collateral requirements for the instrument

and you will be allowed to open 2.81 with a deposit of $100, what are the collateral requirements for the instrument

In this question, it does not matter ... Even if you open with 0.28 lot, it will be +20 pips +0.5% to the deposit, that is 100 + 0.5 = $ 100.5 ... Minus the commission of $ 5.6 = $ 94.9. It turns out that each transaction brings the trader into minus)

For example, you will trade a lot of 0.01. At a profit of 20 pips, you will cover the commission. But you will lose quite a lot on rebate.

Conclusion - take a profit of 25 pips, then your account will be in profit.

PS - I'm talking about 5-digit pips.

This is not important in this matter ... Even if you open with 0.28 lot, it will be +20 pips +0.5% to the deposit, that is 100 + 0.5 = $ 100.5 ... Minus the commission of $ 5.6 = $ 94.9 . It turns out that every deal takes a trader into minus)

Fortunately, you have an error in the calculations. Open a demo account. If you trade experimentally on a demo account you will be able to see what is what.

Below, excerpts from the real data at a commission of $ 20 (but the spread is not zero, the account itself - in rubles). 1.54 rubles. - is the commission(added: the account is in rubles, its size depends on current exchange rates):

2017.07.** **:**:** ******** GBPAUD buy in 0.01 1,66222 ******** - 1,54 0,00 0,00 2017.07.** **:**:** ******** GBPAUD sell out 0.01 1,66452 ******** - 1,54 0,00 106,65

The total commission was -3.08. Becauseit is charged twice: the first time when you open the account, the second time when you close it. If you increase a lot, the value of profit/loss point increases, and so does the deposit (margin). I.e. lot size is important. Especially with 100$.

P./S.: The post above practically suggested that about 20 points of profit on a five-figure may "break" the commission.

P./S.: Added: "...Because...". Otherwise, after my addition about the total commission, it could well be mistakenly perceived as if the total was charged twice.

You are fortunate to have an error in your calculations. Open a demo account. If you trade experimentally on a demo account you can see what's what.

Below, excerpts from the real data at a commission of 20$ (but the spread is not zero, the account itself is in rubles). 1.54 rub. - is commission:

The commission is charged twice (first time on opening, second time on closing). If you increase the lot size, the point value of the profit/loss increases, the deposit (margin) also increases. I.e. lot size is important. Especially with 100$.

P./S.: The post above practically suggested that about 20 points of profit on a five-figure can "beat out" the commission.

I understand that a certain number of pips and above will beat out the commission) And your report shows a profit of 23 pips. And I'm talking about scalping and Pips(of course at five digits) :) There may not even be 20, but 3)

And, if I understand that the probability of a positive outcome of the transaction is VERY high, then I want to increase the risks on each transaction, but by increasing the risks I increase the commission, which, if I do not take a profit in a certain number of points, eats up all the profits. And this is not OK) In this regard, the conditions on the futures market are much more acceptable.

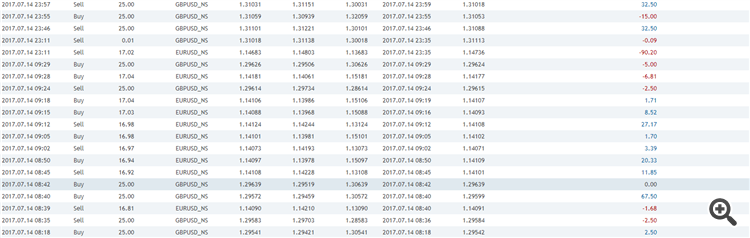

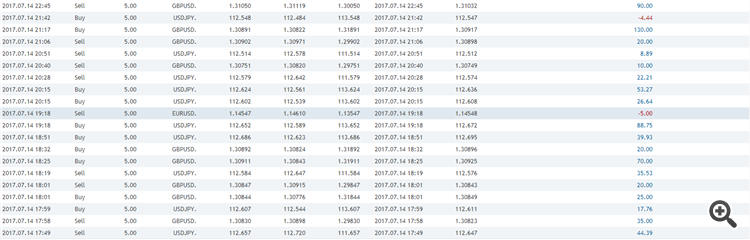

I would like to "hear" comments on the following two screenshots... The pairs are unusual, most likely without a spread... And one has NS at the end of the instrument name, which, as I understand, means No Spread. Look at the size of profits and volume of opened positions. The minimum commission of one of them is $18 per lot, and it's probably for EURUSD. There's rarely any profit that exceeds the commission, considering that it's the same for all pairs ($18).

I understand that a certain number of pips or higher beats out the commission) And your report shows a profit of 23 pips. And I'm talking about scalping and PIPS(of course by five digits) :) They may be not even 20, but 3)

And, if I understand that the probability of a positive outcome of the transaction is VERY high, then I want to increase the risks of each transaction, but by increasing the risks I increase the commission, which, if not taken in a certain number of points, eats up all the profits. And this is not OK) In this regard, the conditions on the futures market are much more acceptable.

I would like to "hear" comments on the following two screenshots... Pairs are unusual, most likely without a spread... And one has NS at the end of the instrument name, which, as I understand, means No Spread. Look at the size of profits and volume of opened positions. The minimum commission of one of them is $18 per lot, and it's probably for EURUSD. There's rarely any profit that exceeds the commission, considering that it's the same for all pairs ($18).

I have not 23, but 230 pips of five digits in my extract. That is, 23 on the old ( four-digit). And this is scalping. The account is ECN.

Profits on EURUSD will outweigh the commission if the TS assumes a profit of more than 20 pips on the five digits.

I have no practical experience on accounts without spread or with NS prefixes. In your screenshots the commission is not indicated. Profit on EURUSD, at a glance there is more than 20 pips. It's cent accounts you have there, as I understand and/or demo. MT4. Although it's late at night now, I might not have understood the screenshots properly.

Everyone chooses their trading according to their temperament. For me hunting for 3-5 pips (unless it's a "something went wrong...") - from the category of "fuck it..., nerves are more expensive". So, with the commission suggested, and then already...

I'll just leave a good tip - when calculating the lot size, start with how much you have in your account, counting on long-term cooperation with the market without stop-outs. And when calculating the lot size, never increase it based on the assumption that there is a very high probability of a positive outcome

P./S.: I saw less than 20 pips on the EURUSD screenshots.The normal commission is 20 quid per million, not per lot. With 20 quid a lot pipsing certainly will not work.

Oh, by the way, yes, I didn't write that I'm based on $20 per million here. On the demo suggested experimenting with knowing the commissions, and about this I did not write, citing data from the real

P./S.: (added) more precisely: 20$ for 1 million USD turnover //not for you, but for the author of the themeThe normal commission is 20 quid per million, not per lot. With 20 quid a lot you cannot pipsaw, of course.

Commission on normal accounts from $7 to $12 per lot (100000) + spread. TC's commission is $20 per lot, this is absolutely comparable to accounts with fix.spreads where there is no commission, and the spread is constant at 2pp.

Commission on normal accounts from $7 to $12 per lot (100000) + spread. TC's commission is $20 per lot, which is absolutely comparable to accounts with fix.spreads where there is no commission, and the spread is constant at 2pp

Are you sure the author of this topic was not mistaken and wrote about $20 commission per lot, and not from a million USD of turnover? And please give me an example where $20 per lot is equal to 2 points of spread. I gave you an example where the commission is $20 per million USD turnover. This in that example is less than 20 pips on five digit quotes.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Hi. I want to scalp but have run into the following problem:

For a zero spread, the commission is $20 per 1 lot... With a deposit of $100 and trade volume of 2.81 lots, for +20 pips you can earn +5% to the deposit... That makes $105. BUT the commission will be 2.81 * 20 = $56.2!!! 105-56.2=48.8$!!!

Or scalping with such trading conditions impossible, or I calculated something wrong? And how do other pip traders scalp? Or are zero spread accounts not for scalping?