- Bar

- [Archive!] I'll write an advisor for FREE

- Bar Data Upon Restart or Reconnect

bendex77!

Excellent exercise! Thank you. Have already adopted the percentage of account or free margin as the method to use. This just reinforces my belief :-)

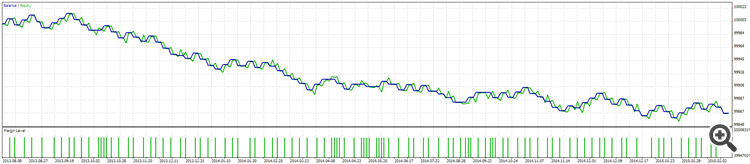

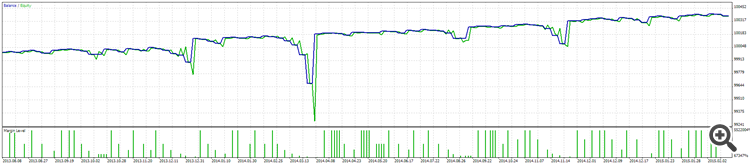

And here is an example of an illusion.

And with a simple Martingale MM applied,

we can usually make it look profitable for some time:

As you can see from this example, we can (usually) delay our downswings with martingale but in return it makes them bigger. We can even disguise a losing strategy as a winning one for some time. I'm not sure why the market allows this.

Forum on trading, automated trading systems and testing trading strategies

Martingale

Royal-Flush, 2016.11.30 02:38

Many of the MT4 top rated signals are martingale strategies especially those over 1,000% return and are well subscribed. Yet most of them are holding large positions which would be a huge draw down if covered. Many of these loosing trades are from Brexit.

There are 2 excellent articles on Martingale;

https://www.mql5.com/en/articles/1446

https://www.mql5.com/en/articles/1481

which describe martingale as being meaningless.

So in conclusion are these highly rated martingale strategies deserving of the rating and the subscriptions or are the articles correct and the strategy is meaningless or is there some other way of resolving this contradiction?

I noticed that the time element is forgotten or excluded most of the time in these examples people come up with.

They only go about the position sizing and number of winning/losing streaks.

But you can also add the time element in which all losing blocks are forced to close at for example the end of the day, week or month...

This will prevent the risk of accumulation of those toxic position blocks.

Like they always call "no more bet's please" and the run of the game has to be done in a known time value it can not last forever.

Personally i don't like martingale and I NEVER use this management type in my manual trading but I must admit that martingale, coupled with a strategy that make sense according to the high probabilities of the specific strategy that is implemented, will outperform most of the strategy out there if we are talking about algorithmic trading; yes it will be risky because you never know when extreme adverse market conditions can materialize in front of you and blow up your account, but surely in the right periods (even years) can give exceptional returns than most of the mechanical strategies that don't implement martingale.

As for manual trading I think that martingale is still effective when used wisely but if you are an experienced manual trader would be better to trade without martingale just because you don't need it, in fact your edge is extremely robust in this case and you don't need them.

So, here the decision to use or not martingale all depends on the type of capital you would trade on.

Is it a pure speculative trading capital so that you can even lose it without fear? In this case martingale can be a good choice.

Do you have a decent amount of capital that is vital for your existence and you can't afford to charge too risk on it? In this case the best option (in my opinion) would be to trade manual WITHOUT martingale and don't be greedy with the lotsize: you can live on that capital for the rest of your life if you learn how to trade manually with realistics expectations.

Actually Martingale is a way to virtually improve an edge and it can be effective but would be wise to base your choice on the meaning of your trading capital.

Happy trading community! :)

Personally i don't like martingale and I NEVER use this management

type in my manual trading but I must admit that martingale, coupled with

a strategy that make sense according to the high probabilities of the

specific strategy that is implemented, will outperform most of the

strategy out there if we are talking about algorithmic trading; yes it will be risky because you never know when extreme adverse market conditions can materialize in front of you and blow up your account, but surely in the right periods (even years) can give exceptional returns than most of the mechanical strategies that don't implement martingale.

As for manual trading I think that martingale is still effective when used wisely but if you are an experienced manual trader would be better to trade without martingale just because you don't need it, in fact your edge is extremely robust in this case and you don't need them.

So, here the decision to use or not martingale all depends on the type of capital you would trade on.

Is it a pure speculative trading capital so that you can even lose it without fear? In this case martingale can be a good choice.

Do you have a decent amount of capital that is vital for your existence and you can't afford to charge too risk on it? In this case the best option (in my opinion) would be to trade manual WITHOUT martingale and don't be greedy with the lotsize: you can live on that capital for the rest of your life if you learn how to trade manually with realistics expectations.

Actually Martingale is a way to virtually improve an edge and it can be effective but would be wise to base your choice on the meaning of your trading capital.

Happy trading community! :)

I agree with you, martingale can be profitable under certain market circumstances in extraordinary manner.

However great trading edges don't need martingale.

You're a wise man :-)

I agree with you, martingale can be profitable under certain market circumstances in extraordinary manner.

However great trading edges don't need martingale.

You're a wise man :-)

I'd disagree with you! If a person has an edge, those are the people who should be using martingale, as simply having an edge refers to an entry not being 50/50. I for one believe that I have an edge because my system doesn't experience more than 3 straight losses. With that said, and not knowing which of the 3 orders will be the winner, I use martingale to end the sequence of trading with net profit. Most people believe that after a loss, your chances of winning on the next trade increases, but that isn't true unless your system, over time, has demonstrated to not experience x amount of losses. Then and only then can you use martingale effectively!

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2018.03.07 06:42

There is famous martingale EA -

-------------------

Ilan1.4 - expert for MetaTrader 4

so someone uploaded the set files (this post):

Here are four setfiles in ZIP.AUDJPY,EURGBP,NZDCAD,USDCHF.H4,Lot0.01with $5000,Lot=0.02 with $10000.

RSI Martingale - expert for MetaTrader 5

Trade without Take Profit , Stop Loss and Trailing Stop . Opening positions only at the time of the birth of a new bar. It is recommended to start the tests on the H1 timeframe.

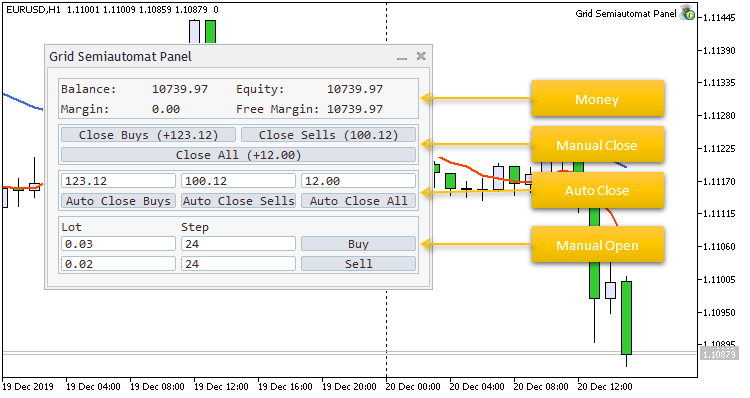

Grid Semiautomat Panel - expert for MetaTrader 5

Trading panel "Grid Semiautomat Panel" is a semi-automatic adviser. The panel is based on the CDialog combined control class. Allows you to gradually create a grid of positions with a certain step.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use