You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

1. Let's get started.

2. I support.... As you need a system that works today, but successful long-term work is welcome :)

3. Improved, wrote in this thread above.

4. First, I will explain the essence of the filter and post the filter itself, so that it is clear what we are working with and the principle of action. I will surely lay it out today, when I have more free time, I have a lot of work (not programming) ;).

Agreed. Waiting.

Just thought I'd post a picture for the sake of introspection

>> maybe you'll get some ideas.

Try it this way - the indicator shows an upward impulse - wait for a pullback (the impulse indicator has returned to 0) and stupidly buy

Everything below is IMHO.

I don't want to impose an opinion, as I think everyone has to go this route themselves, but the way of adding a trend filter is a bad one. This addition reduces profit, although it can reduce drawdown. But at the same time it increases the time to get out of the drawdown. In general, it worsens the statistical parameters of TS.

In my opinion, it is better to follow the way of drawdown reduction using different methods. For example, try to transfer to LOS (or to a given level) at a given level of profit. Or use a stepped or quadratic trawl that takes into account price movement patterns (wavy ones in mind). Or bound the size of TP and SL to the average daily price movement of the last few days. Or... many things you can think of.

The overall goal is to improve the smoothness and fluidity of the balance curve.

So try.... I can't implement all your ideas by myself, look at how many of them have already been suggested...

And about b/w conversion, I already tried it and the result was worse. I did so: transfer to b/u when reaching the goal t.p. by some percentage...

optimised for 10% 20%.... 100%

So the best one was 100%, i.e. without transferring to used ones, and who knows, it might be worse at this stage, but at the end it might work...

Everything below is IMHO.

I don't want to impose an opinion, as I believe everyone has to go this route themselves, but the way of adding a trend filter is a bad one. This addition reduces the profit - absolutely right, I propose to use the "trend filter" not to reduce profits and not even to reduce the number of deals, but to change the terms of the deal (to open in the other direction, to reduce or increase stop levels, etc.), although it can reduce the drawdown. But, at the same time, it increases the time of getting out of a drawdown. In general, it worsens statistical parameters of TS. - No, we will not go this way :)

In my opinion, we should go the way of drawdown reduction in different ways. For example, try to transfer to B/S (or to a given level) at a given level of profit. Or use step trawl or quadratic trawl that takes into account price movement patterns (wavy ones in mind). Or bound the size of TP and SL to the average daily price movement of the last few days. Or... many things can be invented. - That's right, you can do anything, the important thing is to stick to the overall goal.

The overall goal is to improve the smoothness and fluidity of the balance curve. Not to deviate from the original idea of opening, to increase profits, not to decrease the number of trades.

So try.... I can't implement all your ideas by myself, look at how many of them have already been suggested...

I already tried it, but the result was worse. I did so: transfer to b/u when reaching the goal etc. by some percentage...

optimised for 10% 20%.... 100%

So the best was 100% ie without a transfer to b / o and there h.z. Can at this stage and worse, and at the end and will roll ...

Yes, I've already tried it, that's why I'm writing. I agree with Vita - first of all we must try to extract all we can from this idea within the limits of this forum.

The breakdown of the daily range is not worse than other TPs, IMHO.

What about the conversion to B/A - it does not improve the characteristics of TS for all instruments.

About the second-hand conversion - it does not improve the performance of the TC for all instruments.

I didn't really bother with the used ones, I just tried them...

Used must be tried when the concept of expert is fully formed and defined, because if you try it first, it will affect the results of the system later ... I.e., some indicator with this b/w will give much worse results than without it, and we'll think - what a bad indicator is losing and losing, but maybe it's not so bad at all... Well, I guess the one who wanted it understands me...

4. At first I will explain the essence of the filter and lay out the filter itself to show what we are working with and how it works. I will do it today, when I have some free time, I have a lot of work to do (not programming) ;)

I'll explain, this filter has already been posted on this forum. On its basis I want to implement a multicurrency Expert Advisor that works with 6 currency pairs. Of course I just heard somewhere about neural networks, but it seems to me that this is it since the idea itself fulfills the condition EUR+USD+GBP+JPY=0. It is just an index that calculates the strength of one currency against another. I would like to propose the following system...

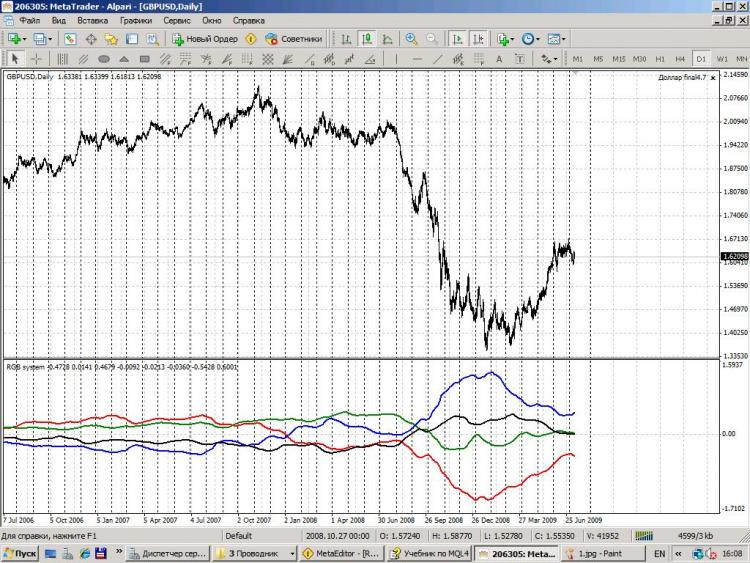

First of all, by colours:

blue - JPY

red - GBP

green - EUR

black - USD

In the picture on the left the uppermost blue line is JPY, the lowest red one is GBP, so... we will consider the breakdown signals only for this pair and only Sell signals etc. This is what I call a filter, and it seems to me that the number of trades will not decrease.... because the EA will work on 6 pairs. I mean on one if of course yes... But just imagine how many more chances of breakthrough trueness will increase. Please comment...

Excuse me...

Didn't post the turkey itself :)

And attention!!! To correctly display the indicator you need to download the quotes history for 3 pairs. EURUSD USDJPY and GBPUSD for the timeframe you are using.

I'll explain, this filter has already been posted on this forum. On its basis I want to implement a multicurrency Expert Advisor that works with 6 currency pairs. Of course I just heard somewhere about neural networks, but it seems to me that this is it since the idea itself fulfills the condition EUR+USD+GBP+JPY=0. It is just an index that calculates the strength of one currency against another. I would like to propose the following system...

First, by colours:

blue - JPY

red - GBP

green - EUR

black - USD

In the figure on the left, the uppermost blue line is JPY, the lowest red line is GBP, so... we will only look for breakout signals for this pair and only Sell signals etc. This is what I call a filter, and it seems to me that the number of trades will not decrease.... because the EA will work on 6 pairs. I mean on one if of course yes... But just imagine how many more chances of breakthrough trueness will increase. Comments please...

This is not a neural network, but a cluster. I can't imagine why the chances of a true breakdown would increase. Nowhere have I seen evidence that the cluster works better than the MA50. And then it is too monstrous to begin with. Isn't there anything simpler? :) Although, if you manage to get a better result, be my guest.

I'll write an off-topic post... :)

Look how beautifully describes the market on large timeframes look from left to right

first was the pound!!!! (red) as the strongest currency in the pre-crisis period, followed by the euro (green), slightly behind the pound, but way above the dollar and the yen was at the very G... It's interesting to see how the crisis evolved :) at first there was some talk in the UK that the crisis was going to hit it the same way it did in America... and the pound started to go down. Then the euro started having problems too and the euro followed the pound, while the yen went down fast, along with the dollar. We see that the pound suffered the most during the crisis, in short, there was a regrouping of forces, as the former strongest ones became the weakest. Look at the convergence of the lines at the end, it shows that the crisis is slowly fading... ;)