You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Dear budimir, do you consider this third parameter in your work ---> the seasonality factor?

And ACF can be taken here'Autocorrelation function'.

budimir could you explain on this example (there is a picture), how do you take seasonality out of it (formula if it's not too complicated) ?

And the ACF can be taken here'Autocorrelation function'.

budimir, could you explain by this example (there is a picture there), how do you take seasonality out of it (formula, if it's not too much trouble)?

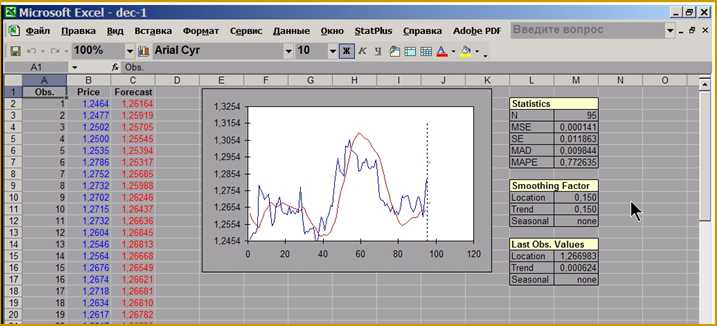

The point is that I don't perform ACF analysis of BP in mql-language, but I do it

in StatPlus (this add-on in Excel), not to be unfounded, give

screenshot:

As you can see from the figure, in Exel installed add-on StatPlus, in the list SmoothingFactor

this third parameter is not defined ie zero, but it can be calculated with the

ACF-option of this add-in, here's a screenshot of this option:

I'm sorry, but my version of StatPlus is out of date.

budimir , in your opinion, is this a promising direction? What percentage of profit can be expected without taking into account brokerage commissions, from the exploitation of the seasonal component on the financial markets?

budimir, in your opinion, is this a promising direction? What percentage of profit can be expected without taking into account brokerage commissions from exploitation of the seasonal component on the financial markets?

I don't think it's worth taking the seasonal component into account, that's why I nullify the third factor.

Am I correct in assuming that the input data means the variables in the external parameters of the EA, with which the coefficients will be compared?

This is how I see the coefficients of a simple Expert Advisor based on fractals:

What should I do with all of them?

The input data for the Expert Advisor (extern ...) are net coefficients, indicator delays Per 1, 2, 3, classification levels u,v, Take Profit and Stop Loss. The indicator (I chose WPR as an example) is calculated inside the Expert Advisor using iWPR.