Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.11.14 17:44

Weekly Outlook: 2014, November 16 - 23Mario Draghi’s speeches, UK inflation data, German ZEW Economic Sentiment, Rate decision in Japan, US Building Permits and FOMC Meeting Minutes, as wee as inflation and employment data. These are the major events on FX calendar. Here is an outlook on the highlights of this week.

Last week, U.S. retail sales edged up 0.3% in October, indicating stronger spending boosting domestic economy. The increase was higher than forecasted. Analysts expect the U.S. economy will expand around 3% next year, the strongest growth rate since the 2007-09 recession. Core sales excluding automobiles also gained 0.3%, beating expectations for a 0.2% gain. Will this trend continue?

- Mario Draghi speaks: Monday, 14:00 & Friday, 8:00. ECB President Mario Dragh is expected to testify before the Committee on Economic and Monetary Affairs, in Brussels and speak in Frankfurt. Market volatility is expected.

- UK inflation data: Tuesday, 8:30. UK inflation dropped to a five-year low of 1.2% in September following 1.5% the prior month. The main price decline occurred in the energy and food sectors. Despite the strong growth in the UK economy, inflationary pressures remain subdued; it is unlikely that the BoE will raise rates before 2015. UK inflation is expected to remain at 1.2%.

- Eurozone German ZEW Economic Sentiment: Tuesday 9:00. Investors’ sentiment plunged in October to its lowest level since November 2012, reaching minus 3.6 points. The ZEW index fell by 10.5 points negative territory, for the first time. Economists expect confidence to remain low over the medium term. Recent disappointing data such as factory orders, industrial production, and foreign trade have contributed to the sharp decline. German economic sentiment is expected to reach 0.9 points this time.

- US PPI: Tuesday, 12:30. Producer prices for finished goods declined in September by 0.1% following an unchanged reading in the previous month. Economists expected a price rise of 0.1%. Meanwhile, core PPI excluding the volatile food and energy sectors came out flat. Unadjusted, the producer price index for final demand rose 1.6% for the 12 months that ended in September. Producer prices are expected to drop again by 0.1%.

- Japan rate decision: Wednesday. The Bank of Japan surprised markets in October while deciding to expand its massive stimulus spending, admitting that economic growth and inflation have not picked up as expected following a sales tax hike in April. BOJ Governor Haruhiko Kuroda announced that the expansion was done to ensure the early achievement of the 2% inflation target and end deflation. Analysts were not expecting further easing measures in such short period.

- US Building Permits: Wednesday, 12:30. US Building permits increased in September 1.5% to an annualized rate of 1.02 million, suggesting the U.S. economy continues to strengthen despite the global slowdown. Building of multifamily projects such as condominiums and townhomes jumped 16.7 percent to an annual rate of 371,000. Work on single-family properties rose 1.1 percent to a 646,000 rate in September from 639,000 the prior month. The positive trend is also evident in factory production and the job market, posting the lowest level of jobless claims in 14 years. US Building permits are predicted to reach 1.04 million.

- FOMC Meeting Minutes: Wednesday, 18:00. The Fed FOMC minutes from the September meeting were mostly dovish. The minutes stressed that the Fed will be lenient in its exit strategy. The focus now is on exit strategy for pulling down the Fed’s balance sheet. Regarding the outlook for the fed funds rate, some noted that markets’ outlook is below FOMC forecasts. Several participants see inflation running below Fed goal for quite some time.

- US Inflation data: Thursday, 12:30. U.S. consumer prices increased mildly in September, showing weak inflation pressures, providing the Federal Reserve ample room to keep interest rates low for an extended period. CPI increased by 0.1% after a 0.2% fall in the previous month. Economists expected a flat reading in September. Sluggish wage growth helped to keep prices nearly unchanged. Meanwhile core CPI excluding food and energy prices, gained 0.1% in September, while the year-on-year change held steady at 1.7%. CPI is expected to drop 0.1% while core CPI is predicted to gain 0.2%.

- US Unemployment Claims: Thursday, 12:30. The Labor Department release showed a rise of 12,000 in initial claims last week, reaching 290K. The increase was larger than expected, but remained below 300,000 for ninth straight week indicating the US job market is stronger than ever. Another good sign was a rise in the number of Americans quitting their jobs under their own volition, suggesting stronger confidence in the labor market condition. The number of jobless claims is expected to decline to 286K.

- US Philly Fed Manufacturing Index: Thursday, 14:00. The manufacturing sector in the Philadelphia region continued to weaken in October, falling to 20.7, after September’s reading of 22.5. However despite the modest decline, Philadelphia manufacturing still shows growth. New orders edged up to 17.3, compared to September’s reading of 15.5; the employment index declined to 12.1, following 21.2 in September; and the six-month outlook dropped to 54.5, compared the precious reading of 56.0. The manufacturing sector in Philadelphia us expected to reach 18.9 this time.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.11.18 05:47

2014-11-18 00:30 GMT (or 01:30 MQ MT5 time) | [AUD - Monetary Policy Meeting Minutes]- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

More hawkish than expected = Good for currency (for AUD in our case)

[AUD - Monetary Policy Meeting Minutes] = It's a detailed record of the RBA Reserve Bank Board's most recent meeting, providing in-depth insights into the economic conditions that influenced their decision on where to set interest rates.

==========

RBA Minutes: Modest Growth Likely To Continue For Economy

Members of Australia's monetary policy board believed that the rate of growth for Australia's economy is likely to hold steady for the time being, minutes from the central bank's November 4 meeting revealed on Tuesday.

At the meeting, the RBA left its benchmark cash rate unchanged at a record low 2.50 percent. The rate has been at the current level since August 2013.

"The forces underpinning the outlook for domestic activity were much as they had been for some time and the forecasts had not materially changed; GDP growth was still expected to be below trend over 2014/15, before gradually picking up to an above-trend pace towards the end of 2016," the minutes said.

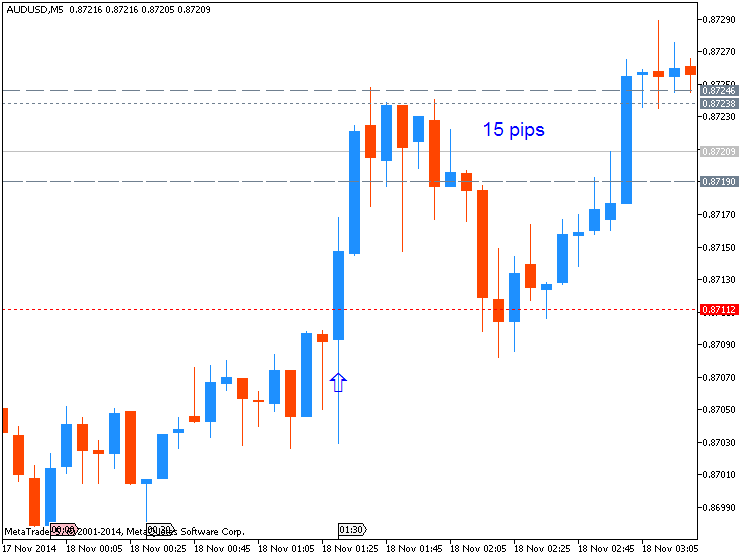

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD M5: 15 pips price movement by AUD - Monetary Policy Meeting Minutes news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.11.16 10:59

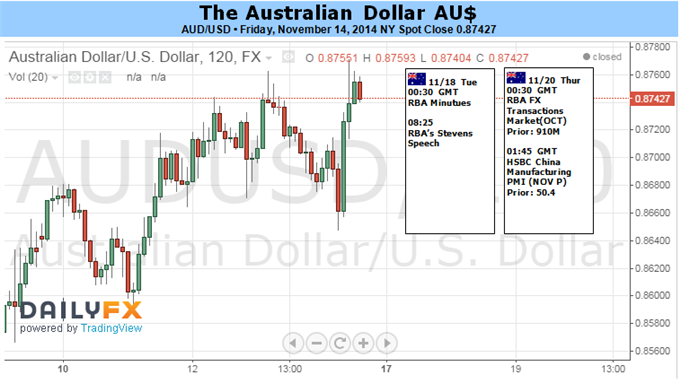

AUDUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for Australian Dollar: Bearish- AUD/USD Demonstrates Surprising Resilience On Positive Risk Sentiment

- Scope For Gains Questionable As Elevated Volatility Caps Carry Demand

- Downside Risks Centered On Recent Lows Near The 0.8540 Mark

The Australian Dollar has witnessed some surprising resilience over the

past week with it posting modest gains against most of its peers. The

driving force behind the small advance may have been a general drive to

yield, given similar gains were witnessed for risk sentiment proxies

(S&P 500). Meanwhile, regional economic data once again proved

uneventful for the commodity currency.

The coming week brings the release of the RBA’s November Meeting

Minutes. The decision itself proved a non-event for the AUD and given

the fairly well broadcast views from the Board, the Minutes are unlikely

to deliver anyrevelations for traders. Similarly, upcoming Chinese

data may see another muted response from the currency since it would

likely take a significant deterioration over an extended period to

generate a response from RBA officials. This could leave the AUD to

continue to seek guidance from sources outside of domestic monetary

policy expectations.

The potential for general positive risk sentiment to act as a

sustainable fuel source for the Aussie may be limited. This is given

implied volatility levels are near their 2014 highs, suggesting traders

are anticipating some strong swings amongst the major currency pairs.

This in turn may detract from the carry appeal of the Aussie and could

limit the scope for further gains.

Speculative trader positioning (reflected in the latest COT report)

reveals short positions are still some distance away from the extremes

witnessed early last year. In turn this suggests the short AUD trade

remains ‘uncrowded’.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.11.19 08:52

AUD/USD Fundamental Analysis November 20, 2014, Forecast (based on fxempire article)

The AUD/USD eased by 49 points give up weekly gains as the US dollar recovered in the morning session. The Aussie is trading at 0.8670. Problems from Japan weigh on the Aussie. Japan’s Abe confirmed widespread speculation by announcing he would delay plans for an unpopular second hike in the consumption tax scheduled for October next year by 18 months and would dissolve the lower house of parliament on Nov. 21 to seek a mandate at the polls next month for his set of economic policies, known as Abenomics, and includes economic reforms that have proven difficult to implement. The announcement came after data this week showed the Japanese economy has fallen into recession, with two quarters of negative growth. This in turn weakened the Australian dollar, as traders focused on the Japanese government getting a mandate to delay a planned sales tax rise.

The Australian dollar eased again as traders positioned themselves for today’s release of minutes from the Federal Reserve’s October meeting, and for possible clues on an American rate rise.

RBA governor Glenn Stevens told a business dinner in Melbourne that interest rates were likely to stay at a record low of 2.5 per cent for some time as mining investment and income growth fell and household debt and unemployment rose.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.11.16 15:48

AUD/USD weekly outlook: November 17 - 21

The Australian dollar bounced back from earlier losses to settle at a

two-week high against its U.S. counterpart on Friday, as a round of

profit-taking sent the greenback sliding.

AUD/USD

hit a daily low of 0.8649 on Friday, before turning 0.48% higher to

subsequently consolidate at 0.8759 by close of trade, the highest since

October 31. The pair rose 1.43% on the week.

The pair is likely to find support at 0.8649, Friday's low, and resistance at 0.8843, the high from October 31.

The

U.S. dollar was boosted after the Commerce Department reported that

U.S. retail sales rose 0.3% in October, ahead of forecasts for a 0.2%

increase.

The greenback trimmed gains after separate data showed

that U.S. inflation expectations fell in an otherwise upbeat report on

consumer confidence for this month.

The preliminary reading of

the University of Michigan’s consumer sentiment index rose to a seven

year high of 89.4, better than forecasts of 87.5 and up from October’s

reading of 86.9.

However, the report also showed that consumers

expected annual inflation of 2.6% this year, down from expectations for

inflation of 2.9% in October.

The US dollar index,

which tracks the performance of the greenback against a basket of six

major currencies, was down 0.25% to 87.61 in late trade, not far from

the more than four-year highs of 88.36 hit earlier in the session.

In

the week ahead, investors will be focusing on Wednesday’s minutes of

the Federal Reserve’s October meeting and Thursday’s report on the U.S.

consumer price index.

Monday, November 17

- The U.S. is to release a report on manufacturing activity in the New York region, as well as data on industrial production.

Tuesday, November 18

- The Reserve Bank of Australia is to publish the minutes of its latest policy meeting, which contain valuable insights into economic conditions from the bank’s perspective.

- Separately, RBA Governor Glenn Stevens is to speak at an event in Melbourne; his comments will be closely watched.

- The U.S. is to release data on producer price inflation.

Wednesday, November 19

- The U.S. is to release data on building permits and housing starts.

- Later Wednesday, the Federal Reserve is to publish the minutes of its October meeting.

Thursday, November 20

- The U.S. is to release data on initial jobless claims, consumer prices, existing homes sales and manufacturing activity in the Philadelphia region.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.11.20 05:26

AUD/USD Daily Outlook (adapted from actionforex article)

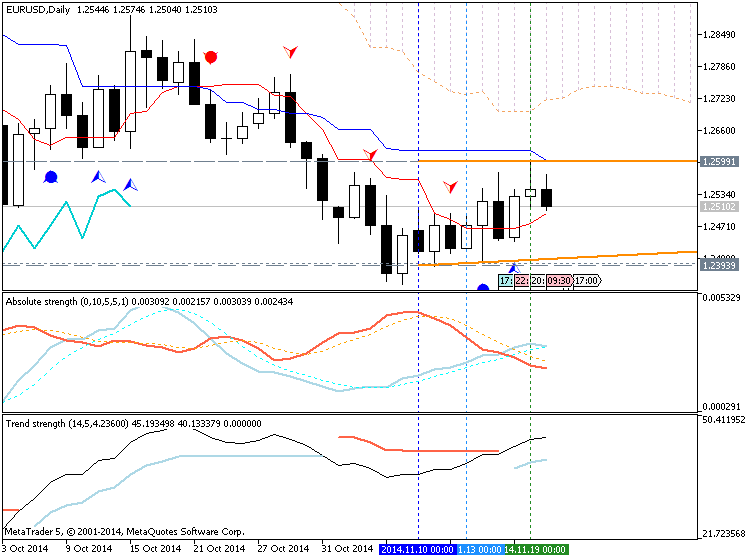

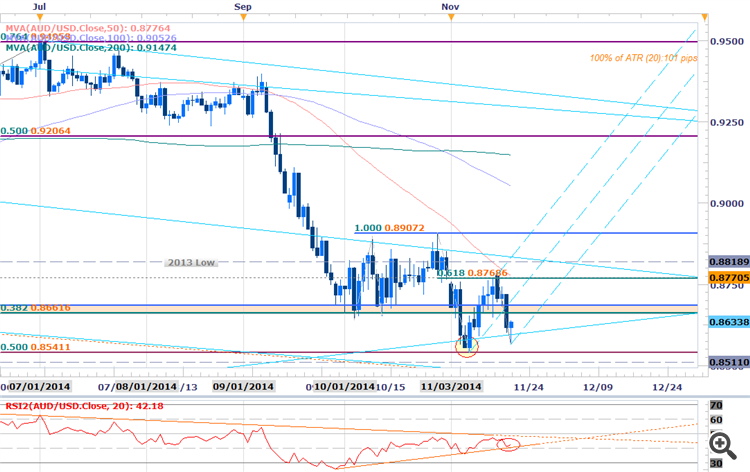

AUD/USD's fall from 0.8795 picked up some momentum. But still, it's held above 0.8539 support. Intraday bias remains neutral and more consolidation could be seen in range of 0.8539/8910. As long as 0.8910 resistance holds, deeper decline is still expected. Break of 0.8539 should target 61.8% projection of 0.9401 to 0.8642 from 0.8910 at 0.8441. However, decisive break of 0.8910 will indicate near term reversal and turn outlook bullish.

In the bigger picture, price actions from 1.1079 are viewed as a medium term correction. The rejection from 55 weeks EMA and current downside acceleration suggests that it's still in progress. Sustained break of 50% retracement of 0.6008 to 1.1079 at 0.8544 will pave the way to 61.8% retracement at 0.7945 and below. On the upside, break of 0.9504 is needed to confirm medium term reversal. Otherwise, we won't turn bullish even in case of strong rebound.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.11.20 12:06

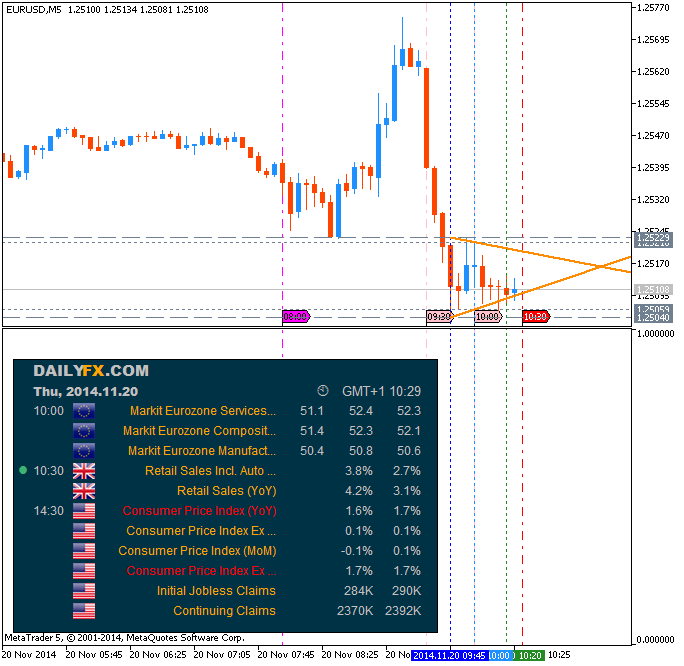

Trading the News: U.S. Consumer Price Index (CPI) (based on dailyfx article)

- U.S. Consumer Price Index (CPI) to Slow for Fourth Time in 2014.

- Core Rate of Inflation to Hold at Annualized 1.7% for Third Month.

A downtick in the U.S. Consumer Price Index (CPI) may spark a more

meaningful rebound in EUR/USD as it dampens the interest rate outlook

for the world’s largest economy.

What’s Expected:

Why Is This Event Important:

It seems as though the Federal Open Market Committee (FOMC) is in no

rush to normalize monetary policy as a growing number of central bank

officials highlight the downside risk for inflation expectations, and a

marked slowdown in price growth may undermine the bullish sentiment

surrounding the greenback as central bank hawks Richard Fisher and

Charles Plosser lose their vote in 2015.

Nevertheless, the ongoing improvement in household and business

confidence may stoke faster price growth, and a strong inflation report

should boost the appeal of the greenback as it raises the Fed’s scope to

normalize monetary policy sooner rather than later.

How To Trade This Event Risk

Bearish USD Trade: U.S. CPI Slows to Annualized 1.6% or Lower

- Need to see green, five-minute candle following the release to consider a long trade on EURUSD

- If market reaction favors a bearish dollar trade, buy EURUSD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

- Need green, five-minute candle to favor a short EURUSD trade

- Implement same setup as the bearish dollar trade, just in the opposite direction

EUR/USD Daily Chart

- With the break of the monthly opening range, will watch former support on EUR/USD for new resistance.

- Interim Resistance: 1.2610 (61.8% expansion) to 1.2620 (50% retracement)

- Interim Support: 1.2280 (100% expansion) to 1.2300 pivot

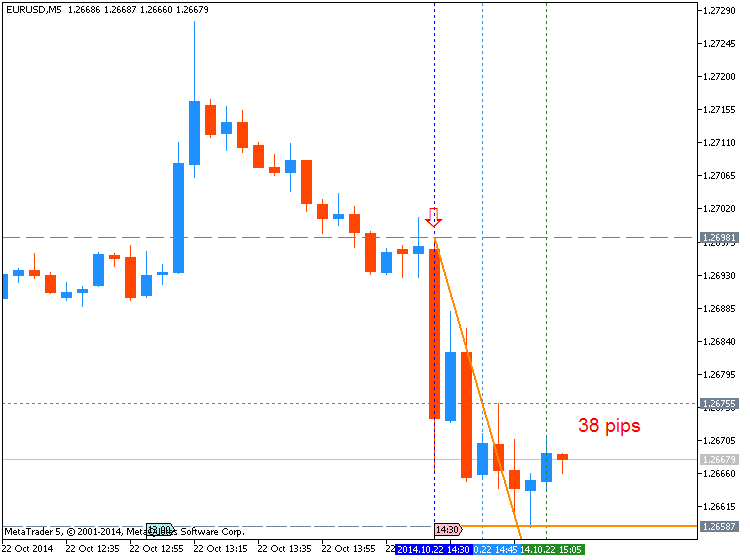

| Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

|---|---|---|---|---|---|

| SEP 2014 |

10/22/2014 12:30 GMT | 1.6% | 1.7% | -24 | -59 |

September 2014 U.S. Consumer Price Index

EURUSD M5: 38 pips price movement by USD - CPI news event :

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD M5: 32 pips range price movement by USD - CPI news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.11.21 06:21

Scalping the AUDUSD Correction- Longs Favored Above 8565 (based on dailyfx article)

- AUDUSD rebounds off key near-term support

-

Scalps target topside correction / short entries higher up

- AUDUSD responds to 2001 pitchfork support / 1.618% extension off October high

- Support at 8565, 8540- bullish invalidation

- Resistance 8660/80, 8700 & 8745

- Daily RSI holding support

- Support and Resistance triggers pending- break to validate bias

- Limited event risk into week-end.

This is Chinese Rate news event (if you follow fundamental news so you know) which was affected on this price movement for AUDUSD:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

D1 price is on primary bearish with secondary market rally:

H4 price is on bullish by breaking the border of Ichimoku cloud to be outside kumo.

W1 price is on primary bearish with 0.8540 support level.

MN price is on bearish market condition ranging between 0.8642 support and 0.9503 resistance levels.

If D1 price will break 0.8764 resistance level so the secondary rally within primary bearish will be continuing

If D1 price will break Sinkou Span A line of Ichimoku indicator so the reversal of from bearish to the bullish may be started.

If not so we may see the ranging within bearish market condition.

UPCOMING EVENTS (high/medium impacted news events which may be affected on AUDUSD price movement for this coming week)

2014-11-17 00:30 GMT (or 01:30 MQ MT5 time) | [AUD - New Motor Vehicle Sales]

2014-11-17 23:00 GMT (or 00:00 MQ MT5 time) | [AUD - CB Leading Index]

2014-11-18 00:30 GMT (or 01:30 MQ MT5 time) | [AUD - Monetary Policy Meeting Minutes]

2014-11-18 08:25 GMT (or 09:25 MQ MT5 time) | [AUD - RBA Gov Stevens Speech]

2014-11-18 13:30 GMT (or 14:30 MQ MT5 time) | [USD - PPI]

2014-11-19 13:30 GMT (or 14:30 MQ MT5 time) | [USD - Building Permits]

2014-11-19 19:00 GMT (or 20:00 MQ MT5 time) | [USD - FOMC Meeting Minutes]

2014-11-20 01:45 GMT (or 02:45 MQ MT5 time) | [CNY - HSBC Flash Manufacturing PMI]

2014-11-20 13:30 GMT (or 14:30 MQ MT5 time) | [USD - CPI]

2014-11-20 15:00 GMT (or 16:00 MQ MT5 time) | [USD - Philly Fed Manufacturing Index]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on AUDUSD price movement

SUMMARY : bearish

TREND : ranging

Intraday Chart