You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.03.25 16:06

2013-03-25 14:00 GMT (or 15:00 MQ MT5 time) | [USD - Consumer Confidence]

if actual > forecast = good for currency (for USD in our case)

==========

U.S. Consumer Confidence Improves Much More Than Expected In March

Consumer confidence in the U.S. has improved by much more than expected in the month of March, according to a report released by the Conference Board on Tuesday.

The Conference Board said its consumer confidence index jumped to 82.3 in March from a revised 78.3 in February. Economists had been expecting the index to edge up to 78.4 from the 78.1 originally reported for the previous month.

The bigger than expected increase by the consumer confidence index reflected a rebound in expectations for the short-term outlook. The report showed that the expectations index surged up to 83.5 in March after tumbling to 76.5 in February.

MetaTrader Trading Platform Screenshots

EURUSD, M5, 2014.03.25

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 18 pips price movement by USD - Consumer Confidence news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.03.25 20:41

Trading the News: U.S. Durable Goods Orders (based on dailyfx article)

2013-03-26 12:30 GMT (or 13:30 MQ MT5 time) | [USD - Durable Goods Orders]

A 1.0% rebound in U.S. Durable Goods Orders may prompt a bullish reaction in the dollar as it raises the outlook for growth and inflation.

Why Is This Event Important:

Indeed, prospects for a stronger recovery may encourage the Federal Open Market Committee (FOMC) to normalize policy sooner rather than later, and we may see Fed Chair Janet Yellen continue to soften her dovish tone for monetary policy as a growing number of central bank officials see a stronger recovery in 2014.

However, the slowdown in private sector credit paired with the pullback in consumer confidence may generate a dismal release, and another decline in U.S. Durable Goods Orders may trigger a selloff in the greenback as it limits the Fed’s scope to remove the zero-interest rate policy (ZIRP) later this year or in early 2015.

How To Trade This Event Risk

Bullish USD Trade: Demands Increase 1.0% or Greater

- Need to see red, five-minute candle following the release to consider a long dollar trade

- If market reaction favors a short EURUSD position, sell pair with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable objective

Bullish USD Trade: Durable Goods Orders Disappoint- Need green, five-minute candle to favor a short dollar trade

- Implement same setup as the bullish USD trade, just in reverse

Potential Price Targets For The ReleaseDemands for large-ticket items decline another 1.0% in January following a revised 5.3% drop the month prior, while Non-Defense Capital Goods Orders excluding Aircrafts, a proxy for business investments, unexpectedly increased 1.7% amid forecasts for a 0.2% contraction. Nevertheless, the initial reaction to the data print was short-lived, with the EURUSD coming off of the 1.3650 region, and the reserve currency continued to lose ground throughout the North American trade as the pair closed at 1.3708.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.03.26 07:33

EURUSD Technical Analysis (based on dailyfx article)

An actionable short Euro trade setupin line with our long-term fundamental outlook remains elusive after an expected move lower the US Dollar. The spotlight is on support in the 1.3779-1.38 area, marked by the 38.2% Fibonacci retracement and a rising channel bottom set from late January. We will look for a daily close below this boundary to confirm reversal and position for selling opportunities. The break lower would initially expose the 50% level at 1.3721. Alternatively, a breach above the 23.6% Fib at 1.3850 would target recently broken rising trend line support-turned-resistance at 1.3876.

2013-03-26 12:30 GMT (or 13:30 MQ MT5 time) | [USD - Durable Goods Orders]

EURUSD M5 : 30 pips ranging movement by USD - Durable Goods Orders news event :

"Nice" movement ... :) good for martingale :

MetaTrader Trading Platform Screenshots

EURUSD, M5, 2014.03.26

MetaQuotes Software Corp., MetaTrader 5, Demo

Forum on trading, automated trading systems and testing trading strategies

Press review

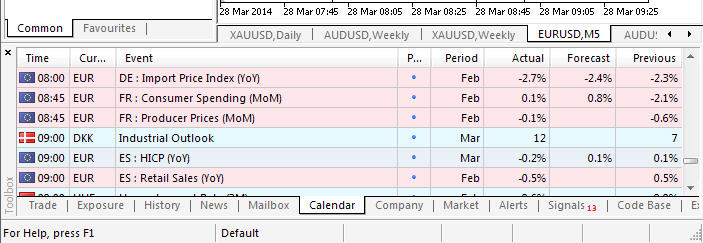

newdigital, 2014.03.28 10:28

2013-03-25 14:00 GMT (or 15:00 MQ MT5 time) | [EUR - Spanish Retail Sales]

if actual > forecast = good for currency (for EUR in our case)

==========

Spain's Consumer Prices Fall For First Time In 5 Months

Spain's consumer prices declined for the first time in five months in March, flash estimates from the statistical office INE showed Friday.

Consumer prices dropped 0.2 percent year-on-year in March, after staying flat in the prior month. Prices were forecast to remain unchanged as seen in February.

The harmonized index of consumer prices also fell 0.2 percent annually in March, following a 0.1 percent rise in February.

Month-on-month, consumer prices gained 0.2 percent in February, data showed.

MetaTrader Trading Platform Screenshots

EURUSD, M5, 2014.03.28

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 42 pips price movement by EUR - Spanish Retail Sales news event

newdigital:

If D1 price will break 1.3749 support level on close bar from above to below so we may see the secondary correction within the primary bullish to be continuing (good to open sell trade.

If not so EURUSD D1 price will be on ranging market condition floating between 1.3749 support and 1.3966 resistance levels.

1.3749 was broken on close D1 bar, and Chinkou Span line is crossing historical price on open bar fron above to below. This is Correction. And I am in profit with +35 pips

I think - it will be very interesting movement for the next week:

the nearest support level (D1 timeframe) is 1.3728 and next one is 1.3685. If D1 price will break 1.3685 so we may see ranging market condition within primary bullish. Yes, it is still bullish sorry.