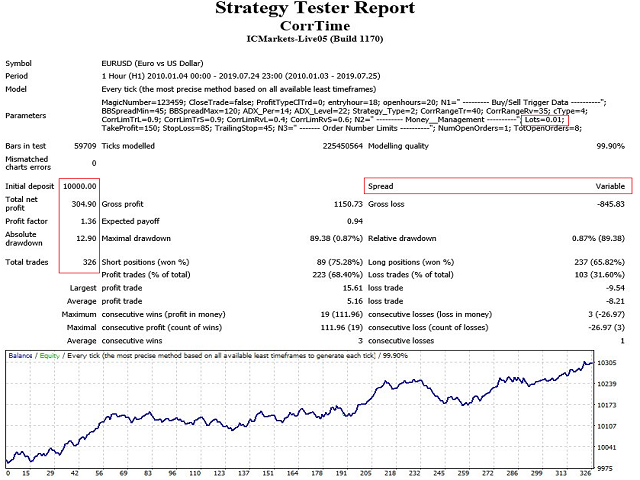

Same situation as with the oscillator ea.....profitability over almost 10 years ends up to be not more then $658.28. Why? something missing definitely....it's about 60-70 bucks roughly a year and that is not good enough unless going very slow and poor profitability doesn't cause an issue for those who might use it.

As the draw down seems pretty small i think a serious thought about implementing money management would make a big difference to the over all performance, well a thought......

Anyway thanks for a good contribution that for sure can be upgraded to be much better ;)

Yes, money management would help the bottom line. But, for performance evaluation of new EAs, I do not like to use money management since it makes it harder to compare results. The trade volume in the test was 0.01 lots (1 micro lot). So a 1.0 lot volume would give a $65.8K profit and an average profit of $179./trade.

A money management system will make it more efficient and a lot more profitable, beside that simply let it function on/off during the evaluation process if that is the big issue. Sure, trade with 1.0 lots size during the whole period is fine but let's say i just want to start with $100 and not $10000....then i go 0.01 the whole period or have to manually increase my lot size.....

And one more thing that's forgotten here - variable spreads and slippage during the test to get a more exact precision how it would perform in almost live conditions! I tested this ea during such conditions and i can say the results are even worse!Same situation as with the oscillator ea.....profitability over almost 10 years ends up to be not more then $658.28. Why? something missing definitely....it's about 60-70 bucks roughly a year and that is not good enough unless going very slow and poor profitability doesn't cause an issue for those who might use it.

As the draw down seems pretty small i think a serious thought about implementing money management would make a big difference to the over all performance, well a thought......

Anyway thanks for a good contribution that for sure can be upgraded to be much better ;)

It is an excellent strategy. The money management is trader choice. There is enough data in the report to tell anyone with a background in trading, it is a very good EA ON PAPER.

It is an excellent strategy. The money management is trader choice. There is enough data in the report to tell anyone with a background in trading, it is a very good EA ON PAPER.

That's what you think for now, but test it as i described above with variable spreads and slippage as near real trading you get (external plugin for MT4) you will get the proof of a very poor performance, worse then the initial standard test! That's the difference that almost fool everyone that is not really aware about this important difference.

And here's that proof when tested with high quality ducas copy tickdata, variable spreads ,slippage, commission(ECN) and swaps. Compare and you will understand how important this is! If you Max Brown have that trading background you should already know this right...

That's also very common for many products, they are tested with standard concept of MT4 and the tests show an excellent performance making people thinking 'wow'. But then on the other hand when it's put on the real market it does not perform at all like the tester graph! Simply the truth reviled with such test and i can promise it's one of the best there is when we talking about MT4

Hello Richard,

I got 3 warnings after compiling. Please can you share the file ex4?

Hello Richard,

I got 3 warnings after compiling. Please can you share the file ex4?

There are no errors when compiling it and there will be an .ex4 file created also automatically when you do this. The question is this - Did you install the libraries file where it should be?

The Library_Correlation.mqh file you put in folder /MQL4/Include and it should work without warnings or errors

There are no errors when compiling it and there will be an .ex4 file created also automatically when you do this. The question is this - Did you install the libraries file where it should be?

The Library_Correlation.mqh file you put in folder /MQL4/Libraries and it should work without warnings or errors

Thanks !!

But the Library_Correlation.mqh you must put in folder /MQL4/include like the description

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Price Time Correlation Trading Model:

A Price Time correlation model is used for Trend and Reversal trading

Author: raposter