Forum on trading, automated trading systems and testing trading strategies

Something Interesting to Read May 2014

newdigital, 2014.05.26 11:16

Market Sense & Nonsense ~ Jack D. Schwager

When it comes to the markets, academics, professionals and novice

investors have one thing in common: They all operate on assumptions that

fail to hold up in the harsh light of reality. The following are a

sampling of observations about how markets really work:

- The market is not always right. The best opportunities arise when the market is most wrong.

- Big price moves begin on fundamentals but end on emotion.

- Past returns are not future returns. Past returns can be very misleading if there are reasons to believe that future market conditions are likely to be significantly different from those that shaped past returns.

- The best-performing past investments often do worse than the worst-performing past investments in the future--and the future after all is where we all have to make our investment decisions.

- The best time to initiate long-term investments in equities is after extended periods of underperformance.

- Faulty risk measurement is worse than no risk measurement at all because it will lull investors into unwarranted complacency.

- Volatility is frequently a poor proxy for risk. Many low volatility investments have high risk, while some high volatility investments have well-controlled risk.

- The real risks are often invisible in the track record.

- High past returns sometimes reflect excessive risk-taking in a favorable market environment rather than manager skill.

- Return alone is a meaningless statistic because return can always be increased by increasing risk. Return/risk should be the primary performance metric.

- Leverage alone tells you nothing about risk. Risk is a function of both the underlying portfolio and leverage. Leveraged portfolios can often be lower risk than unleveraged portfolios--it depends on the assets in the portfolio.

Financial markets are undergoing rapid innovation due to the continuing proliferation of computer power and algorithms. These developments have created a new investment discipline called high-frequency trading. Despite the demand for information on this topic, little has been published to help investors understand and implement high-frequency trading systems—until now.

Written by industry expert Irene Aldridge, High-Frequency Trading offers the first applied "how to do it" manual to building high-frequency systems.Covering sufficient depths of material to thoroughly pinpoint issues at hand, High-Frequency Trading leaves mathematical complexities to their original publications, referenced throughout the book.

Page by page, this accessible guide:

Discusses the history and business environment of high-frequency trading systems

Reviews the statistical and econometric foundations of the common types of high-frequency strategies

Examines the details of modeling high-frequency trading strategies

Describes the steps required to build a quality high-frequency trading system

Addresses the issues of running, monitoring, and benchmarking high-frequency trading systems

Along the way, this reliable resource skillfully high-lights numerous quantitative trading strategies—from market microstructure and event arbitrage to deviations arbitrage—and puts the creation and management of portfolios based on high-frequency strategies in perspective.

High-frequency trading is a difficult, but profitable, endeavor that can generate stable profits in various market conditions. But solid footing in both the theory and practice of this discipline are essential to success. Whether you're an institutional investor seeking a better understanding of high-frequency operations or an individual investor looking for a new way to trade, this book has what you need to make the most of your time in today's dynamic markets.

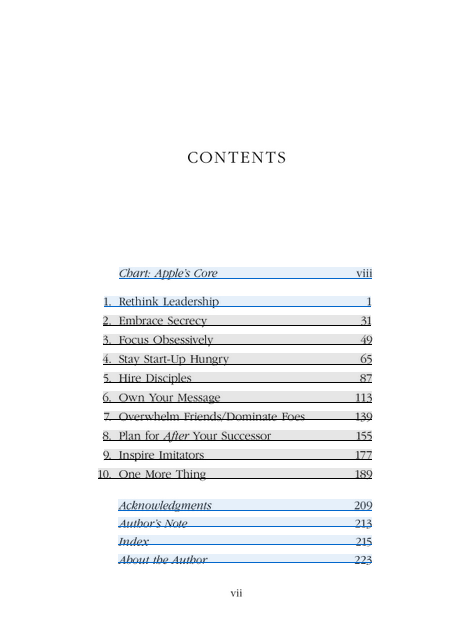

Inside Apple: How America's Most Admired--and Secretive--Company Really Works

INSIDE APPLE reveals the secret systems, tactics and leadership

strategies that allowed Steve Jobs and his company to churn out hit

after hit and inspire a cult-like following for its products.

If Apple is Silicon Valley's answer to Willy Wonka's Chocolate Factory,

then author Adam Lashinsky provides readers with a golden ticket to step

inside. In this primer on leadership and innovation, the author will

introduce readers to concepts like the "DRI" (Apple's practice of

assigning a Directly Responsible Individual to every task) and the Top

100 (an annual ritual in which 100 up-and-coming executives are tapped a

la Skull & Bones for a secret retreat with company founder Steve

Jobs).

Based on numerous interviews, the audiobook offers exclusive new

information about how Apple innovates, deals with its suppliers and is

handling the transition into the Post Jobs Era. Lashinsky, a Senior

Editor at Large for Fortune, knows the subject cold: In a 2008 cover

story for the magazine entitled The Genius Behind Steve: Could

Operations Whiz Tim Cook Run The Company Someday he predicted that Tim

Cook, then an unknown, would eventually succeed Steve Jobs as CEO.

While Inside Apple is ostensibly a deep dive into one, unique company

(and its ecosystem of suppliers, investors, employees and competitors),

the lessons about Jobs, leadership, product design and marketing are

universal. They should appeal to anyone hoping to bring some of that

Apple magic to their own company, career, or creative endeavor.

Forum on trading, automated trading systems and testing trading strategies

Something Interesting to Read February 2014

newdigital, 2014.02.14 14:53

Millionaire Traders: How Everyday People Are Beating Wall Street at Its Own Game

Through interviews with twelve ordinary individuals who have worked hard to transform themselves into extraordinary traders, Millionaire Traders reveals how you can beat Wall Street at its own game.Filled with in-depth insights and practical advice, this book introduces you to a dozen successful traders-some who focus on equities, others who deal in futures or foreign exchange-and examines the paths they've taken to capture considerable profits.

With this book as your guide, you'll quickly become familiar with a variety of strategies that can be used to make money in today's financial markets. Those that will help you achieve this goal include:

- Tyrone Ball: trades Nasdaq stocks almost exclusively, and his ability to change with the times has enabled him to prosper during some of the most treacherous market environments in recent history.

- AShkan Bolour: one of the earliest entrants into the retail forex market, he trades in the direction of the major trend, rather than trying to find reversals.

- Frank Law: a technician at heart, identifies a trading zone, commits to it, and scales down as long as the zone holds.

- Paul Willette: has mastered a method that allows him to harvest some profits right away, while ensuring that he can still benefit from an occasional extension run in his favor.

===============

Other books by Kathy Lien :

- The Little Book of Currency Trading: How to Make Big Profits in the World of Forex (Little Books. Big Profits)

- Day Trading and Swing Trading the Currency Market: Technical and Fundamental Strategies to Profit from Market Moves

===============

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.07 21:15

Silver forecast for the week of June 9, 2014, Technical Analysis

The silver markets rose slightly during the course of the week, but are

closing right at the $19 level. The real question then becomes whether

or not we can continue to go higher, or are we starting to fall? Quite

frankly, we will not feel comfortable with a long-term buy until we get

clear of the $20 level, so we would be a bit cautious at this point.

However, if we break to a fresh, new low, we could see selling down to

the $15 level, and then ultimately the $13 level.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.08 09:51

Gold forecast for the week of June 9, 2014, Technical AnalysisThe gold markets went back and forth during the course of the week, as we continue to meander around the $1250 level. With that, it appears that the market simply has no real direction at the moment, and as a result we are on the sidelines. Nonetheless, we believe that the market will ultimately bounce from somewhere near here or just below, so we are looking for supportive candles in order to start buying. The US Dollar Index looks a little on the weak side at the moment, and as a result we could see gold rise if the US dollar depreciates a bit.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.08 09:56

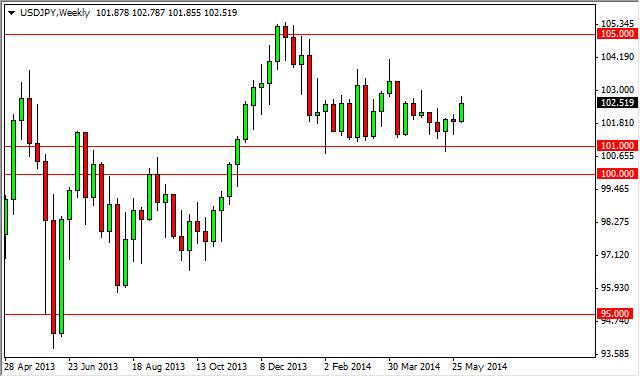

USD/JPY forecast for the week of June 9, 2014, Technical AnalysisThe USD/JPY pair broke higher during the previous week, cracking the top of the hammer that had formed the week before. However, the market is still within consolidation, thereby making this a difficult pair to trade for the longer term focused investor. Pullbacks should continue to offer buying opportunities, and we see far too much in the way of resistance at both the 103 and the 104 levels, and as a result we feel that the market is probably one that is best suited for short-term traders, at least for now.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.08 09:58

USD/CAD forecast for the week of June 9, 2014, Technical AnalysisThe USD/CAD pair had a positive week, grinding straight up from the absolute open for the week. However, we are still below the 1.10 level, and that area needs to be broken to the upside in order to start buying for the longer term. Pullbacks at this point time should continue to offer buying opportunities, so therefore if we form some type of supportive candle below, we are more than likely to continue to start buying. We believe that ultimately this market will head to the 1.1250 level, and as a result we are certainly biased to the upside.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.08 09:59

NZD/USD forecast for the week of June 9, 2014, Technical AnalysisThe NZD/USD pair went back and forth during the course of the week, basically finishing unchanged. Because of this, a longer-term trader can look at this large range and place a trade based upon which direction we break. Ultimately though, we do feel more comfortable buying a break above the top of the candle, and going long. There is quite a bit of noise underneath this area, and as a result we feel that selling could be a bit more difficult. Nonetheless, we will simply follow where the market leads us.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.08 10:00

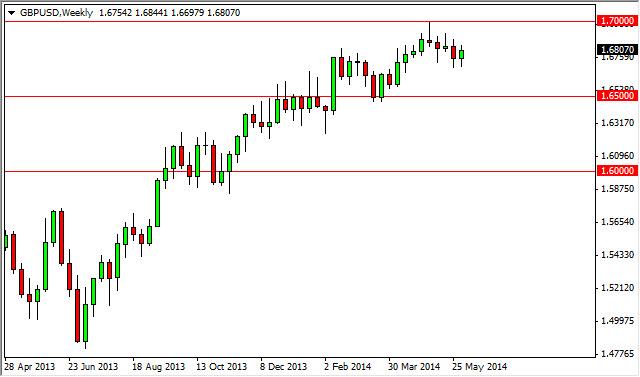

GBP/USD forecast for the week of June 9, 2014, Technical AnalysisThe GBP/USD pair had a slightly positive week over the last 5 sessions, as we continue to bounce around the 1.68 level. This market is still very bullish as far as we can tell, and we are approaching an area that we could consider to be an uptrend line. Nonetheless, we still have a target of 1.70 before it’s all said and done, and as a result we are buyers. We believe that there is a significant “floor” in this market all the way down to the 1.65 handle. That area getting broken to the downside would be very negative, but we do not see that happening anytime soon.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

This is the thread about books related for stocks, forex, financial market and economics. Please make a post about books with possible cover image, short description and official link to buy (amazon for example).

Posts without books' presentation, without official link to buy and with refferal links will be deleted.Posts with links to unofficial resellers will be deleted