Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.21 13:43

Forex Weekly Outlook June 23-27Haruhiko Kuroda’s speech US housing data, German Ifo Business Climate, US CB Consumer Confidence, US Durable Goods Orders, Mark Carney’s speech are the main highlights on FX calendar. Here is an outlook on the main market-movers for this coming week.

Last week, the Fed continued its $10 billion bond tapering, reaching $35 billion, but delivered mixed messages at the press conference on Wednesday evening. The Federal Reserve reduced economic growth forecast to 2.3%, but also a lowered unemployment projection to 6-6.1%, while nearly maintaining its inflation forecast to 2.1-2.3% describing the recent inflation data as “noisy” saying, the FOMC will take its time about interpreting CPI data. Yellen also stressed that the Fed is taking a “balanced approach” to monetary policy and is being very watchful to unfolding economic events. Will the growth trend continue?

- Haruhiko Kuroda: Monday, 6:00. BOE Governor, Haruhiko Kuroda will speak in Tokyo. Kuroda is confident that the BOJ’s massive monetary stimulus pulled Japan out of deflation, but money printing alone will not do the job. Kuroda urges Prime Minister Shinzo Abe to act on his side and carry out badly needed reforms to revive Japan’s economy.

- US Existing Home Sales: Monday, 14:00. Previously owned U.S. home sales advanced in April by 1.3% reaching an annualized rate of 4.65 million units from 4.59 in March. The widening supply of properties raised prospects for a stronger spring buying season with a slower price appreciation. Analysts expected yet another increase to 4.71 million units. Strong employment gains will boost the housing market increasing affordability. Existing home sales are expected to advance further to 4.74 million units.

- German Ifo Business Climate: Tuesday, 8:00. German business sentiment declined more than expected in May, falling to 110.4 from 111.2 in the previous month. Economists predicted a minor decline to 111. German economic growth is mainly dependent on domestic demand while the Bundesbank estimated slower growth in the coming months. However, despite the lack of growth German economy is expected to maintain its leading position in the Eurozone. German business climate is expected to decline further to 110.3.

- US CB Consumer Confidence: Tuesday, 14:00. U.S. consumer sentiment edged up in May to the second-highest level since 2008, reaching 83 from 81.7 in April due to increased optimism about the economy and the employment market. The survey revealed that stronger employment contributed to consumer spending which accounts for almost 70% of the economy. Analysts expected an even stronger reading of 83.2 in May. However, economic expectations declined to a seven-month low in May, indicating a limited rebound from the slow growth witnessed in the last few months. Consumer sentiment is expected to rise further towards 83.6.

- US New Home Sales: Tuesday, 14:00. Sales of new single-family homes edged up in April to a 3-1/2 year high of 433,000 units. The rise ended two months of declines, beating market forecast of 426,000 units. However analysts believe the market has not clearly gained steam. Meanwhile, sales of previously owned homes increased in April to the highest level in nearly two years giving hope for a real recovery. Sales of new family homes are predicted to rise again to 442,000.

- US Core Durable Goods Orders: Wednesday, 12:30. Orders for durable U.S. manufactured goods unexpectedly increased in April by 0.8% while predicted to slide 0.5%. However a drop in business investments could fail expectations for a sharp rebound in economic growth this quarter. Meanwhile Core durable orders excluding transportation items inched 0.1% while expected to rise 0.2%, following a 2.4% rise in March. Durable goods orders are expected to decline 0.1% while, Core orders are predicted to rise 0.3%.

- Mark Carney speaks: Thursday, 9:30. BOE Governor Mark Carney will make two speeches in London. The last BOE meeting confused financial markets about the future course of interest rates. Carney talked about keeping borrowing costs on hold despite strong economic data. Valuable information may be obtained about the BOE’s plans. Market volatility is expected.

- US Unemployment Claims: Thursday, 12:30. The number new claims for unemployment benefits dropped by 6,000 last week, to a seasonally adjusted 312,000, remaining near pre- recession lows. The reading was broadly in line with market forecast. The number of workers continuing to draw unemployment benefits reached 2.56 million on a seasonally adjusted basis, down 54,000 from last week. The ongoing decline in the number of jobless claims together with higher hiring rate indicates the US labor market is continuing to improve. The number of claims is expected to reach 314,000.

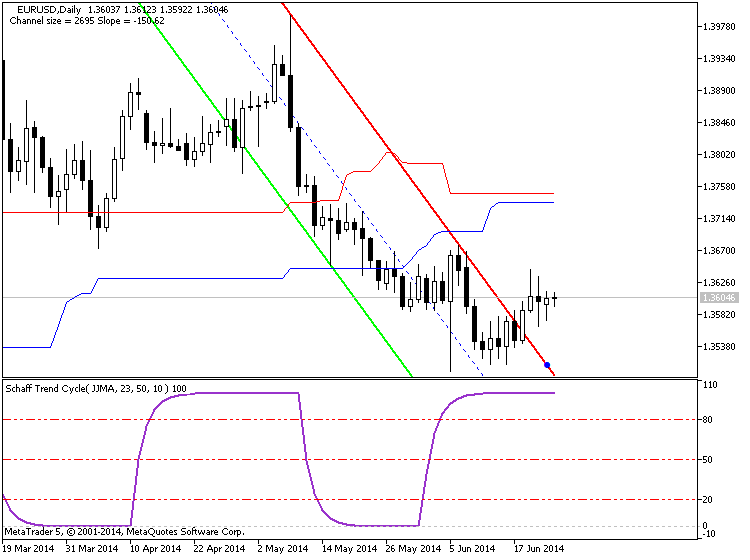

If D1 price will break 1.3512 support level so the primary bearish will be continuing.

If D1 price will break 1.3643 resistance so we may see the bear market rally (good for counter trend systems.

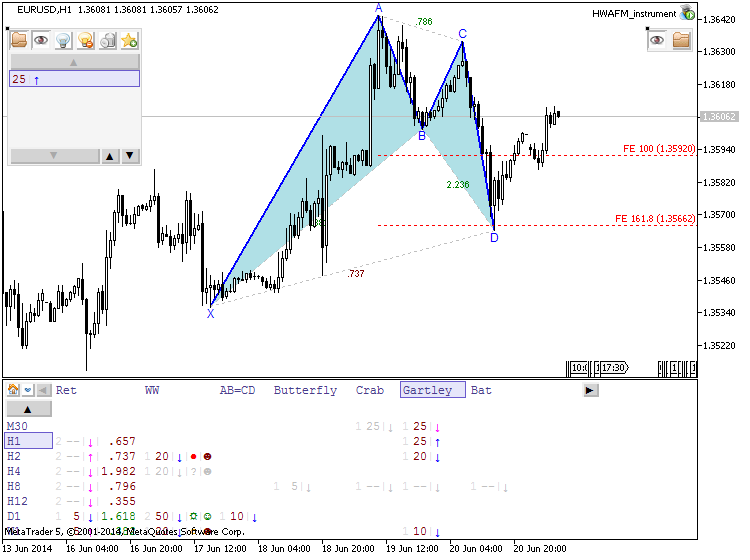

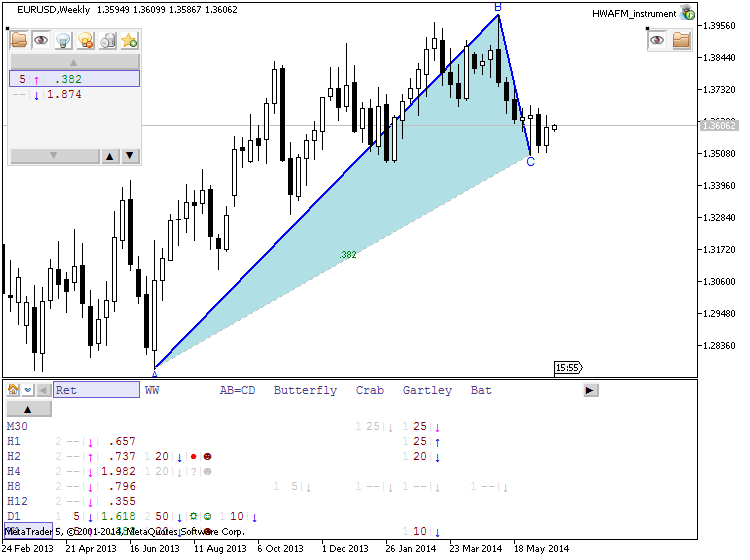

Just some patterns indicating possible uptrend for this pair:

So, 3 patterns only are showing uptrend (see images above):

- Gartley formed pattern for H1

- Retracement forming pattern for W1

- Retracement forming pattern for H2

Other patterns for other timeframes are showing downtrend for EURUSD. I mean: almost all the patterns for all timeframes are showing future possible downtrend for this pair.

Well ... will see ...

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.23 09:36

2014-06-23 07:00 GMT (or 09:00 MQ MT5 time) | [EUR - French Manufacturing PMI]

- past data is 49.6

- forecast data is 49.5

- actual data is 47.8 according to the latest press release

if actual > forecast = good for currency (for EUR in our case)

[EUR - French Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers in the manufacturing industry. It's a leading indicator of economic health - businesses react quickly to market conditions, and their purchasing managers hold perhaps the most current and relevant insight into the company's view of the economy

==========

French manufacturing PMI falls to 6-month low of 47.8 in June

Manufacturing activity in France contracted at the fastest pace in six

months in June, underlining concerns over the economic outlook of the

euro zone’s second-largest economy, preliminary data showed on Monday.

In a report, market research group Markit said that its preliminary French manufacturing purchasing managers’ index fell to a seasonally adjusted 47.8 this month from a reading of 49.6 in May. Analysts had expected the index to dip to 49.5 in June.

Meanwhile, the preliminary services purchasing managers’ index weakened to a seasonally adjusted 48.2 this month from 49.1 in May and worse than expectations for a reading of 49.4.

A reading above 50.0 on the index indicates industry expansion, below indicates contraction.

Commenting on the report, Paul Smith, Senior Economist at Markit said, “The data are consistent with another disappointing GDP outturn for Q2 following stagnation in the first quarter.”

Following the release of the data, the euro turned lower against the U.S. dollar, with EUR/USD shedding 0.03% to trade at 1.3596, compared to 1.3610 ahead of the data.

Meanwhile, European stock markets were modestly lower after the open. The Euro Stoxx 50 dipped 0.2%, France’s CAC 40 declined 0.1%, London’s FTSE 100 slumped 0.1%, while Germany's DAX fell 0.1%.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

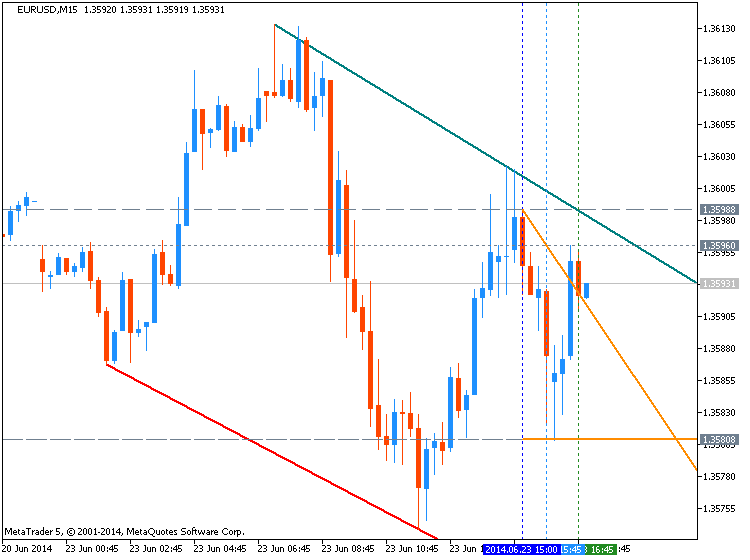

EURUSD M5 : 15 pips price movement by EUR - French Manufacturing PMI news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.22 12:56

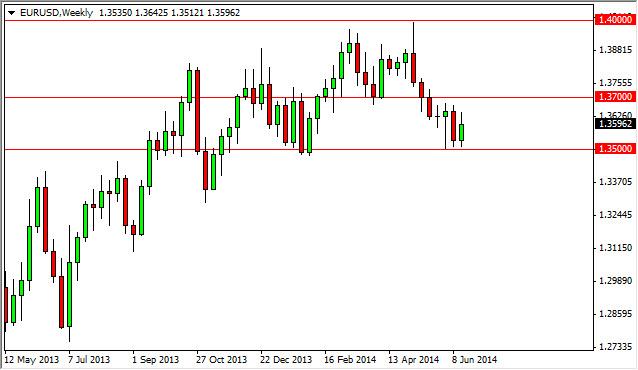

EUR/USD forecast for the week of June 23, 2014, Technical AnalysisThe EUR/USD pair broke higher during the course of the week, using the 1.35 level as support. That being the case, it looks as we continue to bounce around in this general vicinity, using the 200 pips as the range for the market right now. Long-term traders will probably avoid this market, but short-term traders will probably find it very profitable as it looks very well contained and we have very obvious support and resistance levels. However, if we do get above the 1.37 level, we feel that the market will finally go back towards a 1.40 handle. A move below the 1.35 level since this market down to the 1.33 handle.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.23 17:01

EUR/USD: Euro Steady As PMIs Disappoint

The EUR/USD is stable on Monday, as the pair trades slightly below the 1.36 line in the European session. On the release front, the week started off on a sour note as Eurozone, German and French PMIs all softened in May. In the US, today's highlight is Existing Home Sales, a key event.

Eurozone PMIs are key indicators of growth in the services and manufacturing sectors, and across the board, the May data was worse than a month earlier. The German and Eurozone numbers remained above the 50-point level, pointing to expansion. However, the French figures remained below the 50 mark, pointing to continuing contraction in the manufacturing and services sectors of the Eurozone's second largest economy. A worrying trend is that with the exception of Eurozone Services PMI, all of the PMIs posted their weakest reading in 2014.

Unlike his peers at the BOE and Federal Reserve, ECB head Mario Darghi is not being coy about possible interest rate hikes. On the weekend, Draghi stated flat out that he did not foresee the ECB raising rates before 2017. Draghi noted that the ECB had extended access by European banks to unlimited liquidity until that time, and that the Eurozone recovery was still weak. However, traders should not treat Draghi's remarks as etched in stone, as the ECB will likely have to raise rates if the economy recovers faster than anticipated.

There was positive economic news out of the US on Thursday, as Unemployment Claims dipped to 312 thousand last week, beating the estimate of 316 thousand. As well, the Philly Fed Manufacturing Index, which has been on the upswing for most of 2014, continued the trend and improved to 17.8 points, crushing the estimate of 14.3. This was the index's strongest reading since last August, and points to a manufacturing sector which is expanding in order to keep up with increasing demand. The ECB lowered interest rates to record levels earlier in June, so we'll have to wait for the June PMI numbers to see if the ECB moves lead to an improvement in PMI figures.

On Wednesday, the Federal Reserve continued to taper to its QE program, reducing the scheme by $10 billion, to $35 billion/month. If all goes as planned, the Fed could wind up QE in the fall. The Fed also hinted that interest rates will continue to stay low for the foreseeable future, which likely means that we won't see any rate hikes before the first quarter of 2015. With regard to economic activity, the Fed noted that the recovery is continuing, but it reduced its forecast of economic growth to 2.1-2.3%, down from an earlier forecast of around 2.9 percent. The bottom line? There were no dramatic items in the Fed statement, with one analyst describing current Fed policy as "steady as she goes". The perception that US interest rates will remain at ultra-low levels weighed on the US dollar last week.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.22 15:54

Forex Fundamentals - Weekly outlook: June 23 - 27The dollar ended the week lower against a basket of other major currencies despite small gains on Friday, after the Federal Reserve indicated earlier in the week that rates are likely to remain on hold for some time.

The US Dollar Index, which tracks the performance of the greenback versus a basket of six other major currencies, edged up to 80.41 late Friday from lows of 80.24 on Thursday. For the week, the index lost almost 0.3%.

The greenback weakened broadly after the Fed gave no indication of when interest rates could start to rise at the conclusion of its two-day meeting on Wednesday. In addition, the Fed’s forecast of where interest rates might reach in the long term fell from 4% to 3.75%.

The central bank cut its bond purchases by $10 billion a month, to $35 billion, saying there was "sufficient underlying strength" in the U.S. economy to continue tapering.

Despite this, the Fed also lowered its forecast for growth this year to a range of 2.1% to 2.3% from 2.8 to 3.0% previously, due to "unexpected contractions" in the first quarter as a result of the unusually harsh winter.

The Fed acknowledged the recent increases in inflation and drop in unemployment, but Chair Janet Yellen said no formula was in place for when interest rates would start to rise.

EUR/USD dipped 0.06% to 1.3598 late Friday, but posted a weekly gain of 0.47%.

The dollar pushed higher against the yen, with USD/JPY easing up to 102.07 late Friday from 101.93 on Thursday. For the week, the pair eked out a gain of 0.10%.

The pound slipped lower, with GBP/USD ending Friday’s session at 1.7014, 0.15% lower for the day. For the week, the pair gained 0.22% as demand for sterling continued to be underpinned by the view that the Bank of England will raise interest rates ahead of other central banks.

Elsewhere, the greenback slumped to a five-and-a-half month low against the Canadian dollar on Friday, following the release of stronger-than-forecast data on Canadian inflation and retail sales.

USD/CAD was down 0.56% to 1.0757 late Friday, the weakest level since January 7. For the week, the pair lost 0.93%.

In the coming week, the U.S. is to release data on consumer confidence, durable goods orders and home sales. Preliminary data on manufacturing activity from China and flash estimates on euro zone private sector activity will also be closely watched.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets.

Monday, June 23

- China is to publish the preliminary reading of the HSBC manufacturing index.

- BoJ Governor Haruhiko Kuroda is to speak at an event in Tokyo; his comments will be closely watched.

- The euro zone is to release data on manufacturing and service sector activity, while Germany and France are to release individual reports.

- The U.S. is to release preliminary data on manufacturing activity and private sector data on existing home sales.

- Switzerland is to publish data on the trade balance, the difference in value between imports and exports.

- In the euro zone, the Ifo Institute is to publish data on German business climate.

- The U.S. is to release private sector data on consumer confidence, as well as a report on new home sales.

- Market research group Gfk is to publish a report on German consumer climate.

- The U.K. is to release private sector data on retail sales.

- The U.S. is to publish data on durable goods orders, as well as revised data on first quarter growth.

- The Bank of England is to publish its financial stability report and Governor Mark Carney is to hold a press conference to discuss the report.

- The U.S. is to release data on personal income and expenditure, as well as data on inflation linked to personal spending.

- New Zealand is to publish data on the trade balance.

- Japan is to release data on retail sales, household spending and inflation.

- In the euro zone, Germany and Spain are to release preliminary data on consumer price inflation, while France is to publish data on consumer spending.

- Elsewhere in Europe, Switzerland is to publish its KOF economic barometer.

- The U.K. is to produce data on the current account and final data on first quarter growth.

- Canada is to release data on raw material price inflation.

- The U.S. is to round up the week with revised data on consumer sentiment.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.24 09:29

Trading Video: EURUSD a Better Trade Opportunity Despite GBPUSD Event Risk?

- The balance between Market Conditions, Fundamentals and Technicals is shaping trade probabilities

- Market conditions present better probabilities for a short-term EURUSD wedge than long-term GBPUSD run

- Nevertheless, event risk for the Pound tops the docket today with the BoE talking forward guidance

There are high-profile and long-term trade patterns shaping up in the FX

market, but the more probable opportunities are the shorter-term range

and breakouts. Market Conditions - as a third dimension to trade and

systemic analysis - still favors short-term developments. That means a

wedge formation from the EURUSD on the two-hour chart carries better

potential than the high-profile GBPUSD break above 1.7000 or the pent up

pressure for USDJPY

in a multi-year technical pattern. With that in mind, we head into

noteworthy event risk from the UK and key technical levels for a range

of currencies with expectations for what is reasonable from the markets.

We discuss this and more in today's Trading Video.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.24 09:39

EUR/USD: Break above 1.3650 may neutralize heavy bias - OCBC

Emmanuel Ng, FX Strategist at OCBC Bank, shares his view on the EUR/USD,

noting that 1.3650 needs to be re-taken to ease the selling pressure.

Key Quotes

"German

June Ifo numbers are scheduled for release later today and

the EUR-USD may continue to mark time in the 1.3600

neighborhood in the interim . As noted yesterday, a sustained

break above the 1.3600-1.3650 neighborhood may neutralize our inherent

heavy bias for the pair. On a more structural note, the pair’s

eventual direction is expected to be determined by the tussle

between ECB-inspired dovishness and prevailing broad based USD

vulnerability."

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

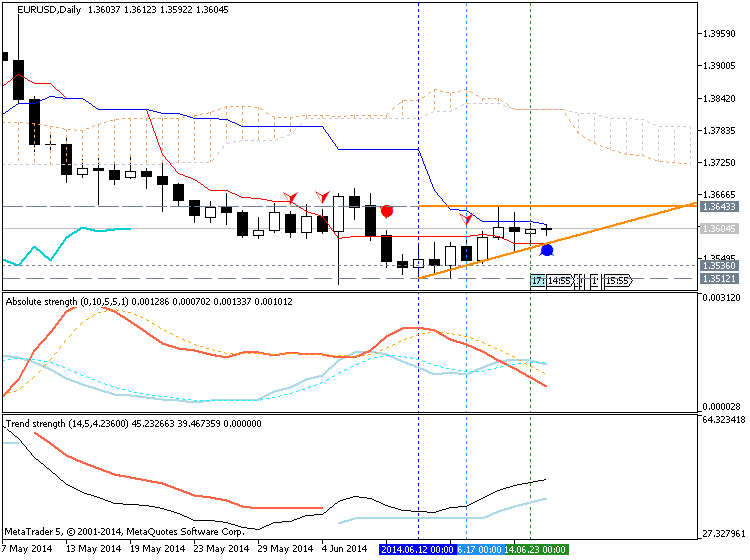

D1 price is ranging between 1.3512 support and 1.3643 resistance levels.

H4 price is located outside Ichimoku cloud/kumo on primary bullish moving along Sinkou Span B line which is one of the border of Ichimoku cloud.

W1 price is secondary correction within primary bullish: the price was stopped by 1.3502 support level.

If D1 price will break 1.3512 support level so the primary bearish will be continuing.

If D1 price will break 1.3643 resistance so we may see the bear market rally (good for counter trend systems.

UPCOMING EVENTS (high/medium impacted news events which may be affected on EURUSD price movement for this coming week)

2014-06-23 01:45 GMT (or 03:45 MQ MT5 time) | [CNY - HSBC Manufacturing PMI]

2014-06-23 07:00 GMT (or 09:00 MQ MT5 time) | [EUR - French Manufacturing PMI]

2014-06-23 07:30 GMT (or 09:30 MQ MT5 time) | [EUR - German Manufacturing PMI]

2014-06-23 08:00 GMT (or 10:00 MQ MT5 time) | [EUR - Manufacturing PMI]

2014-06-23 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Existing Home Sales]

2014-06-24 08:00 GMT (or 10:00 MQ MT5 time) | [EUR - German Ifo Business Climate]

2014-06-24 12:05 GMT (or 14:05 MQ MT5 time) | [USD - FOMC Member Plosser Speech]

2014-06-24 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Consumer Confidence]

2014-06-24 14:00 GMT (or 16:00 MQ MT5 time) | [USD - New Home Sales]

2014-06-25 08:00 GMT (or 10:00 MQ MT5 time) | [EUR - Italian Retail Sales]

2014-06-25 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Durable Goods Orders]

2014-06-25 12:30 GMT (or 14:30 MQ MT5 time) | [USD - GDP]

2014-06-26 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Personal Consumption Expenditure ]

2014-06-27 07:00 GMT (or 09:00 MQ MT5 time) | [EUR - Spanish CPI]

2014-06-27 13:55 GMT (or 15:55 MQ MT5 time) | [USD - UoM Consumer Sentiment]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on EURUSD price movementSUMMARY : bearish

TREND : rally

Intraday Chart