Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.31 16:29

Forex Weekly Fundamentals Outlook June 2-6Currency movements were mixed in the last week of May, and now a very busy week awaits traders: rate decision in Australia, Canada, the UK and the Eurozone are due alongside top-tier US events culminating in the all-important NFP report on Friday are the market movers on FX calendar. Here is an outlook on the highlights of this week.

The ECB kept the pressure on the euro with comments pointing to action. Also the data weighed on the common currency. In the US, the theory of a terrible first quarter and an improvement afterwards was reinforced by the news of contraction in Q1, while fresh jobless claims were encouraging. Apart from that, the pound was pounded and the Aussie recovered. And now, we have the top tier indicators in the first week of the month. Let’s start,

- US ISM Manufacturing PMI: Monday, 14:00.US manufacturing sector activity edged up in April to 54.9 from 53.7 in March, beating forecast of a 54.3 reading. According to the report, new orders remained unchanged at 55.1, while employment climbed to 54.7 from 51.1 in the previous month. Most responders were positive mainly due to strong demand out of China. US manufacturing activity is expected to advance to 55.7 this time.

- Australian rate decision: Tuesday, 14:00. The Reserve Bank of Australia signaled it would maintain low interest rates in the coming months as inflation is contained and the economy adjusts to fewer resource projects. Growth is expected to slow down after mining investment sharply plunged. Therefore, the 2.5% rate and the accommodative monetary policy are expected to stay for the rest of the year. No change in rates s expected now.

- Australian GDP: Wednesday, 1:30. The Australian economy expanded faster than expected last quarter, despite a decline in business investment. GDP edged up 0.8% in the last quarter of 2013, beating expectations for a 0.7% rise. Consumer spending picked-up as well as exports and housing transactions. Low interest rates and a recent decline in the exchange rate had a significant positive impact on growth. GDP growth in the first quarter of 2014 is expected to advance by 0.9%.

- US ADP Non-Farm Employment Change: Wednesday, 12:15. Private sector employment in the US expanded by 220,000 jobs in April following 209,000 in the prior month. The majority of new positions were created in the construction industry gaining 19,000 jobs over the month, compared to 21,000 in March. Manufacturing remained slow adding 1,000 jobs in April, down from 4,000 in March. Analysts expected a lower job addition of 203,000. The impressive gain was well above the twelve-month average, indicating the US job market is improving. Private sector employment is expected to show a 217,000 jobs addition in May.

- US Trade Balance: Wednesday, 12:30. The U.S. trade deficit contracted in March to $40.4 billion from $49.8 billion in February thanks to a rise in exports but the small improvement did not help GDP in the first quarter, plunging into negative territory posting the first contraction in three years. U.S. trade deficit is expected to widen to $40.8 billion.

- Canadian rate decision: Wednesday, 14:00. The Bank of Canada maintained its overnight interest rate at 1%, keeping it unchanged for the last 29 policy meetings. However, the bank left the door open for a rate cut. Bank of Canada governor Stephen Poloz was less concerned with low inflation, high house prices and household debt, claiming recovery is consistent and will improve amid stronger US demand. Rates are expected to remain unchanged at 1%. Canadian GDP slightly disappointed.

- US ISM Non-Manufacturing PMI: Wednesday, 14:00. The U.S. service sector continued to advance in April, expanding to 55.2 from 53.1 in March. Analysts expected a lower reading of 54.3% in March. Responders were positive about business conditions and the current state of the US economy. The strong release indicates that the US economy is advancing and strengthening in Q2. Manufacturing activity in the US private sector is expected to gain further momentum and reach 55.6.

- UK rate decision: Thursday, 11:00. Stronger voices calling to raise rates were heard in the last BoE meeting in May. BoE Governor Mark Carney, who has supported the low rate policy, said that the Bank is getting close to raise borrowing costs. However the estimates suggest a hike may come in a year’s time while other analysts believe a higher rate will executed in the first three months of 2015. Rates are expected to remain unchanged at 0.50%.

- Eurozone rate decision: Thursday, 11:45, press conference at 12:30. The

ECB is likely to act as promised and to keep the pressure on the euro.

While the euro dropped throughout May due to Draghi’s comment last

time, the exchange rate is probably still too high. This keeps

inflation low. In addition, money supply is squeezing. A cut of 10 to

15 basis points is likely in both the main lending rate and the deposit

rate. In addition, the ECB could accompany this move with some new

kind of LTRO. While the governing council is likely to keep the QE

powder dry, Draghi could certainly provide some more details about such

a potential program, making it clear that the option is on the table. A

negative rate by such a major central bank is uncharted territory. In

addition and despite all the preparations, Draghi’s action and words

are not fully priced in. Draghi could drag the euro down once again.

- US Unemployment Claims: Thursday, 12:30. The number of initial jobless claims dropped drastically last week to nearly the lowest level in seven years reaching 300,000 claims. The 27,000 drop was far better than the 321,000 forecasted by analysts, indicating hiring is picking up despite the GDP contraction posted in the first quarter. Employers are confident enough to keep staff reducing the number of layoffs. Unemployment claims is expected to reach 314,000 this time.

- Canadian employment data: Friday, 12:30. Canada’s unemployment rate remained unchanged in April at 6.9%, despite a loss of 29,000 jobs compared to March. Employment worsened in the provinces of Quebec, New Brunswick, Newfoundland and Labrador and in Prince Edward Island, while it increased in Saskatchewan. The unemployment rate remained the same because labor force participation fell 0.2% to just over 66%.Canada’s labor market is expected to increase by 12,300 jobs with no change in the unemployment rate.

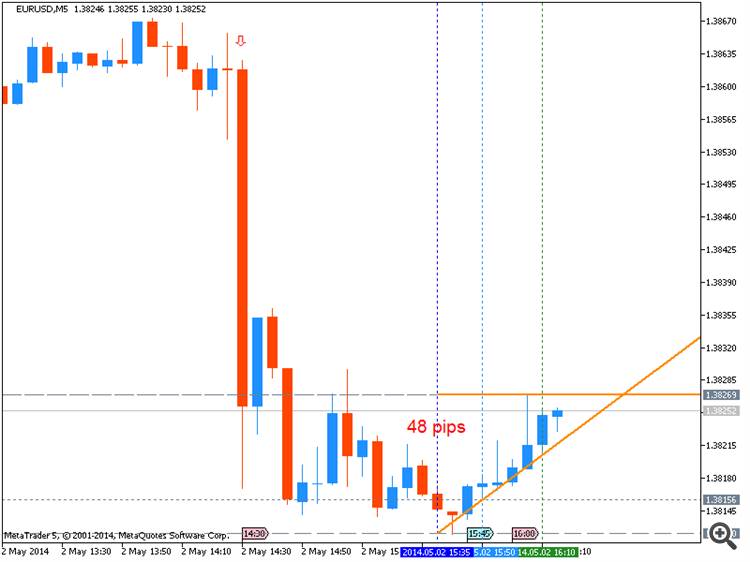

- US Non-Farm Employment Change and Unemployment rate: Friday, 12:30. The US labor market created 288,000 jobs in April, well above the consensus forecast of 215,000 new positions, posting the best reading since January of 2012. The surprising addition pushes the unemployment rate down to 6.3% from 6.7% in March, much better than the 6.6% estimated by analysts. Private sector job creation strengthened and the government started hiring again after many months of layoffs. Overall, the US job market is stronger and consumer spending also improves boosting economic activity. US economy is expected to show a 219,000 jobs addition in May, while the unemployment rate is predicted to rise to 6.4%.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.01 10:53

USD/CAD forecast for the week of June 2, 2014, Technical AnalysisThe USD/CAD pair fell slightly during the course of the week, as we continue to press against the 1.08 level. This area has been supportive lately, but ultimately we believe that the real support is lower. A supportive candle below this current area would be reason enough to start buying, and as you can see on the chart we also have an uptrend line that we are nowhere near yet. That being the case, we feel that this market will probably fall, but quite frankly are not very interested in it at the moment.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.03 17:16

2014-06-03 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Factory Orders]- past data is 1.5%

- forecast data is 0.5%

- actual data is 0.7% according to the latest press release

if actual > forecast = good for currency (for USD in our case)

[USD - Factory Orders] = Change in the total value of new purchase orders placed with manufacturers. It's a leading indicator of production - rising purchase orders signal that manufacturers will increase activity as they work to fill the orders.

==========

U.S. Factory Orders Rise 0.7% In April, More Than Expected

New orders for U.S. manufactured goods rose by more than expected in the month of April, according to a report released by the Commerce Department on Tuesday.

The report said factory orders increased by 0.7 percent in April after jumping by an upwardly revised 1.5 percent in March.

Economists had expected orders to climb by about 0.5 percent compared to the 1.1 percent increase that had been reported for the previous month.

The Commerce Department said factory orders increased for the third consecutive month, rising to their highest level since the series was first published on a NAICS basis in 1992.

The continued growth was partly due to an increase in orders for transportation equipment, which rose by 1.4 percent in April after surging up by 5.2 percent in March.

Excluding the increase in orders for transportation equipment, factory orders still rose by 0.5 percent in April compared to a 0.8 percent increase in the previous month.

Meanwhile, the report showed that factory orders edged down by 0.1 percent in April when excluding a jump in orders for defense.

The Commerce Department said orders for durable goods increased by a revised 0.6 percent in April compared to the 0.8 percent growth that was reported last Tuesday. Orders for non-durable goods rose by 0.7 percent.

The report also showed that shipment of manufactured goods edged up by 0.3 percent in April, while inventories of manufactured goods rose by 0.4 percent.

With inventories and shipments both rising, the inventories-to-shipments ratio was unchanged compared to the previous month at 1.30.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

USDCAD M5 : 7 pips price movement by USD - Factory Orders news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.04 14:55

2014-06-04 12:30 GMT (or 14:30 MQ MT5 time) | [CAD - Trade Balance]- past data is 0.8B

- forecast data is 0.2B

- actual data is -0.6B according to the latest press release

if actual > forecast = good for currency (for CAD in our case)

[CAD - Trade Balance] = Difference in value between imported and exported goods during the reported month. Export demand and currency demand are directly linked because foreigners must buy the domestic currency to pay for the nation's exports. Export demand also impacts production and prices at domestic manufacturers

==========

Canada posts trade deficit in April on record high imports

Canada posted an unexpected trade deficit of C$638 million ($585 million) in April from an upwardly revised C$766 million surplus in March, Statistics Canada data indicated on Wednesday.

Imports climbed 1.4 percent to a record high $43.46 billion, as volumes rose 1.9 percent and prices declined 0.4 percent. Exports decreased 1.8 percent to $42.83 billion as volumes and prices fell by 0.8 percent and 1.0 percent, respectively. Following are the seasonally adjusted figures in billions of Canadian dollars: Merchandise trade April March(rev) change pct March(prev) Balance -0.638 +0.766 n.a +0.079 Exports 42.825 43.625 -1.8 42.703 Imports 43.463 42.860 +1.4 42.623

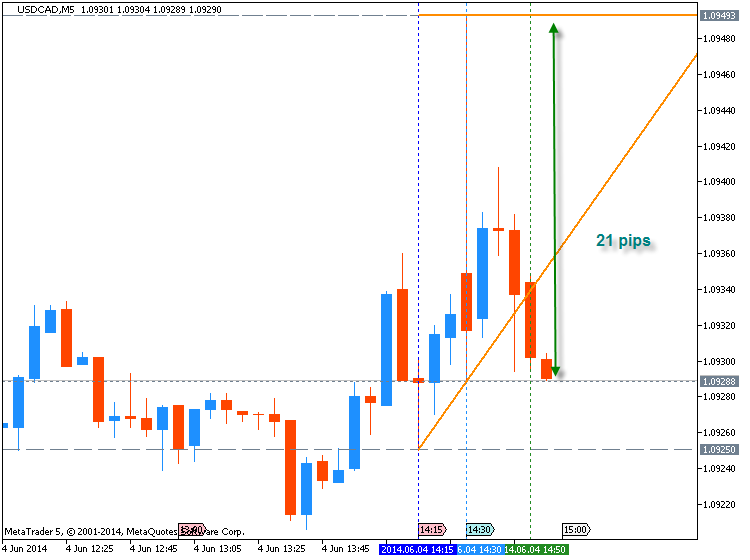

USDCAD M5 : 21 pips range price movement by CAD - Trade Balance news event :

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.04 16:30

2014-06-04 14:00 GMT (or 16:00 MQ MT5 time) | [CAD - Overnight Rate]- past data is 1.00%

- forecast data is 1.00%

- actual data is 1.00% according to the latest press release

if actual > forecast = good for currency (for CAD in our case)

[CAD - Overnight Rate] = Interest rate at which major financial institutions borrow and lend overnight funds between themselves. Short term interest rates are the paramount factor in currency valuation - traders look at most other indicators merely to predict how rates will change in the future

==========

Bank of Canada leaves key interest rate unchanged

The Bank of Canada left its benchmark interest rate unchanged at one per cent today.

An unchanged rate means governor Stephen Poloz does not believe the Canadian economy is strong enough to withstand higher interest rates, despite lingering concern about high consumer debt and rising housing prices.

Poloz is not scheduled to discuss his decision publicly on Wednesday, but the analysis accompanying his announcement notes that inflation is approaching the two per cent target rate earlier than anticipated.

The loonie was down 0.29 of a cent to 91.37 cents US as the central bank signalled it is in no rush to raise rates.

The benchmark overnight rate is used by retail banks to set rates for savers and borrowers, though the range of consumer rates may vary depending on bond yields.

The rate has been a one per cent for more than three years, dating back to September 2010, the longest stretch of level rates in Canadian history.

Poloz is dealing with a mixed bag of economic results, including exports that have not yet picked up as quickly as anticipated and an unemployment rate of 7 per cent, with evidence of many long-term unemployed.

In March, Poloz reiterated a growth rate of 2.5 per cent this year for the Canadian economy, but told a business audience that slow growth is the new norm for developed economies.

Last month it noted only 1.2 per cent GDP growth rate in the first quarter, but Poloz's note this morning attributed that to "severe weather and supply constraints."

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

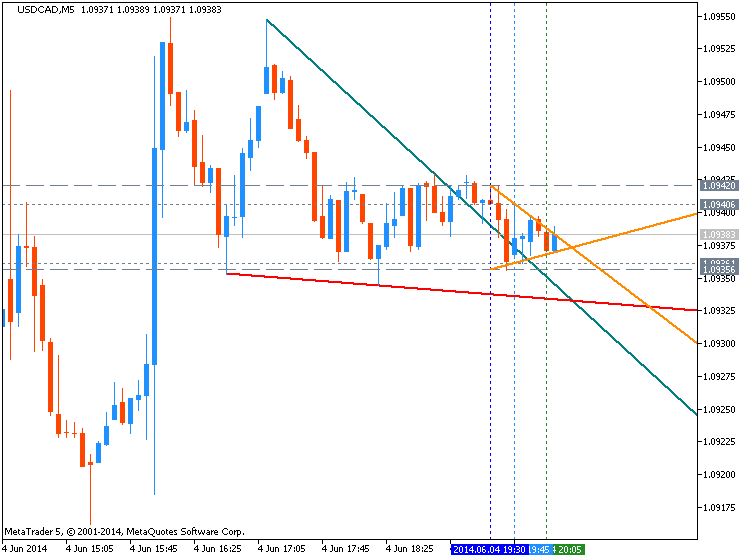

USDCAD M5 : 26 pips price movement by CAD - Overnight Rate news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.04 20:14

USD/CAD rises to 1-month highs, BoC holds

The U.S. dollar rose to one-month highs against its Canadian counterpart on Wednesday, after the Bank of Canada left interest rates unchanged, while downbeat Canadian trade data weighed on demand for the loonie.

USD/CAD hit 1.0951 during U.S. morning trade, the pair's highest since May 6; the pair subsequently consolidated at 1.0947, gaining 0.36%.

The pair was likely to find support at 1.0891, Tuesday's low and resistance at 1.0989, the high of May 5.

In a widely expected move, the BoC held its benchmark interest rate at 1%, saying that "the balance of risks remains within the zone for which the current stance of monetary policy is appropriate."

Earlier Wednesday, official data showed that Canada's trade balance swung into a deficit of C$0.64 billion in April, from a surplus of C$0.77 billion in March whose figure was revised up from a previously estimated surplus of C$0.08 billion.

Analysts had expected the trade surplus to narrow to C$0.10 billion in April.

In the U.S., the Institute of Supply Management said its non-manufacturing index rose to a nine-month high of 56.3 in May, from a reading of 55.2 the previous month, compared to expectations for a rise to 55.5.

The data came after payroll processing firm ADP said non-farm private employment rose by 179,000 in May, below expectations for an increase of 210,000. April's figure was revised down to a gain of 215,000 from a previously reported increase of 220,000.

A separate report showed

that U.S. trade deficit widened to $47.24 billion in April, from $44.18

billion in March whose figure was revised from a previously estimated

deficit of $40.40 billion. Analysts had expected the trade deficit to

widen to $40.80billion in April.

The loonie was lower against the euro, with EUR/CAD adding 0.25% to 1.4902.

Also Wednesday, Markit said Germany's services purchasing managers' index fell to 56.0 in May from 56.4 in April, confounding expectations for the index to remain unchanged.

Separately, Spain's services PMI fell to 55.7 in May, from a reading of 56.5 the previous month, while Italy's services PMI rose to 51.6 last month, from 51.1 in April.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.06 12:37

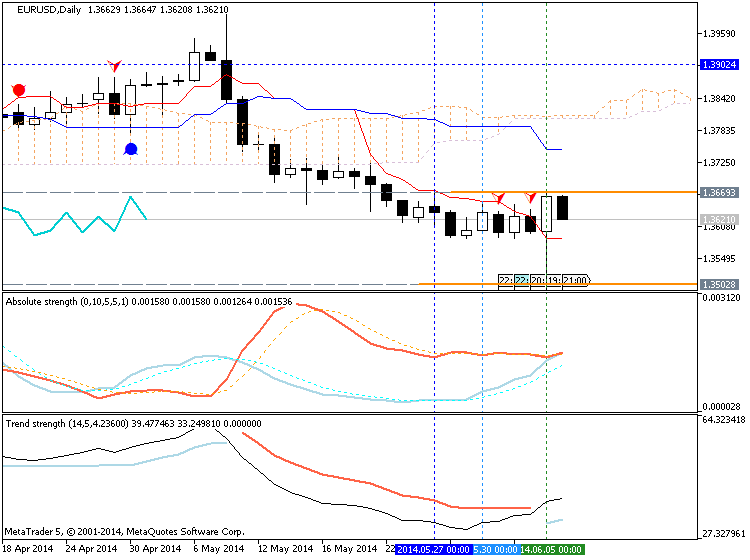

Trading the News: U.S. Non-Farm Payrolls (based on dailyfx article)

- U.S. Non-Farm Payrolls (NFP) to Increase 200+K for Fourth Consecutive Month.

- 288K Print in April Marked the Highest Print Since January 2012.

U.S. Non-Farm Payrolls (NFP) are projected to increase another 215K in

May, but the data print may spur a mixed reaction in the EUR/USD as the

jobless rate is expected to widen to an annualized 6.4% from 6.3% the

month prior.

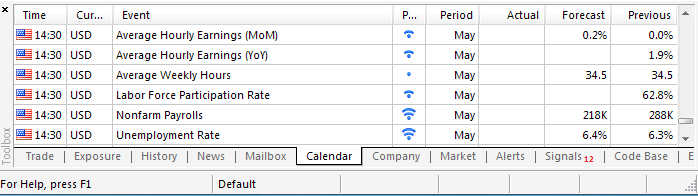

What’s Expected:

Why Is This Event Important:

Despite the ongoing improvement in the labor market, it seems as though the Federal Open Market Committee (FOMC) will stick to its current approach at the June 18 meeting, and we would need to see a marked pickup in NFPs to see a material shift in the Fed’s policy outlook at Chair Janet Yellen remains in no rush to normalize monetary policy.

The ongoing improvement in business sentiment along with the resilience in private sector consumption may encourage U.S. firms to further expand their labor force, and a positive development may spur a bullish reaction in the greenback as it puts increased pressure on the Fed to move away from its highly accommodative policy stance.

Nevertheless, the rise in planned job-cuts paired with the persistent

slack in the real economy may ultimately generate a disappointing labor

report, and a dismal print may heighten the bearish sentiment

surrounding the reserve currency as it drags on interest rate

expectations.

How To Trade This Event Risk

Bullish USD Trade: NFPs Climb 215K+; Unemployment Holds Steady

- Need to see red, five-minute candle following the NFP print to consider a short trade on EUR/USD

- If market reaction favors a long dollar trade, sell EUR/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

- Need green, five-minute candle to favor a long EUR/USD trade

- Implement same setup as the bullish dollar trade, just in the opposite direction

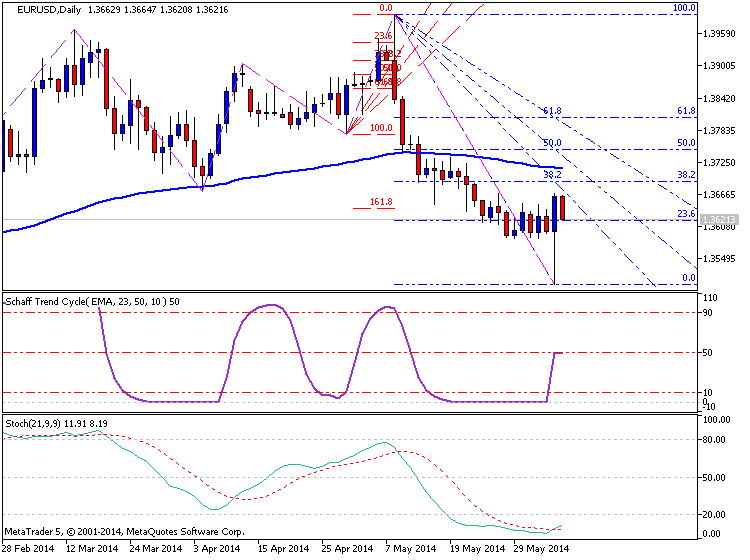

EUR/USD Daily

- Failure to Close Above Former Support Favors Bearish Forecast

- Interim Resistance: 1.3770 (38.2% expansion) to 1.3780 (38.2% retracement)

- Interim Support: 1.3490 (50.0% retracement) to 1.3500 Pivot

| Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

|---|---|---|---|---|---|

| APR 2014 | 5/2/2013 12:30 GMT | 218K | 288K | -47 | +12 |

EURUSD M5 : 48 pips by USD - NFP news event

U.S. Non-Farm Payrolls increased 288K in April following a revised 203K

rise the month prior, while the jobless rate unexpectedly slipped to an

annualized 6.3% from 6.7% as discouraged workers continued to leave the

labor force. The better-than-expected NFP print pushed the EUR/USD back

down towards the 1.3800 handle, but the market reaction was certainly

short-lived as the pair ended the day at 1.3871.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

USDCAD M5 : 39 pips price movement by USD - Non-Farm Employment Change news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

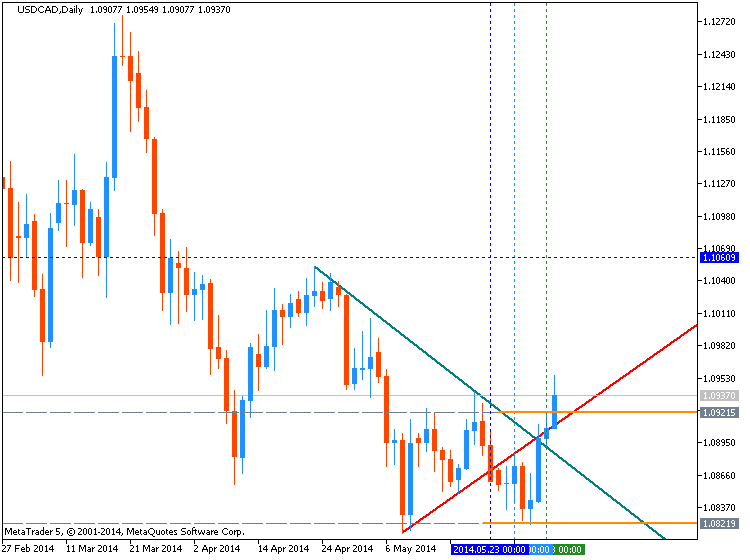

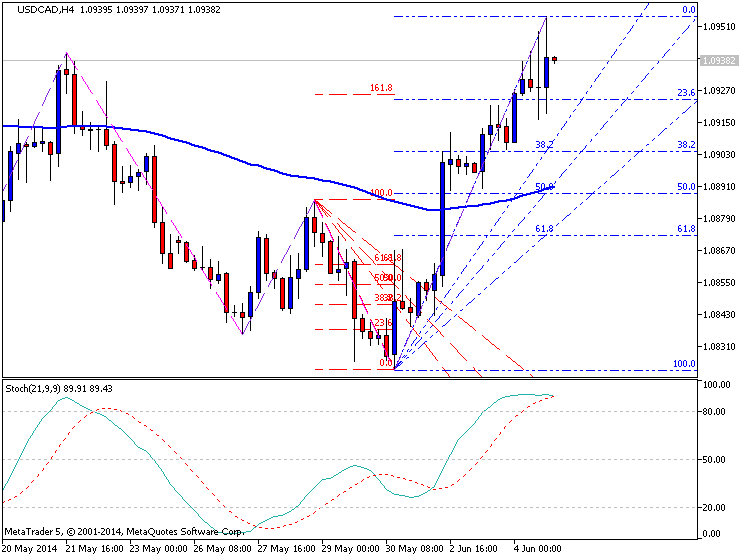

D1 price is on bearish market condition trying to break 1.0825 support on close bar for the bearish to be continuing.

H4 price is on bearish for ranging between 1.0821 support and 1.0867 resistance levels.

W1 price is on secondary correction within primary bullish with 1.0814 as the nearest support level..If D1 price will break 1.0825 support so the primary bearish will be continuing.

If not so we may see the ranging market condition within primary bearish.

UPCOMING EVENTS (high/medium impacted news events which may be affected on USDCAD price movement for this coming week)

2014-06-02 14:00 GMT (or 16:00 MQ MT5 time) | [USD - ISM Manufacturing PMI]

2014-06-03 01:00 GMT (or 03:00 MQ MT5 time) | [CNY - Non-Manufacturing PMI]

2014-06-03 01:45 GMT (or 03:45 MQ MT5 time) | [CNY - HSBC Final Manufacturing PMI]

2014-06-03 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Factory Orders]

2014-06-04 12:15 GMT (or 14:15 MQ MT5 time) | [USD - ADP Non-Farm Employment Change]

2014-06-04 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Trade Balance]

2014-06-04 12:30 GMT (or 14:30 MQ MT5 time) | [CAD - Trade Balance]

2014-06-04 14:00 GMT (or 16:00 MQ MT5 time) | [USD - ISM Non-Manufacturing PMI]

2014-06-04 14:00 GMT (or 16:00 MQ MT5 time) | [CAD - Overnight Rate]

2014-06-05 12:30 GMT (or 14:30 MQ MT5 time) | [CAD - Building Permits]

2014-06-05 14:00 GMT (or 16:00 MQ MT5 time) | [CAD - Ivey PMI]

2014-06-06 12:30 GMT (or 14:30 MQ MT5 time) | [CAD - Employment Change]

2014-06-06 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Non-Farm Employment Change]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on USDCAD price movement

SUMMARY : bearish

TREND : ranging

Intraday Chart