You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Trading Slow-moving Markets

15 minute webinar

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.06.25 11:29

Trading the News: U.S. Gross Domestic Product (GDP) (based on dailyfx article)

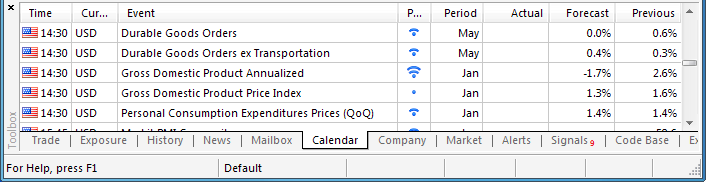

The final 1Q Gross Domestic Product (GDP) report may heighten the bearish sentiment surrounding the U.S. dollar as market participants anticipate another downward revision in the growth rate.

What’s Expected:

Why Is This Event Important:

A more meaningful decline in the growth rate may spark a bearish reaction in the greenback (bullish EUR/USD) as it gives the Federal Reserve greater scope to retain its highly accommodative policy stance, and the reserve currency may face additional headwinds throughout the summer months as central bank Chair Janet Yellen continues to endorse a dovish tone for monetary policy.

The ongoing slack in business outputs paired with the slowdown in housing activity may prompt a larger-than-expected decline in 1Q GDP, and a dismal print may generate a more meaningful rebound in the EUR/USD as the data drags on interest rate expectations.

However, stronger job growth along with the pickup in private sector credit may have helped to limit the downturn in economic activity, and a positive development may generate a bullish outlook for the greenback as it puts increased pressure on the Fed to normalize monetary policy sooner rather than later.

How To Trade This Event Risk

Bearish USD Trade: U.S. 1Q GDP Contracts 1.8% or Greater

- Need green, five-minute candle following the GDP print to consider a long EUR/USD trade

- If market reaction favors a bearish dollar trade, long EUR/USD with two separate position

- Place stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bullish USD Trade: Growth Rate Exceeds Market Expectations- Need red, five-minute candle to favor a short EUR/USD trade

- Implement same setup as the bearish dollar trade, just in opposite direction

Potential Price Targets For The ReleaseEUR/USD Daily

Impact that U.S. GDP has had on EUR/USD during the last quarter

(1 Hour post event )

(End of Day post event)

The final 4Q GDP report showed an upward revision in the growth rate as the U.S. economy expanded an annualized 2.6% amid an initial forecast of 2.4%. The greenback struggled to hold its ground following the release as the EUR/USD climbed towards the 1.3775 region, but the dollar regained its footing during the North American trade, with the pair ending the day at 1.3739.

EURUSD June 26th - EURUSD prica action and current support

Support and Resistance Trading & Chart Video

Support and Resistance Charts

Watch high-speed trading in action

Ichimoku Kinko Hyo (一目均衡表 Ichimoku Kinkō Hyō) usually just called ichimoku is a technical analysis method that builds on candlestick charting to improve the accuracy of forecast price moves. It was developed in the late 1930s by Goichi Hosoda (細田悟一 Hosoda Goichi), a Japanese journalist who used to be known as Ichimoku Sanjin, which can be translated as “What a man in the mountain sees.” He spent thirty years perfecting the technique before releasing his findings to the general public in the late 1960s.

Ichimoku Kinko Hyo translates to ‘one glance equilibrium chart’ or ‘instant look at the balance chart’ and is sometimes referred to as ‘one glance cloud chart’ based on the unique ‘clouds’ that feature in ichimoku charting.

Ichimoku is a moving average-based trend identification system and because it contains more data points than standard candlestick charts, provides a clearer picture of potential price action. The main difference between how moving averages are plotted in ichimoku as opposed to other methods is that ichimoku’s lines are constructed using the 50% point of the highs and lows as opposed to the candle’s closing price.

https://en.wikipedia.org/wiki/Ichimoku_Kinko_Hyo

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video June 2013

newdigital, 2013.06.13 11:00

Ichimoku 101 tutorial

This is good tutorial on the high probability strategy for Ichimoku indicator in general. Ichimoku is standard indicator in Metatrader 5 and we can read here about this indicator. Besides, we can use this indicator as a custom one using this entry in MT5 Codebase for example.

From Stocks & Commodities V. 18:10 (22-30):

.

Only now, in the early 21st century, are western traders really beginning to understand the power of this charting system created by one Japanese newspaper writer before the second World War.