EURUSD: Sees Price Extension, Eyes The 1.0800 Level

EURUSD: With EUR extending its price weakness during Thursday trading session, threats of further downside pressure is envisaged. Support lies at the 1.0850 level where a violation will aim at the 1.0800 level. A break of here will aim at the 1.0750 level with a turn below that level targeting the 1.0700 level. Its daily RSI is bearish and pointing lower supporting this view. Conversely, resistance is seen at 1.0950 level with a cut through here opening the door for more downside towards the 1.1000 level. Further up, resistance lies at the 1.1050 level where a break will expose the 1.1100 level. All in all, EUR remains biased to the downside in the medium term.

GBPJPY: Sets Up To Correct Lower

GBPJPY: The cross remains vulnerable to the downside after failing at higher level prices on Thursday. On the downside, support comes in at the 193.00 level where a violation will aim at the 192.00 level. A break below here will target the 191.00 level followed by the 190.00 level. On the upside, resistance lies at the 194.00 level followed by the 195.00 level where a break will aim at the 196.00 level. A cut through here will aim at the 197.00 level. Further out, the 198.00 level comes in as the next resistance. All in all, the cross remains biased to the downside short term.

USDCHF: Sees Price Hesitation

USDCHF: Broader outlook for USDCHF may be higher but it faces the risk of a move lower following its price hesitation the past week. Resistance resides at the 0.9700 level with a breach targeting the 0.9750 level. A breather may occur here and turn the pair lower but if taken out, expect a push higher towards the 0.9800 level. On the downside, support comes in at the 0.9600 level. A turn below here will open the door for more weakness to occur towards the 0.9550 level and then the 0.9500 level. A cut through here will open the door for additional weakness towards the 0.9450 level. All in all, the pair remains biased to the upside on further strength.

EURUSD: Loses Upside Momentum, Faces Downside Risk

EURUSD: Having EUR reversed its entire past week gains to close flat, it now faces risk of a move lower in the new week. Support lies at the 1.0900 level where a violation will aim at the 1.0850 level. A break of here will aim at the 1.0600 level with a turn below that level targeting the 1.0550 level. Resistance is seen at 1.1050 level with a cut through here opening the door for more downside towards the 1.1100 level. Further up, resistance lies at the 1.1150 level where a break will expose the 1.1200 level. All in all, EUR remains biased to the downside medium term.

GBPUSD: Risk Points Lower On Correction

GBPUSD: GBP continues to look vulnerable to the downside on correction with more decline envisaged. On the downside, support lies at the 1.5550 level where a break if seen will aim at the 1.5500 level. A break of here will turn attention to the 1.5450 level. Further down, support lies at the 1.5400 level. Its daily RSI is bearish and pointing lower leaving risk to the downside. Conversely, resistance lies at the 1.5650 level with a break aiming at the 1.5700 level. A violation will aim at the 1.5750 level and possibly higher towards the 1.5800 level. On the whole, GBP continues to retain its downside bias but with caution.

USDJPY - Vulnerable Below The 124.47/57 Zone

USDJPY - With the pair continuing to maintain below its key resistance at 124.57 level, a move lower should occur. Support resides at the 123.50 level with a turn below here aiming at the 123.00 level. A break will target the 122.50 level. Further out, support comes in at the 122.00 level where a violation will aim at the 121.50 level. Conversely, resistance comes in at the 124.47/57 levels where a break will target the 125.00 level. Below here if seen will aim at the 125.50 level followed by the 126.00 level. On the whole, USDJPY remains exposed to the downside on corrective weakness.

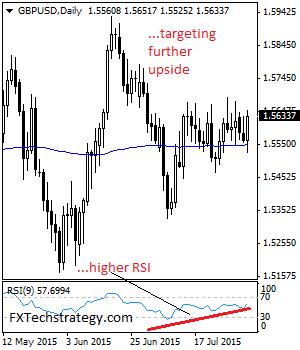

GBPUSD: Reverses Gain, Eyes Further Upside Pressure

GBPUSD: With GBP reversing its two-day weakness on Wednesday following a strong rally, risk of further move higher is likely. On the downside, support lies at the 1.5550 level where a break if seen will aim at the 1.5500 level. A break of here will turn attention to the 1.5450 level. Further down, support lies at the 1.5400 level. Conversely, on the upside, resistance resides at the 1.5700 level with a break aiming at the 1.5750 level. A violation will aim at the 1.5800 level and possibly higher towards the 1.5850 level. Its daily RSI is has turned suggesting further strength. On the whole, GBP looks to retain its recovery bias.

GBPJPY: Turns Lower On Price Failure

GBPJPY: The cross turned lower on Thursday taking back most of its Wednesday gains. This development leaves the cross targeting further downside pressure. On the downside, support comes in at the 193.00 level where a violation will aim at the 192.00 level. A break below here will target the 191.00 level followed by the 190.00 level. On the upside, resistance lies at the 195.00 level followed by the 196.00 level where a break will aim at the 197.00 level. A cut through here will aim at the 198.00 level. Further out, the 198.50 level comes in as the next resistance. All in all, the cross remains biased to the upside.

EURJPY: Set To Weaken Further Towards 136.50

EURJPY: The cross remains weak and vulnerable to the downside with eyes on its support located at the 136.50 level. On the downside, support comes in at the 136.50 level where a break will aim at the 136.00 level. A turn below here will target the 135.50 level with a breach turning spotlight on the 135.00 level. Its daily RSI is bearish and pointing lower supporting this view. Resistance lies at the 138.00 level. Further out, resistance resides at the 138.50 level where a break if seen will threaten further upside towards the 139.00. Below here will open the door for a move higher towards the 139.50 level. All in all, the cross now faces downside pressure on pullback

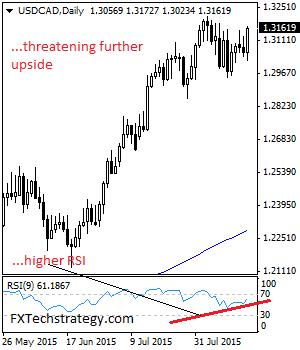

USDCAD: With the pair turning higher on price reversal during Wednesday trading session, risk of further move towards the 1.3212 level is developing. Resistance resides at the 1.3212 level followed by the 1.3250 level. Further out, the 1.3300 level comes in as the next resistance with a break turning attention to the 1.3350 level. Above here if seen will expose the 1.3400 level. Its daily RSI is bullish and pointing higher supporting this view. On the downside, support lies at the 1.3100 level followed by the 1.3050 level. Further down, support resides at the 1.3000 level and then the 1.2950 level. All in all, USDCAD remains biased to the upside in the medium term.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

USDJPY: Bullish, Faces Further Upside Threats

USDJPY: H With a follow through higher on the back of its Friday gain seen during Monday trading session, more strength is envisaged. On the upside, resistance resides at the 124.00 level with a turn above here aiming at the 124.50 level. A break will target the 125.00 level. Further out, resistance comes in at the 125.50 level. Its daily RSI is bullish and pointing higher suggesting further upside pressure. On the downside, support comes in at the 123.00 level where a break will target the 122.50 level. Below here if seen will aim at the 122.00 level followed by the 121.50 level. On the whole, USDJPY remains exposed to the upside medium term