Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.12.24 16:52

Gold (XAU/USD) Q1 2017 Forecast - Gold Weakness to Subside With Fed on Hold in First-Half of 2017 (based on the article)

Fundamental Analysis

- "After raising the benchmark interest rate in December, the upcoming rotation within the Federal Open Market Committee (FOMC) may push the central bank to retain the current policy at the next meeting in February as Chicago Fed President Charles Evans, Philadelphia Fed President Patrick Harker, Dallas Fed President Robert Kaplan and Minneapolis Fed President Neel Kashkari are slate to vote in 2017."

- "Looking at Fed Funds Futures, market participants largely anticipate the Fed to retain the status quo throughout the first-half of the year as the central bank warns ‘market-based measures of inflation compensation have moved up considerably but still are low; most survey-based measures of longer-term inflation expectations are little changed, on balance, in recent months.’ With that said, the FOMC meetings scheduled for the first-half of 2017 may tame the resilience in the greenback and help cushion the rapid decline in gold price, but the outlook for monetary policy continues to cast a long-term bearish forecast for bullion especially as Fed officials see three rate-hikes in the year ahead."

- "With the longer-run interest rate dot-plot still projecting a terminal rate around 2.75% to 3.00%, Fed Funds Futures are currently pricing an 80% probability for a move in June 2017, with additional rate-hikes anticipated to come in the second-half of 2017. Expectations for higher U.S. interest rates should continue to weigh on gold prices, but the weakness may subside over the coming months as the FOMC is anticipated to keep the benchmark interest rate on hold throughout the first-half of the year."

Technical Analysis

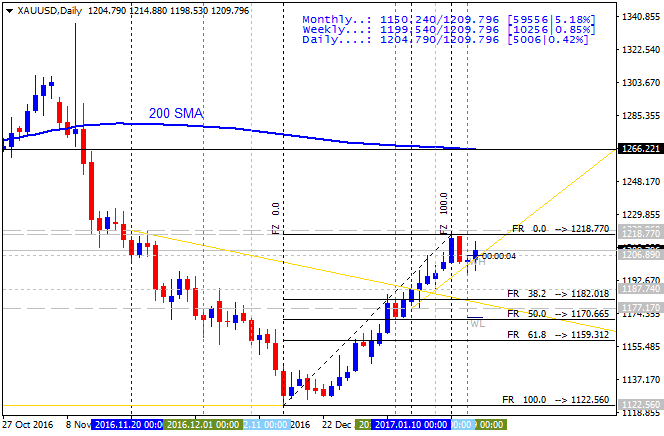

- "Gold prices approached a critical support confluence in late-December at 1220/30- a level defined by the 161.8% extension of the decline off the yearly highs, the 76.4% retracement of the advance off the 2015 low, the 2014 low and the lower parallel of the embedded descending parallel formation. Note that the lower-median-line parallel extending off the 2015 low comes in just below and the immediate downside bias is at risk into this key region."

- "Bottom line: heading into next quarter we’ll be looking for a relief rally to offer more favorable short-entries with a break lower risks substantial losses for gold. Such a scenario eyes subsequent support targets at the low-week close / 88.6% retracement at 1083/85 backed by the 2016 open at 1062 & the 2016 low at 1046."

Currently it's ranging bearish,any suggestions

Currently it's ranging bearish,any suggestions

but on hourly still possible to bearish now

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.07 10:14

Weekly Fundamental Forecast for GOLD (XAU/USD) (based on the article)

GOLD (XAU/USD) - "Despite a miss on the headline Non-Farm Payrolls report on Friday, wage growth figures marked the fastest pace of growth since 2009 with print of 2.9% y/y. On the back of this recent update on the labor markets, traders will be lending a keen ear to a fresh batch of central bank commentary with Minneapolis Fed President Neel Kashkari, Fed Governor Jerome Powell, Philadelphia Fed President Patrick Harker, Chicago Fed President Charles Evans and Chair Janet Yellen slated for speeches next week (all 2017 voting members). Highlighting the economic docket next week is the release of the December retail sales figures on Friday with consensus estimates calling for a print of 0.6%, up from a previous read of just 0.1%. A positive development should keep interest rate expectations well-anchored ahead of the next rate decision on February 1 especially as Fed Fund Futures highlight a greater than 60% probability for a June rate-hike."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.15 06:45

Weekly Fundamental Forecast for GOLD (XAU/USD) (based on the article)

GOLD (XAU/USD) - "Looking ahead to next week, traders will be eyeing inflation data out of the US with the December Consumer Price Index (CPI) slated for Wednesday. Consensus estimates are calling for an uptick in the headline print to 2.1% y/y from 1.7% y/y, with Core CPI (ex food & energy) widely expected to hold at 2.1% y/y. Look for stronger inflation data to stoke interest rate expectations on a beat with such a scenario likely to cap gold advances in the near-term. Note that Fed Fund Futures have seen a slight uptick across the board with markets now pricing a 70% probability for a June rate hike."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.19 07:50

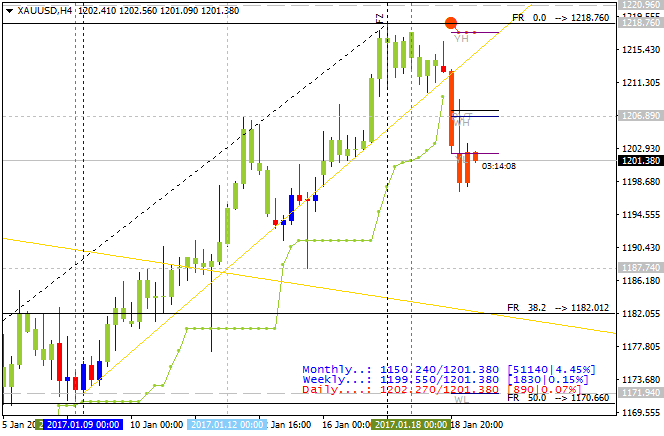

Gold Technicals: intra-day bullish channel to be broken for correction (based on the article)

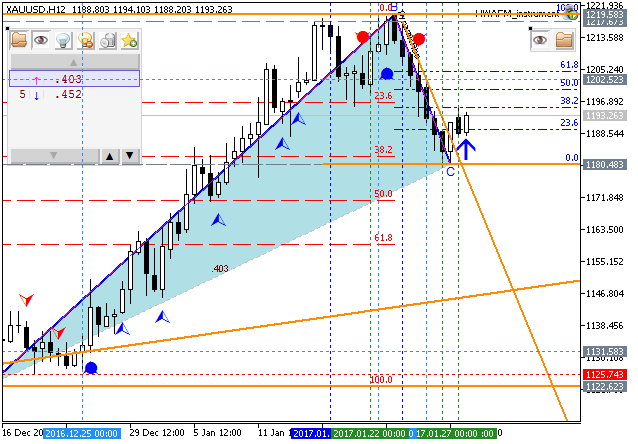

H4 XAU/USD price broke bullish channel to below for the secondary correction to be started with 1,182 target.

- "Traders looking to execute bullish strategies can look to catch support off of prior resistance around the zone comprising $1,200-$1,204.76. Both of these prices are relevant Fibonacci levels and this zone had offered resistance when prices were on the way-up, so this can be a very opportune zone to look for that next zone of ‘higher low’ support."

- "Given the veracity of the move-higher, bears will likely want to wait

for a break of swing support levels at $1,187.50 or $1,177 before

entertaining down-side approaches."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.21 17:06

Weekly Fundamental Forecast for GOLD (XAU/USD) (based on the article)

GOLD (XAU/USD) - "Heading into next week, traders will be closely eyeing the release of US 4Q GDP figures on Friday. Consensus estimates are calling for an annualized print of 2.2% q/q, down from 3.5% q/q. Keep in mind that interest rate expectations remain firmly rooted for the second half of the year with Fed Fund Futures citing a 74% chance for a hike at the June meeting. However, with the inauguration of a new president and a more ‘business friendly’ administration expected to take the reins, markets may take more cues near-term by the first few days of the Trump presidency. From a trading standpoint, while the broader focus remains constructive, the advance remains vulnerable heading into the last full week of January trade."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.30 14:49

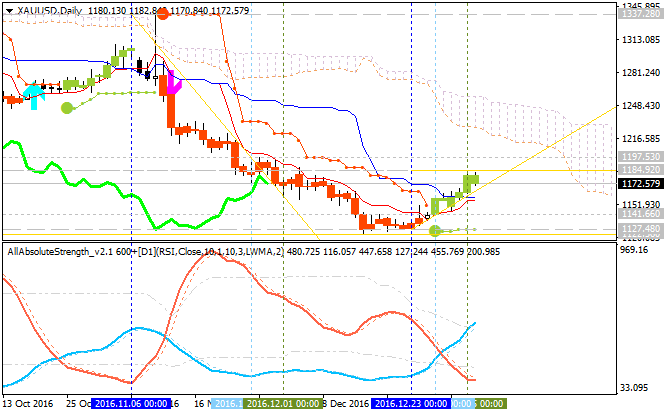

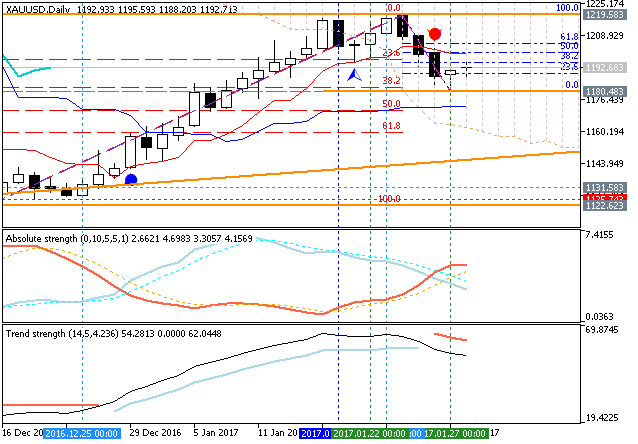

Daily chart is located inside Ichimoku cloud: the price is near and below Senkou Span line which is the virtual border between the primary bearish and the primary bullish trend on the chart.

- "Most analysts said that gold could test the lower bounds of its current range even if the Fed is expected to stick to a fairly tight script ahead of January’s nonfarm payrolls report due for release Friday. Gold could see continued pressure as it prepares to close the week in negative territory, ending its four-week winning streak. February gold futures settled at $1,188.40 an ounce, down more than 1% since last week."

- "Markets are not expecting to see any surprises at Wednesday’s policy meeting conclusion; CME 30-Day Fed Fund futures are pricing in only a 4% chance of a rate hike."

- "Expectations pick up in March as markets price in a 25% chance of a rate hike. June is seen as the most likely month for the first rate hike of the year with markets pricing in an almost 70% chance of a 25 basis-point move."

If the price breaks 1,219.58 resistance level to above on daily close bar so the reversal of the daily price movement from the ranging bearish to the primary bullish market condition will be started.

If the price breaks 1,180.48 support level to below on daily close bar so the ranging bearish trend will be resumed.

If not so the price will be ranging inside Ichimoku cloud waiting for the direction fo the strong trend to be started.

- "While gold ended the week near a two-week low, the market has managed to hold key support above $1,182 an ounce. Analysts said this is the first level to watch as prices try to find some support."

- "Hansen said that if gold falls below $1,182 an ounce, there will be an important battle for support between $1,172 and $1,160. A break of these channels could lead to a test of the 2016 lows."

- "Baruch added that he is also watching the $1,160 level and agreed that

if that support area breaks, the next level to watch will be $1,150 an

ounce."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.02.01 15:44

Gold (XAU/USD) Ahead of FOMC Rate Decision (based on the article)

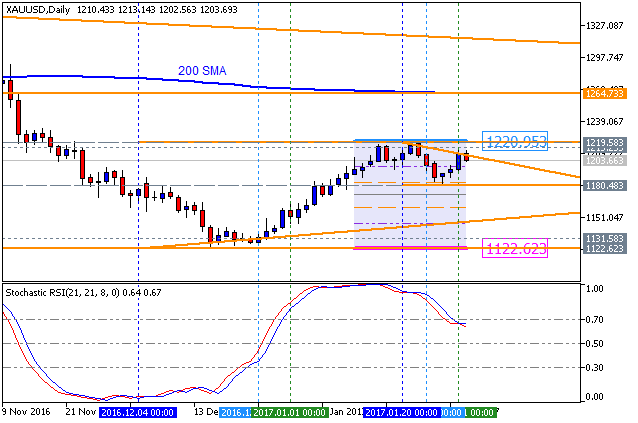

Daily price is below 200-day SMA in the bearish area of the chart. The price is on ranging within 1,220/1,122 levels waiting for the direction of the strong trend to be started. If the price breaks 1,122 support level to below so the primary bearish trend will be resumed. Alternative, if the price breaks 1,220 resistance level so the secondary rally will be started with 1,264 nearest daily target as the bullish reversal level.

- "After declining last week from yearly highs, Gold prices are beginning to rebound ahead of tomorrow’s FOMC rate decision. Expectations for the event are set to see key rates held at 0.75%, and it should be noted that no press conference is schedule this cycle for Fed Chair Janet Yellen. Despite markets expecting little in the way of policy changes, traders should be reminded that this event can still drastically increase volatility for US Dollar based assets such as gold prices."

- "Technically, gold prices are rebounding and trading back above its 10 day EMA (exponential moving average), which is providing short term support at $1,199.85. This bullish resurgence in price, suggests that last week’s dip to $1,184.45 was simply a retracement in a developing uptrend. If gold prices continue to rally, traders will next target the standing 2017 high at $1,220.25. Alternatively, if the commodity stalls near present levels, a breakout under $1,180.65 may suggest a resumption of golds ongoing long term downtrend."

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

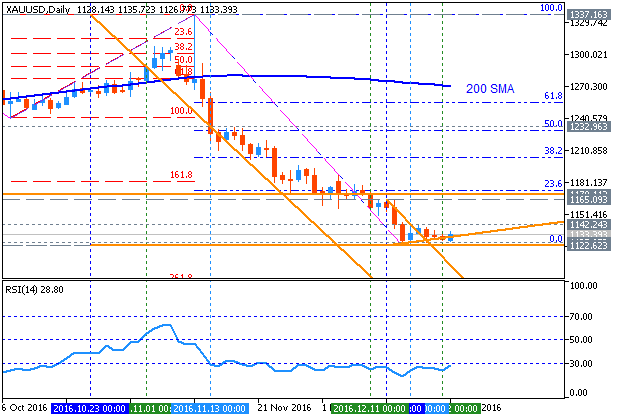

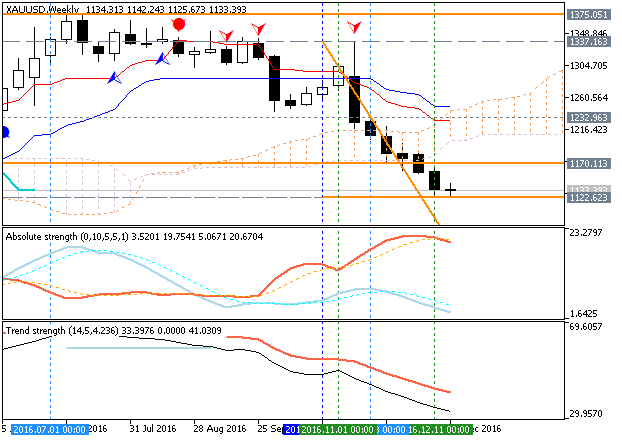

XAU/USD January-March 2017 Forecast: bearish ranging to the bear market rally

W1 price is located below Ichimoku cloud in the berish area of the chart. The price broke Ichimoku cloud together with Senkou Span lines to below in the beginning of November lkast year for the breakdown with the bearish reversal. For now, the price is testing support level at 1122.62 to below for the bearish trend to be continuing. By the way, the bullish reversal level is the resistance at 1197.53, and if the price breaks this level to above so the reversal of the weekly price movement from the primary bearish to the ranging bullish trend will be started.

Chinkou Span line is located below the price indicating the secondary rally to be started within the bearish, Trend Strength indicator is estimating the trend as the primary bullish, and Absolute Strength indicator is evaluating the future trend to be ranging bearish. Tenkan-sen line is below Kijun-sen line for the bearish ranging condition by direction.Trend:

W1 - ranging bearish