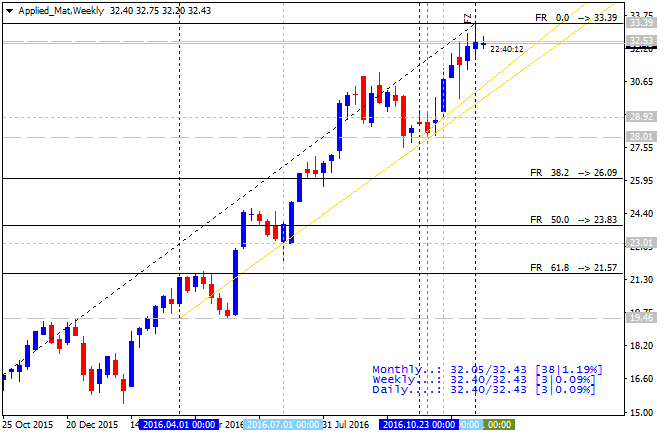

The Best Stocks Of 2016: Applied Materials

It was increased from 16 to 33 for this 2016!

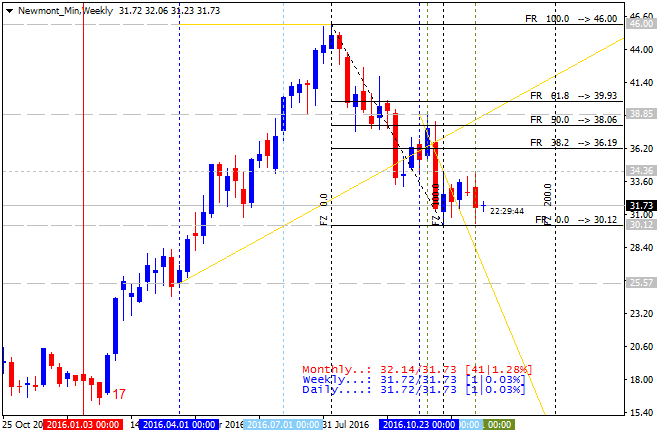

The Best Stocks Of 2016: Newmont Mining

It was increased from 17 to 31 for this 2016!

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.12.27 12:16

These Stocks Will Give You Massive Dividend Hikes In 2017 (based on the article)

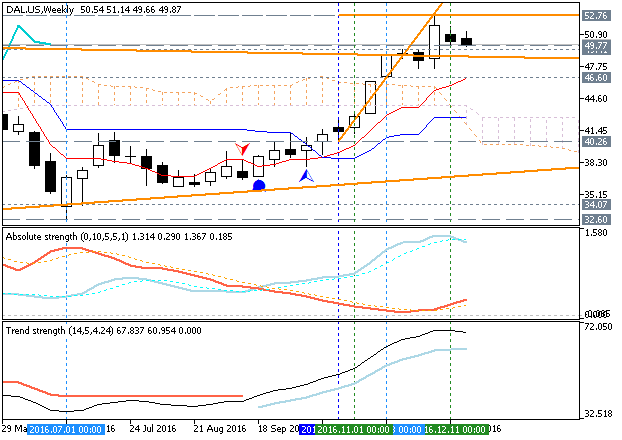

Delta Air Lines

sdsd

- "That’s not much to brag about that yield is just 1.6%. But Delta’s payout has soared 238% since the company started paying dividends in September 2013."

- "Is another big hike likely in 2017? All signs point to yes. The company is a free-cash-flow machine, generating $4.1 billion worth in the last 12 months alone, and just 9.8% of that went to dividend payments."

- 52.76 resistance level located far above Ichimoku cloud, and

- 46.60 support level.

If the price breaks 52.76 resistance to above so the bullish trend will be resumed.

If the price breaks 46.60 support level so the secondary correction will be started.

If not so the price will be on bullish ranging within the levels.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.07 17:08

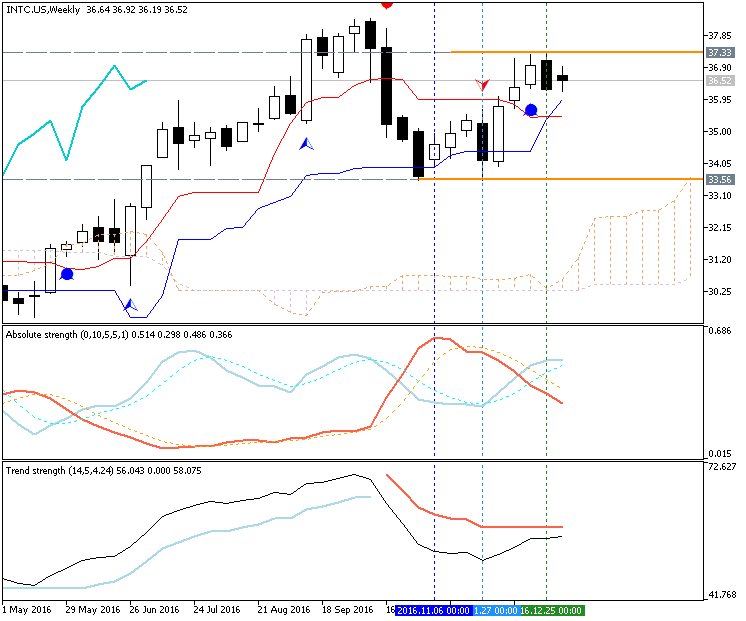

These 5 Stocks Could Double Your Retirement Nest Egg (based on the article)

Retirement Investing Strategy in Action

- "Here’s an example of how it works, using one of the long-term buys I recommend now, Intel (INTC), as a model."

- "Let’s say you bought $5,000 of INTC on the last trading day of the year every year for the past decade."

- "Your first purchase, on December 31, 2007, would have been for $26.66 (good for 187 full shares), and the latest would have been for $36.27 (or 137 full shares) on December 30, 2016."

- "But thanks to the periodic nature of your purchases, your average price would have been just $26.06. That’s a big discount to the stock’s average price of $31.47 during that time and far below today’s price of $36.27."

A Bargain Tech With Serious Upside

- "Even if you go all in on Intel now, it’s hard to argue you’d be doing so at a peak: the stock trades at just 13.0 times forward earnings, a big discount to chipmakers like Nvidia (NVDA) at 34.8, and Texas Instruments (TXN) at 20.4."

- "General Motors (GM): Ignore the tweeter-in-chief; GM will be fine no matter what happens with Mexico. Even first-level investors get that: here’s what the stock’s done since Trump took aim at GM on Tuesday morning."

- "American Tower (AMT) benefits from one of the strongest trends there is: surging demand for mobile data. It has 144,000 wireless towers it rents to big players like Verizon Communications (VZ) under long-term contracts."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.15 13:43

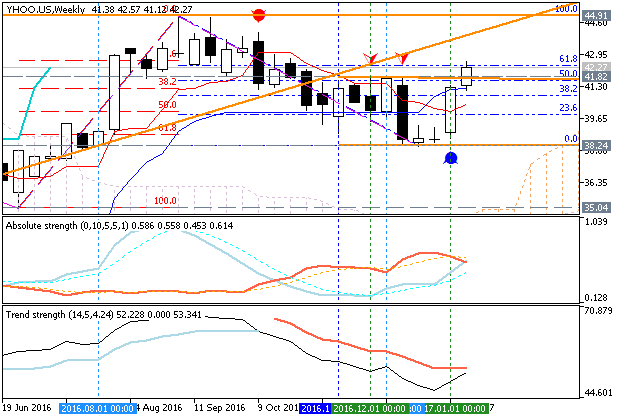

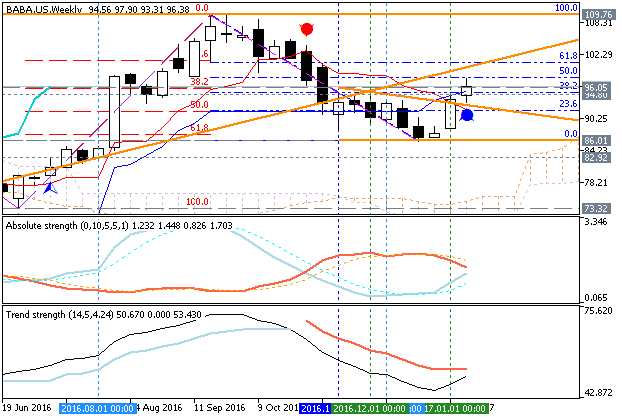

Time to sell Yahoo and buy Alibaba directly instead? (based on the article)

- "Yahoo announced last week that it would be changing its name to Alibaba (upon completion of Verizon acquiring core Yahoo) seemingly to reflect the investment in Chinese giant Alibaba. However, the name change will only take effect if and only if Verizon goes through with the planned acquisition of core Yahoo."

- "However, the question for existing shareholders is whether, even with a few modification (assuming a lower price), is Yahoo still worth staying invested in at current levels."

-----------

The weekly share prices for Yahoo and Alibaba are having similar situation with the poerformance: the prices are located above Ichimoku cloud in the bullish area of the chart with the bullish trend to be resumed after the secondary correction which was started in September last year.

-----------

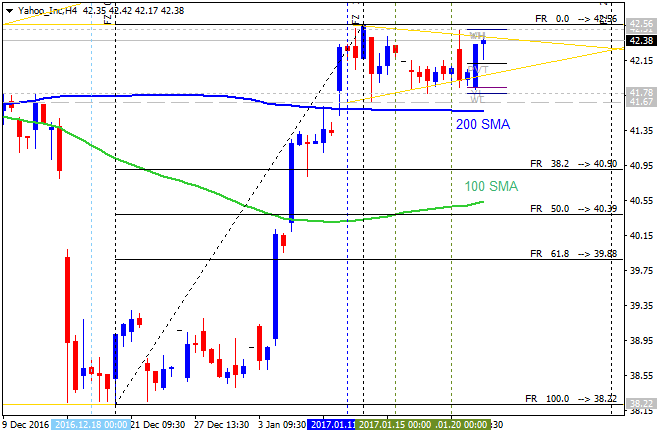

Yahoo

If W1 price breaks 38.24 support level to below on close bar so the bearish reversal will be started.

If weekly price breaks 61.8% Fibo level at 42.36 to above on close bar so the bullish trend will be continuing with 44.91 target.

If not so the price will be on bullish ranging condition within with levels.

-----------

Alibaba

If W1 price breaks 86.01 support level to below on close bar so the bearish reversal will be started.

If weekly price breaks 50.0% Fibo level at 97.93 to above on close bar so the bullish trend will be continuing with 109.76 target.

If not so the price will be on bullish ranging condition within with levels.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.16 09:13

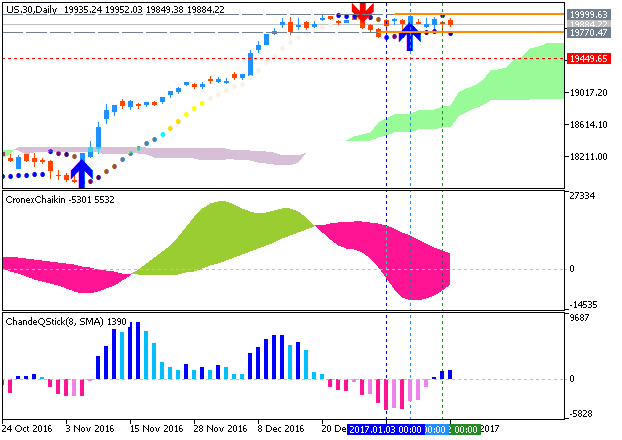

3 Things to Watch in the Stock Market This Week (based on the article)

- "Stocks posted another week of gains last week. And even though the Dow Jones Industrial Average never cracked the 20,000 point level, it and the S&P 500 index ticked higher to keep firmly in rally mode."

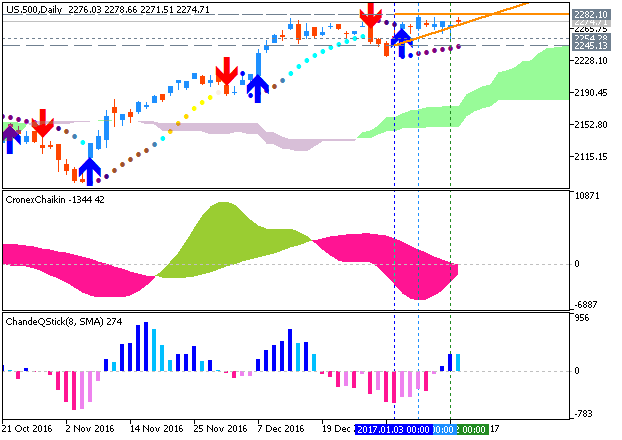

Dow Jones Industrial Average, Daily Chart: the price is testing 19,999 resistance level for the bullish trend to be continuing.

S&P 500, Daily Chart: the price is testing 2,282 resistance level for the bullish trend to be continuing.

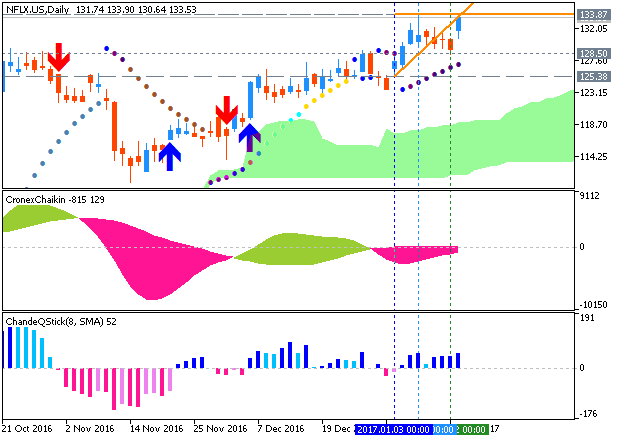

- "The week ahead could bring big portfolio swings for shareholders of Netflix, CSX, and General Electric, as the companies will post highly anticipated earnings announcements over the next few trading days."

Netflix, D1 Chart: daily share price is on bullish breakout for the testing resistance level at 133.87 to above for the bullish trend to be continuing:

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.24 13:16

Yahoo Shares Move Slightly Higher (based on the article)

Yahoo shares price is locatedfar above 100 SMA with near and above 200 SMA in the bullish area of the chart. The price is testing 42.56 resistance level for the bullish trend to be continuing. Symmetric triangle pattern was formed by the price to be crossed for the direction of the bullish trend to be continuing or the correction to be started.

- "Last night, after the close of regular market trading, Yahoo reported results for its December quarter which at first look came in better than investors had expected. The company reported earnings of $0.25 per share on revenues of $1.47 billion versus Street estimates of $0.21 per share and $1.38 billion."

- "The company changed the method of reporting its numbers in the quarter and as a result was able to show a beat when actually revenues were down about 8% or so comparatively and even Marissa Mayer's (CEO of Yahoo) "Mavens" business, which includes newer initiatives in mobile, video and social advertising, showed a decline of about 5% without the change in accounting methodology."

- "Yahoo didn't not provide any further update regarding the possibility of revised terms/concessions or other contingencies that Verizon might have asked for once the two hacks were made public by Yahoo. Yahoo had revealed two major data breaches, one in September (affecting 500 million accounts breached in 2014) and the other in December (data stolen from a billion users in 2013) of last year. Finally, over the weekend, the Wall Street Journal reported that the SEC is investigating Yahoo for the failure to report these breaches to investors in a timely manner."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.02.08 18:32

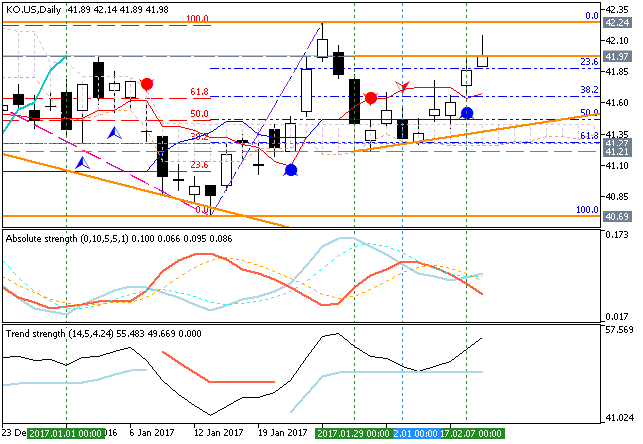

Coca-Cola Co (NYSE: KO) - new options become available today, for the June 2018 expiration (based on the article)

Daily shares price is locaed above Ichimoku cloud in the bullish area of the chart. Chinkou Span line is above Ichimoku cloud indicating the bullish breakout by direction with the good confirmation of Absolute Strength and Trend Strength indicator: the price is crossing ascending triangle pattern to above at 41.97 resistance level for the bullish breakout to be continuing with 42.24 nearest target to re-enter.

- "Investors in Coca-Cola Co (NYSE: KO) saw new options become available today, for the June 2018 expiration. One of the key data points that goes into the price an option buyer is willing to pay, is the time value, so with 492 days until expiration the newly available contracts represent a possible opportunity for sellers of puts or calls to achieve a higher premium than would be available for the contracts with a closer expiration."

- "Turning to the calls side of the option chain, the call contract at the $45.00 strike price has a current bid of 93 cents. If an investor was to purchase shares of KO stock at the current price level of $42.03/share, and then sell-to-open that call contract as a "covered call," they are committing to sell the stock at $45.00. Considering the call seller will also collect the premium, that would drive a total return (excluding dividends, if any) of 9.28% if the stock gets called away at the June 2018 expiration (before broker commissions). Of course, a lot of upside could potentially be left on the table if KO shares really soar, which is why looking at the trailing twelve month trading history for Coca-Cola Co , as well as studying the business fundamentals becomes important."

- "Considering the fact that the $45.00 strike represents an approximate 7% premium to the current trading price of the stock (in other words it is out-of-the-money by that percentage), there is also the possibility that the covered call contract would expire worthless, in which case the investor would keep both their shares of stock and the premium collected. The current analytical data (including greeks and implied greeks) suggest the current odds of that happening are 68%."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.02.09 20:06

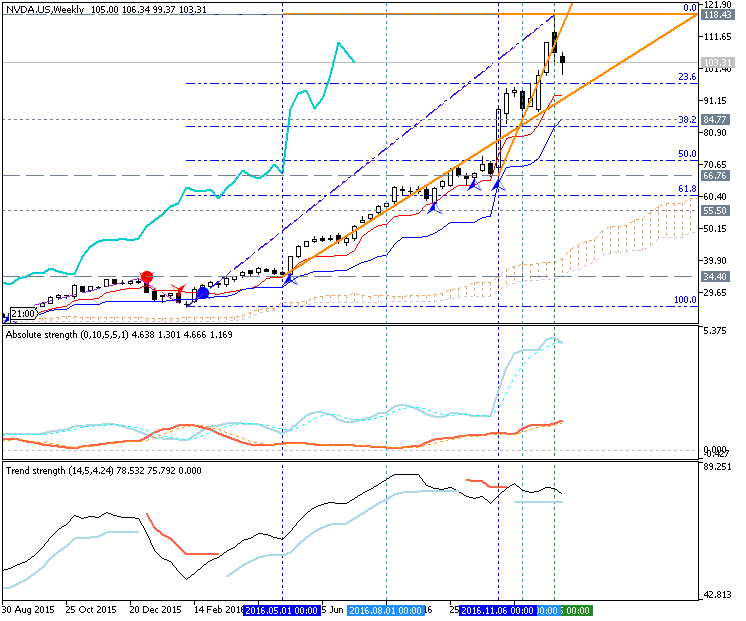

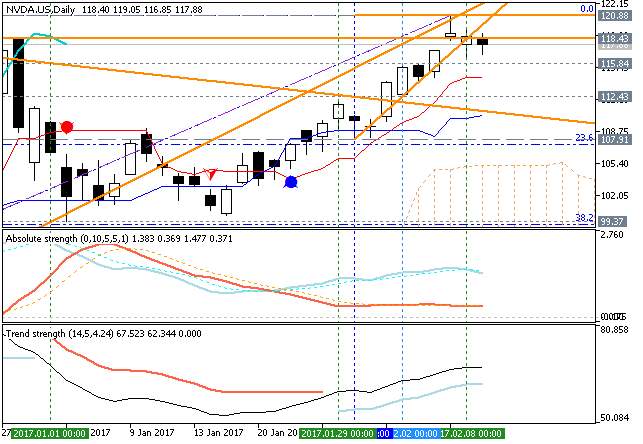

Nvidia shares continues flying high (based on the article)

Shares is on bullish market condition located above Ichimoku cloud: the price is testing 118/120 resistance levels for the bullish trend to be continuing.

- "A little over a year and a half ago, shares of Nvidia were trading at below $20 per share and the company was barely getting much attention, neither on Wall Street or on Main Street. Fast forward to the present and Nvidia is one of the hottest companies around. Since trading at below $20 per share for most part of first half of 2015, shares have exploded higher and are currently trading at just under $120 per share, an impressive return of 600% in slightly over a year and a half."

- "Nvidia will report earnings after the close of regular market trading Thursday night, and Street consensus is for the company to earn $0.83 per share on revenues of $2.1 billion for its quarter ended January 31, 2017."

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

The Best Stocks Of 2016: Nvidia (based on the article)

The price was increased by 10% just for December only!