I am interested in the following: why some charts have a grid and some do not?

It's switched off in the tester. You can switch it on or off.

// Or are you picking on the style of article design? ;)

I am interested in the following: why some charts have a grid and some do not?

Unfortunately, copy-pasting the code of several Expert Advisors into one monolith, as proposed by the author of the article, cannot be called a good programming style.

A modular architecture is preferable, when the code of each strategy is in a separate *.mqh file, and even better, if it is possible, in a separate executable module.

I wonder if the author has considered such options?

Unfortunately, copy-pasting the code of several Expert Advisors into one monolith proposed by the author of the article cannot be called a good programming style.

A modular architecture is preferable, when the code of each strategy is in a separate *.mqh file, and even better, if possible, in a separate executable module.

I wonder if the author has considered such options?

- 2012.08.02

- MetaQuotes Software Corp.

- www.mql5.com

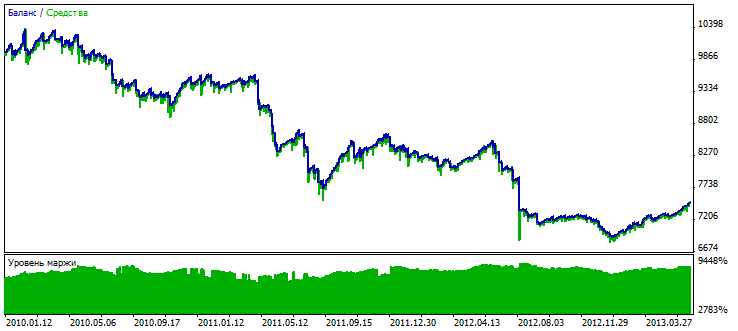

Результат для стратегии А, символ EURUSD:

And now - pay attention! - question. Why is this system in the portfolio? =)

If anything, it's a joke )

Does the article solve the issue of simultaneous (and independent) trading of several strategies on one instrument?

As far as I am concerned, without it the point of the article is lost.

And for quick portfolio evaluation there is such a programme - ReportManager. It combines reports of different tests, draws a chart, and calculates everything. It is very convenient.

It will not work only if the equity line of strategies is very far from the balance - all calculations are, of course, based on the balance.

And now - pay attention! - question. Why is this system in the portfolio? =)

If anything, it's a joke )

Does the article solve the issue of simultaneous (and independent) trading of several strategies on one instrument?

As far as I am concerned, without it the point of the article is lost.

And for quick portfolio evaluation there is such a programme - ReportManager. It combines reports of different tests, draws a chart, and calculates everything. It is very convenient.

It will not work only if the equity line of strategies is very far from the balance - all calculations are made on the balance, of course.

The issue of simultaneous (and independent) trading of several strategies on one instrument is not covered in the article, as such a task was not set here.

Thats Great for Experts, but too much complicated for new bies, if anybody worked on this EA, kindly email me alnoorgfx@gmail.com

Kind regards

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

New article Creating a Multi-Currency Multi-System Expert Advisor has been published:

I believe there are quite a few traders who trade more than one trading symbol and use multiple strategies. This approach does not only allow you to potentially increase your profit but to also minimize the risk of substantial drawdown upon efficient money management. When creating an Expert Advisor, the first natural step in checking the efficiency of the program strategy is optimization in order to determine the best input parameters.

With parameter values identified, Expert Advisors would technically be ready for trading. However that would leave one important question unanswered. What would testing results be like if a trader could put all his strategies together in a single Expert Advisor? The realization that drawdown on several symbols or strategies might at some point overlap and result in a ghastly total drawdown or even a margin call may sometimes come as a nasty surprise.

This article introduces a concept of creating a multi-currency multi-system Expert Advisor that will allow us to find an answer to this important question.

In general terms, the structure of the Expert Advisor is as follows:

Fig. 1. Structure of the multi-currency multi-system Expert Advisor

Author: Maxim Khrolenko