You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

The Australian dollar ended Friday’s session near a three-week low against its U.S. counterpart, after better than expected data on new home sales in the U.S. added to signs of a recovery in the housing market.

AUD/USD hit 0.9207 on Wednesday, the pair’s lowest since May 2, before subsequently consolidating at 0.9231 by close of trade on Friday, 0.04% higher for the day but down 1.43% for the week.

The pair is likely to find support at 0.9207, the low from May 21 and resistance at 0.9272, the high from May 22.

The Commerce Department reported that sales of new homes rose by a larger-than-expected 6.4% to 433,000 in April, after two months of decline. Analysts had been expecting a figure of 425,000. March's number was revised up from 384,000 to 407,000.

The upbeat data added to signs of a recovery in the housing market and bolstered the outlook for the broader economic recovery.

Meanwhile, in Australia, minutes of the Reserve Bank’s May meeting published earlier in the week indicated that rates are likely to remain on hold for an extended period.

Sentiment also remained shaky after ratings agency Standard & Poor’s warned that Australia’s coveted AAA-rating was at risk unless substantial cuts were made to the budget.

Data from the Commodities Futures Trading Commission released Friday showed that speculators increased their bullish bets on the Australian dollar in the week ending May 20.

Net longs totaled 19,462 contracts, compared to net longs of 17,127 in the preceding week.

In the week ahead, U.S. markets will remain closed on Monday for the Memorial Day holiday. Revised data on U.S. first quarter growth and reports on U.S. consumer confidence will be in focus.

Monday, May 26

- U.S. markets will be closed for the Memorial Day holiday.

Tuesday, May 27- The U.S. is to produce data on durable goods orders, house price inflation and consumer confidence.

Wednesday, May 28- Australia is to produce a report on completed construction work.

Thursday, May 29- Australia is to publish data on private capital expenditure.

- The

U.S. is to release revised data on first quarter GDP, as well as the

weekly government report on initial jobless claims and data on pending

home sales.

Friday, May 30The New Zealand dollar fell to a three-week low against its U.S. counterpart on Friday, amid indications that the U.S. economy is shaking off the effect of a weather-related slowdown over the winter.

NZD/USD hit 0.8531 on Friday, the pair’s lowest since April 29, before subsequently consolidating at 0.8553 by close of trade, down 0.15% for the day and 0.93% lower for the week.

The pair is likely to find support at 0.8531, the low from May 23 and resistance at 0.8587, the high from May 22.

The Commerce Department reported Friday that sales of new homes rose by a larger-than-expected 6.4% to 433,000 in April, after two months of decline.

Analysts had been expecting a figure of 425,000. March's number was revised up from 384,000 to 407,000.

The upbeat data underlined the view that the U.S. economy was regaining traction after being slowed by unusually cold temperatures during the winter months.

Data from the Commodities Futures Trading Commission released Friday showed that speculators decreased their bullish bets on the New Zealand dollar in the week ending May 20.

Net longs totaled 17,594 contracts as of last week, compared to net longs of 19,340 contracts in the previous week.

In the week ahead, U.S. markets will remain closed on Monday for the Memorial Day holiday. Revised data on U.S. first quarter growth and reports on U.S. consumer confidence will be in focus.

Monday, May 26

- New Zealand is to publish data on the trade balance, the difference in value between imports and exports.

- Markets in the U.S. will remain closed for the Memorial Day holiday

Tuesday, May 27- The U.S. is to produce data on durable goods orders, house price inflation and consumer confidence.

Wednesday, May 28- New Zealand is to release private sector data on business confidence.

Thursday, May 29- The U.S. is to release revised data on first quarter

GDP, as well as the weekly government report on initial jobless claims

and data on pending home sales.

Friday, May 30The pound was lower against the broadly stronger dollar on Friday after U.S. housing data topped expectations, adding to optimism that the economic recovery in the U.S. is gaining traction.

GBP/USD ended Friday’s session at 1.6828, down 0.25% for the day.

Cable is likely to find support at 1.6770 and resistance at 1.6920, Wednesday’s high.

The dollar was boosted after the Commerce Department reported that sales of new homes rose by a larger-than-expected 6.4% to 433,000 in April, after two months of declines.

Analysts had been expecting a figure of 425,000. March's number was revised up from 384,000 to 407,000.

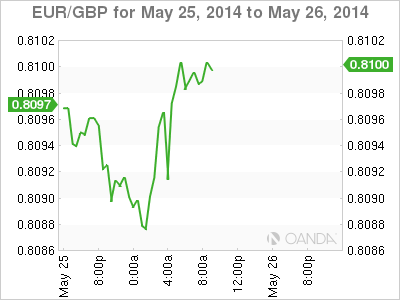

Elsewhere, sterling rose to its highest level in 17 months against the euro after weak German business sentiment data underlined expectations that the European Central Bank will ease monetary policy at its next meeting in June.

EUR/GBP touched lows of 0.8082, the lowest since December 2012 before pulling back to 0.8099 at the close, ending the week 0.69% lower.

The drop in the euro came after a report showed that the German Ifo business climate index declined to 110.4 in May; the lowest reading this year, from 111.2 in April, indicating that economic activity could slow in coming months.

The data came one day after a report showing that manufacturing activity in the euro zone expanded at the slowest rate in six months in May.

Recent comments by senior ECB officials have signaled that the bank is open to acting as soon as June to stop inflation in the currency bloc from falling too low.

On Thursday, ECB Governing Council member Jens Weidmann said the bank is prepared to take unconventional measures to counter the risks of low inflation in the euro zone.

Demand for the pound was underpinned after Wednesday’s minutes of the Bank of England’s May meeting indicated that some policymakers believe the decision on when to raise rates is "becoming more balanced," indicating that they are becoming more hawkish about the argument for hiking interest rates.

Sterling received an additional boost after data on Wednesday showing that U.K. retail sales jumped in April bolstered the outlook for the broader recovery.

Retail sales jumped 1.3% in April, the Office of National Statistics said, more than double forecasts for a 0.5% increase, driven by higher food sales over the Easter holiday.

In the coming week, markets in the U.K. will be closed for a public holiday on Monday, while U.S. markets will also be closed for the Memorial Day holiday. Investors will be looking ahead to revised data on U.S. first quarter growth, while the U.K. is not scheduled to release any major data.

Monday, May 26- Markets in the U.K. are to remain closed for a public

holiday, while U.S. markets will also be closed, for the Memorial Day

holiday.

Tuesday, May 27- The U.K. is to publish a private sector report on mortgage approvals.

- The U.S. is to produce data on durable goods orders, house price inflation and consumer confidence.

Wednesday, May 28- The U.K. is to publish private sector data on retail sales.

Thursday, May 29- The U.S. is to release revised data on first quarter

GDP, as well as the weekly government report on initial jobless claims

and data on pending home sales.

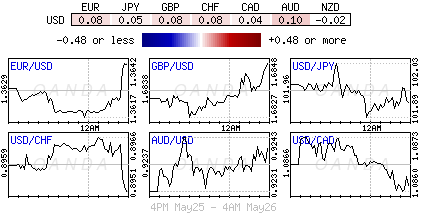

Friday, May 30The euro fell to three month lows against the broadly stronger dollar on Friday after data showing that German business sentiment deteriorated in May added to expectations for easing by the European Central Bank at its upcoming June meeting.

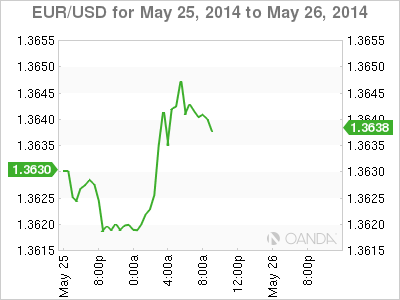

EUR/USD hit lows of 1.3616, the weakest since February 13 and settled at 1.3630, 0.18% lower for the day. For the week, the pair lost 0.60%.

The pair was likely to find support at 1.3560 and resistance at 1.3660.

The drop in the euro came after a report showed that the German Ifo business climate index declined to 110.4 in May; the lowest reading this year, from 111.2 in April, indicating that economic activity could slow in coming months.

The data came one day after a report showing that manufacturing activity in the euro zone expanded at the slowest rate in six months in May.

Recent comments by senior ECB officials have signaled that the bank is open to acting as soon as June to stop inflation in the currency bloc from falling too low.

On Thursday, ECB Governing Council member Jens Weidmann said the bank is prepared to take unconventional measures to counter the risks of low inflation in the euro zone.

The dollar was boosted after data on new home sales added to signs of a recovery in the housing market.

The Commerce Department reported that sales of new homes rose by a larger-than-expected 6.4% to 433,000 in April, after two months of decline. Analysts had been expecting a figure of 425,000. March's number was revised up from 384,000 to 407,000.

Elsewhere, the euro fell to 17 month lows against the pound, with EUR/GBP hitting 0.8082, the lowest since December 2012 before pulling back to 0.8099 at the close.

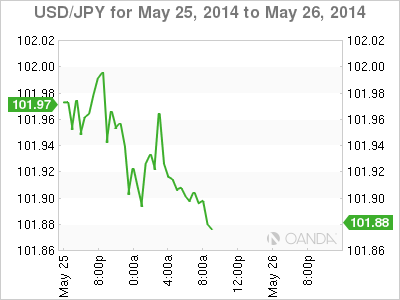

EUR/JPY ended Friday’s session at 139.02, not far from the three-and-a-half month trough of 138.13 struck on Wednesday.

In the coming week, U.S. markets are to remain closed for the Memorial Day holiday on Monday. Investors will be looking ahead to revised data on U.S. first quarter growth, while reports on U.S. consumer confidence will also be in focus.

In the euro zone, data on German consumer climate and retail sales will be closely watched.

Monday, May 26

- ECB President Mario Draghi is to speak at an event in Portugal; his comments will be closely watched.

- U.S. markets will also be closed for the Memorial Day holiday.

Tuesday, May 27- ECB President Mario Draghi is to speak at an event in Portugal; his comments will be closely watched.

- The U.S. is to produce data on durable goods orders, house price inflation and consumer confidence.

Wednesday, May 28- France is to release data on consumer spending, while

Germany is to publish a report on unemployment change. Market research

group Gfk is to publish a report on German consumer climate. The euro

zone is to release data on M3 money supply and private loans.

Thursday, May 29- The U.S. is to release revised data on first quarter

GDP, as well as the weekly government report on initial jobless claims

and data on pending home sales.

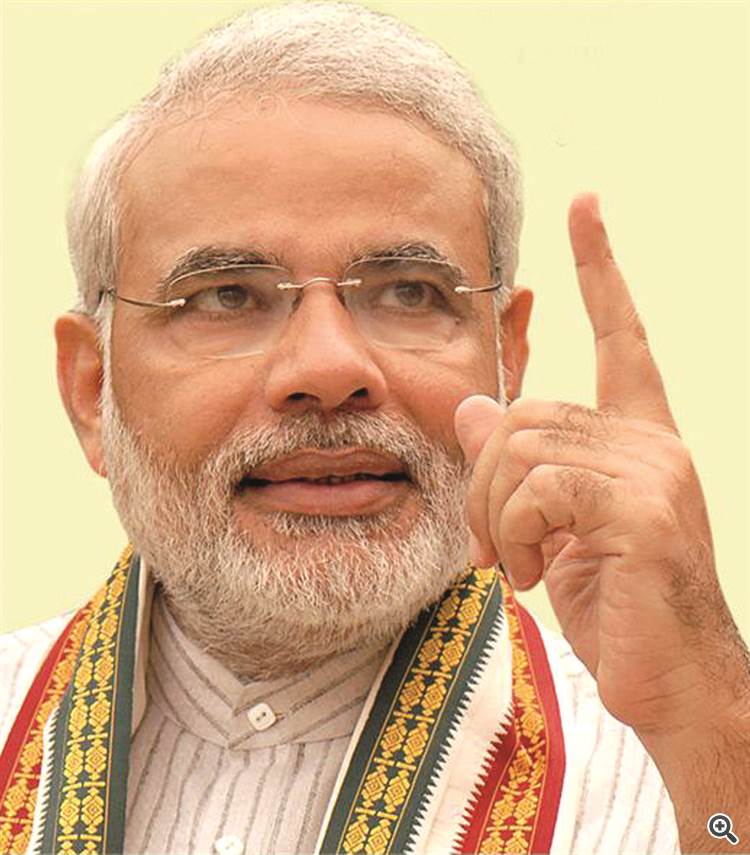

Friday, May 30New Indian government to look at relaxing restrictions aimed at curbing volume of gold the world's most populous democracy can import

Gold has been one of the best performing commodity asset classes this year and the victory of incoming prime minister Narendra Modi in India’s recent elections is being tipped as a further signal for investors to stock up on the precious metal.

One of the first economic policies that the new Bharatiya Janata Party (BJP) government is thought to be considering would be to relax restrictions aimed at curbing the volume of gold that the world’s most populous democracy can import under the so called 80:20 rule.

Introduced last year, the legislation - which increased gold import duties to 10pc and set a 20pc quota on the quantity of imported gold for re-export - has failed to ease inflation, or significantly cut the the country’s budget deficit. It has also spurred a boom in illegal smuggling of the precious metal through the “hawala” black market system.

But Modi’s new government is expected to act quickly on election promises by cutting duties and reducing the amount of gold that jewelry companies are obliged to sell for re-export. Some experts expect a full easing of the unpopular 80:20 rule could be brought into force by the beginning of the Hindu Diwali religious festival in October, when Indians traditionally splurge on gold jewelry and gifts.

“It’s only a matter of time before these restrictions on gold are removed completely by the new Indian government,” Marcus Grubb, managing director of investment strategy at the World Gold Council (WGC) told the Telegraph. Gradually, a number of things are now adding up to make investors more positive about gold.”

India is the world’s second biggest importer of gold and a major driver for the global market in the yellow metal. India imported around 825 tonnes of gold last year down from 860 tonnes in 2012, partly due to the increase in duties and restrictions. At the same time, illegal imports were thought to account for 200 tonnes of supply.

According to the WGC restrictions have hit demand for gold in India as a conventional financial investment with demand for gold coins and bars falling 45pc to 45 tonnes in the first quarter. However, the drop in demand was partly thought to be due to restrictions on the free movement of cash and other assets, such as gold leading up to the elections this month.

Overall, gold is up almost 8pc year-to-date, trading at around $1,300 (£771) per ounce. However, global demand for gold as a form of investment dipped slightly in the first quarter to 282 tonnes, compared with 288 tonnes in the same three-month period last year. Increases in demand for jewelry failed to compensate for sharp falls in the market for investment bullion in the form of bars and coins, according to the WGC.

Total global jewellery demand climbed 3pc to 571 tonnes in the first quarter as consumers splashed out across Asia, said the WGC, which monitors the market.

“It is clear that the longer term underpinnings of the gold market – such as jewellery demand in Asia – remain firmly in place demonstrating the continuing resilience of the gold market and the unique nature of gold as an asset class, rebalancing to reflect demand,” said Mr Grubb. He added that consumers, especially in the jewelry segment in India, have “a lot of confidence” to buy gold at the current level of around $1,300 per ounce.

While a change in government in Delhi is being viewed as broadly positive for the market many analysts are surprised that geo-political events have not played a bigger role in driving up the price of gold in the quarter. Normally, the metal is viewed by investors as the ultimate hedge against risk but prices have so far not reacted to Russia’s actions in Crimea, or the military coup in Thailand.

“Overall I am quite surprised at how gold has not reacted to these political situations such as Ukraine. However, depending on events this could still change,” said Mr Grubb.

Audio - Weekend Edition with John Mauldin and John O'Donnell

New York Times best selling author and financial expert, John Mauldin joins Merlin and John for a look at the current drivers of innovation and change in our country. Topics range from Debt to Jobs, Technology to Energy. Previously on the show, Mr. Mauldin has talked about the fact that Jobs WILL come, just not sure where from. In this episode of Power Trading Radio, he sheds some light onto where job growth may come from, providing some trading and investing opportunities for listeners. John also talks about his book "Code Red" which is available now at Amazon.Com

ECB Alert To Low Inflation Risk, Ready To Take Action, Says Draghi

European Central Bank President Mario Draghi said on Monday that the bank remains alert to the risks to a prolonged period of low inflation and expressed readiness to take action if required.

At an ECB forum in Sintra, Portugal, Draghi said a prolonged period of low inflation would call for a more expansionary stance, which would also include the asset purchase programme.

If a temporary shock turns more persistent, any monetary policy response might arrive too late, he said, suggesting more pre-emptive action from the central bank.

Markets expect expansionary actions from the ECB as hinted by Draghi at the post decision press conference in May. The central bank chief said the bank would decide on further action after seeing the June macroeconomic projections.

"What we need to be particularly watchful for at the moment is the potential for a negative spiral to take hold between between low inflation, falling inflation expectations and credit, in particular in stressed countries," he said today.

There is a risk that disinflationary expectations take hold and that may cause households and firms to defer expenditure in a classic deflationary cycle, Draghi warned.

Banks may respond to this situation with stricter credit standards and worsens debt burden. "This is fertile ground for a pernicious negative spiral, which then also affects expectations," Draghi said.

Term-funding of loans, be it on-balance sheet or off-balance sheet, it could help reduce any drag on the recovery coming from temporary credit supply constraints, the central banker added.

Further, he said, "We are not resigned to allowing inflation to remain too low for too long."

Inflation has remained below the ECB's target of 'below, but close to 2 percent' for the fifteenth consecutive month in April.

IHS Global Insight's Chief European Economist Howard Archer said the ECB seems highly likely to cut its refinancing rate from 0.25 percent to 0.15 percent or 0.10 percent and to take its deposit rate marginally into negative territory.

It is also looks probable that the ECB will take some liquidity measures in June, he added. However, Archer said he is doubtful that the bank will undertake full blown quantitative easing.

Euro Steady As Anti-EU Parties Rock Elections

The euro dipped before recovering losses against the U.S. dollar on Monday following European Union (EU) parliamentary elections that saw several anti-EU parties make significant gains.

Despite thin trading due to a holiday in the U.S. and England, anxious investors also trained an eye on the outcome of the Ukrainian presidential election and a European Central Bank (ECB) hosted gathering in Portugal over the weekend for possible impacts.

Euro equity markets managed to push higher, dismissing the strong gains antiausterity parties made in the EU parliamentary elections. Heading into the event risk last Friday, the market had already priced in a strong euro-skeptic showing. This morning’s push higher is mainly the ‘relief’ effect.

Antiausterity Movements Grow Across EU

In France, the National Front (+25% national vote) appeared to score a historic victory. In Germany, Chancellor Angela Merkel’s Christian Socialists looked to be in control, while the euro-skeptic Alternative for Germany took +7% of the popular vote. Greece’s radical right Golden Dawn party and the U.K.’s Independence Party also gained considerable support. It remains unclear whether the results will have a lasting effect on the markets beyond the beginning of this week. The repercussions are to be felt more at domestic levels rather than at EU or national levels. British Prime Minister David Cameron understands clearly that the electorate in the U.K. is deeply disillusioned with the EU, but he will not shorten the timescale for negotiating any new deal with it. Despite the growing European antiausterity voice, it’s not enough to impact the policy trend, as major political equilibrium remains unchanged.

‘Chocolate King’ Wins Ukrainian Presidency

In Ukraine, candy tycoon Petro Poroshenko declared victory in the first round of that country’s presidential election. A result not unexpected – the pro-European businessman took more than half of the vote. The morning’s fading geopolitical uncertainty is supporting both the Russian stock market (Micex +1%) and the RUB (USD 34.03 and EUR 46.37) especially after Russia gave the nod to Kiev’s new government last Friday. With many uncertainties out of the way, the RUB is expected to restore its correlation with emerging market currencies.

Draghi Warns of Deflation

Meanwhile, ECB President Mario Draghi delivered nothing new in his closing remarks at the ECB’s central banker conference this morning. His comments left the EUR little changed (€1.3840). Not surprisingly, he sees a risk that expectations for ultralow inflations may delay consumer and business purchases. Consider it the latest sign that euro policymakers are prepared to take further easing measures when the ECB’s Governing Council meets on June 5. Again, he signaled that the ECB is weighing a “wide variety of steps from interest rate cuts to new bank loans or broad-based asset purchases” to prevent low inflation from undermining the region’s promising economic recovery. Euro policymakers fear that disinflation expectations could take hold.

The real event risk for next week’s ECB meeting is in the outcome: what if ECB policymakers choose to stand pat yet again? The central bank cannot afford to do so at this well telegraphed meeting, otherwise the ECB’s policy-setting team will lose what’s left of its market credibility. The real fear is that the cuts, or whatever, do not go deep enough. If that’s the case, the dollar’s strength that the market has been pricing in since the last ECB meeting will be given up. In addition to using conventional interest rate tools, options include long-term loans to banks, and purchases of asset-backed securities.

The EUR initially lost ground early Monday on the back of strong gains for the antiausterity parties; however, equities rallied to heights not seen since 2008. Obviously, thin holiday conditions played a part, but so too do limited volumes. The 18-member single currency remains precariously perched ahead of the presumed option barriers and psychological support at €1.3600 (€300M), 15, 20. More are seen above €1.3650 (€350M). Stop-losses are supposedly large sub-€1.3600 and €1.3550. On the crosses, the EUR has been underperforming and this vulnerability could garner further support for the currency. With both London and New York out today, the market may not have the will to entertain much interest. Expect forex market action to pick up tomorrow.

Modi's To-Do List: Priorities For A New India

Tonight, Narendra Modi will be sworn in as India’s new Prime Minister. And there is no shortage of advice on what he should do once he takes power.

Today, India’s daily newspapers and the world’s financial press have been publishing articles telling the new man in charge just what he needs to do to help India reach its potential, and there are some common themes. As context, it’s worth noting what the stock market tells us about expectations: Mumbai’s benchmark Sensex index rose 15% between the announcement of the elections in early March, and the declaration of Modi’s victory on May 16. The rupee gained 4% too. “This,” writes Sanjoy Narayan in the Hindustan Times, “on account of nothing else but a heightened sense of exuberance about what the markets think the new government can do.”

So what can it do? And where should it start?

The Hindustan Times asserts, in common with most other press, that the economy will be a priority, and suggests that there are “some low-hanging fruit that Mr Modi and his government can pluck right away.” An example is to start projects that are easily begun, such as road-building, which will generate jobs and have a multiplier effect on iron and steel, construction materials and transport. It is believed that he will set a target of building about 25 kilometres a day of new highways, the paper says. The HT also recommends tackling inflation – part of the reason the predecessor UPA-II ruling party is perceived to have lost the election – and suggests he use a price stabilisation fund to subsidise prices of six to 10 essential items.

The New Indian Express believes the first priority should be infrastructure, and in particular power. “Far too many industries have suffered or shut down because of low availability of power” in states like Tamil Nadu, the paper says. “If Modi delivers on his promise of cutting the bureaucratic red tape – remember his catchphrase of less government, more governance – he would make life easier for foreign investors.”

Moneycontrol.com, an Indian web site, lists 10 economic reform challenges for the new prime minister. One is the proposed goods and services tax which would replace existing state and federal levies with a uniform tax, “boosting revenue collection while cutting business transaction costs.” The site reckons this could boost India’s economy by up to two percentage points, but notes that the reform requires broad backing because it would involve a change in the constitution. Other challenges include a proposed change to the act that governs the Reserve Bank of India , which would, among other things, remove the debt management functions from the RBI; the privatisation of holdings in state-run firms in order to trim India’s fiscal deficit; reforming subsidies on basic commodities, which cost an estimated 3.3% of India’s GDP in 2013-14; reformed labour laws, so as to boost job-intensive manufacturing and create up to 10 million jobs a year for young Indians; welcoming foreign investment in defence; raising the cap on foreign investment in Indian insurance; helping state-run banks with rising bad loans; implementing a new model for power distribution; and changing the national gas pricing formula.

The Hindu reckons that bullet trains are on top of Modi’s to-do list. In election, he emphasised infrastructure development, and the newspaper believes he plans a blueprint for high-speed trains similar to those in Japan and China. “The government would work towards evolving the public-private partnership model into a people-public-private partnership, or the 4P model, that will involve citizen groups, professionals and retired experts in designing, implementing and monitoring public service projects,” the paper says.

Outside India, the FT says the first item on Modi’s agenda should be “restarting hundreds of stalled investment projects across the country – a task Mr Modi says he will relish, having earned a formidable administrative reputation during his tenure as chief minister of the state of Gujarat.” The FT points out that the same target confounded previous Prime Minister Manmohan Singh, “who spent more than a year trying – and largely failing – to get a range of derailed industrial development projects back on track.” Investment in India’s economy has slumped to almost nothing over the past two years, the paper says, while the number of troubled investment projects has increased dramatically – more than 300 under the last government, worth $356 million, according to Goldman Sachs.

Beyond all of these challenges are two, so immense as to be hardly worth stating in the press: the inequalities of Indian society that leave about 150 million people in poverty, and the difficulty of bringing any kind of government to the world’s largest democracy within which so much power resides not at the federal but at the state or local level. As always, the potential in India is just as immense as the challenge.

Learning To Make The Trade

New traders often get confused when deciding what tools to use in order to analyze the markets and select trading opportunities. Looking at the selections available as well as the tools offered in today’s advanced trading software, it is easy for one to become overwhelmed. Fortunately, there is a simple and logistical way to sort through the market ebbs and flows and identify the highest probability, lowest risk trading opportunities.

When we are planning to trade, we need to start from the top. It does not matter if you are holding for 10 minutes, 10 days, or 10 weeks. The broad markets always have influence over the stocks making up their components. I have seen this hold true for markets in the U.S., India, London, Dubai, and Singapore. We need to establish the trend and potential turning points (supply & demand), of the broad market before we look to our individual stocks. Most stocks will move further and faster with the market’s trend than when they are fighting it.

Of course, there are always exceptions. However, even when the stock is trending opposite of the market, they will often reach supply and/or demand at nearly the same time.

Once we know what the market is likely to do during the timeframe we are trading, it is important to look at the stock to find the current trend. We want to know the direction of the trend, the strength of the trend, and the possible turning points in that trend (again supply and demand). By looking at the price and volume, a trader gains most of the knowledge they need to trade without the added use of any indicators. You can ascertain the trend direction and strength by observing the color, size, and shape of the candles themselves with volume as a supporting indicator. Looking at the past price action, a trader can also see the most probable turning points or entry and exit targets from supply and demand.

For those of you who are not familiar or comfortable with reading price and volume, I suggest you visit your local Online Trading Academy center and take one of our courses that will give you this knowledge. For added information regarding strength of the trend and confirming weakness at turning points, you can use a momentum indicator such as ADX or MACD. Even multiple moving averages offer a clue to a trader looking to determine trend strength. Just remember that you need to rely on price itself to make your entries and exits. Relying on the indicators makes you late as they are all lagging in their movement and signals.

When looking at the possible turning points of price, we can also look at the condition of oscillators like Stochastics, RCI, CCI and others. You have to use them in the correct manner however. Trying to take all buy and sell signals given by them will not only make your crazy, it will also drain your account. They are to be used to confirm decisions made on price action. Stocks will remain overbought or oversold for a long time in a strong trend. What you need to look for are clues that there is a change in sentiment and price action at a previously identified supply or demand zone.

Overall, your trading decisions need to be centered on identifying trends and supply and demand zones of the broad market and your stock. The technical indicators are decision support tools and may not even be necessary once you become adept at reading price.