You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Indicators: Simple Scalping System

newdigital, 2014.05.22 08:45

The Scalpers Checklist (based on dailyfx article)

Traders should have a checklist to consult prior to making any major trading decisions. These steps are critical for Forex scalpers as they often have to make these choices on a moment’s notice. To help with the process it can be helpful to keep a checklist and determine your options prior to approaching the market. Today we will review the scalper’s checklist. Let’s get started!

Identify Market Conditions

The first task assigned to day traders and scalpers is to identify market conditions. Is the market trending or ranging? Is the volatility of an asset low or high? These are both important questions that should be answered prior to entering into a new trade idea. Not only will this help Forex traders which currency pair to trade, but also help determine their strategy. Every scalper and day trader should check this off their list, prior to considering any market entries!

Choose a Strategy

Once market conditions are found, traders need to identify a strategy that is congruent with the market. If you are trading a trend, you will need to not only find market direction but also decide if you are going to trade a retracement, momentum or breakout strategy. In lack of a trend, traders again need to decide how to approach pricing patterns, support & resistance values, as well as potential breakouts. With so many strategies to choose from, it is worth taking your time and doing your due diligence prior to checking this off your scalping list.

Plan Your Entry

Next traders need to select how they are going to enter into the market. Typically traders need to first determine if they will trade with market orders or entry orders. Market orders allow you to trade immediately if conditions are met and you are immediately in front of your trading terminal. Entry orders can be used and will execute at a designated price even if you aren’t watching the market.

Once this is decided, traders need to evaluate which indicators if any will be used for trading. In the event an indicator is added to the graph, prior to execution, plan on its use and know its strengths as well as limitations. When you are 100% certain on your entry triggers then you can proceed to the next portion of the checklist.

Manage Risk

This point of our check list goes beyond the simple placement of stop and limit orders. Scalpers must carefully consider how much they should risk on each trade. At this point specific questions should arise. How many pips are you risking per trade? What is your average profit target per trade? How does a stop order being executed equate to a loss on my account?

While no trader wants to take a loss it is paramount to determine these values prior to scalping. Once these values are set, you can mark this point off your checklist. Now all you have left is to hold yourself accountable to your trading decisions.

Log the Results

Traders, especially short term scalpers, have a tendency to always be looking for the next trade. While looking for trading opportunities isn’t a bad thing, we should also remember to go back and review past events. Keeping a trading log can help us establish market patterns and reflect if your strategy is working in current conditions.

To help with this process, traders should note, why, when and how they entered into a trade. If your strategy is working, stick with it and keep your original strategy rules. If you’re trading is not working out as planned, with a log you can identify what must be changed and make appropriate adjustments.

While this checklist may seem daunting at first, these are all important steps to consider before scalping.

2014-05-22 07:00 GMT (or 09:00 MQ MT5 time) | [EUR - French PMI]

if actual > forecast = good for currency (for EUR in our case)

EUR French PMI = Level of a diffusion index based on surveyed purchasing managers in the manufacturing/services industry

==========

French Private Sector Slips Into Contraction In May

The French private sector contracted for the first time in three months in May, flash survey data from Markit Economics showed Thursday.

The flash composite output index fell to 49.3 in May from 50.6 in April. The score below 50 indicates contraction in the sector.

The Purchasing Managers' Index for manufacturing declined more-than-expected to a 4-month low of 49.3 in May from 51.2 in April. The expected reading was 51.

Likewise, the services PMI dropped to 49.2 from 50.4 a month ago. Economists had forecast the score to remain at 50.4.

Lower output was recorded across the service and manufacturing sectors. New business received by French private sector firms decreased for the second month running in May.

Employment in the French private sector fell for a seventh consecutive month and the rate of job shedding was the sharpest since February.

Divergent price trends were signaled in May. Input price inflation across the French private sector accelerated to a four-month high, driven by a sharper increase in service providers' costs.

On the other hand, private sector output prices continued to fall, with the rate of decline accelerating to the sharpest in ten months.

"With GDP having stagnated in Q1, the PMI data so far suggest another disappointing performance in the second quarter," said Jack Kennedy, senior economist at Markit said.

2014-05-22 01:45 GMT (or 03:45 MQ MT5 time) | [CNY - HSBC Manufacturing PMI]

if actual > forecast = good for currency (for CNY in our case)

CNY - HSBC Manufacturing PMI = Level of a diffusion index based on surveyed purchasing managers in the manufacturing industry

==========

China Manufacturing PMI Jumps To 49.7 - HSBC

An index monitoring manufacturing activity in China came in with a score of 49.7 in May, the latest flash estimate from HSBC and Markit Economics revealed on Thursday.

That topped forecasts for a score of 48.3 and was up sharply from 48.1 in April - and while it does remain below the line of 50 that separates expansion from contraction, the May reading represents a five-month high.

"The improvement was broad-based with both new orders and new export orders back in expansionary territory. Disinflationary pressures also eased over the month and output prices increased for the first time since November 2013," said HSBC Chief Economist, China & Co- Head of Asian Economic Research Hongbin Qu.

Among the individual components of the survey, the index for manufacturing output came in at 50.3 - up from 47.9 in April to a four-month high.

The index for new orders swung to expansion from contraction a month earlier - as did new export orders, output prices, stocks of purchases and quantity of purchases.

Backlogs of work continued to contract, but at a slower pace - as did input prices. The employment index declined at a faster pace, while stocks of finished goods turned to contraction after expanding last month.

Suppliers' delivery times lengthened in May after showing no change in the previous month.

"The employment index fell further to 47.3, which implies that this month's uptick in sentiment has not yet filtered through to the labor market. Some tentative signs of stabilization are emerging, partly as a result of the recent mini-stimulus measures and lower borrowing costs. But downside risks to growth remain, particularly as the property market continues to cool. We think more policy easing is needed to put a floor under growth in the coming months," Hongbin said.

==========

Copper Climbs As China PMI Eases Demand Concerns (adapted from dailyfx article)

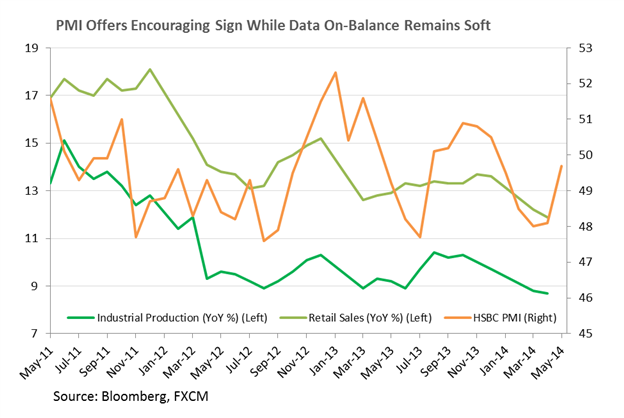

The strongest reading in 5 months for a key gauge of economic activity in the Chinese economy has given copper prices a lift in Asian trading. The HSBC Flash Manufacturing PMI for Aprilreflected a rise to 49.7, beating economist’s expectations for a reading of 48.1. While the improvement is an encouraging sign for the Chinese economy, a figure below 50 signals the manufacturing sector remains in contractionary territory.

On balance Chinese economic data has been soft of-late, which includes the drop in Retail Sales and Industrial Production figures for April to multi-year lows. This suggests that that we’re far from seeing a re-acceleration of growth for the Asian giant, and if data fails to improve further, renewed concerns over the country’s appetite for commodities could reinvigorate the copper bears.

2014-05-22 08:30 GMT (or 10:30 MQ MT5 time) | [GBP - GDP]

if actual > forecast = good for currency (for GBP in our case)

GBP - GDP = Change in the inflation-adjusted value of all goods and services produced by the economy

==========

U.K. Consumers Drive Recovery as Growth Accelerates to 0.8%

U.K. consumers were the driving force behind Britain’s economic growth at the start of the year, continuing a trend after they led the recovery in 2013.

Consumer spending rose 0.8 percent in the first quarter, a 10th straight increase, adding 0.5 percentage point to gross domestic product. The economy grew 0.8 percent in the period, unrevised from an initial estimate, the Office for National Statistics said.

Britain’s recovery over the past year has left GDP just 0.6 percent below where it was at its peak in the first quarter of 2008. The improving economy was underscored by data yesterday showing a faster than forecast increase in retail sales in April.

The brighter outlook is also having an impact within the Bank of England, where some policy makers are moving closer to calling for an interest-rate increase. Minutes of the Monetary Policy Committee’s most recent meeting, published yesterday, showed the argument for higher rates is becoming “more balanced” for some of the panel.

While the outlook is improving and data indicates a squeeze on consumers is easing, Prime Minister David Cameron’s Conservative Party trails the opposition Labour party in polls. The Tories are expected to come third behind Labour and UKIP in European elections being held today.

Exports fell 1 percent in the quarter and imports dropped 1.1 percent, leaving net trade to have zero impact on GDP, today’s report showed. Government spending rose 0.1 percent and business investment increased 2.7 percent. Gross fixed capital formation added 0.3 percentage point to GDP.

First-quarter production growth was revised down to 0.7 percent from 0.8 percent in the initial GDP release. Growth in services, the largest part of the economy, was unchanged at 0.9 percent, and construction growth was raised to 0.6 percent from 0.3 percent. From a year earlier, the economy grew 3.1 percent, the ONS said, unrevised from the initial estimate. That’s the biggest annual increase since the fourth quarter of 2007.

Germany's financial watchdog finds evidence of forex price manipulation (based on theguardian article)

Germany's financial watchdog has discovered clear evidence that market participants attempted to manipulate reference currency rates, widening the probe to include many more banks and saying international investigations into the matter were far from over.

Regulators globally are looking at traders' behaviour on key benchmarks, spanning interest rates, foreign exchange and commodities. Eight financial firms have been fined billions of dollars for manipulating reference interest rates, and the probe into the largely unregulated $5.3 tn-a-day foreign exchange market could prove even costlier.

The head of banking supervision at German watchdog Bafin, Raimund Roeseler, said the latest discoveries in the forex probe were worrying and it was "much, much bigger" than the investigation into benchmark interest rates, such as Libor.

"There were clearly attempts to manipulate prices, that's what was disturbing," Roeseler said on Tuesday at the regulator's annual news conference. Market participants had attempted to manipulate daily fixing rates for a number of different currencies, he said without specifying what evidence had been gleaned.

Deutsche Bank AG, Germany's largest bank and the world's largest forex trader, is the country's only bank known so far to be involved in the currency probe. The bank has said it is conducting its own internal probe and is cooperating with authorities.

Roeseler said he expected to conclude an investigation into the manipulation of reference interest rates during the summer. Bafin will hand over responsibilities for supervising Germany's top 24 banks to the European Central Bank (ECB) in November.

The regulator had clear evidence that there were efforts to manipulate reference interest rates, but it remained unclear whether those efforts were successful.

"We have some evidence of people trying to move the market in one direction and they succeeded in doing precisely the opposite," he said. "They shot themselves in the foot."

The probe into the largely unregulated $5.3 tn-a-day foreign exchange market is expanding.

2014-05-22 07:30 GMT (or 09:30 MQ MT5 time) | [EUR - German PMI]

if actual > forecast = good for currency (for EUR in our case)

EUR - German PMI = level of a diffusion index based on surveyed purchasing managers in the manufacturing industry. It's a leading indicator of economic health - above 50.0 indicates industry expansion, below indicates contraction.

==========

German manufacturing PMI falls to 6-month low of 52.9 in May

Manufacturing activity in Germany expanded at the slowest rate in six months in May, dampening optimism over the health of the euro zone's largest economy, preliminary data showed on Thursday.

In a report, market research group Markit said that its preliminary German manufacturing purchasing managers' index fell to a seasonally adjusted 52.9 this month, down from a final reading of 54.1 in April. Analysts had expected the index to inch down to 54.0 in May.

Meanwhile, the preliminary services purchasing managers' index improved to a 35-month high of 56.4 this month, up from a reading of 54.7 in April. Analysts had expected the index to ease down to 54.5 in May.

A reading above 50.0 on the index indicates industry expansion, below indicates contraction.

Commenting on the report, Ollver Kolodselke, Economist at Markit said, "Survey data for the second quarter so far suggest that we should expect another period of solid growth of GDP."

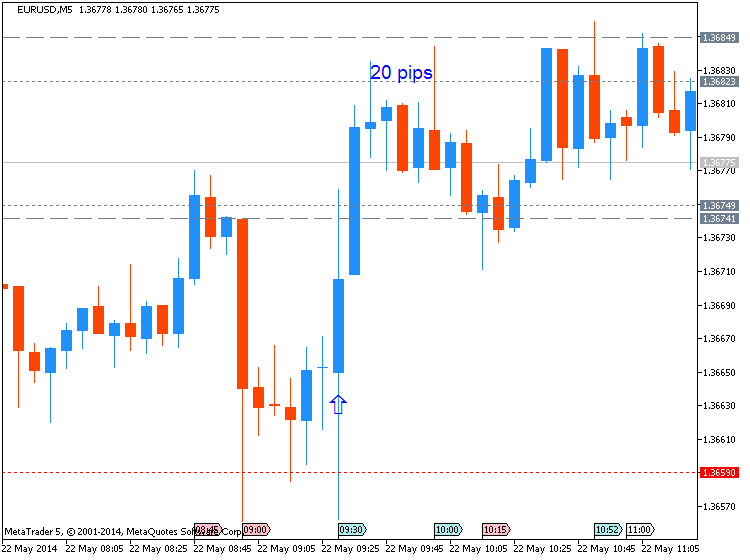

Following the release of the data, the euro trimmed losses against the U.S. dollar, with EUR/USD shedding 0.07% to trade at 1.3676, compared to 1.3665 ahead of the data.

Meanwhile, European stock markets were higher after the open. Germany's DAX picked up 0.3%, the Euro Stoxx 50 rose 0.2%, France's CAC 40 eased up 0.1%, while London's FTSE 100 added 0.3%.

Price & Time: Approaching Key Levels, But EUR/USD Remains Vulnerable

Since reversing from the important cycle turn window that we highlighted at the start of the month the euro has come under steady downside pressure. On Wednesday, EUR/USD touched its lowest level in over three months before rebounding off the 3rd square root relationship of the year’s high at 1.3640 - which is also just above the widely watched 200-day moving average. Was this an important low in the euro? We don’t think so. With the next important turn window eyed around the end of the month/first week of June we suspect general weakness will persist at least until then before a meaningful recovery in the euro is seen (though some minor strength looks possible early next week). The bottom of the1-year standard deviation channel coincides with the 4th square root relationship of the year’s high near 1.3550 and this still looks like a reasonable downside objective. Unexpected aggressive strength over 1.3820 would suggest that the euro has bottomed ahead of schedule.

USD/JPY rebounds sharply from just above YTD low

USD/JPY Strategy: Like the short side while below 102.35

Australian Dollar Declines as Chinese Report Momentum Fizzles Out

The Australian dollar declined in early morning trading in Sydney as its earlier momentum fuelled by favorable Chinese manufacturing data faded. The Aussie was trading at 92.27 US cents at 7:00 a.m. in Friday local time, down from Thursday’s high of 92.35 cents.

The currency touched a high of 92.75 US cents after a joint survey of Chinese purchasing managers by Markit Economics and HSBC showed that Chinese factory activity rose to the highest level in five months in May.

The Aussie roes on the news, but started fizzling out after the US dollar started rising against its major peers, Kymberly Martin, a markets strategist at Bank of New Zealand told The Sydney Morning Herald.

"I think the weakness overnight was reflective of broad US dollar strength as opposed to anything specific to the Australian dollar," she said."When you look across most of the major currencies the US dollar has strengthened pretty much across the board."

Martins revealed that she forecasts the Aussie to hover between 92.10 US cents and 92.70 US cents today. She also said that the market is waiting for May’s data on German IFO business sentiment, which will be released in the evening, local time.

However, analysts were unable to closely attribute any factor for the US dollar’s rally on Thursday, as US data was mixed. In the US, fresh applications for unemployment benefits grew more than forecasted while sales of pre-owned homes surged in April, the first time to do so this year

2014-05-23 06:00 GMT (or 08:00 MQ MT5 time) | [EUR - German GDP]

if actual > forecast = good for currency (for EUR in our case)

EUR - German GDP = Change in the inflation-adjusted value of all goods and services produced by the economy

==========

German GDP Growth Accelerates As Estimated

Germany's economic growth rebounded as previously estimated in the first quarter driven by domestic demand, the detailed report from Destatis showed Friday.

Gross domestic product grew 0.8 percent sequentially in the first quarter, up from 0.4 percent in the fourth quarter. The quarterly rate came in line with the provisional estimate published on May 15.

On a calendar-adjusted basis, GDP grew 2.3 percent year-on-year, faster than the 1.4 percent rise seen in the fourth quarter. This was the largest increase in over two years.

The price-adjusted GDP gained 2.5 percent, also faster than the 1.3 percent growth seen in the fourth quarter. The statistical office confirmed the annual figures.

The expenditure side breakdown of GDP showed that positive contributions were made by domestic demand only.

Gross fixed capital formation advanced at a faster pace of 3.2 percent on the previous quarter. Household final consumption expenditure climbed 0.7 percent on the fourth quarter. At the same time, general government expenditure grew only 0.4 percent.

However, the balance of exports and imports had a downward effect on the GDP growth. The increase in exports slowed to 0.2 percent from 2.5 percent, while the increase in imports accelerated to 2.2 percent.