You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

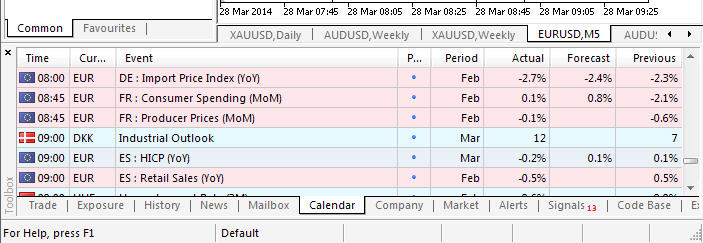

2013-03-25 14:00 GMT (or 15:00 MQ MT5 time) | [EUR - Spanish Retail Sales]

if actual > forecast = good for currency (for EUR in our case)

==========

Spain's Consumer Prices Fall For First Time In 5 Months

Spain's consumer prices declined for the first time in five months in March, flash estimates from the statistical office INE showed Friday.

Consumer prices dropped 0.2 percent year-on-year in March, after staying flat in the prior month. Prices were forecast to remain unchanged as seen in February.

The harmonized index of consumer prices also fell 0.2 percent annually in March, following a 0.1 percent rise in February.

Month-on-month, consumer prices gained 0.2 percent in February, data showed.

2013-03-28 09:30 GMT (or 10:30 MQ MT5 time) | [GBP - Current Account]

if actual > forecast = good for currency (for GBP in our case)

==========

U.K. Q4 GDP Grows 0.7% As Initially Estimated

U.K.'s economic growth came in line with preliminary estimate at the end of 2013, data from the Office for National Statistics showed Friday.

Gross domestic product rose 0.7 percent sequentially in the fourth quarter, unrevised from the second estimate published on February 26. Year-on-year, GDP gained 2.7 percent, also as previous estimated.

At the same time, economic growth for 2013 was revised down to 1.7 percent from 1.8 percent.

Another report from the ONS said services output grew 3.2 percent in January from last year as all main components of the services industries expanded. From December, output advanced 0.4 percent.

In the fourth quarter, business investment rose by an estimated GBP 0.8 billion compared with the previous quarter, in line with previous estimate. The annual growth was revised to 8.7 percent from 8.5 percent, ONS said in a separate report.

The current account deficit was GBP 22.4 billion in the fourth quarter, down from a revised deficit of GBP 22.8 billion in the prior quarter. The deficit in fourth quarter equated to 5.4 percent of GDP at current market price, the statistical office reported.

Forum on trading, automated trading systems and testing trading strategies

Forex Market Update

mapq, 2014.03.28 13:19

Forex Market Update 28Mar14

This morning, the greenback is trading mostly lower against most of the major currencies. Earlier today, the Chicago Fed President, Charles Evans, citing current low inflation and high unemployment rate in the US economy, projected the Fed to keep its interest rates at rock bottom until late 2015.

The EUR pared some of its initial losses after data showed that economic sentiment indicator in the Euro-zone rose more than expected in March to reach its highest level since July 2011.

The GBP initially came under pressure after the UK’s current account deficit barely narrowed in the fourth quarter from the record wide gap in the third quarter. However, the GBP reversed its losses after data showed that GDP came in line with market estimates for the fourth quarter.

The greenback traded mixed in the New York session yesterday, against the key currencies, amid a mixed batch of economic releases in the US economy. Data showed that US GDP rose faster than the preliminary estimate in the fourth quarter while the jobless claims unexpectedly came in at a four-month low reading last week. However, pending home sales in the US fell for an eighth consecutive month in February.

Separately, the Cleveland Fed President, Sandra Pianalto projected an optimistic outlook for the US economy but at the same time also opined that the economy is still short of the Fed’s employment and inflation goal.

EUR USD

This morning at 9:40 GMT, the EUR is trading at 1.3724 against the USD, 0.13% lower from the New York close, after data revealed that Spanish retail sales disappointed in February and consumer prices registered its first decline since October 2009. Meanwhile, the Euro-zone’s economic sentiment indicator and consumer confidence both showed an improvement in March. During the session, the pair traded at a high of 1.3753 and a low of 1.3714. Yesterday, the EUR traded 0.14% lower against the USD in the New York session, and closed at 1.3742.

The pair is expected to find its first support at 1.3693 and first resistance at 1.3768.

GBP USD

At 9:40 GMT, the GBP is trading at 1.6611 against the USD, tad higher from the New York close, after data showed that UK’s fourth-quarter GDP rose 2.7% (YoY) in line with market estimates while the Gfk consumer confidence in the UK improved to a level best seen since August 2007 in March. During the session, the pair traded at a high of 1.6632 and a low of 1.6607. Yesterday, the British Pound traded 0.09% lower versus the Dollar in the New York session, and closed at 1.6608.

The pair is expected to find its first support at 1.6589 and first resistance at 1.6640.

USD JPY

The USD is trading at 102.30 against the JPY at 9:40 GMT this morning, 0.07% higher from the New York close. Data released overnight showed that, Japan’s annual national CPI rose 1.5% in February while unemployment rate declined to 3.6% last month. Separately, retail sales in Japan also rose more than market expectation in February. During the session, the pair traded at a high of 102.33 and a low of 102.11. In the New York session yesterday, the USD traded 0.07% lower against the JPY, and closed at 102.22.

The pair is expected to find its first support at 102.04 and first resistance at 102.50.

USD CHF

This morning at 9:40 GMT, the USD is trading at 0.8884 against the Swiss Franc, 0.18% higher from the New York close. During the session, the pair traded at a high of 0.8900 and a low of 0.8866. In the New York session yesterday, the USD traded 0.10% higher against the CHF, and closed at 0.8868. Late Thursday, SNB’s Fritz Zurbruegg indicated that the central bank is ready to use variety of measures, including a negative interest rate to defend its cap on the Swiss franc.

The pair is expected to find its first support at 0.8850 and first resistance at 0.8909.

USD CAD

At 9:40 GMT, the USD is trading at 1.1014 against the CAD, 0.18% lower from the New York close. During the session, the pair traded at a high of 1.1036 and a low of 1.1005. Yesterday, the USD traded 0.58% lower against the CAD in the New York session, and closed at 1.1034.

The pair is expected to find its first support at 1.0973 and first resistance at 1.1081.

AUD USD

The AUD is trading at 0.9264 against the USD, at 9:40 GMT this morning, marginally higher from the New York close, benefited from China's Premier, Li Keqiang supportive comments on the growth-outlook of the Chinese economy. During the session, the pair traded at a high of 0.9297 and a low of 0.9259. AUD traded 0.29% higher against the USD in the New York session, and closed at 0.9260.

The pair is expected to find its first support at 0.9227 and first resistance at 0.9299.

Gold

At 9:40 GMT, Gold is trading at $1297.15 per ounce, 0.46% higher from the New York close. This morning, Gold traded at a high of $1299.02 and a low of $1290.92 per ounce. In the New York session yesterday, the yellow metal traded 0.36% lower, and closed at $1291.17, on the back of a strong US Dollar. Meanwhile, one of the leading broking houses trimmed its 2014 average price for spot gold by 8% to $1,225 an ounce.

Gold has its first support at $1290.86 and first resistance at $1301.80.

Silver

Silver is trading at $19.84 per ounce, 0.62% higher from the New York close, at 9:40 GMT this morning. This morning, Silver traded at a high of $19.93 and a low of $19.72. Silver traded 0.17% higher against the USD in the New York session, and closed at $19.72. A leading broker cut its 2014 spot silver price forecast by 5% to $19.40.

Silver has its first support at $19.65 and first resistance at $19.98.

Crude Oil

At 9:40 GMT, Oil is trading at $101.74 per barrel, 0.50% higher from the New York close, amid lingering concerns on the supply outlook of the commodity. This morning, Oil traded at a high of $101.76 and a low of $101.18. Yesterday, Oil traded 0.09% higher in the New York session, and closed at $101.25, amid speculation that a strong domestic GDP data could spur demand for crude oil in the US.

It has its first support at $100.63 and first resistance at $102.30.

Economic Snapshot

UK Gfk consumer confidence improved more than anticipated in March

The GfK consumer confidence index in UK improved to a level of -5.0 in March, more than market forecasts and compared to a level of -7.0 recorded in the previous month.

UK economy expanded in line with the preliminary estimate in Q4 2013

On an annual basis, the final GDP in UK rose 2.7% in the Q4 2013, in line with preliminary estimate, following a 1.9% rise recorded in the previous quarter. Additionally, on a quarterly basis, final total business investment in the UK rose 2.4% in the Q4 2013, in line with preliminary estimate, following an increase of 2.0% recorded in the preceding quarter.

UK current account deficit narrowed in Q4 2013

The National Statistics has reported that UK’s current account deficit narrowed to £22.4 billion in Q4 2013, less than market estimates and compared to a revised deficit of £22.8 billion recorded in the previous quarter.

Industrial confidence in the Euro-zone improved unexpectedly in March

The industrial confidence index in the Euro-zone rose to a level of -3.3 in March, contradicting market estimates for the index to remain unchanged at previous month’s revised reading of -3.5. Meanwhile, the economic sentiment indicator in the Euro-zone rose to a level of 102.4 in March, compared to reading of 101.2 reported in the previous month. Additionally, the final consumer confidence in the Euro-zone came in unchanged at previous month’s revised reading of -9.3 in March.

Spain’s CPI unexpectedly fell in March

On an annual basis, the preliminary consumer price index (CPI) in Spain fell 0.2% in March, compared to a flat change recorded in the previous month. Market had expected the index to remain steady in March. Meanwhile, on a seasonally adjusted basis, retail sales in Spain dropped 0.5% in February on a yearly basis, in line with market expectations and following a rise of 0.5% recorded in the preceding month.

Swiss economy likely to witness steady growth until the next year, indicated KOF Institute spring economic forecast

According to KOF Institute spring economic forecast 2014, the Swiss economy is anticipated to grow steadily until the end of next year. The report indicated that the gross domestic product of Switzerland is expected to rise 2.0% in 2014 and 2.1% in 2015.

No rise in interest rate likely until second half of 2015, indicated Fed’s Evans

The Federal Reserve (Fed) Bank of Chicago President, Charles Evans, opined that the US Fed would have to maintain interest rates at the present record low levels until late 2015, given the low inflation and still-high unemployment rate in the US.

Happy pips.

Economists Divided over Effect of Venezuela’s New Foreign Trading System

The Venezuelan government this week introduced a new foreign exchange system as it seeks to curb black market for the greenback, which is being blamed for high inflation and food shortages in the Latin American nation.

While both conservative and liberal economists are in favor of this move, they are divided on whether it will help revive the oil-rich nation’s economy.

While Venezuelan leaders used brutal force against anti-government protests last February, it has also rolled out measures to address a key issue protesters wanted fixed- repair the troubled economy. It launched Sicad II, a market-based exchange system that facilitates sale of dollars at between eight to ten times the official rate of 6.3 bolivars a dollar.

Though Venezuela has huge oil reserves, the tightly-controlled exchange rate has partly contributed to shortage of essential items and hyperinflation. According to Mark Weisbrot, who works with Center for Economic and Policy Research, Sicad II should help get the economy back on the path to recovery by combating the black market for the U.S. dollars.

“You had kind of a bubble in the black market for the dollar, people buying dollars because they thought it was a one-way bet and it was always going to, the dollar value would always go up, and now that is not going to be the case," said Weisbrot, according to the Voice of America.

While Venezuela’s government insists the new rate is for buying non-basic goods, the local opposition views the system as a form of currency devaluation.

On the day the Sicad II was launched, the rate of a dollar in the black market plunged from 90 to close at 50 bolivars a dollar. However, the rate has since risen, as locals still lack an optimistic view of the economy.

- GBPJPY broke out of a 967 pip symmetrical triangle that had a target over 180.00

- The advance from the breakout point of 171.13 was halted at 173.56 and price turned down

- A new triangle can be drawn taking into account the new swing points created by the false breakout

Forex symmetrical triangles are important price patterns relied on by traders to identify periods of consolidation ahead of an anticipated large breakout. Traders like using triangle price patterns because they have risk to reward parameters which are easy to determine from the pattern itself.Not only can the stop be placed just outside the pattern, but a limit can be determined by measuring the height of the pattern and projecting this distance in pips from the breakout point. This is called a measurement objective.

Thomas Bulkowski in his book, Encyclopedia of Chart Patterns stated that symmetrical triangles meet their upside targets 66% of the time. However, the recent GBPJPY triangle that was posted in my March 4th 2014 article was part of the 33% of triangle breakout failures.

Learn Forex – GBPJPY Symmetrical Triangle False Breakout

As you can see in the chart above of the GBPJPY symmetrical triangle, a breakout happened at 171.13. Initially, wide ranging candlesticks breaking above the top of the symmetrical triangle may have led traders to believe the up move had more to go. However, the doji candlestick pattern was joined by a bearish candlestick forming a Japanese candlestick evening star pattern at 173.56 capped this rally.

From this point, we can see an acceleration in bearish price action as a series or red candlesticks form Bullish breakout traders are now caught in what is called a “bull trap” in the 167.60 area. Stops are triggered and longs are shaken out. Today, we see a strong surge in yen weakness and GBPJPY rebounds. The question now is, “Should traders give GBPJPY another chance?”

Learn Forex – GBPJPY Daily Chart Revised Symmetrical Triangle

A New Triangle Emerges

If the fundamental and technical reasons that existed when the trade was made still exist after a stop out, then we would consider re-entering the trade. However, forex triangle traders may make modifications to the initial triangle in order to take into account the new swing highs and swing lows.

First of all, the new swing high which was created by the false breakout is connected to a higher previous high. Next, the new swing low which was created by breakout below support is connected by an upward sloping trend line from the previous swing low. The result is a new symmetrical triangle with new buy and sell parameters. New limits are set as well.

How to Trade this New Triangle

The breakout method for trading a symmetrical triangle has not changed. However, the triangle has become bigger. Despite the big GBPJPY big 350-pip run-up today to 171.05, GBPJPY is another 250 pips from making a confirmed triangle breakout. Triangle resistance is at 172.70 area making a long GBPJPY trade too early of a proposition now.

If and when GBPJPY trades above 173.56, a stop can be placed beneath the last swing low of the triangle at around 167.40 with an upside target of 183.91. On the other hand, a close below 167.40 would trigger a sell signal for a bears to trade the triangle south with a target of 156.75.

After the last false breakout, traders may ask GBPJPY to “show them the pips” with a confirmed triangle breakout before going long GBPJPY a second time

Forum on trading, automated trading systems and testing trading strategies

Something Interesting to Read March 2014

newdigital, 2014.03.29 08:50

Encyclopedia of Chart Patternsby Thomas N. Bulkowski

In this revised and expanded second edition of the bestselling Encyclopedia of Chart Patterns, Thomas Bulkowski updates the classic with new performance statistics for both bull and bear markets and 23 new patterns, including a second section devoted to ten event patterns. Bulkowski tells you how to trade the significant events -- such as quarterly earnings announcements, retail sales, stock upgrades and downgrades -- that shape today?s trading and uses statistics to back up his approach. This comprehensive new edition is a must-have reference if you're a technical investor or trader. Place your order today.

"The most complete reference to chart patterns available. It goes where no one has gone before. Bulkowski gives hard data on how good and bad the patterns are. A must-read for anyone that's ever looked at a chart and wondered what was happening."

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video November 2013

newdigital, 2013.11.13 07:52

How To Trade Descending Triangle Chart PatternsVideo Tutorial on How To Trade Descending Triangle Chart Patterns

===============

Legendary investor Warren Buffett and venture capitalist Marc Andreessen debate the merits of Bitcoin.

Earlier this month, famed dealmaker Warren Buffett warned investors to stay away from Bitcoin, calling it “a mirage,” saying that, while it may be a better way of transmitting money, the “idea that it has some huge intrinsic value is just a joke.” While interviewing Bitcoin investor Marc Andreessen at a CoinSummit “fireside chat” (minus the fire) Tuesday, I asked him to respond to Buffett. He supplied the missing flames.

“The historical track record of old white men crapping on new technology they don’t understand is at, I think, 100%,” said venture capitalist (and younger white man) Marc Andreessen. Fellow Andreessen Horowitz partner Balaji Srinivasan quipped that Bitcoin has outperformed Buffett’s “Berkshire Hathaway by a lot in the last year.” (42 minute mark)

Andreessen’s “skewering” of Buffett has gotten lots of news coverage, but the answers were actually rather glib. Lots of burn, but not much kindle. So I followed up with Andreessen, whose firm has made Bitcoin plays including a $25 million investment in Bitcoin wallet and merchant processing service Coinbase, for a more substantive response to Buffett’s Bitcoin criticism. Here’s Buffett’s full Bitcoin takedown:

“Stay away. Bitcoin is a mirage. It’s a method of transmitting money. It’s a very effective way of transmitting money and you can do it anonymously and all that. A check is a way of transmitting money, too. Are checks worth a whole lot of money just because they can transmit money? Are money orders? You can transmit money by money orders. People do it. I hope bitcoin becomes a better way of doing it, but you can replicate it a bunch of different ways and it will be. The idea that it has some huge intrinsic value is just a joke in my view.”

Buffett says Bitcoin is a very fast anonymous money order. Companies that send money orders make money off of them, so investing in the companies that control the money orders makes sense (the Coinbases and Bitpays of the world) but the money orders themselves (i.e. Bitcoins) aren’t worth buying as an investment. That’s a valid critique. During our chat, Andreessen and Srinivasan said Bitcoin is the “next Internet.” People often compare it to Internet protocols that enabled the development of email and the World Wide Web as we know it. But protocols and the “Internet” don’t make money; the valuable systems built on top of them do. Buffett is essentially saying Bitcoin is a protocol like TCP/IP that isn’t a money maker, and is encouraging investors not to drop $600 bucks/coin (even if unlike TCP/IP, the supply of Bitcoin is limited).

“This is a standard trope of technology criticism by people who don’t understand technology,” says Andreessen by email. “‘Yes, sure, it’s great technology, but it won’t be useful or valuable in the way that those crazy nerds think it will be useful or valuable.’ I’ve heard it my whole life applied to every new important technology. It’s fake sophistication — it sounds nuanced but it’s not.”

Andreesen says the argument “completely misses the logic flow of how Bitcoin works.” When I suggested that the actual value of “a bitcoin” is arbitrary, and that more important than the value is the fact that it’s fluid, and easily converted to “real money,” he objected.

“A value of a BTC is not arbitrary, in fact it’s the opposite of arbitrary,” he says. “It equals the value of a single slot in a finite sized public cryptographic ledger through which value can move. The total Bitcoin ledger has value corresponding to the volume and velocity of transactions that will run through it in the future; by extension, each slot in the ledger has fractional value determined by the total number of slots (which, in Bitcoin’s case, are limited to 11 million today and 21 million ever).”

“So saying what Warren is saying is like saying ‘a car is great technology but it’ll never actually get anyone from point A to point B,” he continued. “Bitcoin is great technology BECAUSE it lets people get value from point A to point B through the public ledger; that functional use creates the value of the ledger, and a single BTC has a corresponding fractional value of the ledger.”

To belabor the car analogy, isn’t Bitcoin more like a taxi than a car one owns? The value is in giving money a ride from one place to another. Those in the taxi don’t care what the taxi’s worth, just how much the ride will cost, i.e. what the Bitcoin transaction fees would be. So why does the value of the Bitcoin taxi matter, and why should people invest in it assuming it will go up? In fact, it seems problematic if you care about the value of the taxi (or the Bitcoin), because then you might not want to drive it/use it, assuming it’s going to get more valuable. That means fewer slots on the ledger that can be used for value transfer — the whole point of Bitcoin.Andreessen then broke out economic theory, saying that the velocity of money will overcome the effect of Bitcoin hoarders, and that hoarders will essentially lead to more valuable Bitcoin.

“The market cap of the ledger needs to be high enough to accommodate all of the value that wants to PASS THROUGH it in any period of time (volume & velocity of value passing through),” Andreessen wrote. “So then, the intrinsic value of a BTC is emergent from the functional value of the ledger as a way to exchange value (or, more accurately, emergent from the collective forecast of the future volume & velocity of value that will pass through the ledger).”

This of course assumes that lots of people settle on using Bitcoin as their cryptocurrency of choice, rather than one of the alt-coins out there or a cryptocurrency without a limit on coins created. And it requires lots of systems dependent on Bitcoin, to up the amount of value that wants to pass through.So Buffett and Andreessen’s disagreement will remain unresolved. Only a time traveler could declare the victor.

More...

AUDUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for Australian Dollar: NeutralGOLD Fundamentals (based on dailyfx article)

Fundamental Forecast for Gold: BearishGBPUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for Pound: BearishUSDJPY Fundamentals (based on dailyfx article)

Fundamental Forecast for Japanese Yen: NeutralForex Trading Video: Yen Crosses and S&P 500 Checked Lower, Break Risk? :