I have a problem with the tester that I'm hoping someone knows how to fix.

When I run a backtest the symbol properties tab appears to get populated with the current spread data (at the time the test starts). The problem is, if I test on the weekend when the market is closed, then the spread is really high since that's what the market closed at. Right now it's showing GBPUSD spread is 13 pips. During regular trading that number would be around 4 pips. The tester is using a 13 pip spread for all back testing. Is there any way to manually set that number to something realistic and keep if from changing? I would be even happier if it would use the real spread value for each tick, but I'm not sure if the history data includes that??? When I look at my 6-month backtest the difference in Ask/Bid is consistantly 13 pips. This is obviously not true.

Any ideas???

Thanks,

Tovan

This is a serious problem and no one seems to have an answer, you have probably seen these links by now:

Not much help but at least you know you are not alone and there is awareness of the problem.

Keith

Hi,

If you want to change Tester Spread,you can try SpreadGenerator_v1.1.mq4 .

This script has not been tested enough.

If we can discover all values in that symbols.sel, we can create new Symbols and update them through external applications,

so we'll be able to add any assets to MetaTrader for analysis if we can find the needed data feed...

Too many unknown values at this moment...

(Another thing is that I'm afraid Metaquotes in fact doesn't want such hacks to be done. www)

Hi,

If you want to change Tester Spread,you can try SpreadGenerator_v1.1.mq4 .

This script has not been tested enough.

i try your script but spread in testing has not changed.

Please tell me, what you did..

which broker ? which CurrencyPair?

where did you copy "symbols.sel"?

and upload "symbols.sel" you made.

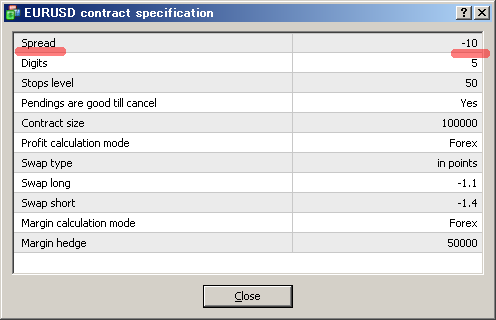

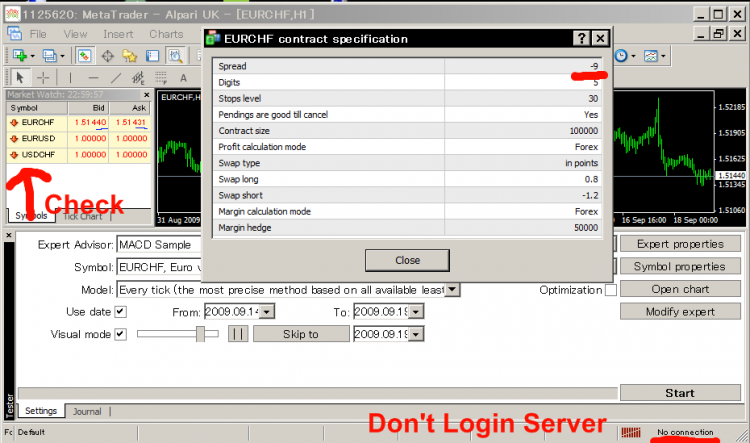

This imageg is Symbol properties when successfully changed spread.

Look in the "history" folder.

Inside you will see a folder for each server you use. Just check modification date to see which you've been using most recently.

In that server folder you will find the symbols.sel file that you need to replace.

Note that you should do this without the platform running, as your file would get overwritten by the cached version when the platform shuts down.

CB

Please tell me, what you did..

which broker ? which CurrencyPair?

where did you copy "symbols.sel"?

and upload "symbols.sel" you made.

This imageg is Symbol properties when successfully changed spread.

I use it on Eur/Chf with aplari it is 5 digits broker. I have a good computer skill and i am sure i follow your instruction but it still not work, what is the problem?

Now, it works. The problem is windows vista have files compatibilities option, then it keep symbol.sel both in history folder and another copy in it's compatibilities folder and MT4 use symbol.sel from that folder.

Thank you for all yours help.

i can change the symbol.sel, but once i open and close platform, I have no more historical data if i´m online, no paris show at all in the strategy tester, what then?

best,

Pablo

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

I have a problem with the tester that I'm hoping someone knows how to fix.

When I run a backtest the symbol properties tab appears to get populated with the current spread data (at the time the test starts). The problem is, if I test on the weekend when the market is closed, then the spread is really high since that's what the market closed at. Right now it's showing GBPUSD spread is 13 pips. During regular trading that number would be around 4 pips. The tester is using a 13 pip spread for all back testing. Is there any way to manually set that number to something realistic and keep if from changing? I would be even happier if it would use the real spread value for each tick, but I'm not sure if the history data includes that??? When I look at my 6-month backtest the difference in Ask/Bid is consistantly 13 pips. This is obviously not true.

Any ideas???

Thanks,

Tovan