Join our fan page

- Views:

- 4309

- Rating:

- Published:

-

Need a robot or indicator based on this code? Order it on Freelance Go to Freelance

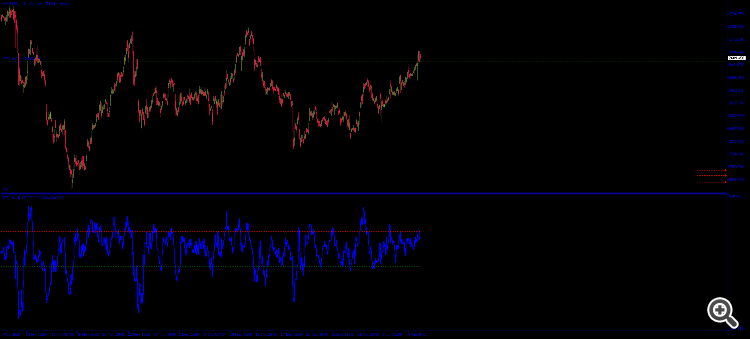

Settings and Parameters General Parameters Momentum Period Used to calculate the number of candles for momentum. Recommended value: 14 (The higher the value, the smoother the curve, but with a lag.) Volatility period The number of candles used to calculate the volatility. Suggested value: 14 Scaling factor The scaling factor adjusts the pointer calculation to produce a readable curve. Default value: 100000 Threshold Overbought level Above which the market is considered overbought. Default Value: 100.0 Oversold Level Below this value, the market is considered oversold. Default value: -100.0 Function Trend Determination: Positive: Indicates upward momentum (bullish trend). Negative: Indicates downward momentum (bearish trend). Volatility Adjustment: This indicator adjusts the momentum calculation according to the current market volatility, providing more accurate and timely signals. Overbought/Oversold Signals: Overbought: Indicates that a price correction may be imminent. Oversold: Indicates that prices are likely to recover soon.

Translated from Chinese by MetaQuotes Ltd.

Original code: https://www.mql5.com/zh/code/55792

Risk management and bot ict daily bias

Risk management and bot ict daily bias

The RiskManagement library in MQL5 provides efficient and dynamic risk management, optimised to minimise resources. It allows setting maximum profit and loss limits with customisable modifiers. It includes OCO order control and tools for candlestick management and price conversions.

Advanced compound interest calculator for the trader

Advanced compound interest calculator for the trader

A compound interest calculator for the trader. Calculates, based on your parameters, your risk of ruin, and the optimal risk per trade. Gives a forecast of your capital size in a year, month, and at the end of the term.

Tuyul Uncensored

Tuyul Uncensored

try to imitate trading system using expert advisor

Watermark

Watermark

The Watermark indicator is lightweight and efficient, designed to display an informative watermark over the main MetaTrader 5 chart. It automatically shows the current symbol, chart time and asset description, allowing traders to customise their interface with style and convenience.