Michal Jurnik / Profil

- Information

|

11+ Jahre

Erfahrung

|

49

Produkte

|

241

Demoversionen

|

|

0

Jobs

|

0

Signale

|

0

Abonnenten

|

I've never said "it cannot be done". Instead, I try to find the way how to reach the goal. Now you are probably telling yourself that it sounds like old cliche but it's really worth it. If you are afraid of new calls you will not have a chance to learn anything new. Do not forget that "every artist was first an amatuer" - Ralph Waldo Emerson.

Everybody has a dream. My dream is simple - make the world a better place. Even in a small amount but do it! I would like to develop a project which improve people's lives. Because there is nothing better than feeling when your client is successful and satisfied. That five minutes long icy sensation on your back after few days or months spent on a project. That is the real payoff!

I am a part of the PipTick team developing professional tools for traders. We are focused on the most important financial indicators of the technical analysis instead of useless products for trading. Therefore we have created PipTick portfolio consists high quality products that everyday help to our customers in trading activities.

Our detail oriented team also continuously collects feedback to get knowledge about customers needs and user experience. The information they provide markedly helps us improving our products to be more valuable and capable of bringing befetis to our customers. A long time ago we realized that if PipTick team wants to survive on the competitive field of trading tools, we have to think about our customers as equal partners. As a result their ideas and opinions are very important for our every day work.

We have released PipTick Supply Demand indicator thus we concluded PipTick Indicators Portfolio. According to our plan we proceed to another phase of development - Automated Trading Systems (EAs). We have gained enough experience from both, trading and development world to create a self sufficient PipTick EA Portfolio. Our team has already developed a few successful EAs based on PipTick indicators but they have remained private yet. The main reason is to provide an excellent service of complete, perfectly balanced portfolio supported by effective money and risk management. We work really hard to achieve this goal so you can expect it very soon!

Meanwhile we would like to wish you a successful trading!

PipTick Team

PipTick Currency Barometer MT4: https://www.mql5.com/en/market/product/8110

PipTick Currency Barometer MT5: https://www.mql5.com/en/market/product/8166

Der Währungsbarometer-Indikator ist ein einzigartiges Instrument, das die Stärke von zwei im Paar vertretenen Währungen misst und die Differenz zwischen ihnen vergleicht. Das Ergebnis wird in Form eines Histogramms angezeigt, an dem Sie einfach erkennen können, welche Währung die stärkste ist. Dieser Indikator wurde entwickelt, um die Stärken und Schwächen von acht Hauptwährungen (USD, EUR, GBP, CHF, CAD, JPY, AUD und NZD) zu messen und funktioniert bei 28 Währungspaaren. Der Indikator

Der Pairs Cross-Indikator ist ein einzigartiges Instrument für negativ korrelierte Handelsinstrumente, wie z.B. die Währungspaare EURUSD und USDCHF. Er basiert auf einem Konzept, das als Pairs Trading (oder Spread Trading) bezeichnet wird. Unser Indikator vergleicht die Stärke von zwei Währungspaaren, die umgekehrt korreliert sind, und zeigt Ihnen schnell an, wann es an der Zeit ist, das erste Paar zu kaufen und ein zweites Paar zu verkaufen und umgekehrt. Dies ist ein unkomplizierter Ansatz für

Der Pairs Spread Indikator wurde für die beliebte Strategie des Pairs Trading, Spread Trading oder der statistischen Arbitrage entwickelt. Dieser Indikator misst den Abstand (Spread) zwischen den Preisen von zwei direkt (positiv) korrelierten Instrumenten und zeigt das Ergebnis als Kurve mit Standardabweichungen an. So können Händler schnell erkennen, wann die Instrumente zu weit auseinander liegen und diese Information für Handelsmöglichkeiten nutzen. So verwenden Sie den Pairs Spread Indikator

Der Pairs Cross-Indikator ist ein einzigartiges Instrument für negativ korrelierte Handelsinstrumente, wie z.B. die Währungspaare EURUSD und USDCHF. Er basiert auf einem Konzept, das als Pairs Trading (oder Spread Trading) bezeichnet wird. Unser Indikator vergleicht die Stärke von zwei Währungspaaren, die umgekehrt korreliert sind, und zeigt Ihnen schnell an, wann es an der Zeit ist, das erste Paar zu kaufen und ein zweites Paar zu verkaufen und umgekehrt. Dies ist ein unkomplizierter Ansatz für

Der Pairs Spread Indikator wurde für die beliebte Strategie des Pairs Trading, Spread Trading oder der statistischen Arbitrage entwickelt. Dieser Indikator misst den Abstand (Spread) zwischen den Preisen von zwei direkt (positiv) korrelierten Instrumenten und zeigt das Ergebnis als Kurve mit Standardabweichungen an. So können Händler schnell erkennen, wann die Instrumente zu weit auseinander liegen und diese Information für Handelsmöglichkeiten nutzen. So verwenden Sie den Pairs Spread Indikator

Der Heikin Ashi-Indikator ist unsere Version des Heikin Ashi-Charts. Im Gegensatz zu Konkurrenzprodukten bietet dieser Indikator umfangreiche Optionen zur Berechnung von Heikin Ashi-Kerzen. Darüber hinaus kann er als klassische oder geglättete Version angezeigt werden. Der Indikator kann Heikin Ashi mit gleitendem Durchschnitt nach vier Methoden berechnen: SMA - Einfacher gleitender Durchschnitt SMMA - Geglätteter gleitender Durchschnitt EMA - Exponentieller gleitender Durchschnitt LWMA -

Der Heikin Ashi-Indikator ist unsere Version des Heikin Ashi-Charts. Im Gegensatz zu Konkurrenzprodukten bietet dieser Indikator umfangreiche Optionen zur Berechnung von Heikin Ashi-Kerzen. Darüber hinaus kann er als klassische oder geglättete Version angezeigt werden. Der Indikator kann Heikin Ashi mit gleitendem Durchschnitt nach vier Methoden berechnen: SMA - Einfacher gleitender Durchschnitt SMMA - Geglätteter gleitender Durchschnitt EMA - Exponentieller gleitender Durchschnitt LWMA -

Der Währungsindex-Indikator ermöglicht es Händlern, einen beliebigen Index der acht wichtigsten Währungen anzuzeigen. Er verwendet eine spezielle Berechnung, die bestimmte Währungspaare und deren Gewichte berücksichtigt. Die Standardgewichte basieren auf den Ergebnissen der dreijährlichen Zentralbankumfrage der BIZ. Dank dieses Vorteils kann der Händler die wahre Stärke und Schwäche jeder Währung erkennen. Hinweis: Wenn der Indikator im Strategy Tester (Demoversion) verwendet wird, beachten Sie

Der Währungsindex-Indikator ermöglicht es Händlern, einen beliebigen Index der acht wichtigsten Währungen anzuzeigen. Er verwendet eine spezielle Berechnung, die bestimmte Währungspaare und deren Gewichte berücksichtigt. Die Standardgewichte basieren auf den Ergebnissen der dreijährlichen Zentralbankumfrage der BIZ. Dank dieses Vorteils kann der Händler die wahre Stärke und Schwäche jeder Währung erkennen. Hinweis: Wenn der Indikator im Strategy Tester (Demoversion) verwendet wird, beachten Sie

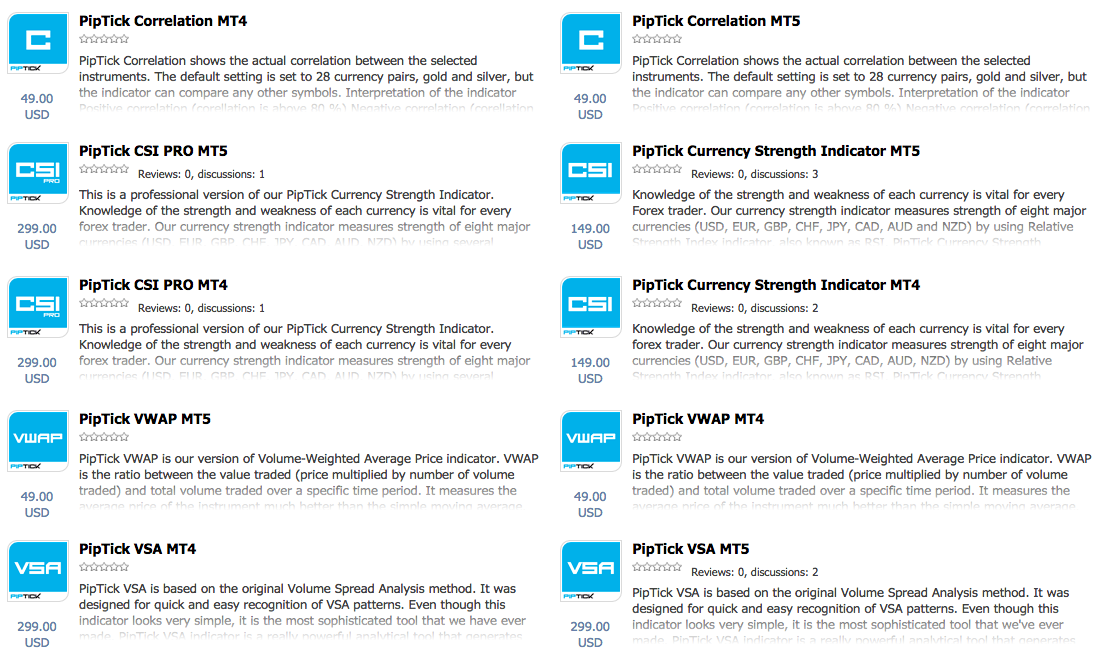

PipTick Correlation MT4 https://www.mql5.com/en/market/product/10620

PipTick Correlation MT5 https://www.mql5.com/en/market/product/10633

PipTick Currency Strength MT4 https://www.mql5.com/en/market/product/7517

PipTick Currency Strength MT5 https://www.mql5.com/en/market/product/7689

PipTick VSA MT4 https://www.mql5.com/en/market/product/8112

PipTick VSA MT5 https://www.mql5.com/en/market/product/8310

Der Indikator Korrelationsmatrix zeigt die tatsächliche Korrelation zwischen den ausgewählten Instrumenten an. Die Standardeinstellung ist auf 28 Währungspaare, Gold und Silber festgelegt, aber der Indikator kann auch andere Symbole vergleichen. Interpretation des Indikators Positive Korrelation (Korrelation liegt über 80 %). Negative Korrelation (die Korrelation liegt unter -80 %). Schwache oder keine Korrelation (die Korrelation liegt zwischen -80 und 80 %). Wichtigste Merkmale Der Indikator

Der Indikator Korrelationsmatrix zeigt die tatsächliche Korrelation zwischen den ausgewählten Instrumenten an. Die Standardeinstellung ist auf 28 Währungspaare, Gold und Silber festgelegt, aber der Indikator kann auch andere Symbole vergleichen. Interpretation des Indikators Positive Korrelation (Korrelation liegt über 80 %). Negative Korrelation (die Korrelation liegt unter -80 %). Schwache oder keine Korrelation (die Korrelation liegt zwischen -80 und 80 %). Wichtigste Merkmale Der Indikator

Der Indikator Korrelationsmatrix zeigt die tatsächliche Korrelation zwischen den ausgewählten Instrumenten an. Die Standardeinstellung ist auf 28 Währungspaare, Gold und Silber festgelegt, aber der Indikator kann auch andere Symbole vergleichen. Interpretation des Indikators Positive Korrelation (Korrelation liegt über 80 %). Negative Korrelation (die Korrelation liegt unter -80 %). Schwache oder keine Korrelation (die Korrelation liegt zwischen -80 und 80 %). Wichtigste Merkmale Der Indikator

You can find my PipTick CSI MT4 indicator from video here https://www.mql5.com/en/market/product/7689

or PRO version here https://www.mql5.com/en/market/product/7766

Der Volume Spread Analysis Indikator basiert auf der ursprünglichen Volume Spread Analysis Methode. Er wurde für die schnelle und einfache Erkennung von VSA-Mustern entwickelt. Obwohl dieser Indikator sehr einfach aussieht, ist er das anspruchsvollste Tool, das wir je entwickelt haben. Es handelt sich um ein wirklich leistungsstarkes Analysetool, das sehr zuverlässige Handelssignale erzeugt. Da es sehr benutzerfreundlich und verständlich ist, eignet es sich für jeden Händlertyp, unabhängig von

Der VWAP-Indikator ist unsere Version des beliebten volumengewichteten Durchschnittspreisindikators. Der VWAP ist das Verhältnis zwischen dem gehandelten Wert (Preis multipliziert mit der Anzahl des gehandelten Volumens) und dem gesamten gehandelten Volumen in einem bestimmten Zeitraum. Daher misst er den Durchschnittspreis des Instruments viel besser als der einfache gleitende Durchschnitt. Obwohl es viele Möglichkeiten gibt, den VWAP zu verwenden, nutzen die meisten Anleger ihn zur Berechnung