Buas

- Experts

- Ahmad Aan Isnain Shofwan

- Versão: 7.4

- Atualizado: 19 outubro 2025

- Ativações: 7

BUAS EA is a hybrid grid breakout system engineered for traders who prefer execution logic over prediction.

It deploys pending Buy Stop and Sell Stop orders as a symmetrical trap and follows whichever side is triggered first.

The latest version introduces Adaptive Asymmetric Grid (AAG) logic and Dual Adaptive Trailing (equity-based + ATR-based), delivering both dynamic protection and refined risk adaptation.

Designed for professional and advanced traders who demand full automation with on-chart remote control.

Core Trading Logic

-

Execution-Driven Entry

-

BUAS sets paired pending orders at configurable distances from price.

-

When breakout occurs, the grid activates in that direction.

-

No indicator-based entries — price action is the only trigger.

-

-

Adaptive Asymmetric Grid (AAG)

-

EMA (fast/slow), ADX (trend strength) and RSI (momentum) generate a bias score [–1 to +1].

-

This bias dynamically adjusts the distance of Buy Stop vs Sell Stop orders: bias > 0 favors Buy, bias < 0 favors Sell.

-

ATR scaling adapts spacing to volatility — more exposure in momentum direction, less during choppy conditions.

-

-

Position & Risk Control

-

Lot mode: choose fixed or progressive (multiplier sequence). Default is Sequence.

-

margin level safeguards prevent over-leverage.

-

Equity Target / Stop and trailing by money protect capital in real money value terms.

-

-

Dual Adaptive Trailing System

-

Equity-based Trailing (by Money): locks profit once a defined equity gain (in USD) is reached and follows equity upwards.

-

ATR-based Trailing Stop: adjusts stop-loss distance per symbol volatility for natural breathing space.

-

Both mechanisms operate concurrently — as soon as a position opens, two adaptive trails stand ready to secure profit.

-

Professional On-Chart Console

BUAS features a fully interactive on-chart panel — tested and functional under all conditions, even when no trades are open.

This turns the EA into a real-time remote trading interface.

Key Functions

-

OPEN BUY / OPEN SELL — instant market entries for manual interventions.

-

OPEN CYCLE — deploy a full grid cycle automatically.

-

OPEN BUY STOP / OPEN SELL STOP — append one-directional pending packages.

-

CLOSE ALL / DELETE ALL — immediate global exit or reset.

-

CLOSE LOSS / CLOSE PROFIT — selectively close losing or profitable positions.

-

SL = BE / SL +1 / Change TP / Change SL — batch-edit protection levels.

-

Cancel Trail DD / Cancel Trail SL — pause/resume money trail or price trail individually — ideal during high-volatility periods.

-

Rest & Realize — take partial profit and restart a fresh cycle.

-

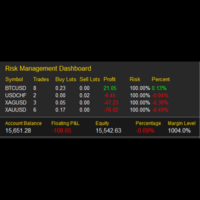

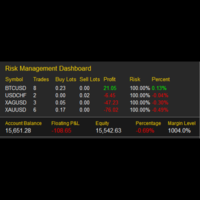

Dashboard Display: Balance, Equity, Free Margin, P/L by Magic Number, Drawdown, Trail Status, Session, and Cycle state.

Every button is live and robust — providing institutional-style execution control without leaving the chart.

Main Parameters

| Category | Key Inputs | Purpose |

|---|---|---|

| Grid Structure | UseAdaptiveGridAsymmetry , GridSkew , GridMinFactor , StartDistancex | Enable AAG logic and spacing rules |

| Lot Control | MartMulti , GridMulti , MaxLotLimit | Progressive or fixed lot modes |

| Trailing by Money | Trailing_Start_by_Money , Trailing_Width_by_Money | Equity protection system |

| ATR Trailing | Use_ATR_TrailSL , ATR_tf_TrailSL , ATR_Period_TrailSL , ATR_Multiplier_TrailSL | Volatility-adaptive price trail |

| Equity Protections | Equity_Target_by_Money , Equity_Stop_Target_by_Money | Hard capital targets |

| Console Behavior | Manual buttons and status switches | Real-time operation |

Operational Recommendations

-

Recommended Balance: minimum USD 10,000 (default). Testing possible from USD 1,000 for simulation.

-

Symbol & Timeframe: XAUUSD on H4 (primary benchmark). Other pairs or crypto require parameter adjustment.

-

Account Type: ECN / Raw Spread / low-latency execution. Leverage ≥ 1:200 recommended.

-

Testing Method: multi-year backtest plus forward demo validation before live use.

-

Lot Scaling: use conservative fixed lot until the EA’s dynamic behavior is well understood.

Risk Disclosure

-

BUAS EA does not guarantee profit. As with any grid system, extended one-sided market movements can lead to significant drawdown.

-

Aggressive lot multipliers can cause margin call or stop-out. Always define MaxLotLimit and equity protection levels.

-

Users must understand position scaling, margin impact and trail behavior before live deployment.

-

Backtesting and demo testing are mandatory steps before using on real capital.

BUAS EA blends mechanical precision with manual agility.

It’s not a “set-and-forget” toy — it’s a remote-operable engine built for professionals who understand structure, liquidity, and risk.

Once deployed, every decision — from grid placement to equity trailing — is adaptive, transparent, and fully traceable through the on-chart interface.

If you want a system that reacts — not predicts — and gives you full tactical control with institutional-grade automation,

BUAS EA delivers exactly that.