Alpinist

- Experts

- Andrey Kolmogorov

- Versão: 1.8

- Atualizado: 22 maio 2025

- Ativações: 5

A mathematical multicurrency trading system based on the principle of a neural network. It uses several thousand of the most stable trading algorithms in its work. Before getting into the "А2М1" general database of algorithms, each block of conditions has passed the testing for stability with the identification of certain market dependencies for that block. A network created in such a way allows the EA to automatically select the most optimal variant of response to the market situation from several thousand possible variants of algorithms included in its database. In case of an unsuccessful entry, the EA uses a unique multistage averaging system with an increasing coefficient.

Despite the fact that the operation of this EA does not involve the use of Stop Loss, such an ability exists in the EA. There is no need to optimize the EA, it is already fully configured for work.

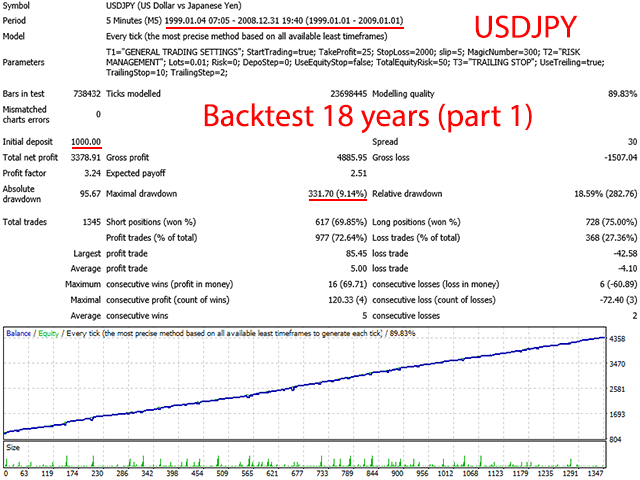

Sets are in the "Comments" section comments #21-22. (For USDJPY trailing stop should be 5.0).

Key Advantages

- 8 currency pairs.

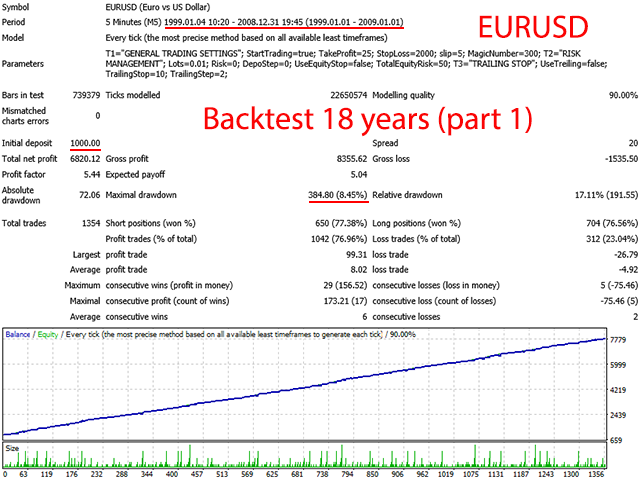

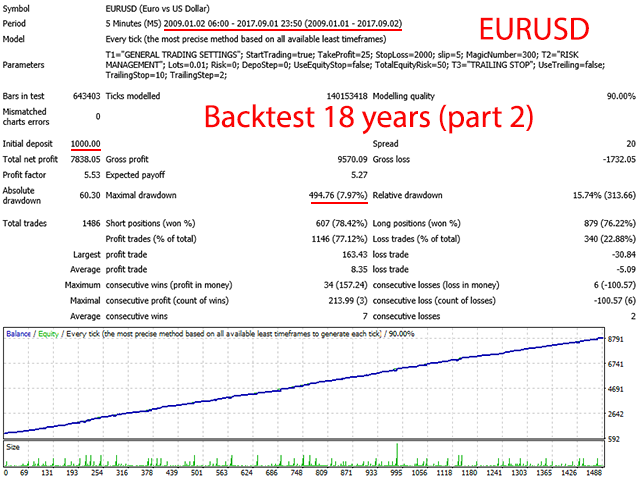

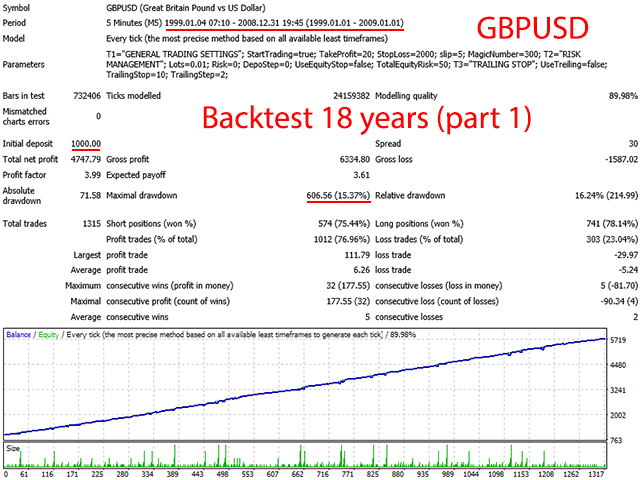

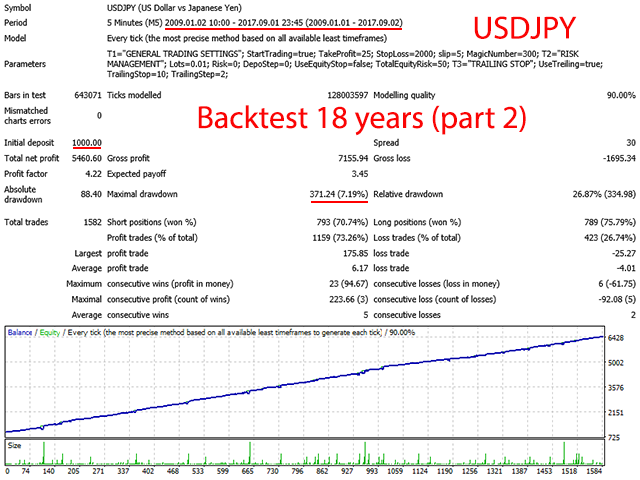

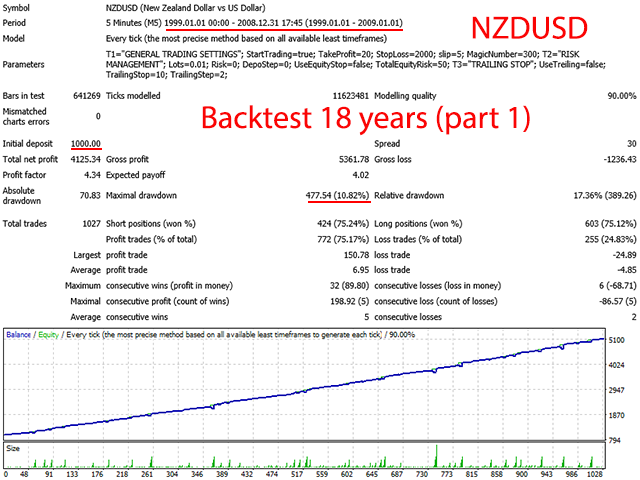

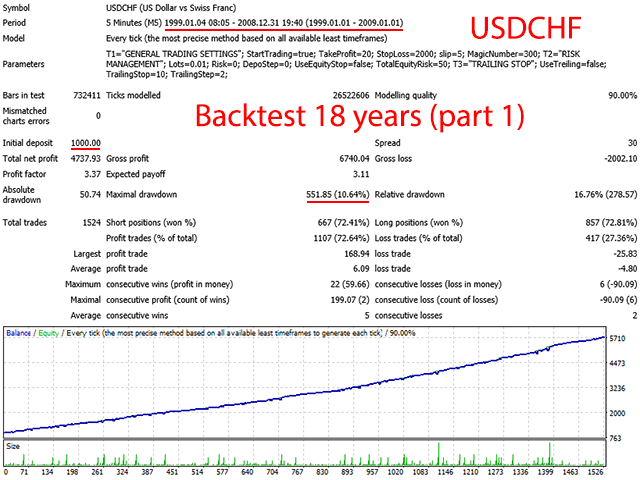

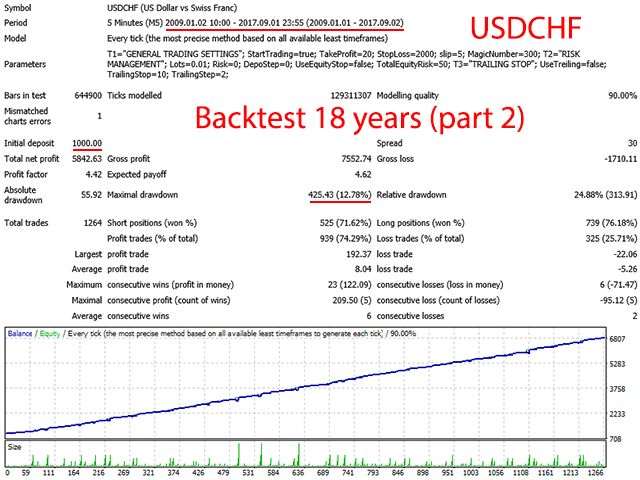

- All 8 pairs pass tests from 1999 to the current time (18 years).

- No need to close the robot during news releases.

- It works with 4 and 5-digit quotes.

- Estimated spread is from 2 to 3 points (4 digits).

- Estimated Take Profit is from 20 to 25 points (4 digits).

Operation parameters

- Currency pairs: EURUSD, EURJPY, GBPUSD, EURGBP, AUDUSD, NZDUSD, USDCHF, USDCAD.

- Timeframe: M5.

Recommended Take Profit values for 8 currency pairs

- EURUSD - 25 points.

- EURGBP, EURJPY, GBPUSD, AUDUSD, NZDUSD, USDCHF, USDCAD - 20 points.

The main recommendations when using a standard Take Profit (20-25 points)

The recommended deposit size for trading one pair with the initial lot 0.01.

- 1500 USDC - cent account.

- $1500 - standard account.

- DepoStep - 1500 (automatic increase of lot, as an alternative to the initial lot 0.01) - increased risk.

- Leverage: 1:500 and higher.

The recommended deposit size for multicurrency trading with the initial lot 0.01.

- 5000 USDC - cent account.

- $5000 - standard account.

- DepoStep - 5000 (automatic increase of lot, as an alternative to the initial lot 0.01) - increased risk.

- Leverage: 1:500 and higher.

The main recommendations when using a reduced Take Profit (10 points)

The recommended deposit size for multicurrency trading.

- 2500 USDC - cent account.

- $2500 - standard account.

- DepoStep - 2500 (automatic increase of lot, as an alternative to the initial lot 0.01) - increased risk.

- Leverage: 1:500 and higher.

General Trading Settings

- Start trading - enable/disable the Expert Advisor.

- TakeProfit - take profit value for the orders opened by the EA, depends on the specific currency pair and trading style (see the above recommendations on TakeProfit);

- StopLoss - stop loss value, depending on the trading style. In this EA, it is best to leave this parameter unchanged.

- Slip - maximum allowed slippage.

- MagicNumber - unique number of positions opened by the EA.

Risk management

- Lots - initial lot size. It is activated, if the values of Risk and DepoStep are zero;

- Risk - percentage of the deposit balance to increase the initial lot. It is activated, if the value of Lots size is zero;

- DepoStep - deposit size step for doubling the initial lot. It is activated, if the values of Lots and Risk are zero.

- Stop by equity - enable/disable limitation of losses by equity.

- Value of equity - allowable loss by equity, at which all orders previously opened by the EA are closed.

Trailing Stop

- Use Trailing Stop - enable/disable the Trailing Stop parameter.

- Fixed trailing size - size of the Trailing Stop in points from the order opening price;

- The size of the correction Trailing Stop - price range in points from Fixed trailing size to trigger Trailing Stop.

Hi. All users.

I have used most of the paid expert in mql, and I am still exploring many experts.

I have been using alpi since October 2017.

The alpi operated steady multi currency, and I just watched.

The result was astonishing. The alpi had a whopping 110% profit over the 15 months. The account that started with 5000usd has already exceeded $ 10,000 and is still on the rise.

Above all, the authors' support was good. I have had enough communication with the author when there have been DD issues or issues. The author explained the current situation in detail. And he actively accepted the opinions of the users and updated the alpi.

The performance of the alpi as well as other experts made by the author is excellent. (BS, Malauder, etc.)

Many of the logic on the market proves their performance through backtesting, but the only real users I have used so far are the author's experts.

Good results are expected in the future. And I am deeply grateful to the author who always supports me. God bless you with you.