Termos de Referência

Hello Everyone,

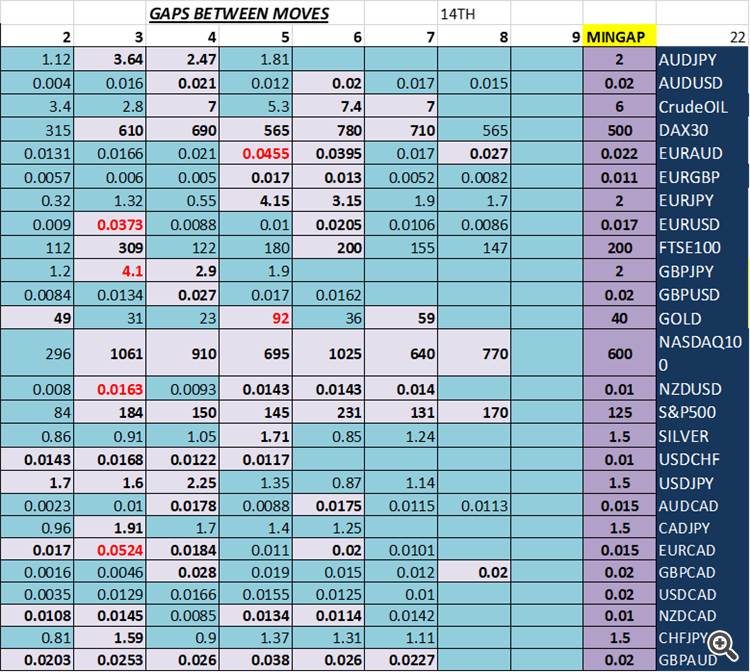

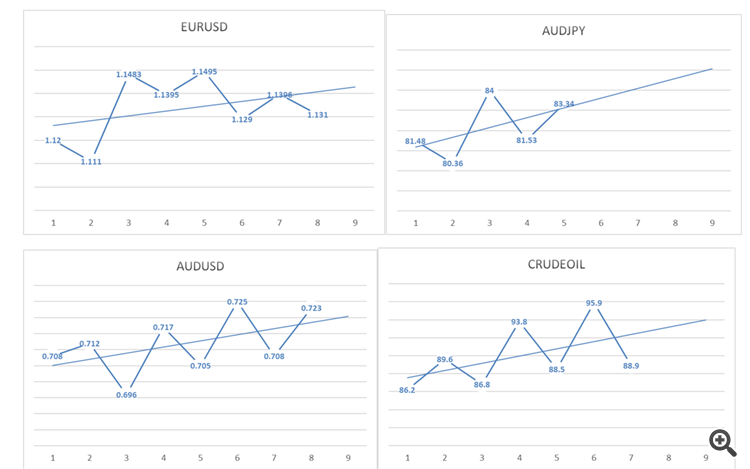

I am seeking a professional and passionate developer to help with my Forex trading strategy on both MT4 and MT5. Currently shown above is my report for February which I will explain to help identify how the EA/ Robot will work. As shown above is price movements between Highs and Lows where RED is HIGH and GREEN is LOW prices. The Robot will identify the HIGH and LOW positions based on the 1. market price movements, 2. Trendline price, 3. DEFINED GAP, 4. BENEFIT GAP( Can be % of DEFINED GAP or absolute price) and 5. TRENDLINE DIRECTION (UP/DOWN).

The Robot will plan for trading only when the prices have crossed the trendline and a certain Defined GAP has been achieved based on last price position at the other extreme of the TRENDLINE. After the DEFINED GAP has been achieved and market still goes against the moves, then new bids will start to activate at the BENEFIT GAP after achieving the DEFINED GAP. If prices have activated and didn’t cross the TRENDLINE, then it will still use the last extreme price to continue to calculate the positions until it crosses or meets the DEFINED GAP at the new position. The DEFINED GAP bid must ALWAYS activate at the opposite side of the CURRENT BID. So if the CURRENT BID is above the TRENDLINE and a SELL, then the BUY must be at a PRICE achieved with the DEFINED GAP and Below the TRENDLINE for a BUY to activate. Also note that lot sizes of Benefit gaps will increase either as addition or multiplication.

example of data

EXAMPLES

AUDJPY Defined GAP= 2, Benefit Gap= 50% of defined gap=1, Trendline direction is UP.

So at High price of 81.48, then first defined bid will activate at 81.48-2(defined gap)= 79.48. However price stopped at 80.36, which is below the trendline. Then ROBOT will identify 80.36 and plan for a SELL bid which must achieve the Defined GAP and also be at the opposite side of the Trendline. So the next bid will be 80.36(LOW) + 2(GAP) =82.36 (which must be above the trendline) and price went above to 84, so 82.36 (Defined Bid) + 1(Benefit Gap)= 83.36 (Benefit Bid 1), Benefit Bid 2 would have been Benefit bid 1 (83.36) + Benefit Gap (1)= 84.36 (but not achieved). So only 2 SELL bids will activate. Then at 84 (HIGHEST PRICE After bid) it will plan a BUY at 84- Defined bid (2)= 82 for a BUY, which must also be below the trendline. While Benefit bid would have activated at 82-1= 81 (but price didn’t reach it. So once the Defined new bid has been activated, it will close all previous bids and then plan for the new direction. So since the LOW is 81.53, then only a BUY price of 82 will activate and all SELL at 82.36 and 83.36 will close. With the current Low at 81.53, the next DEFINED BID will activate at 81.53+2= 83.53. Current High is 83.34. and so only BUY bid at 81.53 will be active.

NASDAQ Defined GAP= 600, Benefit Gap= 30% of defined gap=180, Trendline direction is DOWN.

So at High price of 14515, then first defined bid will activate at 14515 - 600(defined gap)= 13915. However price stopped at 14219, which is below the trendline. Then ROBOT will identify 14219 (based on current LOW) and plan for a SELL bid which must achieve the Defined GAP and also be at the opposite side of the Trendline, ie above the trendline as current position is below the trendline. So the next bid will be 14219(LOW) + 600( Defined GAP)=14819 (which must be above the trendline) and price went above to 15280, so 14819 (Defined Bid) + 180(Benefit Gap)= 14999 (Benefit Bid 1), Benefit Bid 2 will be Benefit bid 1 (14999) + Benefit Gap (180)= 15179. Benefit Bid 3 would have been Benefit bid 2 (15179) + Benefit Gap (180)= 15359 (but not achieved). So only 3 SELL bids will activate. Then at 15280 (HIGHEST PRICE After bid) it will plan a BUY at 15280- Defined bid (600)= 14680 for a BUY, which must also be below the trendline. While Benefit bid 1 will activate at 14680 (Defined bid) – 180 (Benefit Gap)= 14500. So Benefit Bid 2 of BUY would have activated at 14500-180= 14320 (but price didn’t reach it, as it stopped at 14370). So once the Defined new bid has been activated, it will close all previous bids and then plan for the new direction. So since the LOW is 14370, then only a BUY price of 14680, and 14500 will activate, while the previous SELL bids at 14819, 14999 and 15179 will close at or below the Defined BUY bid. If Defined BUY bid is above the TRENDLINE, then the first Buy bid will activate at the trendline PRICE. With the current Low at 14370, the next DEFINED BID will activate at 14370+ 600 = 14970. Current High is 15065. and so Benefit bid would have activated at 14970 + 180= 15150 (but nit reached as Highest was 15050) . So the next bid will be at 15065 (Current HIGHEST PRICE) – Defined bid (600)= 14465 for a BUY which must also be below the trendline. Benefit Bid 1 will activate at 14465 (Defined bid) – 180 (Benefit Gap)= 14285. So Benefit Bid 2 of BUY will activate at 14285 -180= 14105. Benefit Bid 3 of BUY would have activated at 14105 -180= 13925 (but price didn’t reach it, as it stopped at 14040). So once the Defined new bid has been activated, it will close all previous bids and then plan for the new direction. So since the LOW is 14040, then only have BUY bids at price of 14285, and 14105 will activate, while the previous SELL bid at 14970 will close at or below the Defined BUY bid or trendline.

At LOW of 14040, then next positions will be a SELL at 14040+600= 14640 (Defined Bid), 14640+180= 14820 (Benefit bid 1, but price didn’t reach it as it stopped at 14680),

At HIGH of 14680, then next positions will be a Defined bid at 14680-600= 14080, Benefit bid 1 will be 14080-180= 13900, therefore benefit BUY bid will not activate as current Lowest price is 13910.

Please only Developers who have understood the logic of the trading concept should bid for it and also note that the payments will only be fully paid after it has been fully tested and certified by me to work according to the above logic.

I have attached additional pictures to test the bid logic movements.

You can see the DEFINED GAP as MINGAP in Picture 2.

Thanks