Livermore EA

- 유틸리티

- Frank Paetsch

- 버전: 1.0

- 활성화: 5

✅ 1) Livermore EA (Trend Structure EA)

Livermore EA – Weekly Structure Trend Trader (D1 Trigger)

The Livermore EA is a professional structure-based trend trading Expert Advisor designed to trade only confirmed trends. It follows a strict rule-based approach inspired by classic Livermore-style trend logic: a trend is only considered valid after a confirmed pivot break, and the system then builds positions using controlled add-ons (“top-ups”).

The EA uses a Weekly (W1) bias to define trend direction and applies a Daily (D1) trigger for precise entries and top-up execution. This reduces lower timeframe noise and focuses on strong, higher-quality market moves.

Key Features

✅ W1 Trend Bias + D1 Trigger

Trades are opened only after a confirmed Weekly pivot break, with Daily chart confirmation.

✅ Strict Trend Mode (No Sideways Trading)

The EA does not trade neutral markets – it trades only confirmed trend regimes.

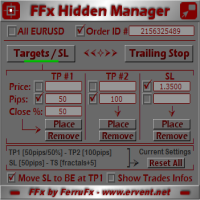

✅ Maximum 2 Top-Ups (No Grid / No Martingale)

Risk remains controlled. The system pyramids carefully and never averages down aggressively.

✅ Automatic Lot Sizing (Risk per Trade)

Position sizing is calculated professionally based on account risk and stop distance.

✅ Portfolio Risk Cap & Currency Cluster Protection

Prevents overexposure to correlated currencies (USD, JPY, etc.).

✅ Reliable Exit Logic on Structure Break / Trend Flip

Positions are closed immediately when the trend structure breaks.

Who is this EA for?

The Livermore EA is ideal for traders who want:

-

a clean trend follower without grid strategies

-

to capture large directional moves

-

strong risk control and portfolio discipline

-

a system based on market structure rather than indicator noise

Recommended Use

-

Portfolio trading on major FX pairs and key crosses

-

Designed for medium to long-term trend movements

-

Works best with conservative money management

Note

This EA is not a scalper or high-frequency system. It is built for structured trend trading with a strong focus on stability, risk management and portfolio-level protection.