당사 팬 페이지에 가입하십시오

- 게시자:

- Harrison Kiptallam Kipchumba

- 조회수:

- 126

- 평가:

- 게시됨:

-

이 코드를 기반으로 한 로봇이나 지표가 필요하신가요? 프리랜스로 주문하세요 프리랜스로 이동

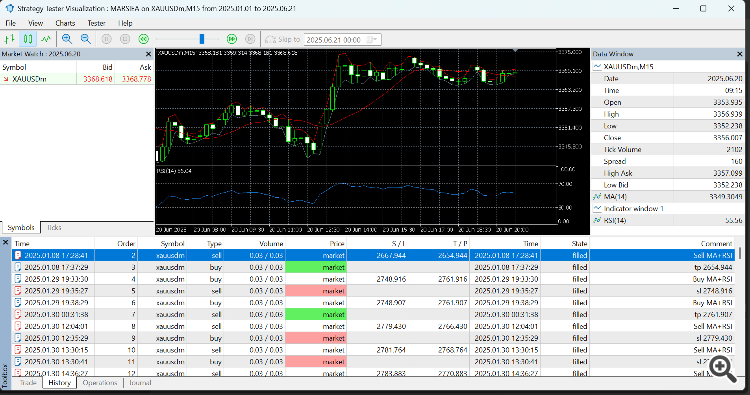

MARSI-

EA는 상대강도지수(RSI) 와 단순이동평균(SMA) 의 논리를 결합하여 XAUUSD(금)와 같은 금융시장에서 거래 신호를 식별하고 실행하는 초보자 친화적인 EA(Expert Advisor)입니다.

EA는 상대강도지수(RSI) 와 단순이동평균(SMA) 의 논리를 결합하여 XAUUSD(금)와 같은 금융시장에서 거래 신호를 식별하고 실행하는 초보자 친화적인 EA(Expert Advisor)입니다.

EA는 데모를 위해 제작되었습니다:

-

계좌 위험도에 따른 동적 랏 크기 조정

-

RSI 기반 과매수/과매도 진입 조건

-

이동평균을 이용한 추세 필터링

-

심볼 틱 정밀도에 맞게 조정된 SL 및 TP 레벨

이 EA는 기술적 전략을 실험하고 지표 처리, 동적 위험, 브로커 숫자 차이가 트레이딩 로직에 미치는 영향을 이해하고자 하는 학습자에게 특히 유용합니다.

트레이딩 로직

EA는 다음과 같은 진입 규칙으로 작동합니다:

-

매수 타이밍:

-

현재 가격이 이동평균 이상(강세)

-

RSI가 과매도 임계치 미만(가격 상승을 시사하는 경우)

-

-

매도할 때:

-

가격이 이동평균 아래(약세)일 때(하락)

-

RSI가 과매수 임계값을 초과한 경우(가격 하락을 시사)

-

-

스톱로스 및 테이크프로핏은 브로커의 호가 정밀도(_자리)에 따라 조정된 _Point를 사용하여 설정합니다.

외부 입력 매개변수

| 변수 | 설명 |

|---|---|

| maPeriod | 단순이동평균에 사용되는 기간 |

| rsiPeriod | 상대강도지수에 사용되는 기간 |

| rsiOverbought | 시장이 과매수로 간주되는 RSI 임계값(매도 트리거) |

| rsiOversold | 시장이 과매도로 간주되는 RSI 임계값 (매수 트리거) |

| 위험 비율 | 거래당 위험 대비 잔고의 백분율 |

| stopLoss | 스톱로스 거리(포인트) |

| 테이크프로핏 | 이익실현 거리(포인트) |

| 슬리피지 | 포인트 단위로 허용되는 최대 슬리피지 |

권장 사용법

-

기호: XAUUSD (Gold)

-

기간 M15 또는 H1

-

브로커: 적절한 틱 데이터가 있는 모든 브로커 (일관성을 위해 2/3 및 4/5 자리 브로커 모두에서 테스트)

-

백테스트 범위: 3-6개월 권장

-

조건: 신뢰할 수 있는 RSI/MA 값에 대한 틱 데이터를 사용할 수 있는지 확인합니다.

추가 참고 사항

-

핍사이즈() 함수는 _자릿수가 다른 브로커의 핍 값을 정규화하는 데 도움이 됩니다.

-

EA는 현재 계좌 잔고와 정의된 리스크를 기준으로 랏 크기를 자동으로 계산합니다.

-

코드는 모듈식이며 추적손절, 뉴스 필터 또는 기타 조건으로 쉽게 확장할 수 있습니다.

-

이 프로젝트는 현재 진행 중이며 피드백을 환영합니다!

MetaQuotes Ltd에서 영어로 번역함.

원본 코드: https://www.mql5.com/en/code/60730

거래 신호 모듈, 브레인트렌드2 보조지표 기반

거래 신호 모듈, 브레인트렌드2 보조지표 기반

매수 신호의 조건은 라임 컬러의 캔들이 형성되는 것이고, 매도 신호의 조건은 마젠타 컬러의 캔들입니다.

브레인트렌드2스톱

브레인트렌드2스톱

브레인트렌드2스톱은 추세 정지 지표로, 정지선으로 표시되며 교차점은 현재 시장 추세의 변화와 이전에 오픈한 거래를 종료해야 함을 의미합니다.

Daily Percentage Change MT5

Daily Percentage Change MT5

일일 백분율 변화(메타 트레이더 지표) - 전일 종가와 관련된 환율 변동을 계산하여 플랫폼의 기본 차트 창에 백분율 포인트로 표시합니다. 또한 주간 및 월간 백분율 변동도 표시할 수 있습니다. 가격 상승 또는 하락에 따라 다른 색상을 설정할 수 있습니다. 또한 사용자 지정 가능한 작은 화살표는 가격 변동 방향을 시각화하는 데 도움이 됩니다. 브로커가 다른 시간대를 사용하는 경우 인디케이터는 시간 이동 매개 변수를 사용하여 하루가 끝날 때 사용할 시간을 조정할 수 있습니다. 이 인디케이터는 MT4와 MT5에서 동일하게 작동합니다.

돈치안 운하

돈치안 운하

돈치안 채널은 최근 최고가와 최저가를 사용해 현재 가격 범위를 계산한 변동성 지표입니다.