Mohammed Abdulwadud Soubra / プロファイル

- 情報

|

8+ 年

経験

|

1

製品

|

7606

デモバージョン

|

|

134

ジョブ

|

0

シグナル

|

0

購読者

|

私は2005年から外国為替市場に参加しています。

この製品をご覧ください:

https://www.mql5.com/en/users/soubra2003/seller

US30およびアメリカ株での有望な取引シグナル:

https://www.mql5.com/en/signals/1770631

https://www.mql5.com/en/signals/2091904

即時のサポートが必要な場合は、このWhatsAppグループに参加してください:

https://chat.whatsapp.com/LItGOMZbpvN730NDA3fJ9W

この製品をご覧ください:

https://www.mql5.com/en/users/soubra2003/seller

US30およびアメリカ株での有望な取引シグナル:

https://www.mql5.com/en/signals/1770631

https://www.mql5.com/en/signals/2091904

即時のサポートが必要な場合は、このWhatsAppグループに参加してください:

https://chat.whatsapp.com/LItGOMZbpvN730NDA3fJ9W

Mohammed Abdulwadud Soubra

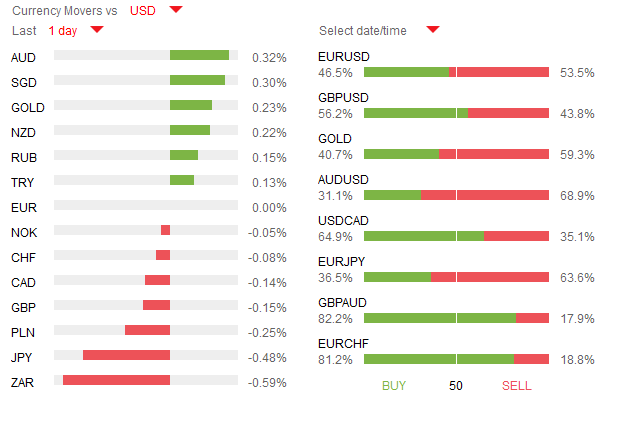

USD/CAD Selloff to Persist on Upbeat Bank of Canada (BoC) Talking Points: - USD/CAD Slips to Fresh Monthly Low; Retail FX Remains Net-Long Ahead of BoC Meeting. - USDOLLAR Extends Decline Amid Slowing U.S. Wage Growth; Fed’s Fischer & Brainard in Focus. USD/CAD...

ソーシャルネットワーク上でシェアする · 3

98

Mohammed Abdulwadud Soubra

パブリッシュされた投稿Pivot Points-Hourly

Pivot Points-Hourly Last Updated: Mar 4, 10:00 pm +03:00 Symbol S3 S2 S1 P R1 R2 R3 EUR/USD 1.09712 1.09827 1.0988 1.09942 1.09995 1.10057 1.10172 USD/JPY 113.438 113.77 113.977 114.102 114.309 114.434 114.766 GBP/USD 1.41679 1.41901 1.42026 1.42123 1.42248 1.42345 1.42567 USD/CHF 0.99173 0...

ソーシャルネットワーク上でシェアする · 2

73

Mohammed Abdulwadud Soubra

Due to it being a state holiday in Russia on 8th March, 2016, - International Women’s Day - trading of USDRUB and EURRUB currency pairs will be closed.

Trading of these pairs will resume as normal on 9 th

March, 2016.

Trading of these pairs will resume as normal on 9 th

March, 2016.

Mohammed Abdulwadud Soubra

Talking Points: February’s US employment report in the spotlight across financial markets Data’s non-impact on March rate hike bets may restrict trend development Upside surprise may translate into US Dollar strength in the weeks ahead All eyes are on February’s US Employment report in the final...

ソーシャルネットワーク上でシェアする · 3

91

Mohammed Abdulwadud Soubra

04 March 2016, Time of Writing: 09:00 am Trader Daily Market Update Major Calendar News Time (GMT) Name Country Vol. Prev. Cons. Sentiment 13:30 Non-Farm Employment Change USD High 195K 151K Positive 13:30 Average Hourly Earnings m/m USD High 0.5% 0.2% Neutral 13:30 Unemployment Rate USD High 4...

ソーシャルネットワーク上でシェアする · 4

68

Mohammed Abdulwadud Soubra

THE NFP REPORT IS EXPECTED TO BREAK ABOVE 200,000 NEW JOBS IN FEBRUARY U.S. employment data has been mixed ahead of the U.S. non-farm payrolls (NFP) report...

ソーシャルネットワーク上でシェアする · 4

77

Mohammed Abdulwadud Soubra

Pivot Points-Hourly Last Updated: Mar 4, 11:30 am +03:00 Symbol S3 S2 S1 P R1 R2 R3 EUR/USD 1.09297 1.09393 1.09446 1.09489 1.09542 1.09585 1.09681 USD/JPY 113.547 113.707 113.784 113.867 113.944 114.027 114.187 GBP/USD 1.41024 1.41285 1.41383 1.41546 1.41644 1.41807 1.42068 USD/CHF 0.98868 0...

ソーシャルネットワーク上でシェアする · 2

57

Mohammed Abdulwadud Soubra

Pivot Points_Daily Last Updated: Mar 4, 11:30 am +03:00 Symbol S3 S2 S1 P R1 R2 R3 EUR/USD 1.06875 1.08068 1.08806 1.09261 1.09999 1.10454 1.11647 USD/JPY 111.794 112.765 113.213 113.736 114.184 114.707 115.678 GBP/USD 1.38081 1.397 1.40706 1.41319 1.42325 1.42938 1.44557 USD/CHF 0.97492 0...

ソーシャルネットワーク上でシェアする · 2

49

Mohammed Abdulwadud Soubra

THE NFP REPORT IS EXPECTED TO BREAK ABOVE 200,000 NEW JOBS IN FEBRUARY

U.S. employment data has been mixed ahead of the U.S. non-farm payrolls (NFP) report. A weak Institute for Supply Management (ISM) Employment Index showing a contraction on Thursday is being balanced against a strong ADP Private payrolls report that beat expectations on Wednesday. The ADP Research Institute reported that US private payrolls grew by 214,000 in February beating the forecast of 185,000. Usually there is a low correlation between the ADP and the NFP due Friday, but aside from the employment change disappointment in January they have consistently beaten expectations in the past four months. The private payrolls report shows manufacturing is still weak with a loss of 9,000 jobs, but the optimism comes from the expansion of the services sector that added 59,000 new jobs.

The USD declined against the EUR after the release of the ISM Employment Index that posted a contraction at 49.7 in February. Overall the U.S. service sector continues to expand albeit at a slower pace, but given the focus on employment data this week investors sold U.S. dollars ahead of what could be a disappointing Non-farm payrolls number. Last month even though the NFP headline number was less than anticipated the fact that wages grew and the unemployment rate was lower was enough to boost the USD.

The NFP will be published by the U.S. Bureau of Labor Statistics on Friday, March 4 at 8:30 am EST. Employment is the strongest pillar of the U.S. economic recovery since the credit crisis and the influence on the Fed's interest rate decision is significant. Economist's forecasts range around 185,000 to 200,000 new jobs added. Anything outside of that range for the biggest forex indicator will set a direction for the USD.

U.S. employment data has been mixed ahead of the U.S. non-farm payrolls (NFP) report. A weak Institute for Supply Management (ISM) Employment Index showing a contraction on Thursday is being balanced against a strong ADP Private payrolls report that beat expectations on Wednesday. The ADP Research Institute reported that US private payrolls grew by 214,000 in February beating the forecast of 185,000. Usually there is a low correlation between the ADP and the NFP due Friday, but aside from the employment change disappointment in January they have consistently beaten expectations in the past four months. The private payrolls report shows manufacturing is still weak with a loss of 9,000 jobs, but the optimism comes from the expansion of the services sector that added 59,000 new jobs.

The USD declined against the EUR after the release of the ISM Employment Index that posted a contraction at 49.7 in February. Overall the U.S. service sector continues to expand albeit at a slower pace, but given the focus on employment data this week investors sold U.S. dollars ahead of what could be a disappointing Non-farm payrolls number. Last month even though the NFP headline number was less than anticipated the fact that wages grew and the unemployment rate was lower was enough to boost the USD.

The NFP will be published by the U.S. Bureau of Labor Statistics on Friday, March 4 at 8:30 am EST. Employment is the strongest pillar of the U.S. economic recovery since the credit crisis and the influence on the Fed's interest rate decision is significant. Economist's forecasts range around 185,000 to 200,000 new jobs added. Anything outside of that range for the biggest forex indicator will set a direction for the USD.

Mohammed Abdulwadud Soubra

Pre European Open, Daily Technical Analysis Friday, March 04, 2016 Please note that due to market volatility, some of the below sight prices may have already been reached and scenarios played out. EUR/USD Intraday: the upside prevails. Pivot: 1.0890 Most Likely Scenario: long positions above 1...

ソーシャルネットワーク上でシェアする · 3

84

Mohammed Abdulwadud Soubra

Crude Oil (WTI) (J6) Intraday: supported by a rising trend line.

Prev Top

Pivot: 34.30

Most Likely Scenario: long positions above 34.30 with targets @ 35.60 & 36.30 in extension.

Alternative scenario: below 34.30 look for further downside with 33.55 & 33.00 as targets.

Comment: the RSI is bullish and calls for further upside.

Prev Top

Pivot: 34.30

Most Likely Scenario: long positions above 34.30 with targets @ 35.60 & 36.30 in extension.

Alternative scenario: below 34.30 look for further downside with 33.55 & 33.00 as targets.

Comment: the RSI is bullish and calls for further upside.

Mohammed Abdulwadud Soubra

Gold spot Intraday: further upside.

Pivot: 1248.50

Most Likely Scenario: long positions above 1248.50 with targets @ 1268.50 & 1276.00 in extension.

Alternative scenario: below 1248.50 look for further downside with 1240.00 & 1235.00 as targets.

Comment: the RSI is mixed with a bullish bias

Pivot: 1248.50

Most Likely Scenario: long positions above 1248.50 with targets @ 1268.50 & 1276.00 in extension.

Alternative scenario: below 1248.50 look for further downside with 1240.00 & 1235.00 as targets.

Comment: the RSI is mixed with a bullish bias

Mohammed Abdulwadud Soubra

AUD/USD Intraday: the upside prevails. Prev Next

Pivot: 0.7295

Most Likely Scenario: long positions above 0.7295 with targets @ 0.7385 & 0.7420 in extension.

Alternative scenario: below 0.7295 look for further downside with 0.7250 & 0.7200 as targets.

Comment: the RSI is mixed to bullish.

Pivot: 0.7295

Most Likely Scenario: long positions above 0.7295 with targets @ 0.7385 & 0.7420 in extension.

Alternative scenario: below 0.7295 look for further downside with 0.7250 & 0.7200 as targets.

Comment: the RSI is mixed to bullish.

Mohammed Abdulwadud Soubra

USD/JPY Intraday: the bias remains bullish. Prev Next

Pivot: 113.20

Most Likely Scenario: long positions above 113.20 with targets @ 114.25 & 114.55 in extension.

Alternative scenario: below 113.20 look for further downside with 112.85 & 112.50 as targets.

Comment: the RSI advocates for further upside.

Pivot: 113.20

Most Likely Scenario: long positions above 113.20 with targets @ 114.25 & 114.55 in extension.

Alternative scenario: below 113.20 look for further downside with 112.85 & 112.50 as targets.

Comment: the RSI advocates for further upside.

Mohammed Abdulwadud Soubra

GBP/USD Intraday: the upside prevails. Prev Next

Pivot: 1.4095

Most Likely Scenario: long positions above 1.4095 with targets @ 1.4215 & 1.4255 in extension.

Alternative scenario: below 1.4095 look for further downside with 1.4020 & 1.3980 as targets.

Comment: the RSI is mixed to bullish.

Pivot: 1.4095

Most Likely Scenario: long positions above 1.4095 with targets @ 1.4215 & 1.4255 in extension.

Alternative scenario: below 1.4095 look for further downside with 1.4020 & 1.3980 as targets.

Comment: the RSI is mixed to bullish.

Mohammed Abdulwadud Soubra

EUR/USD Intraday: the upside prevails. Prev Next

Pivot: 1.0890

Most Likely Scenario: long positions above 1.0890 with targets @ 1.1000 & 1.1030 in extension.

Alternative scenario: below 1.0890 look for further downside with 1.0850 & 1.0820 as targets.

Comment: the RSI is well directed.

Pivot: 1.0890

Most Likely Scenario: long positions above 1.0890 with targets @ 1.1000 & 1.1030 in extension.

Alternative scenario: below 1.0890 look for further downside with 1.0850 & 1.0820 as targets.

Comment: the RSI is well directed.

Mohammed Abdulwadud Soubra

With Stocks Showing Strength, Will the Feedback Loop of the Fed Continue? Talking Points: - Many global indices have continued higher into resistance points. Heavy data is on the docket for the next two weeks, and this will likely determine whether stocks rip or dip...

ソーシャルネットワーク上でシェアする · 2

77

Mohammed Abdulwadud Soubra

Pivot Points-Hourly Last Updated: Mar 3, 6:30 pm +03:00 Symbol S3 S2 S1 P R1 R2 R3 EUR/USD 1.08456 1.08803 1.09025 1.0915 1.09372 1.09497 1.09844 USD/JPY 112.859 113.261 113.411 113.663 113.813 114.065 114.467 GBP/USD 1.39933 1.40535 1.40912 1.41137 1.41514 1.41739 1.42341 USD/CHF 0.98577 0...

ソーシャルネットワーク上でシェアする · 2

59

Mohammed Abdulwadud Soubra

パブリッシュされた投稿Crude Oil (WTI) (J6) Intraday: supported by a rising trend line.

Pre US Open, Daily Technical Analysis Thursday, March 03, 2016 Crude Oil (WTI) (J6) Intraday: supported by a rising trend line. Pivot: 33.55 Most Likely Scenario: long positions above 33.55 with targets @ 35.18 & 35.60 in extension. Alternative scenario: below 33...

ソーシャルネットワーク上でシェアする · 2

82

: