Aleksey Ivanov / Perfil

- Información

|

8+ años

experiencia

|

32

productos

|

146

versiones demo

|

|

0

trabajos

|

0

señales

|

0

suscriptores

|

-------------------------------------------------------------------------------

💰 Productos presentados:

1) 🏆 Indicadores con filtrado óptimo de ruidos de mercado (para elegir puntos de apertura y cierre de posiciones).

2) 🏆 Indicadores estadísticos (para determinar la tendencia global).

3) 🏆 Indicadores de investigación de mercado (para aclarar la microestructura de precios, construir canales, identificar diferencias entre reversiones de tendencias globales y reversiones locales).

-------------------------------------------------------------------------------

☛ Más información en el blog https://www.mql5.com/en/blogs/post/741637

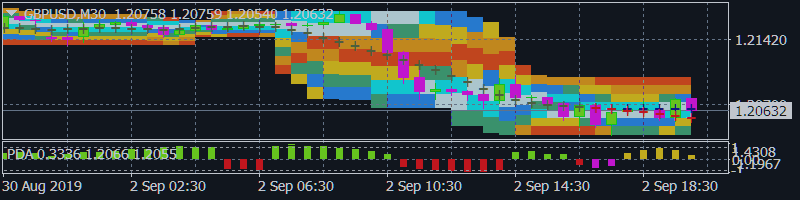

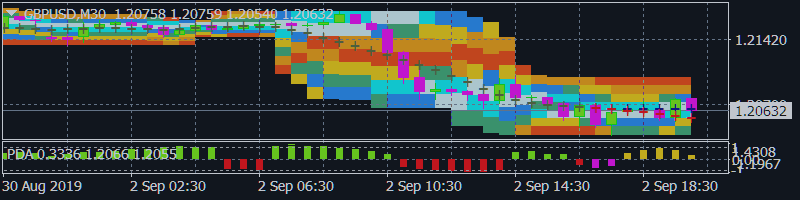

El indicador se utiliza para: definir las distribuciones de probabilidad de los precios. Esto permite representar detalladamente el canal y sus fronteras y prever la probabilidad de que un precio aparezca en cada segmento de sus fluctuaciones; definir el momento de cambio del canal. Principios de funcionamiento y características El indicador analiza un historial de cotizaciones en los marcos temporales inferiores y calcula una distribución de probabilidad de precios en los superiores. Los

The indicator predicts the price in accordance with the prevailing trend and its own small statistical price fluctuations around this trend.

The indicator predicts the price in accordance with the prevailing trend and its own small statistical price fluctuations around this trend.

PDP indicator is used for:

1.defining price probability distributions. This allows for a detailed representation of the channel and its borders and forecast the probability of a price appearing at each segment of its fluctuations;

2.defining the channel change moment.

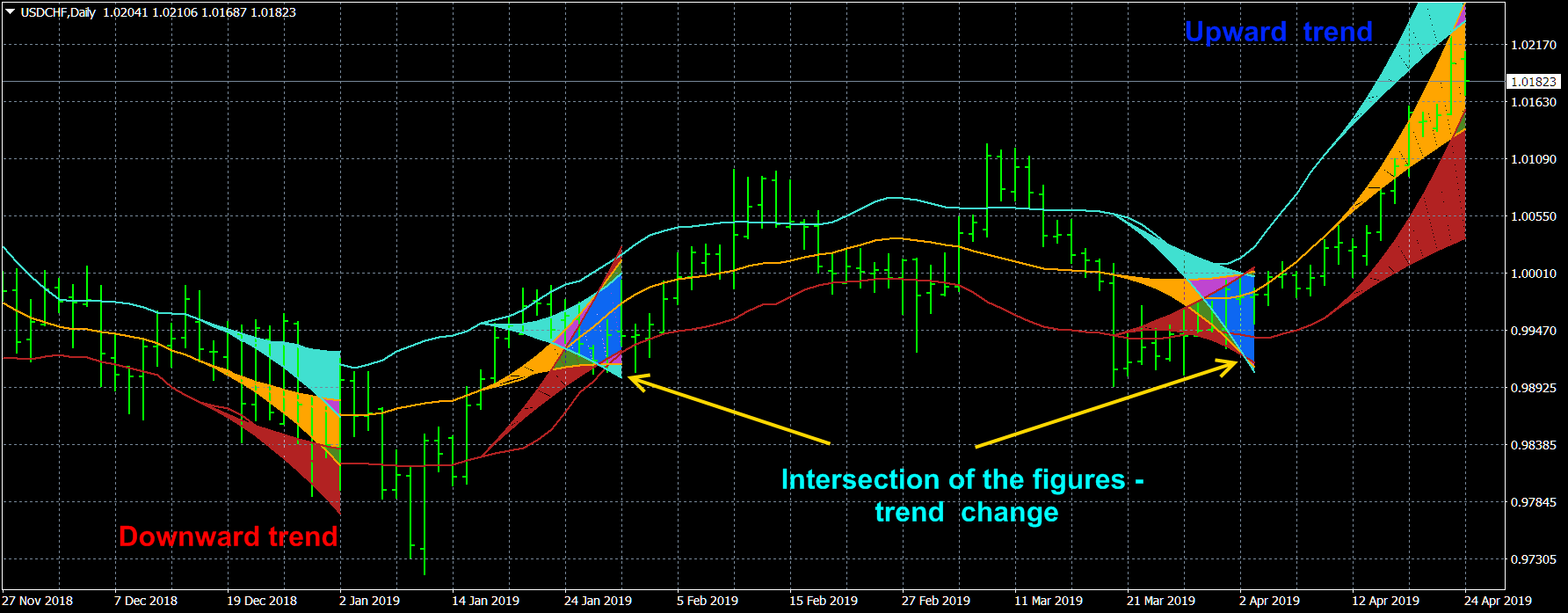

Signal Bands is a sensitive and convenient indicator, which performs deep statistical processing of information. It allows to see on one chart (1) the price trend, (2) the clear price channel and (3) latent signs of trend change. The indicator can be used on charts of any periods, but it is especially useful for scalping due to its high sensitivity to the current market state.

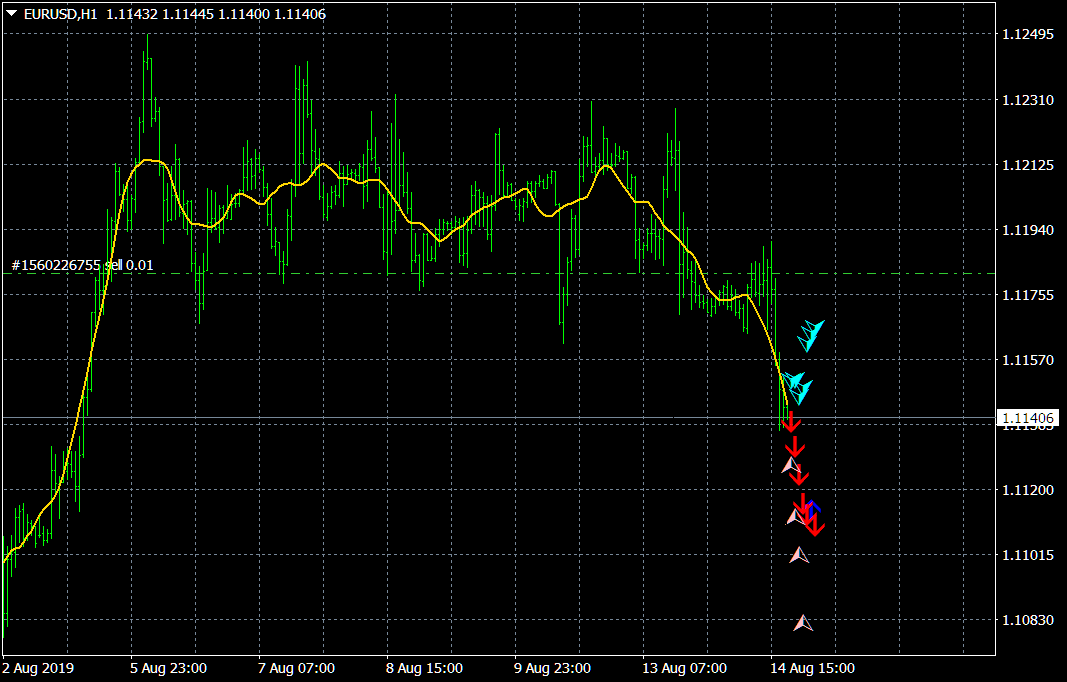

The Sensitive Signal (SS) indicator, using the filtering methods developed by the author, allows, with a high degree of probability, to establish the beginning of the true (filtered from interference - random price walks) trend movement. It is clear that such an indicator is very effective for trading on the currency exchange, where signals are highly distorted by random noise.

I present an indicator for professionals. ProfitMACD is very similar to classic MACD in appearance and its functions. However, ProfitMACD is based on completely new algorithms (for example, it has only one averaging period) and is more robust, especially on small timeframes, since it filters random price walks.

The indicator predicts the price in accordance with the prevailing trend and its own small statistical price fluctuations around this trend.

I present an indicator for professionals. ProfitMACD is very similar to classic MACD in appearance and its functions. However, ProfitMACD is based on completely new algorithms (for example, it has only one averaging period) and is more robust, especially on small timeframes, since it filters random price walks.

El principio del indicador. El indicador Asummetry le permite predecir el comienzo de un cambio en la dirección de las tendencias, mucho antes de su aparición visual en el gráfico de precios. El autor reveló estadísticamente que antes de cambiar la dirección de la tendencia, la función de distribución de probabilidad del precio se hace lo más asimétrica posible. Más concretamente, el movimiento del precio en cualquier dirección siempre arrastra lateralmente la función de su distribución, pero

Signal Bands is a sensitive and convenient indicator, which performs deep statistical processing of information. It allows to see on one chart (1) the price trend, (2) the clear price channel and (3) latent signs of trend change. The indicator can be used on charts of any periods, but it is especially useful for scalping due to its high sensitivity to the current market state.

The indicator predicts the price in accordance with the prevailing trend and its own small statistical price fluctuations around this trend.

The StatChannel indicator is constructed in the same way as a classic Bollinger Bands indicator, but only on the basis of the non-lagging moving average. Such a curve is calculated at points (Inf, n + 1], as a moving average at the segment (Inf, 0], where 0 is the number of the last bar, shifted back by n bars, and at the points of the segment [n, 0] it is estimated. The estimate is a curvilinear sector (sweeping confidence interval) in which the line of the non-lagging moving average is laid with a given confidence level. The non-lagging average is also surrounded by non-lagging std, which is determined at points at points (Inf, n + 1) in the same way as the non-lagging moving average, and at points of the segment [n, 0] - by a special algorithm that calculates the set of values std, that will be within the specified value of the confidence interval.

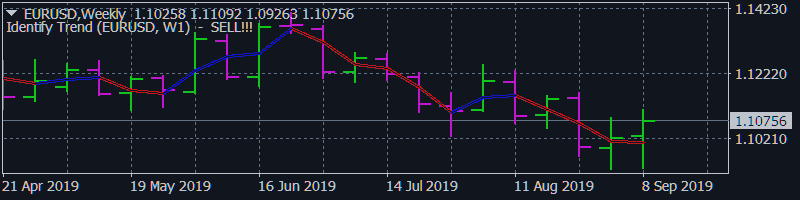

Description of the slides.

1. With quiet natural price movement, its tendency is determined and a position is opened.

2. There is an artificial process of price consolidation.

3. The artificial consolidation process is completed and the price continues its natural movement, closing the position.