Equilibrium Fractal Wave Analytics MT4

- Indicadores

- Young Ho Seo

- Versión: 10.8

- Actualizado: 1 julio 2022

- Activaciones: 5

Introducción a EFW Analytics

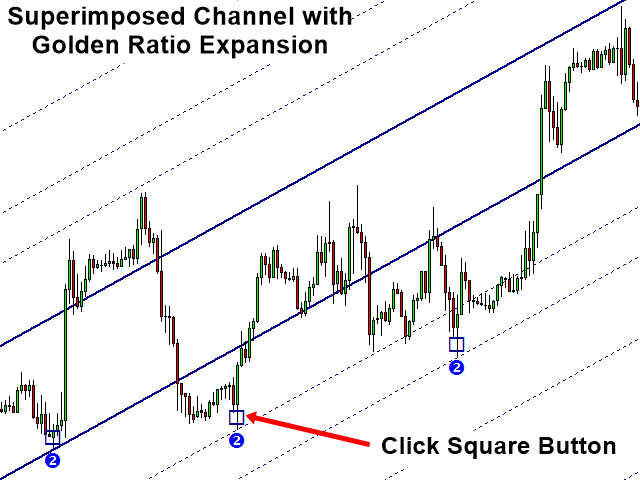

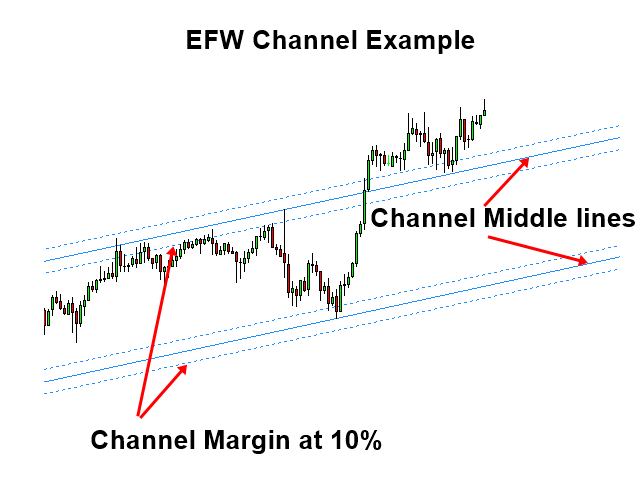

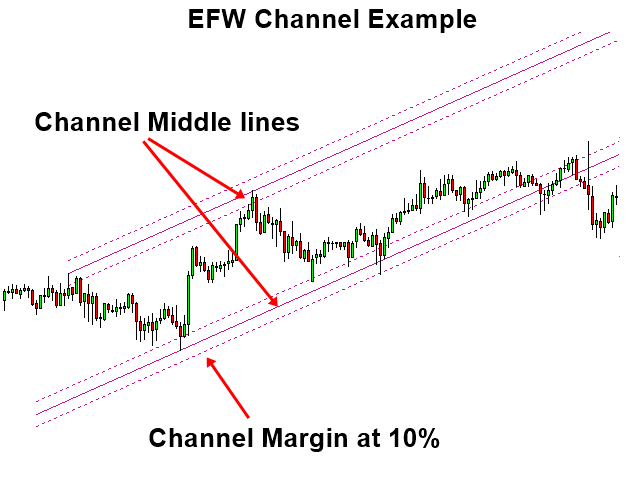

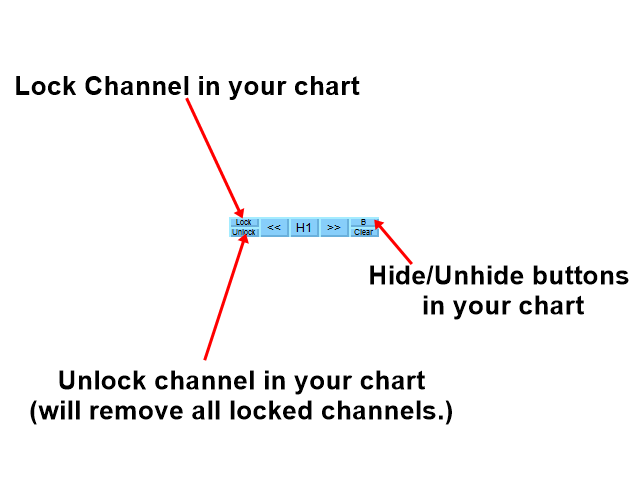

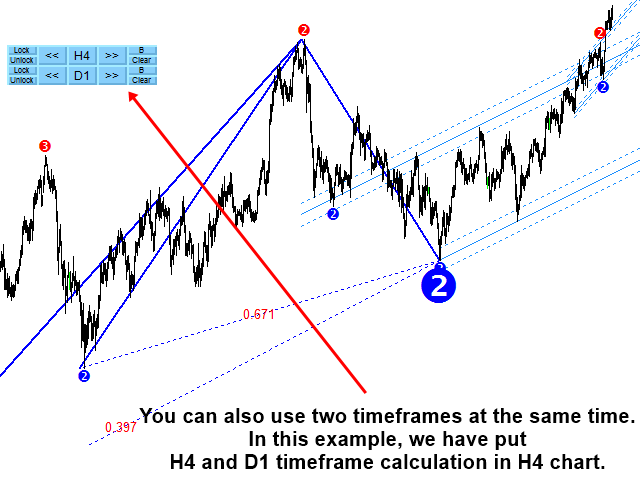

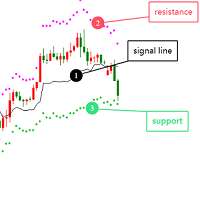

EFW Analytics se diseñó para cumplir la afirmación "Operamos porque existen regularidades en el mercado financiero". EFW Analytics es un conjunto de herramientas diseñadas para maximizar el rendimiento de sus operaciones mediante la captura de la geometría fractal repetitiva, conocida como la quinta regularidad del mercado financiero. La funcionalidad de EFW Analytics consta de tres partes. En primer lugar, Equilibrium Fractal Wave Index es una herramienta exploratoria que apoya su lógica de negociación para elegir con qué ratio operar. En segundo lugar, EFW Analytics puede detectar los patrones superpuestos en su gráfico. En tercer lugar, puede detectar patrones de canales de ondas fractales de equilibrio (EFW). EFW Analytics proporciona un soporte gráfico rico y totalmente visual para la toma de decisiones de trading. En la estrategia de negociación por defecto, usted estará buscando la señal combinada de patrones Superimpsoed + EFW Channel. Además, puede realizar muchas más estrategias de inversión y ruptura. También puede ejecutar dos marcos de tiempo diferentes en un gráfico para reforzar su decisión de trading. Alerta de sonido, correo electrónico y push notifiaction se construyen dentro del indicador.

Índice de ondas fractales de equilibrio

El índice Equilibrium Fractal Wave es una herramienta de análisis exploratorio para sus operaciones. La forma de utilizar el índice EFW es similar al exponente de Hurst de Harold Edwin Hurst (1880-1978) o a la dimensión fractal acuñada por Mandelbrot en 1975. Literalmente, el índice EFW puede ayudarle a confirmar la presencia de ondas fractales de equilibrio en el mercado financiero. Sin embargo, el índice de ondas fractales de equilibrio es más práctico e intuitivo que el exponente de Hurst y la dimensión fractal para sus operaciones. El valor del índice de equilibrio de ondas fractales puede oscilar entre 0,0 y más de 1,0. Cuanto más alto sea el índice, mayor será el valor. Cuanto mayor sea el índice de onda fractal de equilibrio, puede confirmar la presencia más fuerte de una relación de forma particular de onda fractal de equilibrio. Por lo tanto, esta relación será su elección de comercio. Si usted sólo cree en los ratios de fibonacci como 0.618, 0.382, etc, entonces usted puede saltarse esta parte porque la configuración por defecto del ratio utiliza 0.382, 0.500 y 0.618. Sin embargo, usted encontrará que algunos ratios de fibonacci no son significativos para algunos pares de divisas.

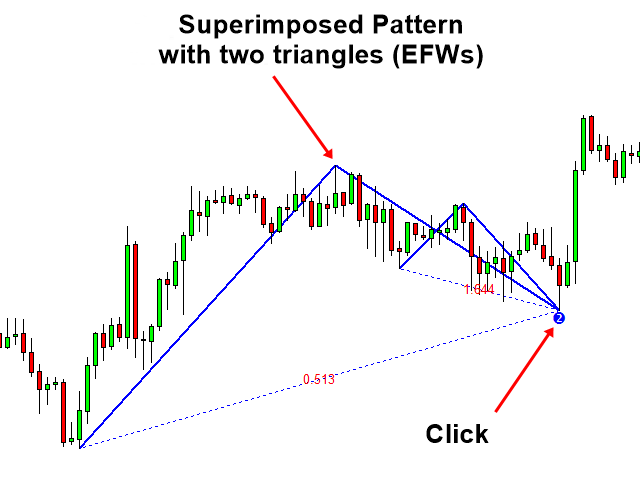

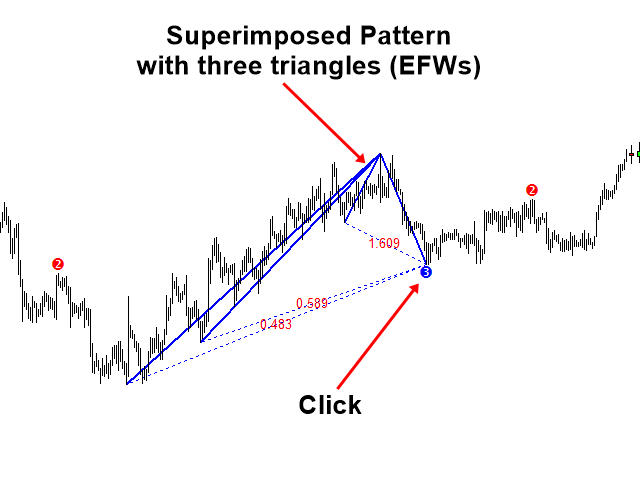

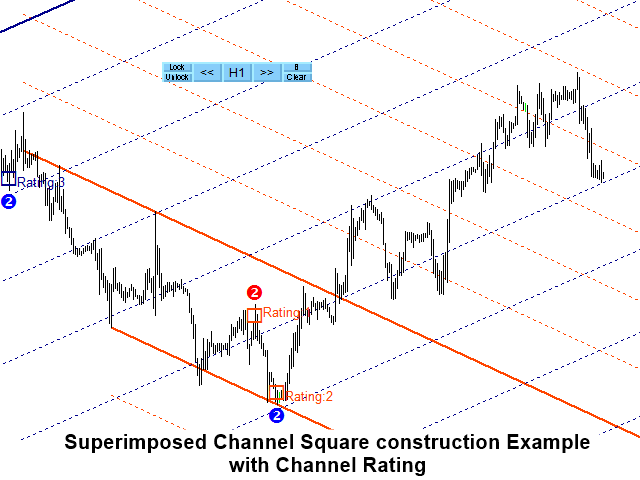

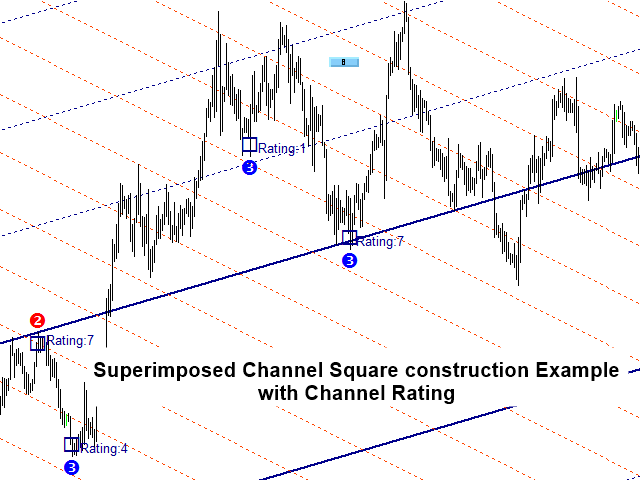

Patrones Superpuestos

Los patrones superpuestos son varios triángulos superpuestos en el mismo lugar del gráfico. Los patrones superpuestos pueden proporcionar buenas entradas de operaciones cuando se utilizan junto con el canal EFW.

Cómo operar

Cuando utilice esta herramienta por sí sola, le recomendamos la señal combinada del patrón superpuesto y el canal EFW. Puede utilizar EFW Analytics con algunos de nuestros otros productos. Aquí hay algunos ejemplos de señales de trading que puede generar.

- Patrones superpuestos + Canal EFW (Estrategia de inversión por defecto cuando se utiliza EFW Analytics solo)

- También puede utilizar el canal EFW para las operaciones de ruptura. Pero, por favor, utilice su propia configuración para este caso.

- Patrones superpuestos con patrón triangular, patrón de cuña descendente, patrón de cuña ascendente y canal.

- Canal EFW con indicador de detección de patrón armónico

- Patrón superpuesto o canal EFW con Indicador de Oferta y Demanda

- Patrón superpuesto o canal EFW con Indicador de Onda de Elliott

- Patrón superpuesto o canal EFW con análisis de dispersión de volumen

Entradas controlables

- Configuración de usuario común: configuración de entrada común para EFW Analytics

- EFW Index setting: esta entrada controla todo lo relacionado con el índice EFW

- EFW Channel setting: esta entrada controla todo lo relacionado con EFW Channel

- Configuración de patrones superpuestos: esta entrada controla todo lo relacionado con los patrones superpuestos.

- Configuración de la visualización de los botones: esta entrada controla cómo se muestran los botones en el gráfico.

Guía de estrategias de negociación

Usted puede encontrar la guía detallada estrategia comercial acerca de cómo utilizar el patrón superpuesto dentro EFW Analytics MetaTrader Indicador desde el enlace de abajo. Le recomendamos encarecidamente que lea este artículo antes de utilizar el patrón superpuesto en sus operaciones.

https://www.mql5.com/en/blogs/post/750385

Nota Importante

Este es el producto fuera de la plataforma. Por lo tanto, no aceptamos ninguna solicitud de modificación o personalización de este producto. Además, no proporcionamos ninguna biblioteca de código o cualquier soporte para su codificación para este producto.

I agreed with Vincent review 100% Amazing Wave and Superimposed patterns! Thanks Author! but need some manual instruction pdf or url on the setting that explain how to use, the previous tutorial link you posted in comment I click but no instruction cannot find anything, I've posted some comment question in comment page, please help answer my questions?

*updated review 10/3/2023 * What I like about this is able to draw trend for different period easily with a click of a button and it also draw trend into the future and price reacted to the line, accurate and amazing!