CandleWick Sniper

38 USD

Descargado demo:

53

Publicado:

26 septiembre 2024

Versión actual:

1.0

¿No ha encontrado el robot adecuado?

Encargue el suyo

en la bolsa Freelance.

Pasar a la bolsa

Encargue el suyo

en la bolsa Freelance.

Cómo comprar un robot comercial o indicador

Inicia el robot en el

hosting virtual

hosting virtual

Pruebe un indicador/robot comercial antes de comprarlo

¿Quieres ganar en el Market?

Cómo ofrecer un producto para que lo compren

Está perdiendo oportunidades comerciales:

- Aplicaciones de trading gratuitas

- 8 000+ señales para copiar

- Noticias económicas para analizar los mercados financieros

Registro

Entrada

Usted acepta la política del sitio web y las condiciones de uso

Si no tiene cuenta de usuario, regístrese

v1.0 Parameters

In my backtesting, I used historical data from the XAUUSD 5-minute chart, and the results were quite intriguing. A spread of 5 was applied consistently across all tests. Please keep in mind that backtest results are purely hypothetical and do not guarantee future performance. Additionally, my shared set files are intended for backtesting purposes only. Once you have gained a thorough understanding of the EA from your tests, you are encouraged to fine-tune the input settings to suit your specific trading style.

This result is based on backtesting from Jan 1, 2024, to Sept 25, 2024, using the XAUUSD 5-minute timeframe with a spread of 5. Since many traders prefer starting with a smaller account balance, I conducted this test using an initial balance of $100. With the specified input parameters, the EA grew the $100 to $2,879,079, achieving a 54.55% profit rate. A 5% maximum risk percentage was used, allowing the EA to dynamically adjust the lot size based on the available account balance. In this scenario, quick market orders were employed, and the maximum drawdown was kept at 8.72%.

The critical aspect of this result lies in the use of the 5% maximum risk percentage, along with the EA's ability to automatically adjust lot sizes based on the risk. This combination allowed for significant growth while maintaining controlled risk.

This input file is similar to CandleWick Sniper_A_2024_1_54%.set, but in this version, I used pending stop orders instead of market orders. The pending stop orders are placed at the candle open price when the EA detects a wick length of 20 pips. The maximum drawdown in this test was 6.55%, with 57.44% of trades being profitable. The $100 account balance grew to $1,215,092 over the course of 9 months in 2024. You can download the set file as 'CandleWick Sniper_A_2024_2_57%.set' for backtesting with your broker.

In this test, I achieved an 86.76% profit ratio, starting with $100 and ending with $2,113 over 9 months in 2024. The EA was set to a 1% maximum risk percentage, which automatically adjusted the lot size. Stop orders were utilized, with a take profit level of 60 pips and a stop loss of 56 pips—these were the key parameters for this test. Additionally, I set the trailing to start at 10 pips with a 5-pip trailing step, allowing profits to be secured as the market moved in favor of the trade.

In this test, I adjusted the maximum risk percentage from 1% to 3%, and the EA turned $100 into $229,762 with an 86.76% profit rate. However, if the maximum risk percentage is increased to 5%, as in previous tests, the account balance of $100 would result in losses. This shows the importance of balancing risk and reward, as higher risk percentages can lead to significantly different outcomes, especially with smaller account balances.In this test, I used the same set file for both 2023 and 2024 with a 5% maximum risk percentage. The wick length was increased to 25 pips, and market orders were used. A stop loss of 11 pips was applied, with trailing starting at 10 pips and moving in 2-pip steps. In 2023, the EA achieved a 57.88% profit ratio, turning $100 into $98,433 using historical data. For 2024, the EA had a 55.45% profit ratio, turning $100 into $519,641. The maximal drawdown in both tests was between 16%-33%. Please note that these backtest results are hypothetical and do not guarantee future performance, they are shared for testing purposes only.

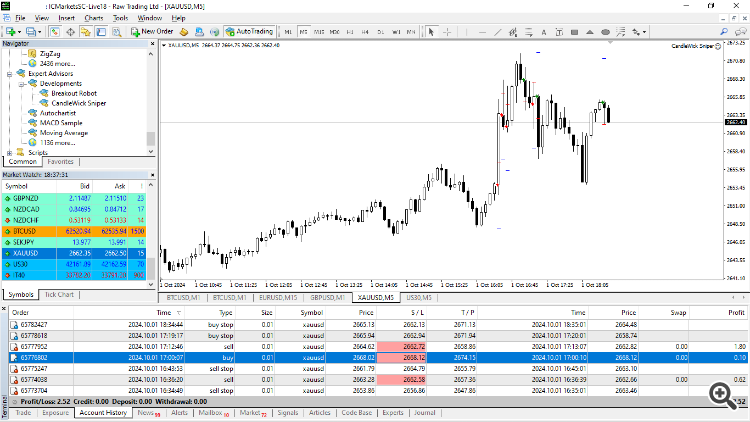

In this image, you can see that all my trades were losses. Here's the setup I used: Minimum wick length of 20 pips, and a stop loss of 11 pips. I had mentioned before that my backtesting results were based on a 5-pip spread, but as you can see here, the spread was 15 pips, which easily triggered the 11-pip stop loss. I believe that’s why this happened. After seeing these results, I adjusted the minimum wick length to 25 pips, and increased the stop loss to 30 pips.

Since then, I've had a few successful trades. Please remember, I'm sharing these screenshots for educational purposes and to help you find the best settings. If you have any suggestions, feel free to share!

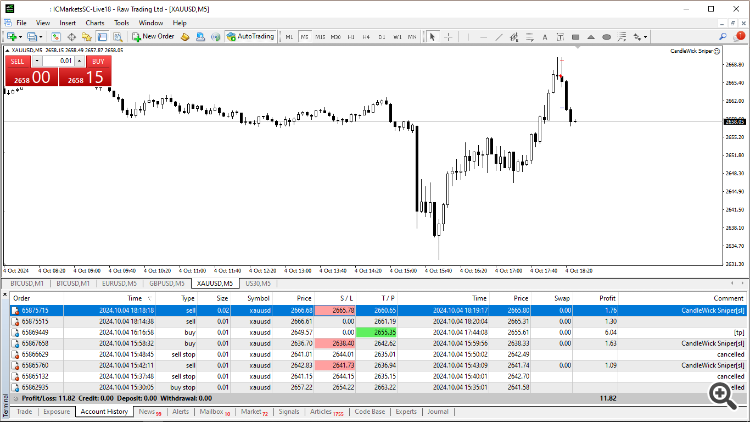

Today, I had 3 successful trades during the Unemployment Claims and ISM Services PMI news events.

Today, I had 3 successful trades, though none of them hit the take profit target. All trades were closed by hitting the stop loss with trailing activated.I put on 1k demo account since Feb its now end of March.

I posted a screen shot of how the EA did. I have been in communication with the developer. My last message was asking if he had any more ideas on how to get the ea profitable. Never responded but thats ok. Unfortunately the EA idea might be sound but it didn't work for me.

The biggest change that I did was open the SL larger, and that did help quite a bit but still remained less than break even.

Hopefully someone can make it work and share like I am.

I put on 1k demo account since Feb its now end of March.

I posted a screen shot of how the EA did. I have been in communication with the developer. My last message was asking if he had any more ideas on how to get the ea profitable. Never responded but thats ok. Unfortunately the EA idea might be sound but it didn't work for me.

The biggest change that I did was open the SL larger, and that did help quite a bit but still remained less than break even.

Hopefully someone can make it work and share like I am.

Thank you for your feedback on the EA! I truly appreciate you taking the time to share your experience. Apologies for the delayed response, I’ve been busy with modifications and responding to many messages.

I’m always open to adding new features, making improvements, and integrating additional filters based on traders' experiences to enhance my products. Like any strategy, there can be periods where performance fluctuates. Since you now have a full month of real trading results, my suggestion would be to backtest the same input settings, fine tune the parameters, and identify the best configurations for this market period. Spending some time optimizing the EA can help make it more profitable and align it better with current market conditions.

Once you find a profitable setup through backtesting, running it in the same market conditions can improve performance. That’s how traders effectively optimize any EA or strategy. Unfortunately, I haven’t been able to test your last input settings over the past few months due to a busy schedule. However, I’ll make time to run the tests for you and share my findings. Let’s work together to improve the EA and make it better!

Thank you for your feedback on the EA! I truly appreciate you taking the time to share your experience. Apologies for the delayed response, I’ve been busy with modifications and responding to many messages.

I’m always open to adding new features, making improvements, and integrating additional filters based on traders' experiences to enhance my products. Like any strategy, there can be periods where performance fluctuates. Since you now have a full month of real trading results, my suggestion would be to backtest the same input settings, fine tune the parameters, and identify the best configurations for this market period. Spending some time optimizing the EA can help make it more profitable and align it better with current market conditions.

Once you find a profitable setup through backtesting, running it in the same market conditions can improve performance. That’s how traders effectively optimize any EA or strategy. Unfortunately, I haven’t been able to test your last input settings over the past few months due to a busy schedule. However, I’ll make time to run the tests for you and share my findings. Let’s work together to improve the EA and make it better!

Optimizer says 40 wick for the month of March

40TP

60SL

18 wins

250 profit (1% risk on 1k)

So I'll let it run little longer on demo.